Unless you were following our research, see below, and were already aware of the many warning signs we've been posting in our continued efforts to help traders and to help educate skilled investors, you were probably caught completely off guard by the news of near trade tariffs last Sunday, May 5

th. Let's face it, the short position in the VIX was an indication that institutional and retail investors had gone “all in” on this rally and had failed to even consider anything disrupting the narrow range price rally that had been in place over the past 45+ days. Well, all of that changed on Sunday night and many traders woke up Monday morning to the INDU down nearly -500 points.

The most incredible facet of this rotation was that the markets had already discounted the trade tariff news and began to rally almost immediately after the opening bell on Monday. Sure, we are not out of the woods at this time with the potential for continued price volatility and price rotation, but the fact that the US stock market was capable of rallying back from a very deep opening price shows just how resilient the US stock market and the economy really are. The issue this time, we feel, will be felt in the global market and in foreign currency rates. We'll get into that more as we continue.

In case you missed our most recent research posts, we suggest you take a few minutes to review the following posts to bring you up to speed with our analysis/research. Reviewing these posts may help you to better understand the rest of this article and our expectations for the next 60 to 90 days.

March 31, 2019: Proprietary Cycles Predict July Turning Point for Stock Market

https://www.thetechnicaltraders.com/proprietary-cycles-predict-july-turning-point-for-stock-market/

April 10, 2019: Intra-Day Fibonacci Modeling Shows Volatility Is About To Spike

https://www.thetechnicaltraders.com/intra-day-fibonacci-modeling-shows-volatility-is-about-to-spike/

April 17, 2019: US Stock Markets Setting Up For Increased Volatility

https://www.thetechnicaltraders.com/us-stock-markets-setting-up-for-increased-volatility/

April 22, 2019: Prepare For Unknown Price Action As New Highs Are Reached

https://www.thetechnicaltraders.com/prepare-for-unknown-price-action-as-new-highs-are-reached/

April 28, 2019: Markets Are Setting Up a SHAKE-OUT – Be Prepared

https://www.thetechnicaltraders.com/markets-are-setting-up-a-shake-out-be-prepared/

Now that we've covered a bit of our past research, allow me to attempt to summarize things a bit.

_ First, we continue to expect new high prices to be established over the next 30+ days. Yes, volatility will be larger than it was 30 days ago, but we believe the “Shake-out” is just starting and we believe the US stock market will continue to push higher – at least for the next 3+ weeks.

_ Second, we are very cautious of the July/August 2019 Cycle Predictions, see above. We believe these cycles could be a warning of a major price trend change that prompts some type of “dynamic shift” in the global markets. Right now, it appears a “Shake-out” in China/Asia may be in play. But we believe a bigger “Shake-out” may be brewing somewhere else in the world.

_ Lastly, we believe any top formation in the US Stock market will result in a Pennant/Flag formation, rotational top formation, that will give traders ample time to reposition their trades and reduce risks.

Just a few days ago, we posted this research to help traders understand just how close the markets are to topping and what to expect – see below. We continue to believe this “Shake-out” is more about disrupting low volatility expectations and less about a major market top in the US stock market

April 30: How Close Are The Markets From Topping?

https://www.thetechnicaltraders.com/how-close-are-the-markets-from-topping/

The Chinese stock markets will likely continue to drop as new expectations are suddenly realized and trade issues, especially IP and future IP partnerships, become a major contention moving forward. Every step China takes, right now, is very fragile in terms of US expectations and the ability to show the world China is willing to become a responsible player in the technology field. If China fails to realize this, the world will clearly see that China's intention is to take as much as they can from global technology leaders while stuffing their pockets full of foreign cash – it will not end well.

The Shockwave that has just started to unfold across the global stock market/financial world is that trade, economic expectations, and currency valuations will continue to “revalue” to address these ongoing concerns until some formal resolution works itself into place. In the meantime, any new issues that become present could further complicate these “revaluation” efforts. The concert just started, folks. We have a long way to go before this is all over with.

This Weekly YM chart showing our proprietary Fibonacci price modeling system is suggesting we have a “long way to go” before we could consider any downside price rotation a major risk. The recent price highs in this YM chart have prompted a Bearish Fibonacci Trigger Price near the December 2018 lows (see the RED line near the $21,450 level). You might be asking, “why so low?”. This “learning modeling system” attempts to learn from price and attempts to identify where key price levels are that MUST be reached for a confirmed trend change. As price has continued to rotate within a very wide range over the past 7+ months, the Fibonacci modeling system is suggesting that price could fall all the way back to near the December lows WITHOUT triggering a new “long term” bearish price trend.

In other words, the current price range that would constitute “normal price volatility” is anywhere between $21,450 and $26,950. When we said to expect increased volatility, we really meant it. This is a $5,500 range in the YM that could become a “normal volatility zone”.

The NQ Weekly chart, on the other hand, is providing us a much clearer Bearish Fibonacci Trigger level, near $7,393. Once the price is able to close below this level, then we would consider the NQ entering a new Bearish trend as long as price stays below the $7,393 level. If it was to rally back above this level, then the trigger is negated as long as it stays above the trigger level.

Pay very close attention to the YELLOW price channels that originate back in early 2018. Those levels are likely to play a very important role in going forward as price attempts to establish new price ranges/channels throughout this expected price rotation and volatility.

Lastly, we've been warning that the Financial Sector could come under some intense pressures over the next 5 to 16+ months as all of this “Shockwave” plays out. The reason we believe the Financial sector is vulnerable to this crazy volatility is that the exposure to multiple levels of capital risk could complicate the long-term earnings capabilities of this sector. Almost all of these firms are involved in Personal, Corporate/Business, Real Estate, Trade, Global financing, Currency, and Bond related business ventures. These firms are not remotely immune to any “Shockwave” - they are located right in the Bullseye/Target zone.

We believe the XLF may come under increased pressure over the next 3~6+ weeks as the Shockwave event continues to unfold. We believe issues with Personal/Consumer credit will be the first sign of a Shockwave event and further pressures from Corporate/Business/Global/Currencies would likely be the second shoe to drop over the next 8+ months. We believe a rotation in the XLF to near $25 is very likely over the next 3~6 months and that this move could be the result of extended risk factors originating from the “Shockwave event” we've been suggesting is currently unfolding.

Skilled traders should be watching technology stocks, the NASDAQ, the INDU, the Financial Sector and commodity prices over the next 4+ months for any signs that the Shockwave event is increasing in amplitude. Additionally, pay very close attention to how currencies are moving and where the US Dollar is moving in relation to other currencies. Gold and Silver should also be on your radar over the next few months as well. Lastly, prepare for the major cycle event in July/August 2019.

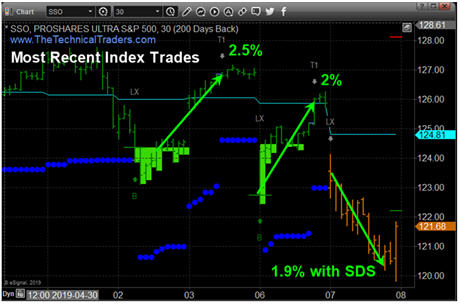

The past three tradings sessions with volatility has kept us busy check out our most recent index trades on the SP500

Our advice continues to be to look for opportunities as the volatility increases and continue to expect an upside price bias in the US stock market – at least until we have any strong evidence that price trend has changed. Don’t buy into the doom-sayers just yet. In our opinion, this US upside price move is not over yet.

If you want to become a technical trader and pull money from the markets during times when most others cannot be sure to join the

Wealth Trading Newsletter today. Plus, for a few days only I’m giving away and shipping Free Silver Rounds to subscribers who join our select membership levels.

Chris Vermeulen

www.TheTechnicalTraders.com