The market for natural resources remains subdued, but there are pockets of strength. In the uranium sector, Energy Fuels, IsoEnergy and Appia Energy are up an average of ~150% from their respective 52-week lows. In copper, Trilogy Metals and Pacific Booker are up an average of ~250%. Good things are happening, but not in cobalt, at least not yet.

Could This Pure-Play, North American Cobalt Junior Shine Again?

However, when natural resource stocks gather steam, other sectors will join the party, and select cobalt names will be invited. That doesn't mean they all will; many companies are broken beyond repair. Last year there were over 100 cobalt juniors listed in North America alone. Most are still listed, but many can't raise a penny to move projects forward. I believe there are fewer than 10 cobalt names worth looking at.

One of 2017's blue chip cobalt juniors that I think has ample room for upside (again) this year is First Cobalt Corp. (FCC:TSX.V; FTSSF:OTCQX; FCC:ASX). The company just raised C$1.6 million. Sell-side analysts peg the stock price in a range of C$0.70 to C$1.00. Yet, the current price is C$0.145. Without going into the analyst's methodologies, (I have not seen the reports), I can see why they're bullish. But before continuing, we need to discuss the pink elephant in the room—cobalt prices. You may have noticed that they are down quite a bit.

But, What About the Cobalt Price?

That's a big problem, but only for readers who believe that cobalt will remain below US$15/lb. If one does not believe the price will rebound, then First Cobalt Corp. is not the stock for you. I'm not suggesting the price will soon soar, but a near doubling in the price to US$25/lb in the next year could propel the best positioned companies higher, perhaps a lot higher. The price was >US$40/lb less than 12 months ago, and at US$25/lb less than three months ago.

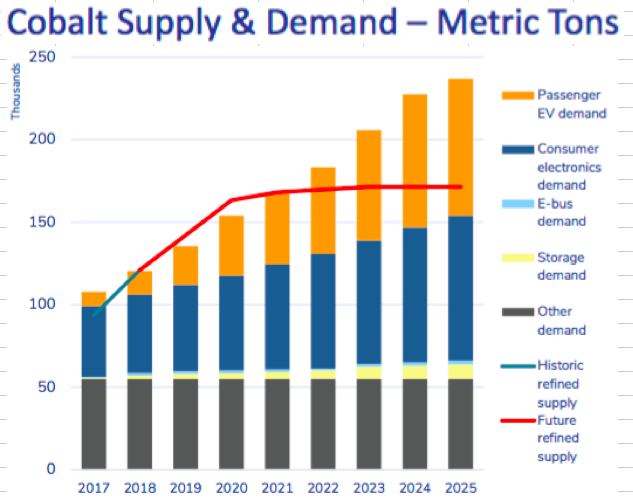

For those fearing that cobalt is being engineered out of electric vehicle (EV) batteries due to high cost and/or security of supply concerns, they are only partially correct. I defer to industry experts Benchmark Mineral Intelligence. In February, Simon Moores said, "As the energy storage revolution continues to pick up pace, cobalt demand is set to rise 4 times by 2028." That would be a 15% CAGR. The 8.1.1 chemistry is nickel-manganese-cobalt in the ratio of 8:1:1.

Experts That I Trust See Strong Cobalt Demand Through 2028

Cobalt was designated a strategic mineral in the U.S. and in many other countries. I believe it will remain in strong demand, and that North American sources will be highly sought after. There's growing discussion about the 2021 and 2022 EV model years being a global tipping point. Security of supply dictates that cobalt needs to be locked up by end-users well before then. The U.S. is not low on cobalt supply…it has NO domestic cobalt supply!

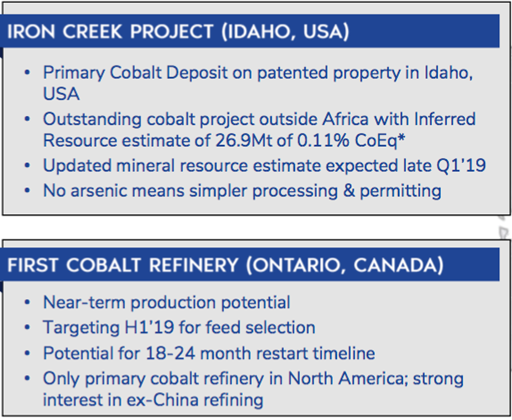

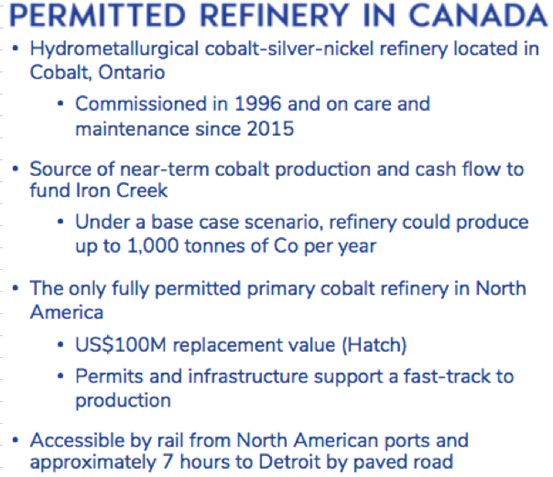

In addition to controlling ~45% of the past-producing Cobalt, Ontario, Cobalt-Silver camp, First Cobalt owns 100% of a fully permitted, primary cobalt refinery. It can produce cobalt sulfate or metallic cobalt products and is the only one of its kind in North America. Management believes it could be up and running in 18–24 months. (See Corporate Presentation.)

Very Few Cobalt Juniors Have Hard Assets, like a Permitted Cobalt Refinery

Mining services firm Hatch estimated the refinery's replacement value at US$100 million = C$133 million. That figure does not include the time value of money, the four to six years it might take to get a new refinery designed, permitted, funded, constructed and commissioned. Compare that to the company's Enterprise Value [market cap + debt – cash] of ~C$43 million. The estimated replacement value of the refinery alone is three times First Cobalt's entire Enterprise Value! There are few options outside of China to produce cobalt sulfate for the battery market, and management says there's no other near-term refining prospect in North America.

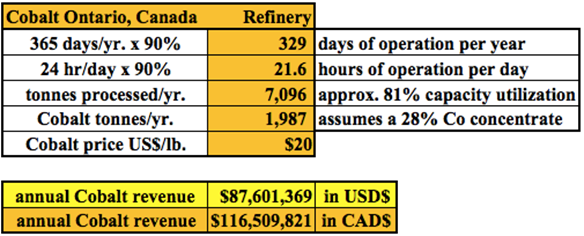

How much revenue could the refinery generate? At the company's base case of 1,000 tonnes/year, at US$20/lb, that's roughly US$44 million = ~C$59 million in revenue. Energy Fuels, an established uranium/vanadium producer, trades at 11.8x trailing 12-month revenue. SQM, a large lithium producer, trades at 4.8x. Bushveld Minerals, a vanadium player, trades at 6.2x, Katanga Mining, a copper-cobalt producer with operations in the Democratic Republic of the Congo, trades at 6.4x. Those companies average ~7x trailing revenue. All have refineries or processing facilities. I'm not saying that First Cobalt will or should trade at 7x revenue. However, one can see the potential value of owned and operated hard assets.

In the bare bones analysis above, I estimate what revenue the refinery could generate operating 90% of the days in a year and 90% of the hours in a day. Combined, that's 81% annual capacity utilization. I assume a 28% cobalt concentrate feedstock, and a 90% recovery of cobalt. At a price of US$20/lb, annualized gross revenue would be ~C$117 million. At US$25/lb, it would be ~C$146 million, and at US$30/lb, gross revenue would be ~C$175 million. Although US$30/lb cobalt seems high today, it might not be in two years. As mentioned, the price was > US$40/lb less than 12 months ago. However, to be clear, there's no guarantee of a meaningful rebound in price.

I fear that investors are treating the estimated replacement value of the refinery like they would the Net Present Value (NPV) of a mining project. That would be a mistake. The estimated value of a hard asset is more reliable than the NPV of a project, especially if the NPV comes from a PEA or PFS. Management says the refinery can be monetized (cash flowing) in 18–24 months. By definition, a NPV is the present value of future cash flows stretching out decades.

First Cobalt's Refinery Has Estimated Replacement Value of US$100 Million

First Cobalt is trading at ~0.33x the estimated replacement value of the refinery alone. That means investors today get the company's flagship project in the U.S. for free, plus 50 past-producing mine sites in Cobalt, Ontario, with a large margin for error embedded in the estimated value of the refinery.

There's considerable risk for mining projects at PEA or PFS-stage. First Cobalt's refinery simply does not carry that kind of risk. Management needs to arrange funding to get it into production, that's the primary risk. And, a higher cobalt price would be nice. However, unlike for mining projects, the company does not need to raise hundreds of millions of dollars. It needs ~US$25 million (includes a 30% contingency). That funding should be achievable through a combination of debt, equity, streaming/royalty financing, and/or selling a portion of the asset.

U.S. Project Iron Creek Has 45 Mlb Cobalt and 175 Mlb Copper, with Substantial Upside

Nearly 1,000 words in and I haven't discussed First Cobalt's flagship project, Iron Creek in Idaho (U.S.). There are very few primary cobalt projects in the world. This one has a resource (26.9 million tonnes) that will be upsized by up to 50% (my guess only) this quarter. The existing resource contains an estimated 45 million pounds Cobalt plus 175 million pounds copper. Importantly, there's no arsenic, which means simpler processing and permitting. The grade is low, so I asked CEO Trent Mell about that. His response,

"One can certainly point to some high-grade cobalt drill results that have been released over the past couple of years, but these are typically vein-style deposits that struggle to hold together in resource modeling. In other words, grade is worthless without sufficient tonnage. By contrast, there are a number of Australian nickel-cobalt deposits that have the tonnage but lower grades than we have at Iron Creek."

The rule of law, plus strong access to infrastructure, plus superior proximity to U.S. markets, make Iron Creek a desirable project compared to the dozens of projects and mines in Africa, a continent that accounts for up to 75% of global supply. Sourcing cobalt from North America is becoming more important by the day. It will be interesting to see the size of the new resource and how much larger still the resource could become next year.

Iron Creek remains open in all directions. That suggests the possibility of a much larger resource. If the company could double the size, that would greatly enhance the indicative economics of a PEA or PFS. In addition, CEO Trent Mell has mentioned the potential contribution from copper. He said that up to one third of Iron Creek's revenue could come from copper. That would be a tremendous credit against the primary cobalt production costs. I'm a big fan of copper, the world cannot have an energy revolution (clean/green renewable energy sources), or the electrification of passenger and commercial transportation, or the building and rebuilding of critical infrastructure, without Copper.

Conclusion

I said that there are 10 or fewer cobalt juniors worth looking at. First Cobalt (TSX-V: FCC) / (OTCQX: FTSSF) / (ASX: FCC) is high on the list. It has a lot of boxes checked, but at the same time, is still relatively early stage. So, there's high return potential, with commensurate high risk. As more boxes get checked, like the upcoming resource update at Iron Creek, ongoing metallurgical testing, lining up feedstock and funding sources for the refinery…this de-risking should get noticed by the market. That, and the estimated value of the refinery being three times larger than the company's entire Enterprise Value, suggest today's share price could be an attractive entry point.

See Corporate Presentation.

See latest Press Releases.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about First Cobalt Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of First Cobalt Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned shares of First Cobalt Corp. and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Energy Fuels. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by author.