SIGNS OF WEAKNESS - MARCH 2000

The weekly chart below shows NYSE volume associated with advancing issues less volume associated with declining issues (NYUD). During the topping process in 1999-2000, notice how NYUD made a discernible lower high relative to the S&P 500’s higher high in March 2000.

SIGNS OF WEAKNESS - OCTOBER 2007

In October 2007, the S&P 500 printed a new high and NYUD printed a discernible lower high, an indication the broad NYSE Index was showing some signs of internal weakness.

HOW DOES THE SAME CHART LOOK TODAY?

Weekly NYSE advance - decline volume printed a higher high in April 2019 that exceeded the September 2018 high. Last week, NYUD printed another higher high by exceeding the April 2019 high. Market breadth was waving yellow “pay closer attention” flags in both 2000 and 2007. Thus far, the same warning flags are not waving in 2019. We use the chart below to monitor the market’s current risk-reward profile, which is significantly different from using it to forecast, project, or predict. It is quite possible market breadth will shift in a negative manner in the coming weeks. Thus far, it still looks constructive.

DOES THE BIG PICTURE SUPPORT A TRIPLE TOP?

This week’s stock market video shows how the laws of supply and demand can be used to better understand Fed policy, credit spreads, and the market’s current risk-reward profile.

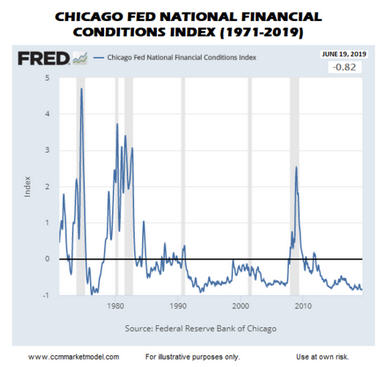

CURRENT READ OF FINANCIAL CONDITIONS

The Chicago Fed National Financial Conditions Index allows us to better understand the present day in the context of economic and stock market history. A description of the index is helpful prior to reviewing the chart below:

“A comprehensive weekly update on U.S. financial conditions in money markets, debt and equity markets and the traditional and shadow banking systems. Positive values of the NFCI indicate financial conditions that are tighter than average, while negative values indicate financial conditions that are looser than average.”

Notice how the index (chart below) tends to gravitate toward the centerline prior to recessions and bear markets. Present-day readings remain firmly in “looser than average” territory, meaning financial conditions, like market breadth, are not currently waving yellow flags for the economy and stock market. The financial conditions index is a helpful monitoring tool rather than a forecasting tool. Concerns would increase if the index begins to rise rapidly as it did in the second half of 2007.

LONG-TERM TRENDS: 2000 vs. 2007 vs. 2019

You can make an argument large institutions were selling stocks near the 200-week moving average after the 2000 and 2007 stock market peaks (top two charts below). Recent activity near the 200-week looks more like the institutional buying support that took place near the lows in 2016 (third chart below).

Similar concepts were covered on a shorter timeframe in a recent 100/300-day moving average study.

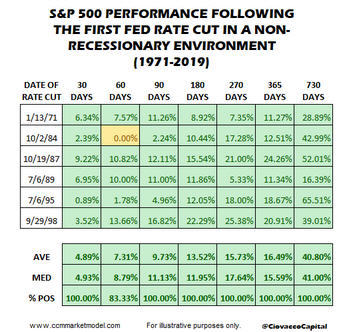

FED CUTS IN A NON-RECESSIONARY ENVIRONMENT

Last week’s video made the case the present day economy remains in expansion mode and demonstrated good things tended to happen in the S&P 500 after a first rate cut in a non-recessionary environment. Markets are expecting the first Fed cut in July; if so, it may help offset the trend of weaker economic data.

TRADE REMAINS THE BEARISH WILD CARD

Given the complexity of any trade agreement between the United States and China, it is highly unlikely any binding agreements will be made at this weekend’s G-20 meeting. Thus, markets will most likely move based on signs of escalation versus signs of getting back to the negotiation table.

With ongoing trade and tariff uncertainty, it is very difficult for businesses to make long-term hiring and capital expenditure decisions. If this drag continues and trade tensions escalate in the coming days, weeks, and months, it would not be surprising to see the charts above deteriorate in a meaningful manner. Therefore, we must remain open to a wide range of future outcomes, from wildly bullish to wildly bearish. We will continue to take it day by day.

This post is written for clients of Ciovacco Capital Management and describes our approach in generic terms. It is provided to assist clients with basic concepts, rather than specific strategies or levels. The same terms of use disclaimers used in our weekly videos apply to all Short Takes posts and tweets on the CCM Twitter Feed, including the text and images above.