This is big, really big. I can’t say that it’s a surprise that

Glencore might want to partner with

First Cobalt Corp.

(TSX-V: FCC) / (QTCQX: FTSSF), but it would be by far the best possible outcome for management’s strategic review of its 100%-owned Refinery in Ontario. Shareholders & prospective investors were understandably growing nervous about First Cobalt’s ability to deliver the restart funding with little or no additional equity issuance. Not because of management, because the battery metals sector is a complete disaster. Everyone knows that the Cobalt price is down a lot, did you know that Vanadium is down 73.5% in 6 months? This news alone, if this Agreement is consummated, could mark a turning point for select Cobalt juniors. {See

full press release here}

Glencore adds tremendous credibility to First Cobalt’s Refinery

In addition to the potential for significant revenue (

C$100M+ at US$20/lb. Cobalt) and good, very good or great EBITDA margins (

depending on the Cobalt price), this would open A LOT of doors for the Company. They would instantly become the premier pure-play, North American Cobalt junior, not that there are many left to choose from. First Cobalt could solidify its leading position by acquiring other companies & assets. Might

eCobalt Solutions (TSX: ECS) be first on the list !?! eCobalt might now prefer the embrace of First Cobalt over a takeover by Australian-listed

Jervois Mining. I have no insight on this, I’m just reflecting on the recent acquisition of ECS shares.

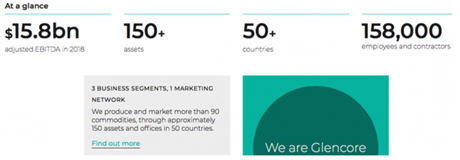

At the risk of getting ahead of myself, this is a MOU not a signed, sealed & delivered deal, I continue with the benefits of an Agreement between First Cobalt & Glencore. Glencore adds increased credibility to First Cobalt, the management team and the Refinery. It would be a supreme vote of confidence. Outside of North America, First Cobalt might not be a very well-known name. That would change overnight, in fact it might be changing as I write this sentence…. First Cobalt would attract additional world-class executives. The Company could pay a dividend! My quick math suggests that a 5% dividend yield would be possible from 50% of the cash flow on 2,000-2,500 tonnes of production at

US$20/lb. Cobalt.

Glencore would greatly de-risk Refinery restart & attract attention to FCC.v

It’s amazing what Glencore would bring to the table that no one else possibly could. It appears from the press release that Glencore might provide a loan for up to

US$30M, all of the capital needed, to restart the Refinery. In addition, Glencore would provide technical assistance in bringing the Refinery back into production, for instance they would, “

collaborate on final flow sheet design.” Glencore would source up to 100% of the feedstock. The Refinery is a hydro-metallurgical Cobalt facility in the Canadian Cobalt Camp of Ontario. It has the potential to produce either a Cobalt Sulfate for lithium-ion batteries, or Cobalt metal for the North American Aerospace industry and other industrial & military applications.

Taking this news a step further, if the restart were to be a success, guess who would be there to help (if feasible) ramp up operations from 2,000-2,500 to perhaps 4,000-5,000 tonnes/yr.? Glencore is to Cobalt what

Albemarle and

SQM are to Lithium. Yes, closing on this Agreement would be really, really good for shareholders.

Assuming that Glencore is on board, the Refinery would likely be up and running sooner than otherwise would be the case. And, once the world realized that a Cobalt Refinery was coming online in Canada in 2021, and that produced Cobalt would to be ethically sourced from mine to finished product, end-users would be very interested in speaking with First Cobalt. First on the list of visitors to see CEO Trent Mell would likely be execs from the automakers. The Company has already signed NDAs with a number of them. Next to visit? Li-ion battery makers. Both automakers and battery companies need ethically sourced Cobalt for genuine moral considerations, for public relations and for security of supply.

As per the press release,

“

With no cobalt sulfate production in North America today, the First Cobalt Refinery has the potential to become the first such producer for the American electric vehicle market. The Company has signed confidentiality agreements with several automotive companies interested in securing cobalt for the North American market.”

I have to remind myself that this is a MOU, not a done deal, but I think the chances of it getting done are pretty high. First Cobalt & Glencore have likely been talking about the Refinery for months now, if not longer. And, although I’ve outlined the many benefits for First Cobalt shareholders, Glencore benefits as well. Over time, if the Refinery could produce 5,000 tonnes of Cobalt products, and Glencore controls that off-take, that’s a meaningful amount, probably > 10% of the battery-grade Cobalt processed / refined & sold outside of Africa & China.

Speaking of China, recent news shows that geopolitical risks are alive and well with China hinting at restricting the free trade of rare earth metals from China to the U.S. It doesn’t matter who’s to blame, how the U.S. and China got here, all that matters are the potential consequences. Today it’s rare earth metals, will China threaten to stop exporting lithium & cobalt next? I doubt that China would sell to Canada or Mexico if there was an embargo against the U.S. for rare earth metals, lithium, cobalt, vanadium, graphite, etc.

But now I’ve veered off course, this isn’t about China… The news today is about Glencore signing a MOU with

First Cobalt Corp. (TSX-V: FCC) / (OTCQX: FTSSF) to help design, re-engineer, refurbish & commission the Company’s Cobalt Refinery in Ontario, Canada. Glencore could deliver up 100% of the feedstock needed to produce 2,000-2,500 tonnes of finished Cobalt. And, Glencore is considering paying the entire

US$30M cost (

in the form of a loan to First Cobalt Corp.) to get it up and running again. This is the biggest news of the year for the Company. This is important news for the Cobalt sector. Let’s see if this marks a change in sentiment for Cobalt juniors.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of

Epstein Research [ER], (together, [ER]) about First Cobalt Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of First Cobalt Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned shares of First Cobalt Corp. and the Company was an advertiser on [ER].

Readers should consider me biased in favor of the Company and understand & agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.