Delrey Metals Corp. (CSE:DLRY) (FSE:1OZ) (OTCPINK: DLRYF) has acquired 5 promising properties in Canada. Four are prospective for vanadium, for a total of

10,856 hectares, and 1 is a cobalt–copper-zinc opportunity that

Cobalt 27 Capital Corp. acquired a 2% NSR on. Management recently signed a non-binding term sheet to acquire an 80% Interest in select mineral licenses in the

Four Corners Project and to establish a JV with the seller.

On

Delrey’s website it says the Project, “

conservatively represents a potential target of over 2 billion tonnes” That’s based on known dimensions and an estimated specific gravity. To be clear, these figures are historic in nature and not compliant with current NI 43-101 standards. Drilling this year will seek to validate the potential large scale of the deposit.

Four Corners

Four Corners consists of a

5,157-hectare property located in western Newfoundland & Labrador that has had significant historical work done on it. It is transected by Route 480 and a 33 megawatt power line, and located 40 km along a paved highway, east of the deep-water, ice-free Port Harmon Complex. Year-round access to rail & port are crucial for bulk commodities. This is a potentially transformational transaction for

Delrey Metals, a tremendous opportunity. A giant, bulk tonnage project in a great jurisdiction, Newfoundland & Labrador, with world-class supporting infrastructure. {Please read

press release for further details}

Here’s a recent article I wrote featuring the

Four Corners Opportunity.

Airborne Geophysics Results are Very Encouraging….

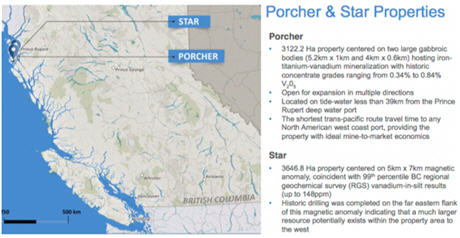

On April 15th,

Delrey Metals announced the completion of airborne geophysics across its wholly-owned

Porcher, Blackie & Star properties near Prince Rupert, BC, Canada. Management believes the results are very encouraging. They outline sizable magnetic anomalies on all 3 properties. On

Porcher there are 2 magnetic highs, one is 3 km x 2 km, and the other 2.7 km x 1.8 km. There’s a 11 km long magnetic high on the

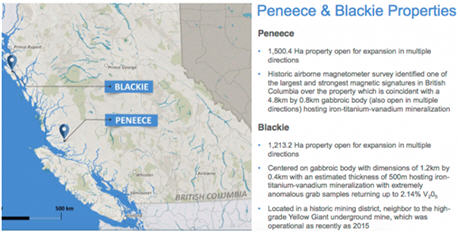

Star property, and a 1.5 km x 800 m magnetic high on the

Blackie property. A historic 2.14% V205 bedrock sample from the

Blackie property is believed to be coincident with the newly mapped geophysical anomaly (

McDougall, 1984). {see

Press Release}

The surveys were completed by

Ridgeline Exploration Services Inc. and were flown in a systematic low-level grid pattern at 150 m line spacing. The average terrain clearance was 75 m across all surveys and a total of 1,106 line-km was flown. Based on results from the surveys the Company increased the size of the

Porcher property from 3,122 to 3,525 hectares and the Star property from 3,647 to 4,618 hectares to capture the new anomalies. Results will be used to help

Delrey’s technical team plan a Phase II work program of prospecting, mapping & rock sampling.

Full Speed Ahead at Peneece, Star, Porcher & Blackie Properties

Crews are currently mobilizing to the

Peneece property and it is estimated that the survey will be completed within the week with results released shortly thereafter.

Morgan Good, Delrey’s President & CEO commented,

“

The Delrey team is quite excited by the results of the Phase I work program on the Blackie, Porcher & Star properties. High-resolution magnetics are an effective tool used for vectoring towards Fe-Ti-V bearing magnetite deposits. The large anomalies identified by the 2019 surveys, combined with historic surface sampling confirming vanadium and titanium mineralization, gives us confidence in the potential of these 3 properties. We are looking forward to returning to the properties in coming weeks to follow up with a Phase II work program over the magnetic anomalies. This timeline will allow Delrey to conduct a Phase III work program on the properties during the summer months which may include diamond drilling over the highest priority targets…”

Delrey Metals, Delivering on Promises, Active Exploration + Acquisitions

Delrey Metals Corp.’s mandate is to create shareholder value by sourcing, financing & developing undervalued strategic energy metals properties & projects through staking ground or making accretive, prudently & creatively financed acquisitions & JVs / farm-ins. They’re off to a great start and have a clean balance sheet with just 34 million shares outstanding. The market cap is about

C$6.5M = US$4.9M. The airborne geophysics results show that unlike so many natural resource juniors these days,

Delrey is actively exploring their properties. They can do this because they have strong financial backing from a loyal shareholder base.

Concurrently, the Company is aggressively pursuing additional strategic energy metals assets, (

as they promised), recently announcing the potentially Company-making (non-binding) Four Corners transaction & JV deal. This was announced in March, just a few months after the Company’s other 5 assets were acquired.

Delrey is moving at lightning speed!

Here’s a recent article I wrote featuring the

Four Corners Opportunity.

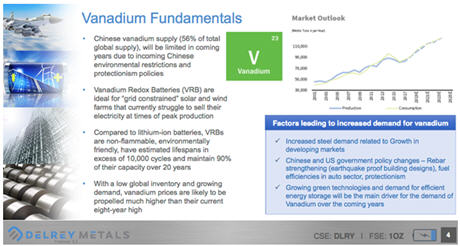

Will 2019 be Good for Vanadium Prices? Good Year for Delrey Metals?

2019 could be a sweet spot in vanadium pricing, several experts now expecting prices in the

US$12.50/lb. to

US$17.50/lb. range for the remainder of the year. That would sustain bullish sentiment for companies with properties outside of China, Russia & South Africa.

Delrey Metals has exactly that, 5 early-stage prospects in Canada, all with decent infrastructure, all situated on past producing mining or logging sites and most important, all having had historical work done, and being actively explored this year.

Prior work included magnetic and other surveys, soil sampling, surface samples (

concentrates were made from some samples), and a drill program at the

Star property. They all have titaniferous magnetite & vanadium-enriched geology. It’s critical to understand that no one was looking for vanadium in the past. Three-four years ago it was priced at just

US$2-US$3/lb. Titanium & iron ore were the metals of interest, now those metals could be valuable credits to a vanadium focused operation.

CONCLUSION

The

Delrey Metals‘ management team has created an investment vehicle that is laser focused on battery metals, most notably vanadium, but also cobalt at the Company’s Sunset property. They would also consider lithium, graphite, manganese, copper & nickel properties or projects in good jurisdictions with attractive deal terms. And, make no mistake, we are in a buyers’ market. There’s no end to the number of transactions that management can pursue. They have the luxury of choosing only the very best opportunities.

That might mean turning down 49 out of 50 proposals to get to a

Four Corners. This is the time to be acquiring assets, this is the time to be invested in a vehicle that has access to capital. This is the time to be searching for battery metals. This is the time for readers to consider taking a closer look at

Delrey Metals Corp. (CSE:DLRY) (FSE:1OZ) (OTCPINK: DLRYF)

April 2019Corporate Presentation

RecentPress Releases

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of

Epstein Research [ER], (together, [ER]) about Delrey Metals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Delrey Metals are highly speculative, not suitable for all investors.

Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned no shares of Delrey Metals and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.