Yes, you have read that right. Rallies are not necessarily bullish, and declines are not necessarily bearish. If it was the case, it would be possible to make a living by going long every time a market moves higher on the previous day, and going short when it declines. But the market is much more complex than that. Besides, if you want to make money, you have to buy low and sell high, right? And what happens before the price is high? That’s right, it rallies. So, perhaps all daily rallies are bearish, and all daily declines are bullish? Things are not so simple either. Let’s dig deeper.

The precious metals sector moved higher on Friday, most likely based on the surprisingly good

employment numbers. Silver actually spiked up, while miners lagged behind. While this relative performance may not seem important at first sight, especially to those who are new to the precious metals market, it’s actually an excellent combination of signals that make the outlook for the next several days quite clear. It’s also a

perfect example of what the markets do when they really want to move lower, but something forces them to move higher instead.

In the May 1

st Alert, we wrote the following:

(…) the USD Index's rally might be the trigger for the decline, but actually no trigger is required. The trigger might speed things up, but if one is absent, PMs and miners will likely decline anyway, only a bit later. The "bit later" means several days later, not months. It might mean weeks, if something bullish surprises the markets, though.

Something bullish has indeed surprised the markets – the jobs report was very bullish. The improving situation should theoretically make the Fed less likely to hike the interest rates – at least that’s the prevailing interpretation. Over the long run, gold tends to shine when the US economy is in big trouble, the above positive link between jobs and gold price shouldn’t hold for long. On the short run, however, the interest-rate decision mechanism seems to prevail. Regardless of whether the market interprets the jobs report correctly or not, we can agree that we just saw a bullish surprise.

As it’s usually the case, it’s not the news that was particularly informative – it was gold, silver and mining stocks’ reaction to it that was the key to understanding what’s really happening right now.

Let’s take the markets one at a time and then discuss their relative performance.

Getting Right Into the Precious Metals Sector

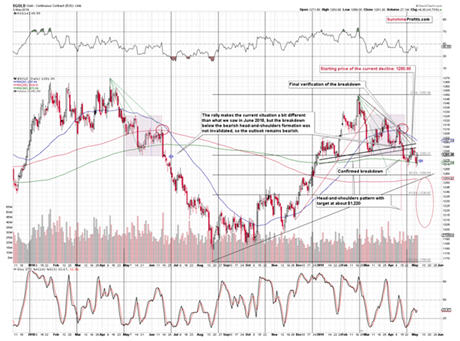

Gold’s reaction was rather average. It moved somewhat higher, but it didn’t erase Thursday’s decline. Gold didn’t close above the Wednesday’s close, let alone the neck level of the previously completed head-and-shoulders formation. Consequently, it didn’t really change anything. The very bearish implications of the breakdown below the neck level of the H&S formation remain in place. As a reminder, this formation alone suggests that gold should slide to about $1,220. While other techniques point to higher targets, but their implications are still bearish.

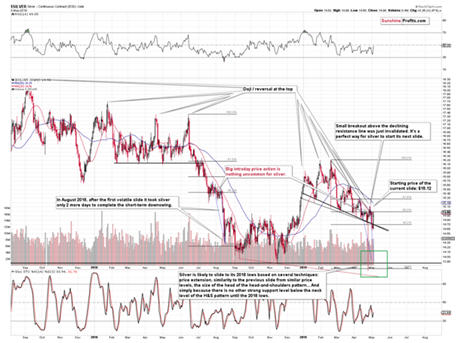

Silver moved sharply higher, which – at the first sight – appears bullish. Let’s put it in the proper context. The only similar situation from the recent past is what we saw in late July and early August 2018. That’s when silver was also within a decline that lasted (so far) more than 2 months. The back-and-forth action was very volatile, which was a good indication of what was about to follow. When silver finally broke to the downside, it truly plunged.

Just because silver moved sharply higher for one day, doesn’t change the overall trend, which remains down. And, given the similarity to what happened in the middle of the previous year, we know that one-day rallies are something normal. Friday’s upswing was not a game-changer – far from it.

Let’s recap what we just saw in the precious metals market. Gold and silver suggest that nothing really changed so far. In other words,

Friday’s move higher was not bullish. Gold’s and silver’s price action doesn’t make Friday’s action bearish on its own, either.

It’s the miners’ reaction that does.

The

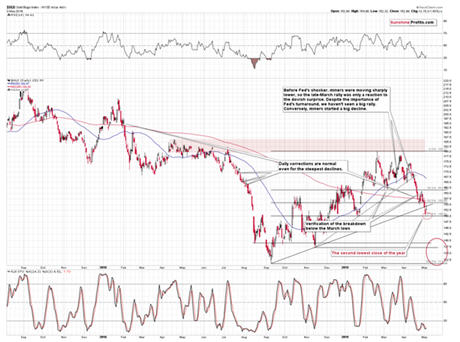

HUI Index moved higher by mere 2 index points. This is bearish for two reasons. We’ll move to the more important one in a few paragraphs. The other one is that this small upswing wasn’t enough to even take

gold miners back above the rising support/resistance line. This was the second day when the miners closed below this line, so the move is now almost confirmed.

On Friday, we wrote that despite the multiple bearish signs, it was still possible that the 61.8% Fibonacci retracement in the HUI would trigger a small correction. It was unlikely, but based on the surprising employment numbers, that’s exactly what happened. The key is that the move was small and didn’t manage to invalidate the technical breakdown despite the bullish news, the rally in gold, and the rally in the general

stock market.

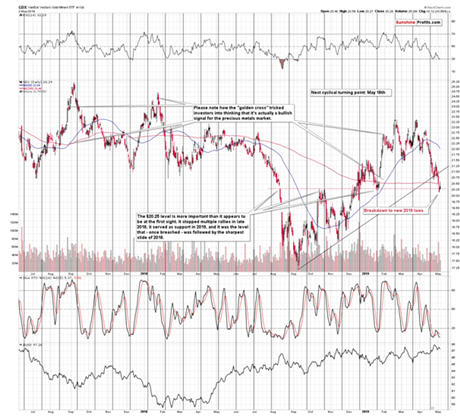

And it was not a coincidence that the GDX ETF, another popular proxy for the miners, has barely moved higher.

The move higher was tiny and in case of the GDX, the move – by itself – was a daily bearish reversal. The rally that took place based on the surprisingly good fundamental news is likely over.

The

volume marking the upswing was relatively low, which is yet another confirmation that up is not the way in which the precious metals market is likely to move next.

Several paragraphs above, we promised to get back to the key bearish thing about Friday’s small move. The most important thing is what we already wrote in the opening paragraphs of this analysis – the relative performance.

Clear Signs from the Relative Valuations

Declines in the precious metals sector often start with silver’s very short-term outperformance of gold. Another bearish sign comes from the mining stocks that underperform gold during both: daily rallies and daily declines. The most profound signal, however, is when gold rallies and miners refuse to do so, or they rally only slightly (i.e. they underperform).

We saw both bearish conformations: silver’s outperformance, and miners’ underperformance.

This is a clear sign showing that the precious metals didn’t form any major bottom on Friday, but rather did what it virtually had to do in light of the bullish surprise. It moved higher. But, at the same time, it provided us with a very important last-minute confirmation – it moved higher in the most bearish way imaginable. The move higher is likely to be reversed shortly –

most likely we’ll see decline’s continuation (and perhaps the next short-term bottom) this week.

Friday’s upswing has merely delayed the slide, nothing else. The downside targets remain unaffected and the same goes for our

gold price forecast for 2019.

Summary

Summing up, Friday’s upswing in the precious metals market is not a bullish sign, but – based on miners’ poor performance – a bearish one. The price action is a perfect example of how the market reacts when it really wants to move lower, but something unexpected gets in the way and prevents that decline. The slide to next near-term bottom is likely to start shortly and this bottom might be reached as early as this week – in a volatile manner. This upcoming bottom might be a good opportunity to go long, but we are definitely not in this kind of situation right now. Conversely, in our view, short positions are likely to generate sizable profits.

Naturally, the above is up-to-date at the moment of publishing it and the situation may – and is likely to – change in the future. If you’d like to see the

precise price near-term targets for gold, silver, and mining stocks and receive follow-ups to the above analysis (including the intraday ones, when things get hot), we invite you subscribe to our Gold & Silver Trading Alerts today.

Thank you.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.