Thibaut Lepouttre, editor of the

Caesars Report, considers the implications of the deal recently negotiated with OceanaGold for exploration of gold projects in Nevada.

Introduction

Over the past few years, we noticed one common thing in the mining sector: Most companies prefer to fall back on the so-called Tier 1 destinations in safe mining jurisdictions like North America and Australia.

One of those companies that has been pulling the "safe jurisdictions card" is OceanaGold Corp. (OGC:TSX; OGC:ASX),as it wanted to reduce the importance of the Didipio copper-gold mine in the Philippines in its asset portfolio. The company made a first strong move into North America with the acquisition of Romarco Minerals, which was bringing its Haile gold mine into production but has shifted gears and is going down the development curve by entering into exploration joint venture agreements with juniors.

One of those companies is Bravada Gold Corp. (BVA:TSX.V), which owns numerous prospects and projects in Nevada, a jurisdiction that's probably as safe as it gets. Bravada was a bit "dormant" in the past few years as this small company was waiting for better times in the gold sector, but we feel the recently announced deal with OceanaGold is a good move for the company. Oceana will need to spend CA$13 million (US$10 million) on exploration to earn a 75% stake in the project, and that minimum spending requirement on this single project is a multiple of Bravada Gold's current market capitalization.

There's another reason why we are giving Bravada Gold another good look. CEO Joe Kizis was the person who brought the DeLamar project to Integra Resources Corp. (ITR:TSX.V; IRRZF:OTCQB). Unlike the upper management of Kinross Gold Corp. (K:TSX; KGC:NYSE), which failed to properly identify the exploration potential at the Idaho-based property, Kizis does seem to have a good nose for potentially valuable projects and this nose, in combination with his field experience on Nevada properties and his extensive in-state network, were important considerations for us as well.

Zooming In on the Main Projects

Bravada has approximately a dozen projects in its asset portfolio, and while all those projects seem to have their own merit for being part of the portfolio, we will just highlight two of them. The Highland project is the project OceanaGold will be spending its money on, while Bravada Gold will use the cash from the recently upsized private placement to drill its SF project.

Highland

We will discuss the joint venture terms with OceanaGold later in this article, but there are some very good reasons why OceanaGold was so keen on securing a right to earn into the Highland property in Nevada.

The project does have a rich history, as the first gold occurrences were discovered in the early 1900s, which was followed by a short period of gold production wherein just a handful of ounces were produced right before the Second World War started.

But what mainly attracted Bravada (and its joint venture partner OceanaGold) to this project is the sinter-based exploration theory.

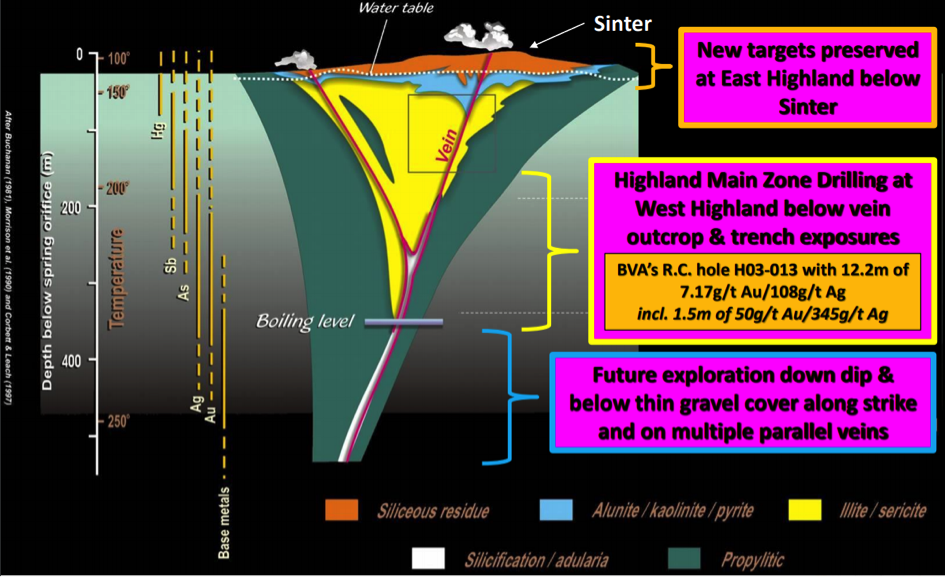

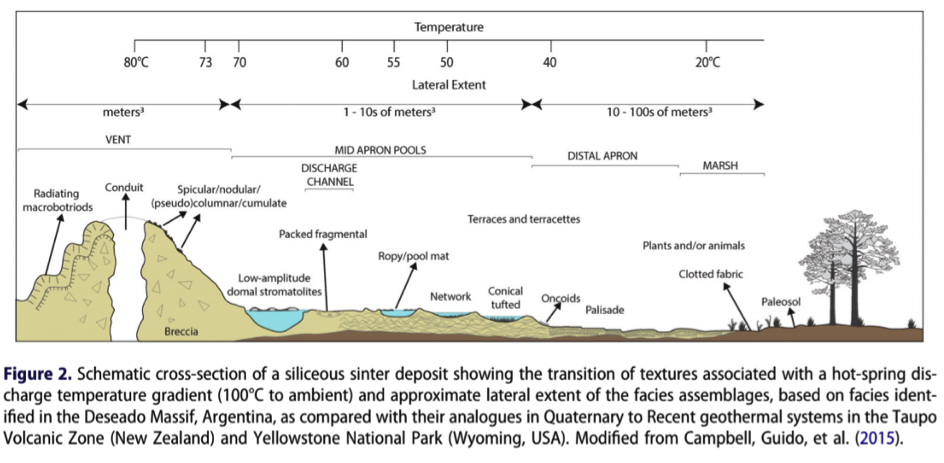

Sinter zones (high silica rock) are formed by hot springs and have been encountered along ancient surfaces on top of some existing gold deposits (which are "hidden" underground and sometimes remain completely undetected). Those sinters usually do not "contain" gold, which has been "left behind" as the fluids made their way to the surface. So if you’d complete a sampling program of the sinter zones, the assay values wouldn't be too exciting.

What matters is that these sinter zones that appear on the surface could very well point toward the existence of one of those hidden gold deposits, usually 200¬–400 meters deeper as the gold deposited at the right chemical environment along the way to the surface hot spring and developed high-grade gold-bearing veins. So detecting and defining these sinter zones could help a company to zoom in on high-priority drill targets to find the gold zones.

Just an elusive theory? Not really.

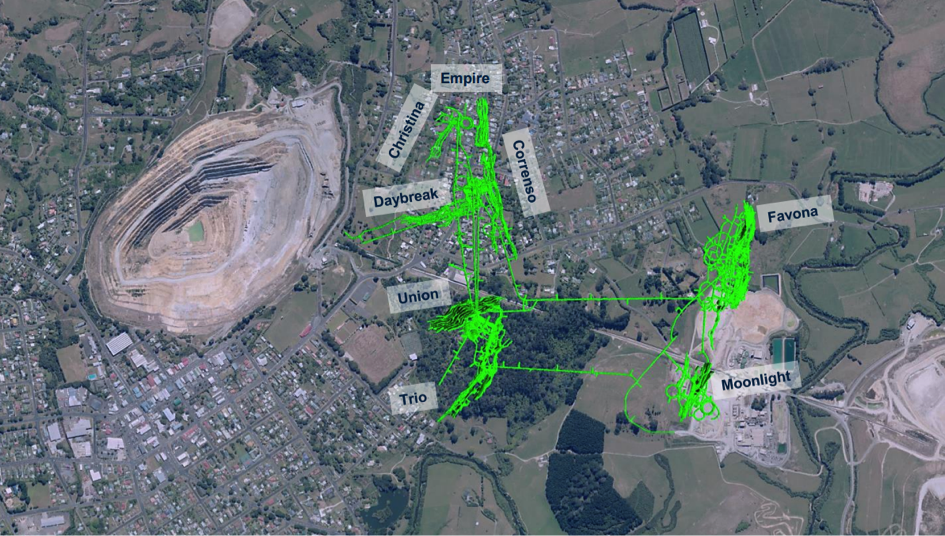

There's a very good reason why specifically OceanaGold has shown a lot of interest in Highland's sinter model. Oceana owns the Waihi mine in New Zealand, which has been mined and explored for several decades and in the past few years. The company has been successful in deploying its sinter-focused exploration theory at Waihi, and now wants to deploy its knowledge in Nevada.

In fact, OceanaGold has been deploying the sinter-based exploration theory all over New Zealand's northern island in an attempt to increase its project and resource base in the country. So if any company understands the importance of and how to deal with a sinter-based exploration theory, OceanaGold would probably top that list.

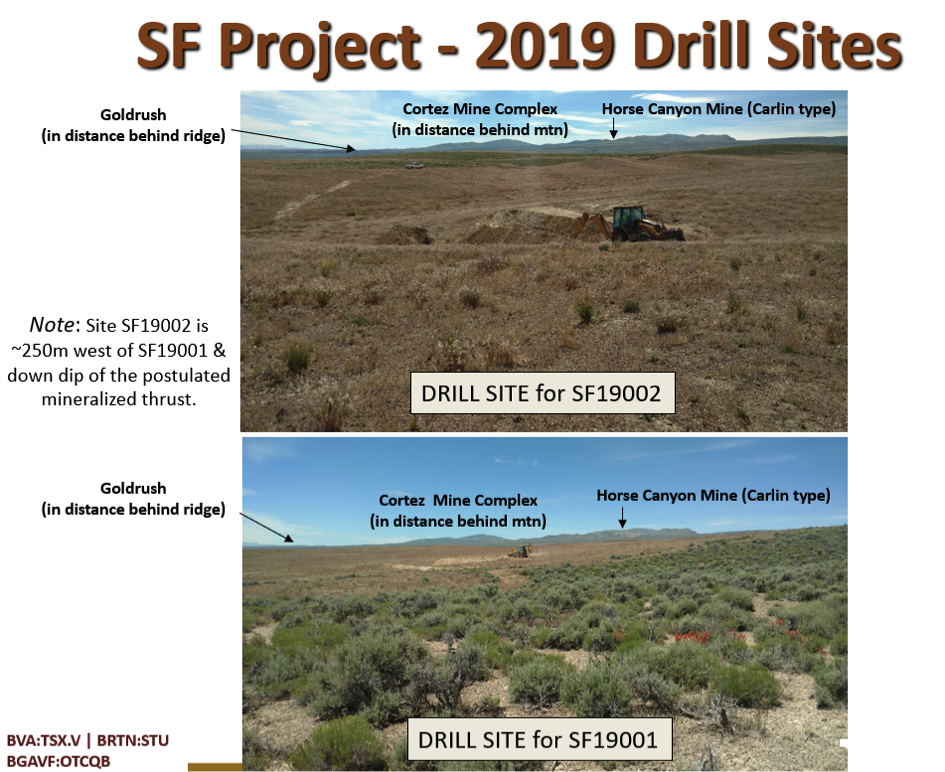

SF

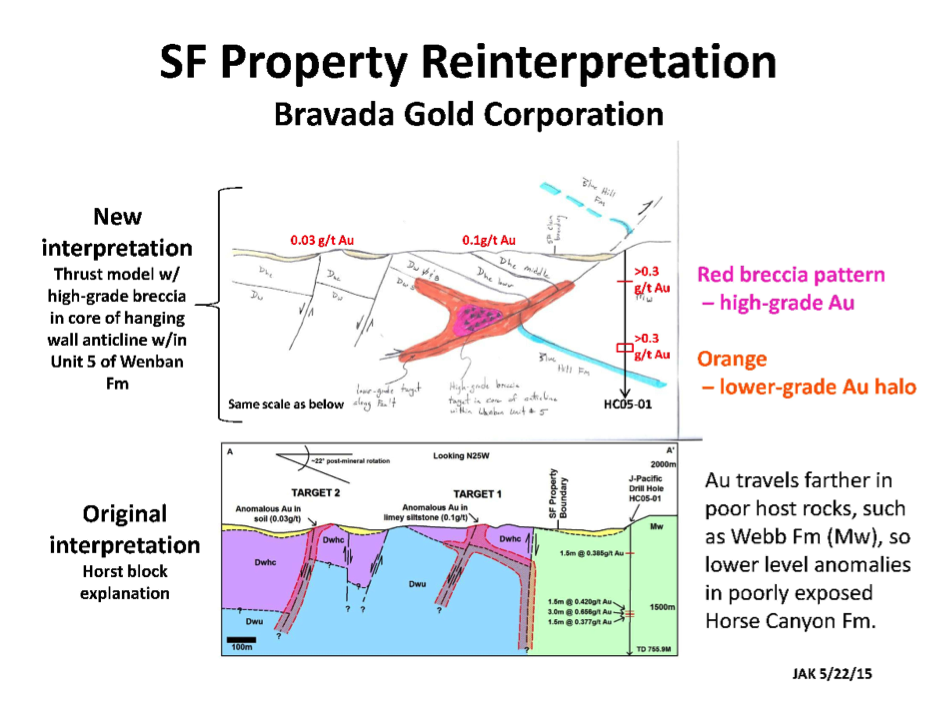

The SF project (which hosts a Carlin-type exploration target) is located directly east of the Cortez mining district in Nevada, on the Battle Mountain Gold Trend. The geological structures of the property weren't well understood in the past few years, but when a neighbor encountered short zones of gold mineralization with grades of in excess of 0.3 g/t gold, Bravada Gold was finally able to put a few additional pieces of the puzzle together and overhauled its exploration theory.

According to Bravada Gold: "Recently published data on Nevada stratigraphy and structure has led to a reinterpretation of stratigraphy and structure at SF, greatly upgrading an untested target."

Of specific interest are the rocks encountered at SF: the Wenban and Horse Canyon formations are the host rocks for, for instance, the Goldrush deposit, while two other Barrick Gold Corp. (ABX:TSX; GOLD:NYSE)-owned projects, Pipeline and Cortez Hills, also occur in the same geological setting.

Of course, these are just two projects from Bravada Gold's extensive portfolio, but as these will receive most of the attention over the next few months, we feel it was worth highlighting these specific two projects.

What Attracted Oceanagold to the Highland Project?

Just one month after signing a letter of intent (LOI) with OceanaGold, Bravada Gold was able to convert the LOI into a binding agreement, which allows OceanaGold to acquire a 75% stake in the Highland gold-silver project located just a few kilometers north of the Bruner gold deposit in Nevada's Walker Lane gold trend.

OceanaGold can earn an initial 51% stake in the property by completing some initial cash payments to Bravada Gold, which will subsequently be used to make the advanced minimum royalty payments to the vendors of the property while a final US$200,000 payment from OceanaGold can be made in cash or shares.

On top of that, Oceana will be required to spend at least US$4 million (US$4M) on exploration before establishing the 51% stake. And this means OceanaGold will be spending 170% of Bravada Gold's entire market cap just to acquire a little over half of one project (indicating the perceived value of the remaining 49% of the project already exceeds Bravada's current market capitalization).

Should OceanaGold like what it sees, it will be able to acquire an additional 24% stake in the property for US$6M in exploration expenditures, whereafter a 75/25 joint venture will be established.

Some people don't appreciate the fact Bravada Gold is giving up a majority stake in one of its most important properties, but let's just leave emotions out of this decision and look at the numbers. OceanaGold needs to spend US$10M, or approximately CA$13M, on the ground to establish a 75% stake. This basically means Oceana needs to spend roughly three times Bravada's current market capitalization on exploration for its initial stake in just one of the projects in Bravada's asset portfolio. And the choice between this and seeing Bravada dilute its share count by several hundreds of percents is an easy one. In some cases it really is better to own 25% of a project that effectively is being advanced by a smart partner than retaining 100% of something that's just gathering dust on the proverbial shelf.

For OceanaGold, the Highland project just is a good match. It meets the requirement of a project being located in a Tier 1 country, and as Oceana has proven it knows its way around sinter zones and connecting those zones to epithermal systems, the exploration joint venture appears to be a good match.

Bravada Gold Is Increasing Its Current Financing

Exploring costs money, and Bravada Gold is currently wrapping up a private placement. The company already closed a first tranche of the placement in May, raising CA$567,000, but has now extended and increased the size of the placement as Bravada is now aiming to raise an additional CA$300,000 (to end up at CA$870,000).

The $0.07 units consist of one common share as well as a full warrant, allowing the warrant holder to acquire an additional share of Bravada Gold at CA$0.12 for a period of four years after closing. Should Bravada Gold (and/or OceanaGold) effectively be successful in the upcoming exploration campaign, the CA$0.12 warrants could act as a "secondary" financing, as the 12.43M units that are expected to be issued would represent an additional CA$1.5M in cash hitting Bravada's treasury. But, of course, before these warrants even come in play, Bravada will need to convince the market it effectively has the goods, and a successful exploration program at SF would be very helpful.

Conclusion

Bravada Gold has a lot of horses in its stable, and future exploration programs on, for instance, Wind Mountain, which currently contains 900,000 ounces of gold and almost 25 million ounces of silver (in a low-grade resource estimate that could become interesting again with the gold price exceeding $1,400/ounce) will depend on Bravada's ability to raise money.

One could expect news flow in the second half of the year to be dominated by the exploration activities on both the SF project and the Highland project.

Thibaut Lepouttre is the editor of the Caesars Report, a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.

Disclosure:

1) Thibaut Lepouttre: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: a long position in Bravada Gold. My company has a financial relationship with the following companies referred to in this article: Bravada Gold. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.