As Lion One moves forward with getting its low-cost, fully permitted Fiji gold mine into production, Dr. Quinton Hennigh joins the team as an advisor.

Lion One's Tuvatu Gold Project

The mention of Fiji conjures pictures of pristine tropical beaches and pristine water. Fiji Water has become one of the top selling brands of imported water in the United States, and is intertwined, unexpectedly, with mining.

In the late 1960s, two Canadian entrepreneurs, David Gilmour and Peter Munk, bought property in Fiji and founded the Southern Pacific Hotels Corp., which they sold within a decade. They then went on to found Barrick Gold Corp., now the largest gold mining company in the world, and eventually also started Fiji Water.

Some two decades later, mining executive Walter Berukoff visited Fiji to invest in the hotel and resort industry, and learned that the same ancient volcanoes that served as aquifers for Fiji's water also created gold fields. He founded Lion One Metals Ltd. (LIO:TSX.V; LOMLF:OTCQX), which in 2011 acquired the high-grade Tuvatu gold mining project, located less than 20 kilometers from Fiji's major airport, Nadi, on the main island of Viti Levu.

"Lion One 'remains a levered exploration and development play on gold.'" - Brien Lundin, Gold Newsletter

Tuvatu's previous owners advanced it to a feasibility study in 2000, and the project has seen more than 110,000 meters of drilling to date, along with 1,600 meters of underground development. Last year the company reported that surface sampling from the Jomaki prospect of Tuvatu returned the high-grade result of 502 g/t gold over 0.70 meters. Less than 10% of its leased land has been explored.

Dr. Quinton Hennigh's appointment as technical advisor highlights the potential of the project. Dr. Hennigh is an "internationally renowned economic geologist, with over 25 years of exploration experience and expertise with major gold mining companies such as Homestake Mining Company, Newcrest Mining Limited, and Newmont Mining Corporation where he last served as senior research geologist in 2007."

Lion One noted that Hennigh has since "made a number of significant gold discoveries for Canadian exploration companies such as the 5 million ounce Springpole alkaline gold deposit near Red Lake, Ontario, for Gold Canyon Resources, and the Rattlesnake Hills gold project for Evolving Gold." He is the chairman and president of Novo Resources Corp., which is exploring for gold in Australia.

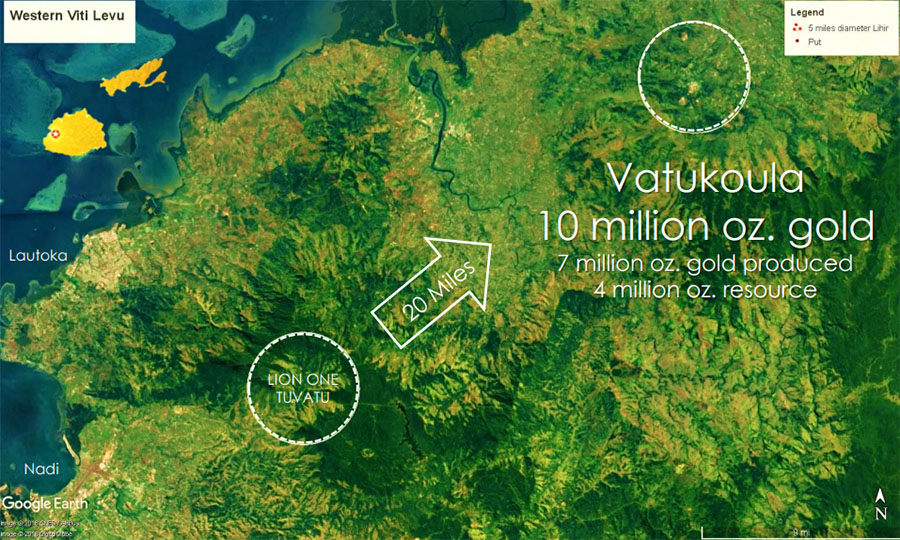

"Quinton is the ideal person to direct our Fiji exploration activities in conjunction with Lion One Managing Director Stephen Mann, and VP Exploration Darren Holden," said Lion One Chairman and CEO Walter Berukoff. "We're excited about him joining our team as we advance this project towards production. He clearly shares our thesis that Tuvatu is a gold system of similar potential scale to the world-class Vatukoula gold deposit 40 km away where 7 million ounces of gold have been produced."

"I recently visited Walter Berukoff and his Fiji exploration team and I'm very excited to provide strategic technical advice to Lion One on Tuvatu," said Dr. Hennigh. "After completing my site visit and technical review I believe that Tuvatu has similarities not only to Vatukoula and other large alkaline systems in the South Pacific, but also to several multi-million ounce alkaline gold systems I'm familiar with in North America. Given that only a very small volume of the overall system has been explored, I see excellent potential for growth at Tuvatu."

Clive Maund noted on March 1 on CliveMaund.com, "Hennigh was the driving force behind Novo Resources, which as we know turned out to be a spectacular investment for early buyers."

The share price of Hennigh's Novo Resources skyrocketed from CA$0.80 to over CA$8 in 2017 after it announced it found gold nuggets in its trench sampling at its Purdy's Reward prospect in Australia. The stock is currently trading at around CA$2.73.

Ring of Fire

Fiji sits in the southwest Pacific Ring of Fire that has resulted in large volcanic deposits in places like Papua New Guinea and the Solomon Islands. The Lihir Gold Mine in Papua New Guinea features a resource of 50 million ounces of gold, on top of the 9 million ounces of gold already produced.

Vatukoula, a gold mine in Fiji just 20 miles from Lion One's Tuvatu, has produced 7 million ounces of gold and has a 4 million ounce gold resource.

The government of Fiji supports mining and awarded Lion One a long-term mining lease in 2016. Prime Minister Voreqe Bainimarama has said, "Mining will take Fiji forward; Tuvatu is a model of what we can achieve economically, socially and environmentally."

Hamish Greig, vice president of Lion One, lists some of the advantages Tuvatu offers. "Lion One has many of risks associated with mining covered," Greig noted. "On commodity price risk, Tuvatu is a high-grade, low-cost gold mining start-up with an internal rate of return (IRR) of 52% at a US$1,200 gold price. And gold is hanging in there at or above US$1,300."

On permitting, "Pierre Lassonde, chairman of Franco-Nevada Corp., has said that it is now taking an average of 7 to 12 years to permit a mine, but Lion One is fully permitted to production," Greig stated.

"Large miners face the issue of replacing reserves. We have an entire volcanic system that has gold outcroppings across five miles," he added.

At Tuvatu, derisking, development and exploration continue with plant site construction underway. The mine plan is to produce 260,000 ounces of gold in the first three years at a cash cost of US$567 per ounce and an all-in sustaining cost of $779 per ounce.

Advancements continue. The company recent announced that Lion One has contracted with Switzerland-based clean energy provider meeco Group to build and install a hybrid solar-diesel power plant for Tuvatu. "Lion One will use meeco's 7 MW peak 'sun2live' solar power generation system coupled with diesel generators to generate up to 11 MW peak power production providing a continuous 24-hour source of power for the Tuvatu gold mine and processing plant," the company noted.

"We are excited to partner with meeco to build a clean solar energy solution for powering the Tuvatu Gold Project," said Lion One Managing Director Stephen Mann. "meeco has a solid track record of installing and operating solar hybrid power plants world-wide. This hybrid system will not only reduce our carbon footprint, but will enable Lion One to meet our power capacity requirements while significantly reducing fuel consumption and operating costs for the Tuvatu gold."

Brien Lundin, writing in the March issue of Gold Newsletter, noted Lion One "plans to power its gold mine and processing plant at Tuvatu with a hybrid solar/diesel power plant that will generate up to 11 MW of peak power production. The company is working with Swiss-based clean energy provider the meeco Group to build and install the plant."

Lion One is also constructing an assay lab in Fiji and plans to start the commissioning process in Q2 2019. The new lab will be equipped for gold analysis by "fire assay with atomic absorption spectrometry (AAS) finish. A large range of other elements will be assayed by Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES). The facility will also be utilized to conduct metallurgical optimization test work including flotation and leaching."

"The new facility will greatly reduce costs and return times on geochemical and metallurgical sampling results," Mann noted. "Currently the return times on average take 4 to 6 weeks with samples sent to Australia or Canada at a significant cost that included other logistics such as customs clearance, freight, transport, and analysis. The company will soon be able to benefit from 24-48 hour turnaround on results, greatly enhancing planning and direction of future exploration, mine planning and metallurgical work at the Tuvatu Gold Project."

Because Fiji doesn't not have any geochemical and metallurgical analysis facilities, the company plans to have the facility internationally certified so that it also can serve local industries.

And, in another move to lower its costs, Lion One in January announced that it has purchased all the drilling assets of a Fiji-based drilling company, Geodrill.

"With the purchase of these drilling assets Lion One has also hired an experienced local drilling team that will ensure the company has readily available, cost effective drilling capabilities well into the future," said Mann. "We can now plan future exploration drilling and have access to essential equipment at a significantly reduced cost to undertake that work. Such further work will be scheduled following the end of the current wet season in Fiji."

Lion One has around 101 million shares outstanding, and just under 112 million fully diluted. Management owns about 22% of the shares, and major institutional shareholders include Donald Smith & Co. at 14%, Franklin Precious Metals Fund at 9.99%, JP Morgan Asset Management UK at 6% and MacKenzie Precious Metals at 3%.

Brien Lundin opines Lion One's stock "remains a levered exploration and development play on gold."

Technical analyst Clive Maund, writing on CliveMaund.com on March 1, noted, "Lion One is certainly showing signs that it is turning up here, and so it should given the company's steadily improving fundamentals and the brightening outlook for the sector. . .We therefore have a situation now that is explosively bullish – and the good news for buyers here is that even after the sharp rally in January, the stock still hasn’t broken out of this downtrend, so the news that Quinton Hennigh is getting involved should really light a fire under it."