Blue Sky Uranium Looking to Significantly Increase Resource of Flagship Ivana Uranium-Vanadium Project

The Critical Investor takes a look at the fundamentals for uranium and profiles a company with a uranium-vanadium property in Argentina.

1. Introduction

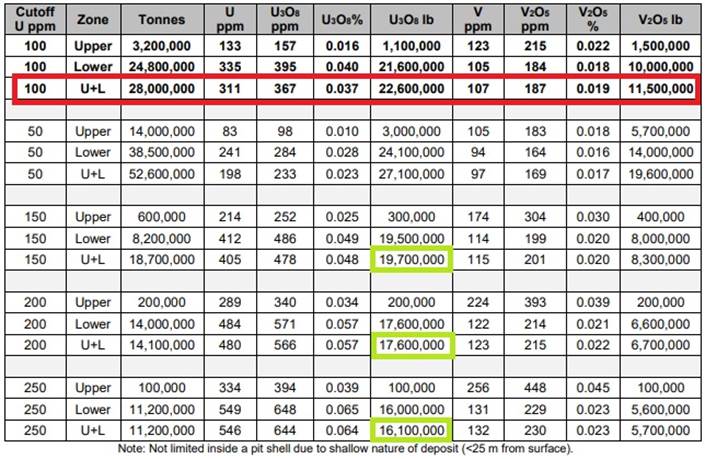

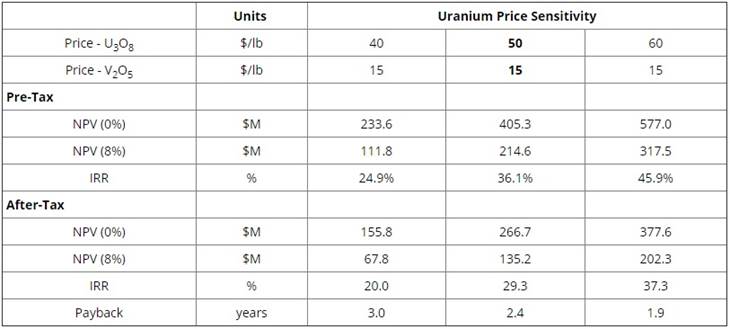

After publishing the results of the Preliminary Economic Assessment (PEA) for its Ivana uranium/vanadium project in Argentina on February 27, 2019, and filing this study recently on April 12, 2019, Blue Sky Uranium Corp. (BSK:TSX.V; BKUCF:OTC) positioned itself immediately as a low-cost development play in the uranium mining sector. At a low base case uranium oxide (O3O8) price of US$50/lb U3O8, the after-tax NPV8 is US$135.2 million and the IRR is 29.3%. These are very decent numbers as most competitors use US$60–65/lb U3O8 for their base cases. Initial capex is US$128.05M, and the all-in sustaining costs (AISC) net of vanadium credits is US18.27/lb U3O8. This AISC is amongst the lowest in the industry.

This doesn't mean that the entire project is economic at this time as the long-term (or also called contract) uranium oxide price is US$32/lb U3O8 (Source: Cameco), as is any project worldwide except the ISR operations in Kazakhstan and Arrow of NexGen Energy, but it sits at the front of low-cost projects and operations. It is believed by market experts that contract prices need to increase to at least US$50/lb U3O8 before any new project gets developed into a mine, and there are many different views around on this pricing topic if and when this could occur. Blue Sky Uranium has made its mark now, and sets out to potentially grow its flagship Ivana deposit considerably, which in turn could improve economics even further. What this could mean for investors will be discussed in the following article.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. Company

Blue Sky Uranium is an exploration and development company, focusing its uranium and vanadium exploration efforts on southern Argentina, with 100% control of more than 434,000 hectares of mining tenures. The company is a member of the Grosso Group, led by Joe Grosso, and is a resource management group that has pioneered exploration in Argentina since 1993.

The company's Amarillo Grande Uranium-Vanadium Project in the Rio Negro province is a district-scale uranium discovery and includes the flagship Ivana project, containing the country's largest NI 43-101 resource estimate for uranium, with a significant vanadium credit.

Blue Sky Uranium currently has 109.79 million shares outstanding (fully diluted 157.61 million), 43.3 million warrants (the majority is due @C$0.30–0.35 in 2020), and several option series to the tune of 4.5 million options (C$0.30, expiring at Jan 23, 2023) in total, which gives it a market capitalization of C$24.7 million based on a April 14, 2019, share price of C$0.225.

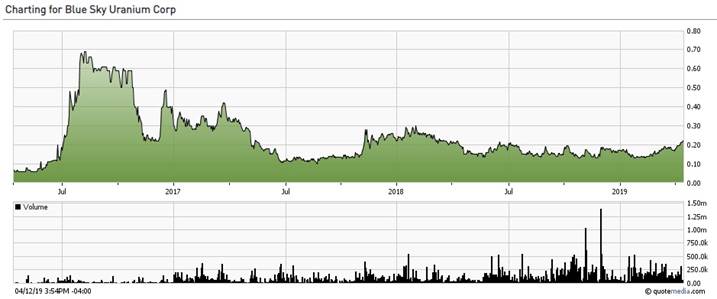

The company has no trouble raising cash despite the difficult sentiment for the last year or so, as it raised C$3.4 million in June 2018. This kind of money goes a long way for exploration (drilling) at the Ivana project, as all mineralization is very near surface, at a maximum depth of just 30m, and the host material is soft unconsolidated gravels and sands. The share price showed a bit of a pulse after the PEA results were released last February, but it will be clear that the stock is just coming off bottom levels, which formed strong support:

Share price; 3 year time frame

This is predominantly related to the current low uranium prices for spot and contract, rendering almost all uranium projects worldwide uneconomic as mentioned, making the uranium juniors and miners an unloved niche sector at the moment. The uranium market itself is a very intransparent and therefore complex market to understand and surely forecast, but I will try to make things a bit more insightful in the next section.

The management team is the core of the Grosso Group team, and is led by President and CEO Nikolaos Cacos, who has been with the Grosso Group since inception in 1993, and a director of Blue Sky Uranium since 2005, and a director of Golden Arrow Resources since 2004 and president and CEO of Argentina Lithium since 2013. All three companies are members of the Grosso Group, and operate in Argentina. CFO Darren Urquhart isn't that long with the group but also closely involved like Cacos as he is CFO of all three companies. With all three companies there is a specific metal specialist geologist on board, and with Blue Sky it is Guillermo Pensado, the VP of Exploration and Development, who has over two decades of experience in exploration and economic project assessment in the Americas, with most of it focused on uranium.

When we are talking about the Grosso Group, there is no way we can go around the founder and president, Joseph (Joe) Grosso. He became one of the early pioneers of the mining sector in Argentina in 1993 when mining was opened to foreign investment, and was named Argentina's "Mining Man of The Year" in 2005. His knowledge of Argentina was instrumental in attracting a premier team, which led to the acquisition of key properties in Golden Arrow Resources' portfolio, of which the development of Chinchillas eventually resulted in a JV with SSR Mining. He has successfully formed strategic alliances and negotiated with mining industry majors such as Barrick, Teck, Newmont, Viceroy (now Yamana Gold) and Vale S.A., and government officials at all levels. At the moment he is the chairman of Blue Sky Uranium, a director of Argentina Lithium, and executive chairman, CEO and president of Golden Arrow Resources, which is the flagship company of the Grosso Group.

To me, Grosso is instrumental in managing any jurisdictional risk in Argentina, and very important for Blue Sky Uranium in this role. So far for management, let's have a look at the commodity in focus, which is of course uranium.

3. Uranium

Uranium (chemical element U, better known as U3O8) in its pure form is a silvery white metal of very high density—even denser than lead. Uranium can take many chemical forms, but in nature it is generally found as an oxide (in combination with oxygen). Triuranium octoxide (U3O8) is the most stable form of uranium oxide and is the form most commonly found in nature.

Canada, Australia and Kazakhstan are estimated to account for over half of the world's resources of uranium, which are estimated to total approximately 4.74 million tonnes. Australia has approximately 30% of world resources, Kazakhstan 17% and Canada 12%.

Many industrialized nations are heavily dependent on nuclear power generation, with nuclear electricity representing a major component in such countries as the United States (21%), Hungary (36%), Sweden (46%), and particularly France (78%) and Lithuania (80%). As renewable energy (wind, water, solar) is becoming increasingly important, but it's main issue is its lack of continuity, society needs sufficient base load power, and coal and nuclear can provide this certainty, and therefore will not go away anytime soon, especially nuclear.

Worldwide, there are 448 nuclear power reactors operating in 31 countries with total installed capacity of 392,000 MWe. The scale of the world's nuclear industry is considerable and uranium demand is projected to be growing again after Fukushima created havoc and Germany and Japan were facing closures of their nuclear fleet. Japan used to be one of the biggest nuclear electricity producers (34%), but since the Fukushima disaster in 2011 all nuclear reactors have been shut down. Since Q3, 2014, Japan is slowly restarting reactors again, which caused some optimism regarding the uranium prices, but the latest news is the Japanese courts are hesitant to approve restarts, and only granted approval for seven reactors so far. The government is very pro nuclear energy so expectations about the prospect of a fleet wide restart remain high.

As of January 2019, there were 58 reactors under construction, 167 planned (approved and funded) and another 345 proposed (intended but not approved or funded). New construction is currently concentrated in Asia with China and India in the forefront. There are also a number of reactors being phased out, so it is expected around 2020 to have a net addition of 50–60 reactors worldwide, of which the majority will be located in Asia.

An important development are the production cuts by Cameco and Kazatomprom as a reaction on ongoing low uranium oxide prices. In general, US$60–65/lb U3O8 is believed to be the minimum threshold to bring most idled operations back online again, or start up new mines.

Uranium prices; Source Cameco

Cameco even shut down its flagship McArthur River Mine last year, the world's largest high-grade uranium mine, for an indefinite period of time, besides Key Lake. This meant it has put its mines on care and maintenance, laying off most of its staff (even firing 150 people at headquarters) at undoubtedly a hefty price tag, and this means it will take a lot of time and much more money, and therefore much higher uranium prices, to restart it all again.

Necessary pricing could involve US$50/lb U3O8 levels, and maybe even higher, as it is rumored by experts that the McArthur River mine needs a complex, difficult and expensive expansion to mine the next phase. It is even suggested that it would be cheaper to buy and build Arrow, the Tier I deposit of NexGen Energy, and this seems valid on the longer term as Arrow appears to be much more profitable than McArthur River or Key Lake at the moment. In the meantime, Cameco fulfills its delivery duties by buying in the spot market, buying that could reach as much as 20M lb U3O8 this year.

Cameco is not the only one doing this, as for example traders, banks and hedge funds are buying uranium oxides left and right in order to speculate on future price increases. A new fund, Yellow Cake PLC, has an offtake agreement in place with Kazatomprom, which accounted for the buying of 8.1M lb U3O8 at the discounted price of US$21.01/lb U3O8 in 2018, and gives Yellow Cake the possibility, not the obligation, to buy large quantities for the next nine years, to the tune of US$100 million each year.

World uranium production is dominated by Kazakhstan, Canada and Australia, which, together, produce about 74% of annual mine supply. These countries are followed by Niger, Russia and Namibia. These leading producers combined account for approximately 95% of worldwide mine production. In 2018, world production of uranium was estimated at about 123M lb of uranium. The four largest producers, Kazatomprom, Cameco, Orano (former Areva) and ARMZ-Uranium One, have a market share of 65%. In 2018 worldwide production of uranium came from underground (34%), open pit (24%) and ISR mines (36%).

Prices of uranium are always, just like gold, subject of widespread sentiments and not the result of a healthy supply/demand mechanism, although the uranium markets are well known by the number of utilities (the nuclear power plants) in production, under construction, etc. Something that isn't very well understood however, but obviously key to demand, is the stockpiling by utilities, usually by fulfilling their long term contracts, like the Japanese appeared to be doing during the shutdown since 2011. Because of this, the markets expected a huge stockpile to come on the market sooner or later, when it would be clear Japan would dismantle its nuclear reactors. This development didn't pan out as we know now, and it is expected that Japanese utilities will enter the LT markets in a few years after they restarted. It is also expected that not all Japanese reactors will be restarted, so in my view there should be a lot of idle stockpiles available for restarting utilities.

It is widely agreed upon that the growing net number of reactors will eventually generate increased demand, which would in turn create shortages based on current supply levels. However, this can take a few years to materialize.

Olympic Dam, BHP, Australia

Uranium oxide supply isn't switched on in a short period of time, and an increase in demand by utilities can't be met by the mining industry in time, and this is the catalyst all uranium investors are waiting for. It will probably take at least one year to have McArthur River and Rabbit Lake back online again, and the same or even longer goes for existing or new ISR operations of Kazatomprom. It recently said it could add 7M lb U3O8 of production annually by investing US$100 million many times over, but ISR is slow to ramp up, it takes about 18 months after the wells are in place.

Besides this, there is spare capacity waiting in Australia (Olympic Dam, BHP) which will likely be expanded as soon as uranium contract prices improve meaningfully, and the Honeymoon Mine (Uranium One), which was closed in 2013 due to low prices and would be reopened in that case, and possibly Kazakhstan, currently globally the largest producer. In Namibia there is the Langer Heinrich (Paladin Energy) mine waiting for better times, but it will be clear that new production capacity will take a lot of time. And the Chinese-owned Husab mine is coming online this year. But all these mines and projects have one thing in common: it takes time, to the tune of 1.5–2 years. And when the spot market has dried up and utilities start buying, there is no time. Much has been made of current stockpiles of utilities, but most of these stockpiles are government owned and will not go back to the markets again.

According to the World Nuclear Association, global demand is expected to rise to 180M lb U3O8 in 2025, supply will be an estimated 140M lb U3O8 at the time, including restarted McArthur River, Key Lake and Kazatomprom mines.

Another issue that might influence supply/demand is the Section 232 investigation, which looks into the potential for imported goods to harm national security, and uranium is one of them. A proposal by Ur-Energy and Energy Fuels has been made for a 25% quota on domestic uranium, whereas domestic production is not even 1% at the moment. The ramping up production of Kazakhstan since 2005 at very cheap prices has effectively put most U.S. producers out of business. A large part of this Kazakh production went to China, which has massive stockpiles, accounting for more than half of total stockpiles worldwide.

An organization representing utilities, the Ad Hoc Utilities Group (UHAG) is vehemently opposing this proposal, as such a quota could cause a dramatic spike in uranium prices, which in turn, according to them, could threaten 100,000 direct jobs and 475,000 indirect jobs. It could also force the U.S. to deplete its own stockpiles at rapid pace, as sufficient new production coming online would take a long time and a huge amount of money. I believe these to be unrealistic claims as unprocessed uranium costs only about 6% of total costs for utilities, and such a spike could cause an estimated $300–500 million increase in fuel costs for the top eight utilities, but at the same time their combined net income for 2017 was US$18.8 billion, so they have quite a bit of margin in my view. The UHAG furthermore denies the dependency of the U.S. on uranium imports from potential enemies like China and Russia, but this is not true as Canada and Australia accounted for almost 60% of U.S. uranium supply, and Kazakhstan delivered another 11%.

This last country enjoys a very strong relationship with the U.S. as a NATO partner, and has no close relations with Russia, on the contrary. As the uranium mining industry in the U.S. is very small (under 500 people work there), it is very likely to see the utilities as a much larger industry having more (political) impact in this discussion. I expect them to mobilize quite a bit more potential presidential campaign donors and influential Republicans so I don't believe the 25% quota to make it. But on the other hand, Trump is Trump, always looking at money, protectionism and enemy countries, so you never know. Anyway, it is very hard to provide a meaningful forecast for something as speculative as the uranium price as there is no transparent market.

What is the situation in Argentina these days regarding nuclear energy?

Argentina has three nuclear reactors generating about 5% of its electricity. Its current annual consumption is approximately 300 tonnes U3O8 (or 660,000 lb U3O8). The country's first commercial nuclear power reactor began operating in 1974 and collectively the three plants produce 1667 MWe. The current reactors include a CANDU 6 and a Siemens design; the next two planned reactors are to be built by China National Nuclear Corporation. Additionally, five research reactors are operated by the National Commission of Atomic Energy (CNEA) and others.

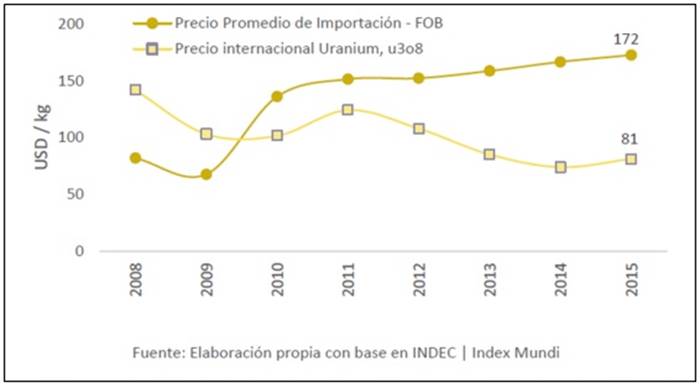

Two further research reactors are under construction. The CAREM-25 nuclear reactor, which has been developed by CNEA with INVAP and others, since 1984, is a modular 100 MWt simplified pressurized water reactor designed to be used for electricity generation (27 MWe gross, 25 MWe net) or as a research reactor or for water desalination. The prototype will be followed by a larger version, possibly 200 MWe with potential to upscale to 300 MWe. Sites in Argentina and internationally are being considered for the CAREM-25. Argentina requires 100% importation of its uranium supply. As shown in Figure 19-1 below, sourced from the Mining and Energy Industry of Argentina, the 2015 price paid for uranium was more than double the international market price for uranium.

It doesn't look like this situation will be solved anytime soon in Argentina, and provides an excellent environment for Blue Sky and the Grosso Group to negotiate with the government on long-term contracts.

4. Amarillo Grande Project

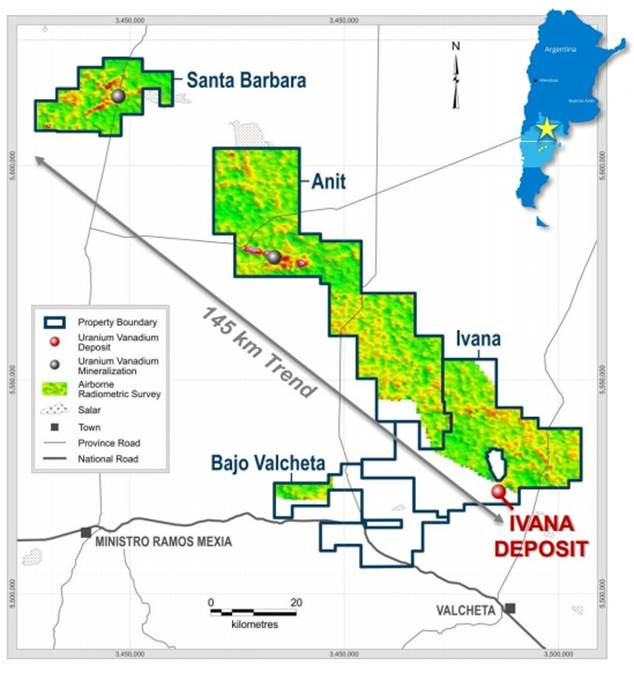

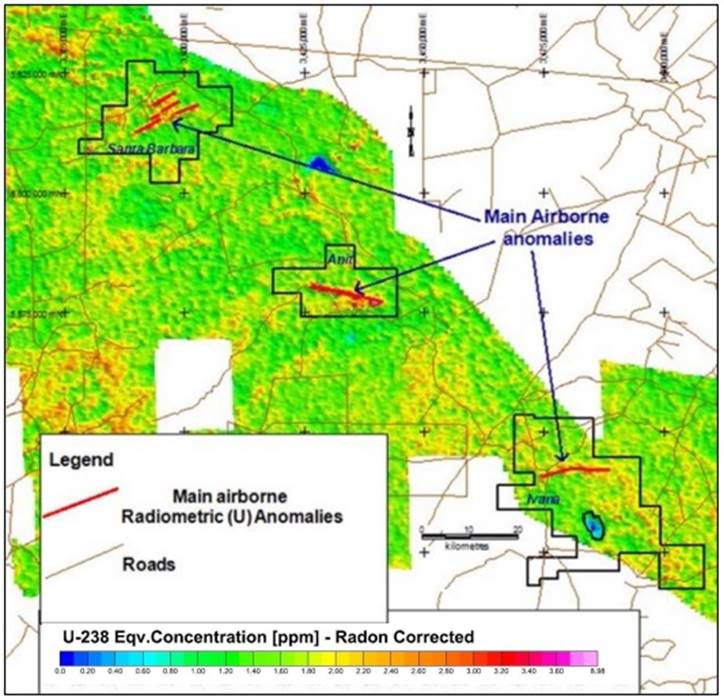

The Amarillo Grande Project, located in the Rio Negro Province, covers over 280,000 hectares of mineral exploration rights. Within this, the Ivana group of properties containing the flagship Ivana project covers over 118,000 hectares north of Valcheta City in Rio Negro Province. It is the southernmost property along the 145 kilometre NW-SE trend, of which only 7,000 hectares have seen recent exploration, that contains not only the Ivana deposit but also a series of airborne radiometric anomalies that represent future exploration targets. The remaining 111,000 hectares also represent a lot of potential for multiple blind deposits, related or not to superficial anomalies according to management. The project has year-round access through a well-maintained gravel road network, in an area of very low population density.The project is in a semi-arid topographical depression, close to 100m below the elevation of Valcheta City (25km south of the Ivana deposit and the location of the regional office of Blue Sky Uranium), with low rainfall, and within a closed hydrologic system. Therefore, any mining and processing activity developed in the area would likely have a low potential risk to local fresh water aquifers.

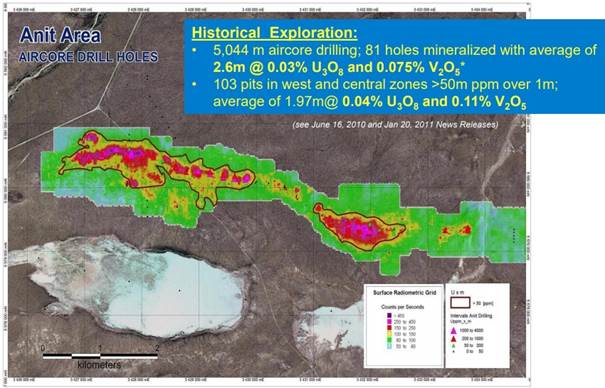

Blue Sky Uranium has been exploring the Amarillo Grande Project since 2006 after it acquired the private company holding the project, and came up with interesting results for the initial Anit and Santa Barbara targets. Trenching in the Central zone of Anit uncovered an interval 30 meters in length that average 0.397% U3O8. Pit sampling in the West Zone returned 3m of 0.85% U3O8, and aircore drilling also in the West zone returned values of 0.078% U3O8 over 4m (hole AN174) and 0.071% U3O8 over 3m (hole AN186). A follow-up trenching program resulted in an average grade of 0.06% U3O8. After this, a follow-up aircore reverse circulation (RC) drill program in 2010 delivered average grades of 0.03% U3O8. It has to be said that Anit has a much higher vanadium grade than Ivana (0.075–0.11% V2O5 vs 0.019% V2O5).

Based on these results and size, I would like to estimate for Anit a mineralized envelope of 4,000 x 500 x 2.3m x 2.1t/m3 = 9.66Mt, which would result in 6.3M lb U3O8 and 15,78M lb V2O5.

Analyses of early samples from pits at Santa Barbara ranged on average from 0.01 to 0.06% U3O8, although a few soil and rock samples in 2007 even had grades as high as 1.58% U3O8 (on a sidenote for who will study the tables in the resource reports: 10,000 ppm = 1% and 1% U = 1.1792% U3O8).

Blue Sky Uranium made the discovery of Ivana in 2010 after flying an extensive airborne radiometric survey.

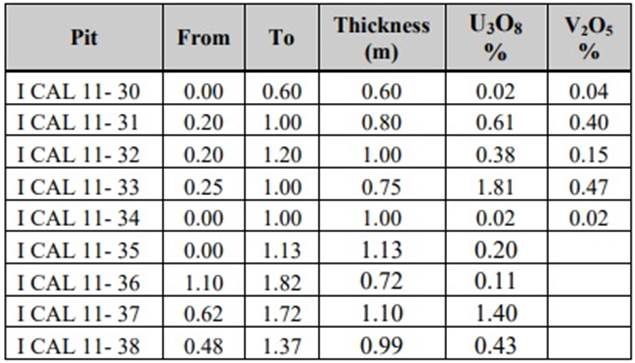

Initial reconnaissance exploration results at Ivana were much more impressive for management compared to Anit and Santa Barbara, as pit sampling over the radiometric anomaly returned on average much higher grades, up to 1.81% U3O8 over 0.75m as can be seen in this table of the 2012 technical report:

The resulting recommendation of this report was pretty clear:

"The next phase of exploration work on the Properties should focus on the Ivana property."

With this report in hand, the company signed a MOU during 2012 with Areva for a 49–51% JV on all Argentinian uranium assets. The goal for Areva was to target roll-front type uranium mineralization at a depth up to 400 meters. However, after spending almost US$3 million in exploration, Areva didn't find this and terminated the agreement in May 2014, hereby returning the project to Blue Sky Uranium. Ivana has been basically shelved for quite a while, basically since then until the beginning of 2016, when general mining sentiment started to recover. Of the three projects, the focus still was on the Ivana area where Blue Sky finally found a so-called roll-front deposit covered by surficial mineralization, all in the first 30m from surface. Notwithstanding this, as Ivana is the most economic project so far and probably the first to be developed, management hasn't forgotten about the other two projects, or the various radiometric anomalies along the 145km long potential exploration trend.

According to management, this new district may be hiding multiple blind deposits, and its potential may be not only at surface but also in depth, as suggested by Areva in its exploration program. The Blue Sky exploration team, armed with the experience of the Ivana deposit discovery and the development of an exploration model to be applied all over the district, is now focused in the re-assessment of the Anit and Santa Barbara surficial mineralizations, as well as the several radiometric anomalies in between. Management thinks that those areas may represent the superficial expression of multiple blind deeper and higher grade roll-front type deposits representing an estimated potential for about 100M lb U3O8 along the entire district (now 23M lb). I asked them specifically how they got to this concept. This is their explanation and in my view the key to the story:

"The surficial mineralization is the indicator itself because the roll front deposits, or the uranium comprised in those deposits, can be remobilized by oxidized ground waters and precipitated as surficial mineralization near surface. This is the model observed at Ivana deposit. Therefore, the several radiometric anomalies along the 145km long district, including Santa Barbara and Anit, may be indicating deeper blind deposits."

Let's see if the company manages to prove its concept right. Besides this, the Ivana deposit is not an ordinary one, so let's have a more in-depth look into its geology.

The Ivana uranium-vanadium deposit has a rather unique geology, as it is a combination with characteristics of both surficial and sandstone-type uranium deposits. Most of the delineated mineralization has similarities to the surficial uranium deposits of Australia and Namibia in that the oxidized uranium mineralization consists of carnotite coating pebbles and sand grains, and as disseminations, in poorly consolidated sediment or soils of relatively young age. The main uranium mineral in these deposits is typically carnotite (as is the case with Ivana), a yellowish hydrated potassium uranium vanadium oxide.

Well-known examples of surficial uranium deposits include the Langer Heinrich deposit in Namibia (93 Mlb P&P reserves @ 471 ppm U3O8) and the Wiluna deposit in West Australia (62 Mlb M&I resources @ 525 ppm U3O8). Yeelirrie, another example from Australia and owned by Cameco, may be the world's largest reported surficial uranium deposit with measured and indicated resources of 128 Mlb of U3O8 at a grade of 0.16% U3O8. The Yeelirrie deposit is a 9 km by 1.5 km horizontal sheet of poorly consolidated fine sediments in which the bulk of uranium mineralization is confined to an interval between 4m and 8m below the surface.

Ivana, however, lacks the well-developed calcrete layers generally associated with surficial uranium deposits in semi-arid to arid climates. Calcrete layers are layers of sand or gravel densely cemented with calcium or magnesium carbonates, often occurring above the uranium mineralization. The Ivana deposit contains layers of poorly consolidated sediments that are calcareous, but the strength of the calcite cement is far from being considered calcrete. The absence of these calcrete layers improves metallurgical recovery a great deal. The primary uranium mineralization at Ivana also has considerable similarities to sandstone-hosted uranium deposits in other locations, particularly basal-channel sandstone-hosted uranium deposits, and appears to be related to a redox boundary of possible regional extent.

For the ones interested in even more geology and chemistry, or simply trying to understand what is meant here (like myself): redox is a chemical reaction in which the oxidation states of atoms/molecules are changed, involving oxidation and reduction of the atoms/molecules reacting with each other. Redox boundaries in mining have the following definition: the redox boundary in aquatic sediments is the depth below the sediment–water interface that separates the stability fields of the oxidized and reduced species of a given redox couple. It is loosely represented by the boundary between oxic and anoxic sediment. In our case sediments can be interchanged with sandstone. It appears that uranium enrichment occurs along this redox boundary within sandstone aquifers. Management added this for better understanding: "the way the oxidation/reduction front works is as follows: uranium in the oxidized state (U+6) is very mobile on water and it is almost immobile at the reduced state (U+4). Oxidized groundwater transports U+6 from some fertile source (leaked from volcanics, sediments, granites, etc.), and it is "trapped" when the water finds a reduced environment like black shales, bitumen from mature oil, trunks/logs/veggy debris, etc. The reductant stimulates the "reduction" of U+6 into U+4 and precipitates as uranium minerals at the redox front, where it is accumulated for long periods of time, and potentially generates an economic deposit."

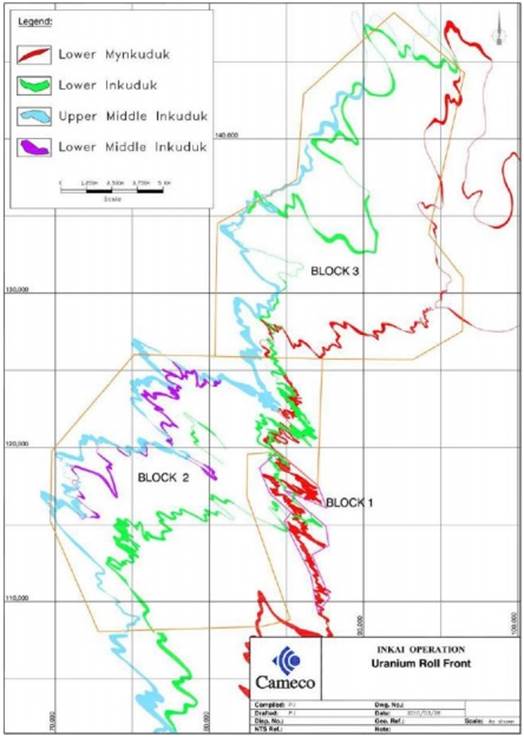

Examples of this style of mineralization can be found in the Powder River Basin of Wyoming, USA; the Coastal Plain of Texas, USA; and in the Chu-Sarysu and Syrdarya Basins of Kazakhstan, where mapable redox boundaries have been followed for hundreds of kilometers and contain many deposits. Uranium deposits of this type formed along regional redox boundaries can reach large sizes, as at Inkai, Kazakhstan, where the proven and probable reserves are about 270 million pounds of U3O8 at a grade of 0.03% U3O8, and in situ recovery (ISR) production at these deposits (JV of Cameco and Kazatomprom) currently dominates global supply.

Of course, this doesn't mean that Ivana could get very large as well, but as Blue Sky has traced uranium on a district scale trend here, this could indicate significant potential in that direction. Thus, the Ivana uranium-vanadium deposit is currently considered a hybrid, in part a surficial deposit, and in part a sandstone-hosted deposit.

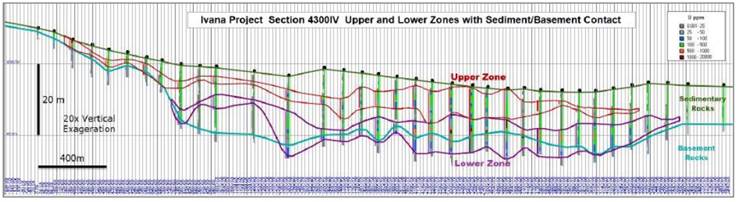

As all mineralization is positioned very much near surface, drilling by many reverse circulation (RC) drill holes for a total of over 9,000m was done since the summer of 2017 at an average drill hole depth of 15.4m. The Ivana deposit is characterized by two stacked zones of uranium mineralization, the upper zone and the lower zone. The upper zone is composed of oxidized mineralization, and the lower zone contains a mixture of oxidized and altered primary-style mineralization.

I was impressed by the sampling at Ivana, were just digging a 2m deep hole often resulted in mineralized rock with very high off-scale (10,000–61,000 cps) radiation readings:

These readings didn't result in 5–20% U3O8 as we know from NexGen Energy's similar Arrow readings, but as we will see in a second, the mineralization still generates pretty interesting economics in the PEA.

The Ivana deposit has the following highlights:

- Surficial deposit with a NI43-101 compliant Inferred resource of 22.7M lb U3O8 and 11.5M lb V2O5 (28 Mt averaging 370 ppm U3O8 & 190 ppm V2O5)

- Hosted by loosely consolidated sediments from surface to just 24 meters depth; mining via open-pit methods

- Oxidized uranium-vanadium mineralization amenable to upgrading by simple wet scrubbing and screening and alkaline leach processing

- The Ivana deposit remains open for expansion and additional near deposit (or brownfield) exploration resource potential exists in the Ivana area

This is the resource estimate table at different cut-offs, whereas 100 ppm is the base case:

It shows that at higher cut-offs the resulting uranium oxide content remains significant, which could prove to be useful for improving economics later on. Talking about economics, let's have a look at the initial Preliminary Economic Assessment (PEA) that came out recently.

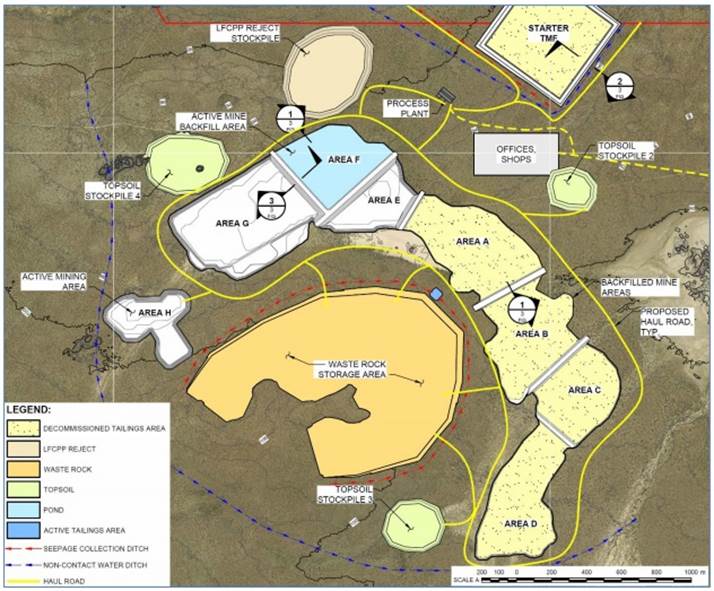

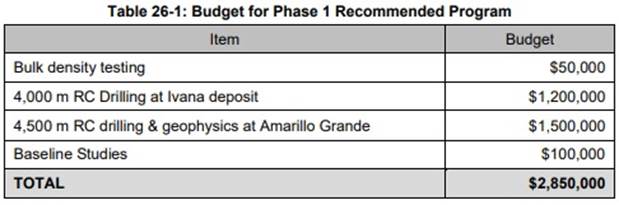

The PEA dated February 27, 2019, is describing an open-pit operation with a 13 year life of mine (LOM), a 6,400 tpd throughput and a strip ratio of 1.1 : 1. This is what the mine plan looks like:

Overall recovery of uranium oxide is 84.6%, and of vanadium pentoxide 52.5% which is solid. The annual production is 1.35M lb U3O8 on average, which would make Ivana a small uranium project, but as mentioned management sees potential to increase the total amount of pounds to about 100M lb. The PEA showed decent economics for a uranium project, at US$50/lb U3O8 and US$15/lb V2O5 the post-tax NPV8 is US135.2 million, IRR is 29.3% and capex is US$128.05 million. The sensitivity looks like this:

So despite the low-grade mineralization, the Ivana project manages to become economic at US$50/lb U3O8, whereas many projects under development or mines in care and maintenance need US$60–65/lb U3O8 nowadays. Beneficiary factors are of course the very near surface mineralization and low strip ratio, and the very soft host rock. As mentioned, Blue Sky Uranium could increase the cut-off and improve the average grade, but the PEA doesn't provide a sensitivity on this unfortunately. Because of the vanadium by-product of about 10% of revenues, the all-in sustaining costs are pretty low, at US$18.27/lb U3O8. This means as long as the Ivana project gets financed, it could endure uranium oxide contract pricing as low as US$20/lb, which hasn't happened since July 2004, and will most likely never happen again.

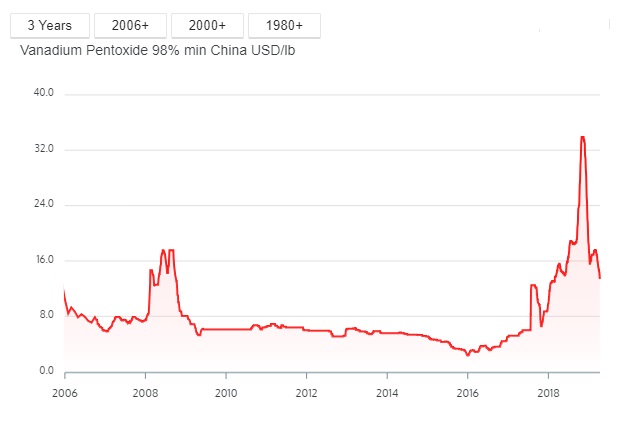

The base case price for vanadium was set at US$15/lb, which in my view is a bit on the high side as it trades at US$13.40/lb at the moment. Notwithstanding this, the metal saw a huge spike recently because of potential involvement with grid storage and other aspects of the ongoing renewables paradigm shift:

/www.streetwisereports.com/images/article_images/CriticalBlueSky4-16-19/image018.jpg" width="694" />

/www.streetwisereports.com/images/article_images/CriticalBlueSky4-16-19/image018.jpg" width="694" />

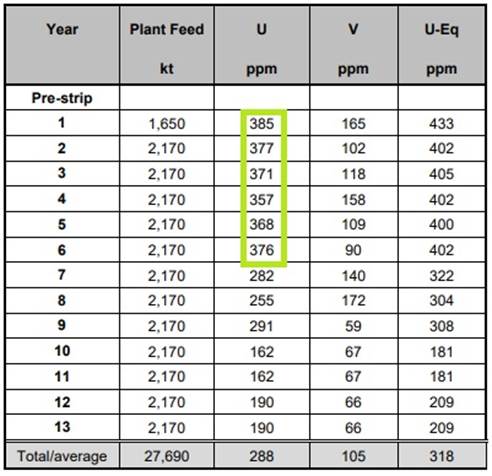

The current drill spacing of 100 x 200m appears to be adequate to update Inferred into Indicated resources but this is up to the geologists; however, more extensive bulk density testing is needed before the resource can be moved to the Indicated category. Ideally, there would be enough bulk density measurements to interpolate density into the block model. This has to happen according to the resource estimate report:

Uranium production averages 1.35 Mlb U3O8 per annum as mentioned, and totals 17.5 Mlb U3O8 over the life of mine. Vanadium production averages 0.5 Mlb V2O5 per year and totals 6.5 Mlb V2O5 over the life of mine. As can be seen in the table below, as the mineralization is so near surface, it is easy to mine the highest-grade ore in the first years (also called "front loading"):

One thing that struck me in the PEA was this remark about export duties: the applicable rate for the recently introduced temporary tax varies generally from 5 to 12 per cent. However, the Argentine government currently indicates that the export duty will expire at the end of 2020. Since the Ivana project will not be in production prior to that time, it will not be burdened with these duties. I consider this a clear advantage of course, now let's see if Macri and his government can live up to expectations this time. And if not, Blue Sky also has the potential option to sell at least 50% of production to Argentina itself, avoiding export duties.

On a closing note: Blue Sky Uranium also has numerous projects in Chubut province. Situated directly south of Rio Negro, Chubut hosts several uranium deposits, however, none are currently in production and the provincial government has enacted restrictions against open-pit mining. The company's projects in this area, Sierra Colonia, Tierras Coloradas, Regalo and Cerro Parva, comprising more than 150,000 hectares of 100% controlled mining properties, are shelved now because of this.

5. Conclusion

Blue Sky Uranium has been around for quite some time, but after Fukushima, one of the longest bear markets and a JV partner walking away, it seems that management is revitalizing everything again. The recent PEA has a very decent base case price for uranium (US$50/lb U3O8), putting it ahead of many other developers and existing mines currently dormant in care and maintenance that will need higher prices. What is very interesting is that the price for imported uranium oxide in Argentina is currently far above the base case price of the Ivana PEA, which would put Blue Sky in a perfect position to be a preferred supplier.

Besides Argentina, at some point it seems likely the world needs more uranium oxide again as well, and then Blue Sky is one of the first developers in line as a perfectly leveraged pure play on uranium. Besides the uranium price, the company also has organic growth opportunities, as according to management it can grow its resources four-fold. This will in turn improve economics a great deal, and will most likely also have a positive impact on the share price.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website https://www.criticalinvestor.eu to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Disclaimer:

The author is not a registered investment advisor, and has a long position in this stock. Blue Sky Uranium is a sponsoring company. All facts are to be checked by the reader. For more information go to www.blueskyuranium.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Energy Fuels. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.