Technical analyst Clive Maund charts a semiconductor company that he believes is well positioned.

The outlook for Lattice Semiconductor Corp. (LSCC:NASDAQ) is considered to be extraordinarily positive because it looks like it is centrally placed to capitalize on the imminent Edge and 5G boom markets, and is fast overcoming debt problems that arose as a result of its heavy investments in these megagrowth sectors.

Edge, which we encountered with VSBLTY (Visibility), which uses it in its rapid facial recognition technology, is an Intel development, and is succinctly described by Deepak Boppana, senior director of segment and solutions marketing at Lattice as follows, "Edge computing is critical to the evolution of the AI (Artificial Intelligence) experience as it greatly reduces the latency, privacy, and bandwidth challenges involved in moving data from the network edge to the cloud or data center for analysis," and adds, "Lattice sensAI stack is a compelling solution for seamlessly implementing edge AI," and we can also add that it is cheaper and much faster than using the Cloud, and in any case data can always be backed up to the Cloud at leisure.

Lattice Semiconductor stock broke out to new highs April 10 on the news that the company's sensAI™ solutions stack was named "Most Competitive FPGA Product" by China Electronics Market (CEM) magazine as part of their 2018 Editor's Choice Awards.

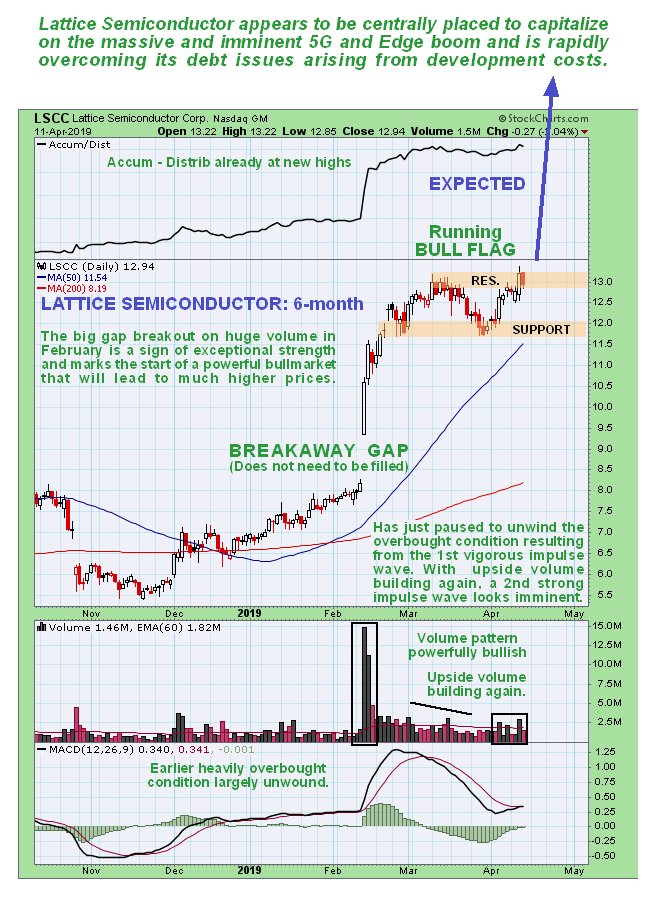

In light of all this you should be able to readily understand why Lattice's stock is not thought to be topping out here—on the contrary, it is believed to be coiling in readiness for another upleg, which could be really big. On its latest 6-month chart we can see how superficially it looks like it might be forming a Double Top here with its March highs, but this is belied by the tremendous power of the February high volume gap breakout and advance, and backed up by other factors, like the strongly positive volume indicators—the Accumulation line is making new highs, as is On-balance Volume (not shown)—and the 50-day moving average catching up with the price to support another vigorous impulse wave, with the sideways action of the past six to seven weeks having unwound the earlier heavily overbought condition, as shown by the MACD indicator. For all these reasons the pattern that has formed from late February to the present is considered to be a highly bullish "Running Flag"—running because it is upwardly skewed or, as in this case, horizontal, because the stock is so strong. Typically a Flag of this type following a high volume breakaway gap, which does not need to be filled, leads to another powerful upleg, and with the price pushing new highs on increased volume in recent days, this second big upwave looks imminent.

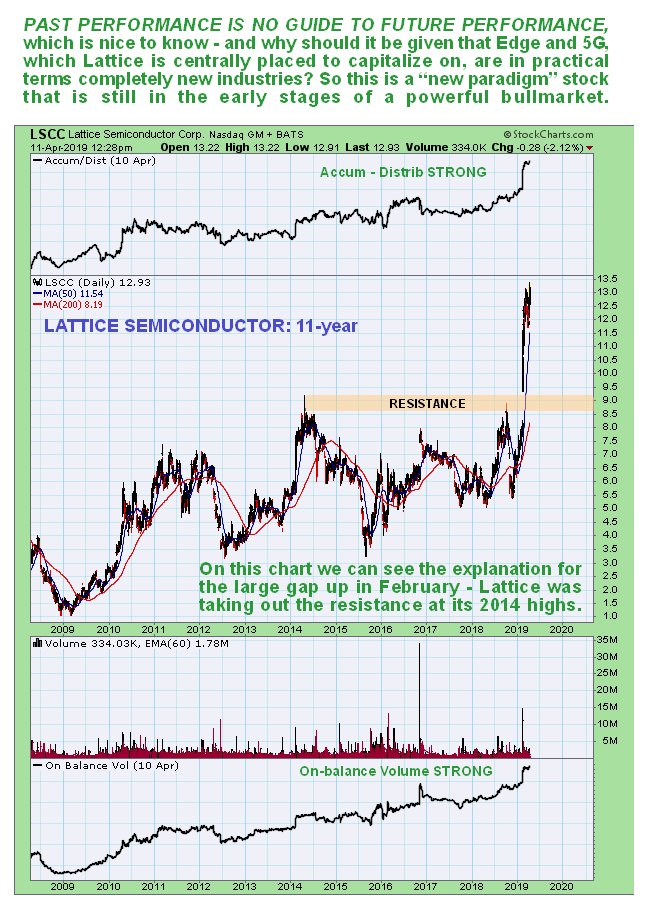

The long-term 11-year chart enables us to determine exactly why February's big breakaway gap occurred where it did—it was because the price vaulted above the resistance at its 2014 highs and thus out of the giant trading range that formed from 2011 through early this year. Beyond that, it has to be said that the long-term history of the stock is largely irrelevant, because Lattice has positioned itself centrally to capitalize BIG TIME from the imminent Edge and 5G booms, which are going to be on a gigantic scale, and amount to a new paradigm.

The conclusion is that Lattice Semiconductor is an immediate strong buy here for the next (2nd) big upwave, which may be on the point of starting now. For those with the requisite experience in this area it is also a good candidate for Call options, a suggested series being the June $15 Calls at $0.70 ask (June 17th expiry). Spreads are quite wide with the out-of-the-moneys with the June $15s being $0.45 bid, but if this makes the kind of move we are expecting, it won't matter.

FULL DISCLOSURE: I HAVE MAY $17.50 CALL OPTIONS IN THIS STOCK. The reason for recommending the June $15s for subscribers is that they are less risky. I am prepared to assume the much higher risk of failure inherent in the May $17.50s because I want the leverage.

Lattice Semiconductor website.

Lattice Semiconductor Corp, LSCC on NASDAQ GM, closed at $12.93 on 11th April 19.

Posted at 8.45 pm EDT on 11th April 2019.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Lattice Semiconductor. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.