I’ve attended 2 Metals & Mining conferences this month and 2 in May. Last month there was little consensus on what might happen with Section 232 in the U.S. This month, I’ve heard more positive takes. While exciting for the 5-6 uranium juniors with assets in the U.S., it’s also very good for the sector. The removal of this uncertainty next month could move uranium prices higher after having stalled at ~US$29/lb. 6 months ago.

I’ve spoken with > 20 companies exploring for Au, Ag, Cu, Zn, Ni, Pb, Li, Mg, V, Co, REE & uranium. Spot price notwithstanding, sentiment on uranium is surprisingly high. Rare earth metals are hot, copper sentiment is solid, vanadium, gold, silver, cobalt, lithium — cold to ice-cold.

It’s great timing,

Skyharbour Resources (TSX-V: SYH) / (OTCQX: SYHBF) announced good results from its winter/spring drill program at its 100% owned

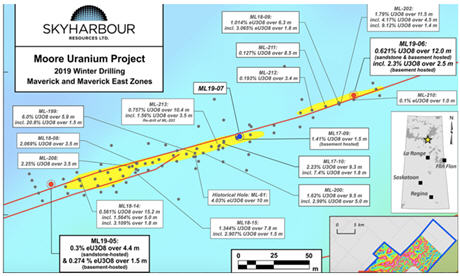

Moore Uranium project on the southeastern side of the Athabasca Basin, in northern Saskatchewan. The recently completed winter diamond drilling program totaled 2,783 m in 7 holes. Readers may recall that the Project contains 12 contiguous claims totaling 35,705 hectares (~88,230 acres).

Just 3 days earlier, on June 17th,

Azincourt Energy Corp. reported positive results from its Phase 1 drill program at the East Preston uranium project. Azincourt is earning into a 70% Interest on that Project as part of a JV agreement with Skyharbour &

Clean Commodities Corp.

From the

June 20th press release,

“

Unconformity style uranium mineralization was discovered on the Moore Project at the Maverick Zone in April 2001. Historical drill highlights include 4.03% eU3O8 over 10 m, incl. 20% eU3O8 over 1.4 m, and in 2017, Skyharbour announced an interval of 6.0% U3O8 over 5.9 m, incl. 20.8% U3O8 over 1.5 m at a vertical depth of 265 m.“

In the latest program, drill hole ML19-06 into the Maverick East zone hit a zone of uranium mineralization from 273 m to 285 m downhole. The interval returned

0.62% U3O8 over 12 m, incl. 2.5 m of

2.31% U3O8. According to management, this is one of the broadest zones of mineralization intersected on the property. This was the first hole ever drilled into the basement rocks at the East Maverick zone, and…. success!

This is not a discovery hole, but could lead to one in a future drill campaign. These were exploration holes, they could have missed. The fact that Skyharbour’s technical team is finding smoke suggests the real possibility of fire nearby.

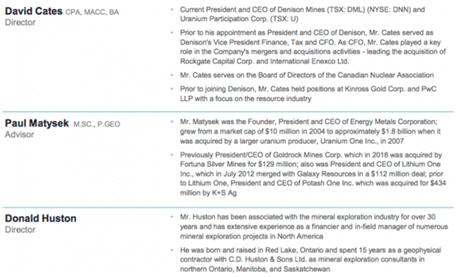

Importantly, a significant portion of the 12 m intercept was in the basement rocks. Finding areas of high-grade U3O8 in the basement rocks of Athabasca properties has been a recipe for success for companies such as

NexGen, Fission Uranium &

Denison Mines. These results are very encouraging. They don’t guarantee a big discovery, but the odds have gone up.

Hole ML19-05 was drilled at the western end of the Main Maverick zone and found 2 areas of mineralization above and below the unconformity, incl. 0.30% U3O8 over 4.4 m and 0.27% U3O8 over 1.5 m at 264.7 m to 269.1 m downhole and 274.7 m to 276.2 m downhole, respectively.

Jordan Trimble, President & CEO of Skyharbour

Jordan Trimble, President & CEO of Skyharbour, commented,

“

We are very pleased with the results from this drill program at our flagship Moore Project as we continue to discover new high-grade uranium mineralization in the underlying basement rocks at the Maverick corridor, as well as making new regional discoveries. We will be commencing a summer drill program to test more extensively the highly prospective potential feeder zones in the basement rocks, and follow up on the early success at the newly discovered Otter Zone.”

Management also reported that, “

strong potential for high-grade uranium mineralization was identified at a newly discovered regional target called the Otter zone, which is 7 km northeast of the Maverick zone.”

Analysis of the regional geophysical & geological data from the Otter zone area indicate that it’s in a setting that is highly prospective for uranium mineralized deposits in the Athabasca Basin. Only 2 km of the total 4 km long Maverick corridor have been systematically drill tested, leaving robust discovery potential along strike as well as at depth. Planning is well underway for a summer/fall drill program.

Richard Kusmirski, Head Geologist of Skyharbour

Richard Kusmirski, Head Geologist of Skyharbour, commented,

“

The fact that significant uranium mineralization has once again been intersected in untested target areas bodes well for the discovery of additional uranium deposits. Furthermore, much of this uranium mineralization is associated with basement lithologies, a characteristic common to recent discoveries like NexGen’s Arrow Deposit, Fission’s Triple R Deposit and Denison’s Gryphon Deposit.”

Skyharbour will conduct a drone-assisted airborne magnetic survey to better identify high-priority structures along the Maverick corridor. Following that, a 2019 summer/fall diamond drill program will commence in August or September. This program will test both unconformity and basement targets and regional targets identified by Skyharbour’s technical team.

Of particular interest are potential underlying basement feeder zones to the unconformity-hosted high-grade uranium present at the Maverick corridor. These targets have seen only limited historical drilling. Additional drilling will also be done on portions of the recently discovered Otter zone.

This is important news for the Company. Shareholders should be pleased that the management team, Board & technical advisors are moving its wholly owned Moore Uranium and JV projects forward when most uranium (

and other natural resource) juniors are dead in the water. The longer the uranium spot price remains below US$30/lb., the more explosive the move higher in price could be. Pre-Fukushima in March 2011, the price was in the low US$70’s/lb. That was 8 years ago!

Mining cost inflation since then suggests that a long-term contract price of US$60-US$80/lb. is not an unreasonable expectation. The question is, how long before we see evidence that those prices are indeed coming?

Skyharbour Resources (TSX-V: SYH) / (OTCQX: SYHBF) is in no hurry, it doesn’t need higher prices this year or next. But, when the price moves definitively through US$30/lb., high quality uranium juniors like Skyharbour could see substantial share price gains.

{

see Corp. Presentation}

{

Latest press releases}

Disclosures: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Skyharbour Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Skyharbour Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned no shares in Skyharbour Resources, and it was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.