The last few weeks for gold trader has been really exciting. Let face it, metals are starting to out perform us Equities late in a US stock bull market and we all know what that means.

If you don’t know what I mean check out these charts!

Recently I posted an exclusive gold analysis article on Gold-Eagle.com talking about the next big moves and timing for the price of gold. Things are about to get much more exciting and life changing for those involved on the right side of the move.

In fact, in the next week I will be sharing the absolute best way to take advantage of gold move and it is most likely the exact opposite of what you are doing/plan to do. Recently Eric Sprott (Canadian billionaire, precious metals specialist) talked about my analysis and

he touched on this gold trading strategy as well.

Ok, lets jump into some really exciting charts showing where gold should move next based on the dollar price and my gold cycles.

USD DOLLAR CONTROLS THE PRICE OF GOLD

The daily chart of the US Dollar index below shows where I think it should move in the next week. If the dollar rises it will keep the price of gold contained and possibly force it lower, which is what my gold cycle analysis system is confirming as well.

The big question is if the dollar just had this bounce and rolls over, or if the dollar continue to rise after this upside target is reached. This will control what the

price of gold does in the neat future.

MY PRICE OF GOLD CYCLE PREDICTION SYSTEM

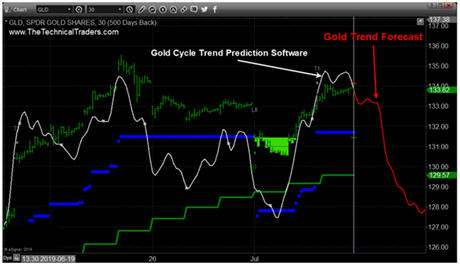

My custom gold cycle analysis which take the most active cycles in the market and blends them into one line paints a clear picture of where the price of gold should move in the next few days.

While the red forecast shows a strong sell off, keep in mind this is just the trend bias, price does not move to the levels of the cycles, but rather if the cycle is moving lower expect price to trade sideways or lower as well during that time frame. It’s a trend guide only, not to be used for price targets.

This awesome indicator is just one of my trading tools I developed, which I use for oil, the SP500 and many other assets is what I use and share with subscribers of my trade alert newsletter.

GOLD TRADE SIGNALS MADE SIMPLE

GOLD TRADE SIGNALS MADE SIMPLE

So how do we trade cycles and time the price of gold? There are infinite ways, but I have honed in two key strategies/tools I created to make things visual and simple to follow.

Below is what I currently call V9 (Velocity-9 from the show Flash I watch with my son), or maybe because its Version 9 (It’s 9 years in the making)? Does not really matter, the point is it’s designed to identify trading signals for gold, silver, miners, indexes, etc… and it does this remarkably well.

The chart I think is self explanatory but in short, it tells us the market trend, when to be long, short, or in cash. It further goes on to provide high probability trade trigger and price targets for both quick momentum trades, and swing trades.

To take things one step further, by knowing the trend and when its starting to change direction you can simply buy and hold high beta stocks or leveraged ETF’s with the market trend as an active trader/investor.

This system focuses to pull 1.2% – 2.5% out of any market its trading, and if you use a 2x or 3x ETF you can generate 5% – 7.5% return quickly and with little downside risk.

Food for thought, only fifteen 5% winners = 100+% return!

If you want to see this tool used on the SP500 take a look at these charts here.

CONCLUDING THOUGHTS:

In short, I’m bullish on gold as mentioned in my recent Gold-Eagle.com article but in the near term we could be in for a little choppy price action.

I can tell you that huge moves are about to start unfolding not only in real estate, but metals, stocks, and currencies. Some of these super cycles are going to last years. Brad Matheny goes into great detail with his simple to understand charts and guide about this. His financial market research is one of a kind and a real eye-opener. PDF guide:

2020 Cycles – The Greatest Opportunity Of Your Lifetime

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

I urge you to visit my

Wealth Building Newsletter and if you like what I offer, join me with the 1 or 2-year subscription to lock in the lowest rate possible, get a

FREE BAR OF GOLD and

ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next set of crisis’.

Chris Vermeulen

www.TheTechnicalTraders.com