It’s not that often that we see such a strong confluence of two rarely occurring phenomena. The deeper you go in exploring them, the more sense they make. You see, it’s the strength of complementarity in action. Never to miss a paradigm-changing event, we’re proud to be the first to share this ground-breaking knowledge with you.

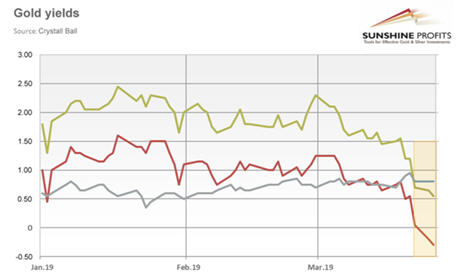

Let’s start with the fundamental and underappreciated one. We’ve just seen an

inversion in the gold yield curve, with the long-term rates dropping below zero. Despite the critical weight of this news, there were zero reaction to this in the mainstream media.

The inversion by itself is an uncommon phenomenon, but what is truly breathtaking is the move below 0 in the long-term gold rates. This stealth introduction of the GNIRP (gold negative interest rate policy) in case of long-term rates may influence the precious metals market in a profound manner as thousands of investors rush to the nearby banks to deposit gold for minimum 5 years.

Gold is a sought-after asset class due to the positive cash flow it brings, and this event is meant to push out gold investors to the long end of the gold yield curve. Let’s admit it folks, on the short-end of the curve, gold has become a certificate of guaranteed confiscation and therefore it is the only rational choice to part with it for the above-mentioned time horizon as minimum.

In case of gold, the yield is shown for the side of the contract that runs the deposit facility. Normal, positive rates, mean that they charge investors for storing their gold for them. The negative rates mean that they will now be paying investors for the privilege of storing their gold for the long run. Investors, who decide to trust the bank or any other depository with their yellow metal for 5 years or more will receive a monthly payment. Some facilities have already reported record inflow of gold. The spokespersons for the head deposit facilities pledged not to sell the gold received through this program on the open market. It is reported that they failed to prevent automatic winking while making the pledge.

We didn’t feature it previously, but gold also created an

ultra-rare “happy cat” formation.

This

gold price pattern is very difficult to spot, because the cat’s head is based on both: price and volume readings and they very rarely align to create it. The ears of the cat are based on the medium-term price moves and its body is based on a long-term bull market. The cat’s tail is the final part of the preceding downtrend (here: the action that we saw before 2001).

The cat’s right ear should ideally be lower than the left one – this factor increases the pattern’s reliability. The cat is always looking into the future and it’s looking at the future bottoming prices. The look alone is not a particularly precise technique, because the cat’s interested in what’s going on and his eyes are wide open – it’s difficult to tell what he’s really looking at. It’s actually analogical to the horse’s perception of the term “now”: it’s really now and it means forever. Fortunately, the above technique can be supplemented by the use of the Fibonacci whiskers.

The Fibonacci whisker fan should start at the time of the most recent medium-term bottom and it should be based on the most recent high. After applying the above, the lowest whisker is the line to which gold is likely to – approximately – move before the final bottom takes place. Combining both techniques point to the proximity of $900 as the next long-term

forecast for the price of gold in the second half of the year.

Unfortunately, the formation doesn’t provide any details with regard to the shape of the decline as cats can be quite unpredictable in the short run. The same for horses.

Be sure to check the date, before acting on today’s article J

For more directly applicable gold analysis, we encourage you to sign up for our free newsletter. You’ll be updated on our free articles on a daily basis, and you’ll get access to our premium Gold & Silver Trading Alerts for the first 7 days as a starting bonus. And yes, it’s free.

Sign up today.

Thank you.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.