It looks like crude oil is set for a sizable weekly decline. After yesterday’s plunge, the market looks to have stabilized today. But is it really so? In today’s analysis, we’re bringing you the details. We objectively reveal what to expect next. Either the bulls or the bears won’t like it. Who do you think it’ll be?

Let’s take a closer look at the chart below (charts courtesy of

https://stockcharts.com).

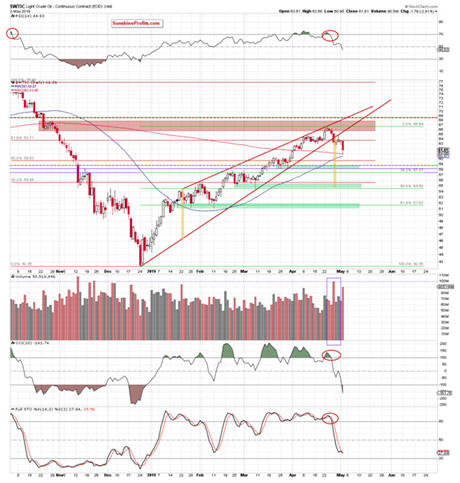

We’ll start with the weekly chart. Earlier this week, crude oil has verified last week’s breakdown below the 61.8% Fibonacci retracement. This has encouraged the sellers to act and black gold slipped below the previously-broken 50-week

moving average.

If today’s session closes below this support, the way further south will open. Of note, both the CCI and Stochastic Oscillator have issued their sell signals. These increase the probability of further deterioration in the coming week(s).

In our

Wednesday’s Alert, we have written about crude oil verifying its earlier

breakdown below the lower border of the rising red wedge. We noted that this was a bearish development and that it was likely to translate into further deterioration.

Looking at the daily chart, we see that our expectations turned out to be correct. Black gold plunged below $62.00 and currently trades at around $61.90,

making our short positions even more profitable.

Light crude has reached the 200-day moving average and this has triggered a tiny rebound. Tiny when compared to the preceding slide. The commodity however still closed yesterday’s session below its mid-April lows. It suggests that lower prices are still ahead of us.

Examining the

volume for further clues reveals an interesting point. Yesterday’s volume was significantly higher than that of either preceding upswing days. It reinforces the bearish scenario. That’s the same situation as we have had with last Friday’s volume. And we remember where the price went next eventually.

How low could the commodity go? Let’s recall our

Wednesday’s Alert. It remains up-to-date also today:

(…) Taking into account the shape of the current decline, black gold could move even lower than the first green support zone. It could visit the second green support zone because there the size of the decline would correspond to the height of the wedge that the oil price has broken down from.

Summing up, the oil outlook remains bearish. After the breakdown from the rising red wedge has been verified, crude oil set sail south without really looking back. The increased volume on yesterday’s downswing supports this interpretation. The weekly indicators (CCI, Stochastics) have generated their sell signals. The daily indicators are also on sell signals. The bearish divergences between the daily indicators and the oil price itself are receiving their downward price resolution. The short position continues to be justified.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Oil Trading Alerts also benefit from the trading action we describe. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts.

Sign up for the free newsletter today!

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Sunshine Profits - Tools for Effective Gold & Silver Investments

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.