We had warned you about the miners’ bluff and we hope that you heeded it. Gold is still testing the neck level of the head-and-shoulders pattern, but silver is already back at its 2019 lows, while miners broke decisively below them. It may seem that the miners have declined enough and that a rebound is imminent from these levels. Should you hold your breath? Are we on a doorstep of a tradable rebound, or it ain’t here just yet?

To answer that, let’s turn to two analytical gems that have served us so well in the past. Not once, but many times.

We would like to point your attention to two factors that confirm that the next move lower is going to be significant. Yes, we know that you already know that as we provided myriads of details beforehand, but looking at the situation from a fresh perspective and seeing new signals makes it easier to be patient before the move gathers real momentum.

The first of them is the analysis of the silver stocks, and the second is the analysis of the popularity of 2 key search phrases for the gold market. Let’s start with the former.

Silver Stocks Make Themselves Heard

We have extensively commented on the silver stocks on April 3 (in our premium analysis) and on

April 8 (in our free analysis), when we emphasized that their daily decline on huge volume was the harbinger of something very bearish to happen. Let’s quote what we wrote back then – it will also serve as a brief introduction to those, who haven’t read the early-April analysis. We will make only small adjustments within the quote, because almost everything that we wrote remains up-to-date and continues to have important impact on the following weeks and months.

Gold price usually moves in tune with the silver price, and

silver stocks usually move in tune with silver. The sizes of the moves are not identical, but the turnarounds often take place at the same time. The price moves are similar enough to say that the big moves will take place at the same time, but they are different enough for the markets to provide different signals. At times, one market might lead the other. There may also be other specific features and in today’s analysis, we’ll focus on one of them.

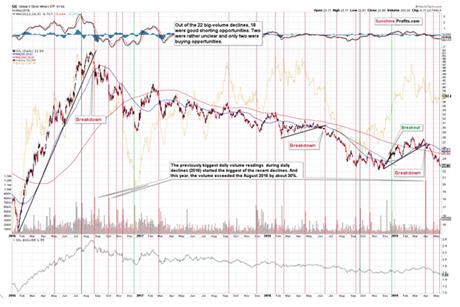

Namely, we’re going to discuss the huge daily volume spikes. And in particular, we’re going to focus on days when the silver miners (were using the SIL ETF as a proxy for the sector) declined on big volume. There were quite a few such days since early 2016 and they were almost all characterized by analogous price action - not only in the case of silver miners, but also in the case of gold.

To put it simply,

gold usually took a dive after silver miners declined on huge volume.

The above doesn’t reveal the efficiency, nor the severity of the signal, though.

As far as efficiency is concerned [note: we are leaving the numbers as they were in early April – we will comment on the update later in a few paragraphs], there were 19 signals and 15 of them were good (or excellent) shorting opportunities. In two cases, it was unclear if it was a good shorting opportunity or not. There were only two cases when the signal clearly failed: in December 2016 and in December 2018.

[None of the failed signals is similar to the current case as silver stocks are neither after a breakout, nor after several-month long decline, so let’s consider the neutral signals]

One of them was mid-July 2016 case where the market moved higher one more time before forming the final top, and the other one was the September 2018 situation, when the market moved lower in the near term, but that was actually the start of a bigger upleg. One case was a good shorting opportunity in the medium term, but a bad one in the near term, and the other case was the opposite. None of them clearly invalidated the signal, but to be conservative, we can say that only one additional case confirmed the signal, while the other one didn’t. This means that [based on information that was available in early April] we get the ultimate efficiency of 84.2% (16 out of 19). That’s an extremely high efficiency and…

That’s not everything.

You see, the very recent price/volume action in silver stocks was not average. It was special.

There are two reasons for it:

- The daily volume was higher than what we saw previously. In fact, it was the highest daily volume that we ever saw in case of the SIL ETF.

- The volume spike took place right after a major breakdown.

The April 1st volume in the silver miners was no April Fools’ Day joke. It exceeded the previous record by about 30%. Out of the recent years, we saw the biggest daily volume during a decline in silver in 2016: in August and September. That was the beginning of the biggest decline in gold of the recent years. In other words, the only analogy that we have based on the size of the volume points to the biggest decline in the recent history. And the volume was even bigger this time – it broke the previous record. Will the decline be bigger than the late-2016 one? That’s what is very likely based on many other

gold trading techniques and what the above silver chart is confirming.

Moving to the second point, silver miners are right after a major breakdown. There were two similar breakdowns in the recent past that were then followed by the huge-volume signal. That was in August 2016 and in June 2018. In both cases, silver miners and gold continued to decline for many weeks.

Both the above-mentioned factors suggest that 84.2% efficiency is likely understated and should in reality be higher. In particular, both links point to analogy between the current situation and what we saw in August 2016. It then took gold less than 4 months to decline over $200. And let’s keep in mind that the volume was much higher this time, so the move – based on the above chart alone – could also be bigger this time.

Basically, everything about the above signal remains up-to-date.

The only thing that changed is the efficiency. It’s now even better.

The huge-volume decline in early April was indeed followed by visible declines in the entire precious metals sector and this adds to the credibility of the technique. There was one more case in late April when we saw a relatively big volume during a daily decline and this was also a great shorting opportunity in the silver stocks. It was relatively neutral in case of gold and silver, but it was clearly a great shorting opportunity in case of the mining stocks. Overall, it seems that both cases confirmed the previous bearish implications and the efficiency of the technique.

The reason we are mentioning all this is not only to show you that the bearish implications that we described in early April haven’t yet fully developed as the volume was bigger than the previous record and the decline – so far – isn’t bigger than the past slide. We are mentioning all this, because we have once again seen a daily decline on relatively big volume.

Consequently, the above-mentioned 84.2% efficiency is definitely understated. If it wasn’t clear what the precious metals sector is likely to do next based on what gold stocks have been doing, the

silver stocks’ bearish scream should get more than one’s attention. It should result in action. The opportunity in the mining stocks is decreasing on a daily basis, but there’s still are still plenty profits that remain on the table, especially from the medium-term point of view.

Having said that let’s take a look at the really big picture.

The Sentiment Indicator Not to Miss

Wait, that’s not a price chart.

Wait, that’s not a price chart.

It isn’t. It’s a sentiment chart. However, if you’ve been monitoring the gold market for some time, you should immediately recognize its immense value for all precious metals investors. There are two clear spikes in the more distant past. It’s clear that both differ from other parts of the chart and that the only case that’s – very – similar to them is what happened several months ago.

The chart is based on monthly values, and the first spike is based on March 2008 data, while the second spike is based on August 2011 data. The seasoned gold investors know very well what happened on those occasions. Something very different from what had happened any other time. These were the final tops before the blood-letting precious metals carnages started.

Think about it. Two key tops in gold. Two ultimate shorting opportunities. And two clearly visible spikes on the above chart. There were no other cases that were similar to them, just as there were no declines that were similarly epic. And if anyone argues that the declines were not epic, ask them to look at the long-term HUI Index chart. Better yet, ask them to talk to someone who was invested in mining stocks at that time. Have them ask these investors how much would they pay to be able to travel back in time for just a few seconds to scream at themselves GET OUT OF THE MINERS, GET OUT NOW! RUN!

How many times can you relive a given situation and make a good decision instead of making the one that you would regret for years? It’s extremely rare. In fact, it’s on the border of being a miracle. And yet, that’s exactly what the above chart does. Several months ago, we saw the third spike – it was once again crystal clear that it happened. In the last 15 years, there were not 2 critical situations, but 3. The blessing here is that the implications of the third signal have not yet played out. We’re running out of time, but we still have it.

After the March 2008 top, gold declined about 34%.

After the August 2011 top, gold declined about 20% initially, but since there were no new tops since, it seems that it’s more appropriate to focus on how much it declined before the medium-term decline ended and became the multi-year consolidation. From August 2011 top to the June 2013 bottom, gold declined about 38%.

The most recent medium-term top in gold formed at about $1,350. And you know where it would decline if it was to repeat the smaller of the above-mentioned declines and slide by 34%? To about $890 – which is exactly our final target for the current medium-term decline in gold based on other factors (i.a. the 61.8% Fibonacci retracement based on the entire previous bull market).

Making money on both: the decline (over 30% in gold alone) and the rebound (once again over 30% in gold alone) is a huge opportunity, not only because of the sizes of the moves, but because the target for gold is confirmed by multiple technical tools; and because these profits might be further increased by applying

more sophisticated techniques that go beyond the simple use of leverage (which also has its merits, when applied correctly). For instance, miners and silver are likely to magnify what gold does. There’s a tremendous difference in taking advantage of it all compared to simply waiting for gold to slide and then to come back to the current price levels, which wouldn’t result in any return. The sleepless nights during gold’s decline would be included in such profitless package at no extra charge, though.

It's incredible that we received such a clear confirmation of what’s to come. The only more incredible thing will be when someone knows all this and then still chooses to ignore it, losing the opportunity. You have been warned.

Thank you.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.