I was looking over the charts last night (over a fine Merlot and some fava beans), trying desperately to avoid the temptation of attending that embarrassment of capitalism called PDAC. The mining conference held annually in Toronto has transformed from an industrial showcase of new ideas and opportunities in the mid-70s to its newfound status as the premier key-chain, shopping bag and BS dispensary in the world.

The hundreds of thousands of dollars squandered away from the challenged treasuries of the junior exploration and development issuers in airfare, hotel and "entertainment" expenses is money that could be properly allocated into "the ground," thus reducing the devastating dilution so crippling for the sector. These investment conferences, once so necessary before the advent of the Internet and online access to literally anything mining- and-money-related, were also once mainly populated by the buyers—those with money looking for ideas in the mining space—are now overpopulated with the sellers‚ those with projects or prospects in dire need of funding.

However, in the New World of cheap money and bank-controlled domination of everything, those "projects and prospects" in need of financing are really disguises for "personal expenses and lifestyle maintenance," which explains the proliferation of key chains and shopping bags up and down the aisles of the Toronto Convention Centre.

PDAC and its "conference brethren" are now Harvard Business School case studies in Marketing 101, complete with the perfunctory "panel of experts" that pontificates about the future price of this and the future price of that. But in the end, cell phone cameras are able to do immediate look-backs at these prognostications a year later, and what appeared as gospel-anointed "sure things" in 2018 turned to be simply beautifully orated guesses, the accuracy rate of which was no better than calling the outcome of a coin toss.

Yet, out in the audience, the legions of eager wealth-hunting amateurs, replete with stuffed shopping bags full of animated key-chains and high resolution brochures, are mesmerized by the rock-star status assigned to financial entertainers with questionable track records and equally questionable intent, often running from rooms to get their brokers on the line in a herd-like rush to own a piece of a deal that has been transformed from a sow's ear into a silk purse—not through drill results or execution, but rather by the skilled persuasions of the moderator-expert-salesman.

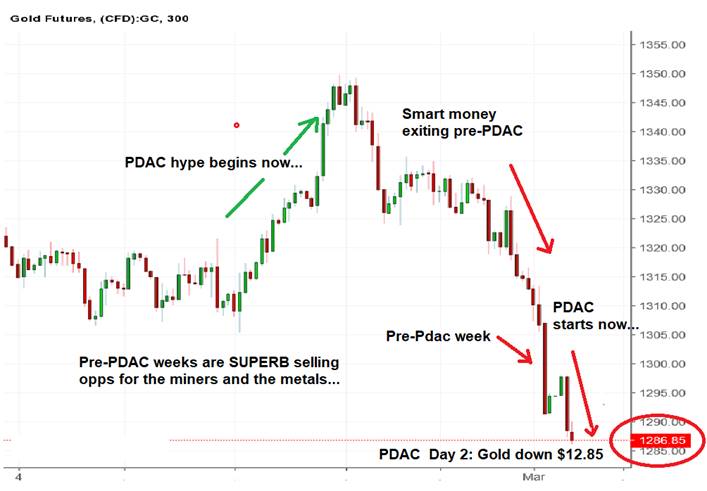

Typically, the period immediately following PDAC is plagued by pervasive weakness in mining issues of all shapes and sizes but because everyone knows this fact by now, the dependability of this seasonal anomaly is now suspect and I am tempted to fade the bloggers just now discovering this, hammering it home at their keyboards and screaming it out in podcasts. Smart money exited the gold and gold miners in the January to mid-February buying climax, which ended exactly on Feb. 20, and continued right through the end of February, finally bottoming smack dab into the middle of PDAC (March 5).

So, as all of the bedraggled PDAC junior mining stock salesmen leave Toronto, I contend that the old routine of selling the miners right after PDAC's final morning has become somewhat of a "crowded trade," and that a counterintuitive upside reaction to the last three weeks of indiscriminate selling is about to reverse. Of course, the mining sector will be 90% reliant on commodity price trends, so with the RSI (relative strength index) numbers in the mid-30s for gold and silver, the bulk of the correction is probably complete.

Rising early Feb. 6, just before I headed to the elliptical machine, I tweeted out this message: "With gold $50 beneath my Feb. 20 exit signal, I am going to initiate 50% replacement of all leveraged gold and silver positions this morning on opening."

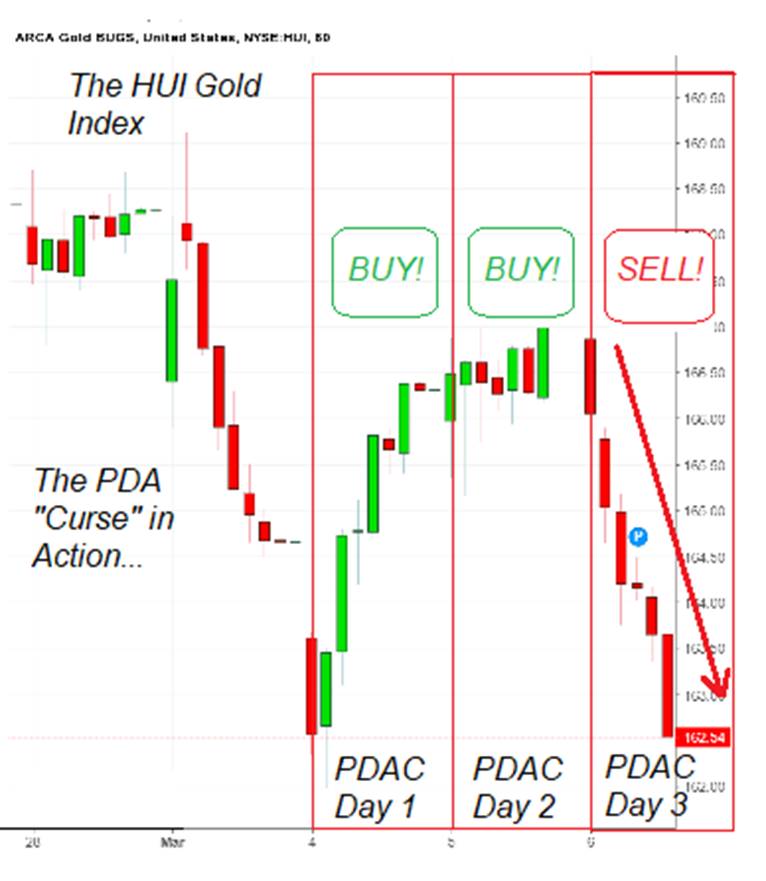

That worked out relatively well for the opening prices for gold and silver but not quite so for the JNUG and NUGT, as the exact moment PDAC ended, all of the miners decided to do their usual swoon (as you can see from the chart below). At exactly noon on Day 3 of the PDAC gong show, they proceeded to throw the miners overboard, despite relatively flat action in the precious metals. I committed 50% on the opening and am now bidding for both JNUG and NUGT at levels slightly below the day's lows. I might have been a tad early in the re-entry, but given I was cashing the ticket thirteen days ago with JNUG north of $13.50, I am willing to take some risk with some of the "house money"sitting in my jeans. As they say in the maritime warfare arena, "Damn the torpedoes, and may you get your own shower stall!"

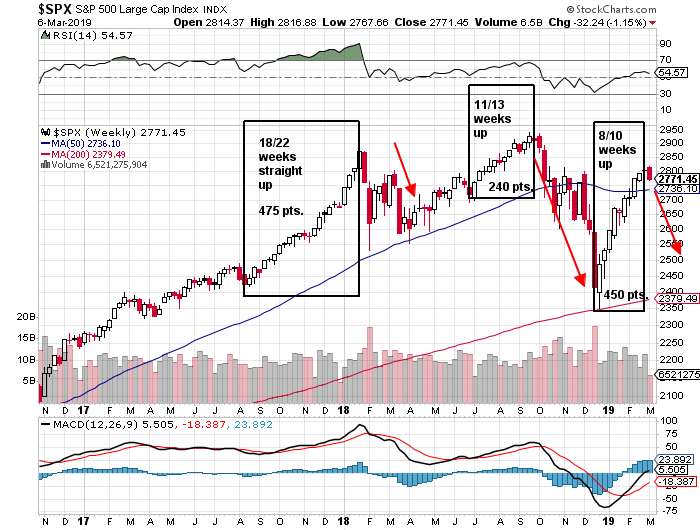

This week feels like it will be a transition week, with the gold and silver sector reversing its two-week downtrend and the S&P 500 about to put in its second down week since Christmas Eve. To the extent that gold and gold miners are oversold, it is insignificant when compared to the degree to which the stock market is overbought.

Looking at RSI and MACD (moving average convergence/divergence) for the weekly chart, the S&P looks overbought for the histograms, but neutral as to MACD and RSI. However, the daily chart shows the S&P has a) broken the December-late February uptrend line; b) failed at 2,800 for the fourth time since October; c) had a negative MACD crossover; and d) now appears headed to the lower of the two Bollinger Bands at around 2,700.

I am today 50% short the SPY April $270 puts bought March 4 at $2.25 (average of the two purchases now $2.55) and the Goldman Sachs April $180 puts @ $2.70. I am looking to add to shorts at any sign of strength into the end of the week, with the ECB (European Central Bank) rate decision being a possible rally point into the weekend. Again, a two-day close above S&P 2,810, and I bail like a floundering fisherman in a Newfie tempest.

I will have more to speak about after the COT report because that should probably be the near-term indication of how the now-heavily-short bullion banks intend to play the most recent gold-silver manipulation. If they have moved to cover the bulk of their aggregate short position during the end-of-Feb COT week, then I will add the remaining 50% to the leveraged gold-silver positions, which include the GLD April $120 calls (long at $2.50), the SLV April $13 calls (long at $1.26) and the JNUG (long at $9.74). Conditions look ripe for a face-ripping rally in these issues, but only the COT will confirm.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.