Gold soared past $1,400 per ounce last week, hitting a high of $1,439 per ounce.

I’ve discovered an interesting angle in the gold markets that hasn’t gotten a lot of fanfare.

But I think it’s a cause for the price of gold appreciating.

What’s Making the Gold Price Go Up?

$13,049,718,112,256.

What’s that number you ask? That’s $13 TRILLION and change.

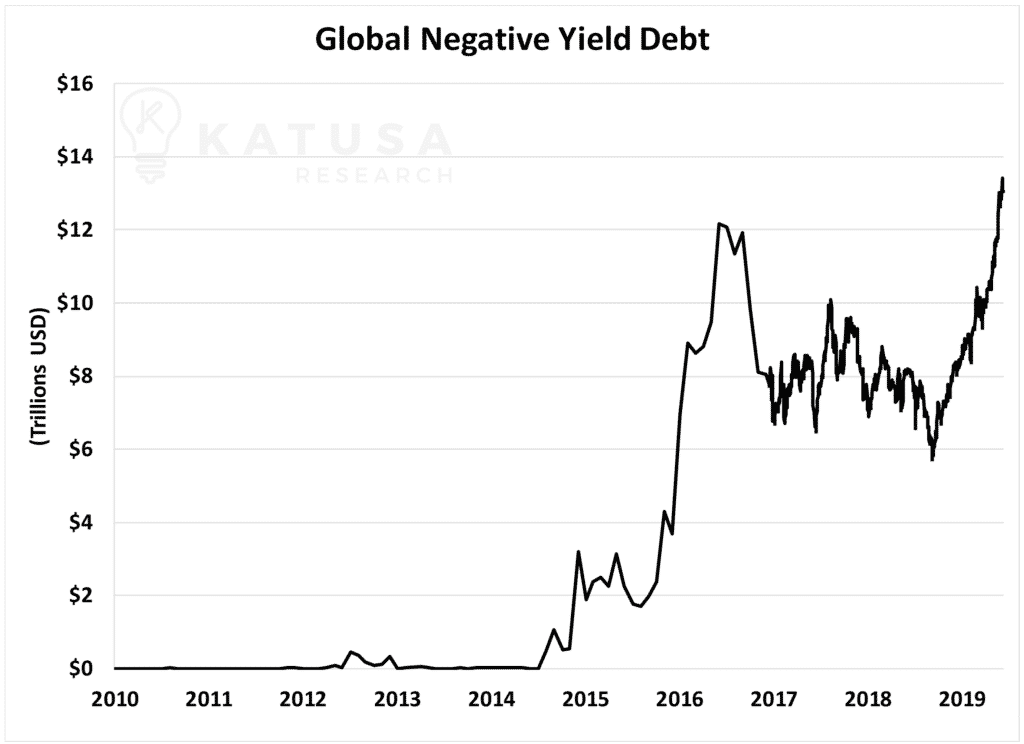

That’s the total amount of debt in the world that currently has a negative yield.

And it just hit a new high.

What is Negative Yield and Why Does It Matter?

Yield refers to the interest rate paid on a bond.

The higher the yield, the more interest paid to the bondholder.

Lower yields equal less interest paid. And when it’s negative, it means investors are actually paying the bond issuer rather than vice versa. It’s a bizarre phenomenon but it’s become a major global issue.

I’ll explain…

The United States pays around 2% on its 10-year bond.

However, in places like France, Austria and Germany, this interest rate is negative.

It means if you buy a French 10-year bond, you’ll actually get back less than you started with in 10 years when the bond matures.

The world is so upside down right now: The Greek 10 year is priced roughly at the same yield as the U.S. rate. I don’t care how much you love souvlaki and the bikinis at the beautiful Sarakiniko beach – there is no way I take the Greek side of that trade.

Seriously, the Greek 10-year has roughly the same rate as the U.S yield rate?

Has the world gone mad?

Right now, cash under the mattress is a better investment than ¼ of the bonds from Austria, Italy, France – and the list goes on.

According to Bloomberg, in the global bond market nearly 40% of all bonds are yielding less than 1%.

Gold is now looking good to even Warren Buffet when compared to these other options to store cash.

What Is the “Real” Rate of Return?

You can calculate this by taking the bond’s nominal interest rate and subtracting the national inflation rate…

There’s even more bonds with a “real” negative return.

Below is a chart which shows the skyrocketing total of negative yield debt. You’ll see we have just ripped through the previous 2016 highs of $12 trillion.

Why Is Negative Yield Debt a Problem?

Debt is commonly considered a safer investment than stocks.

Very large investors like central banks, sovereign wealth funds, or large private equity funds buy these debt instruments for security and a small yield.

With negative yields, these investments are off the table.

These funds could go down the value chain and invest in top tier blue chip bonds with perfect credit ratings. But, as shown by Bloomberg, 24% of those bonds also have a negative yield.

There’s just no place in the bond market to earn a safe, sustainable yield.

Nothing to See Here – Everything Is Normal in the Crazy Land of Interest Rates

A second problem lies in national monetary policies.

Zero interest rates are effectively money printing presses. This has the potential to cause widespread currency depreciation in the denominated currency.

To show how desperate investors are for yield…

- At the recent Italian bond auction, demand for the 50-year bond with an interest rate of 2.90% was 6 times oversubscribed.

The European Central Bank (ECB) has been a strong advocate for monetary stimulus and lower-for-longer interest rates.

The ECB will likely appoint Christine Lagarde as the new head of the Bank.

She is not a trained economist but ran the International Monetary Fund and was the Head of Finance for the French Government.

She is very pro-monetary spending and supports low interest rates. As such, I just don’t see the ECB changing their path.

In the United States, you have President Trump who comments every other day on Twitter about how interest rates are too high.

He’s also made several nominations for FOMC members (the fed rate setters) who would be advocates of ultra-loose monetary policy and even the gold standard.

Fed Chairman Jerome Powell is likely backed into a corner at this point.

And the market is forecasting a nearly 100% chance of a rate cut in July.

Making Money in a Negative Yield Market

There are a couple ways to make money.

You can buy the 50-year Italian bond like many others and earn a whopping 2.9% before inflation.

Or you can buy a safe, stable commodity like gold. Over thousand years of history has proven that gold is a safe heaven to protect yourself from the lunacy of the ruling party. History always rhymes.

And in a race to currency deprecation, it’s always a good idea to have an asset which will move opposite the direction of the currency.

I think it’s probable that central banks and major institutions look at gold as place to rotate some capital to.

In fact, many central banks have been active purchasers of physical gold over the past few years.

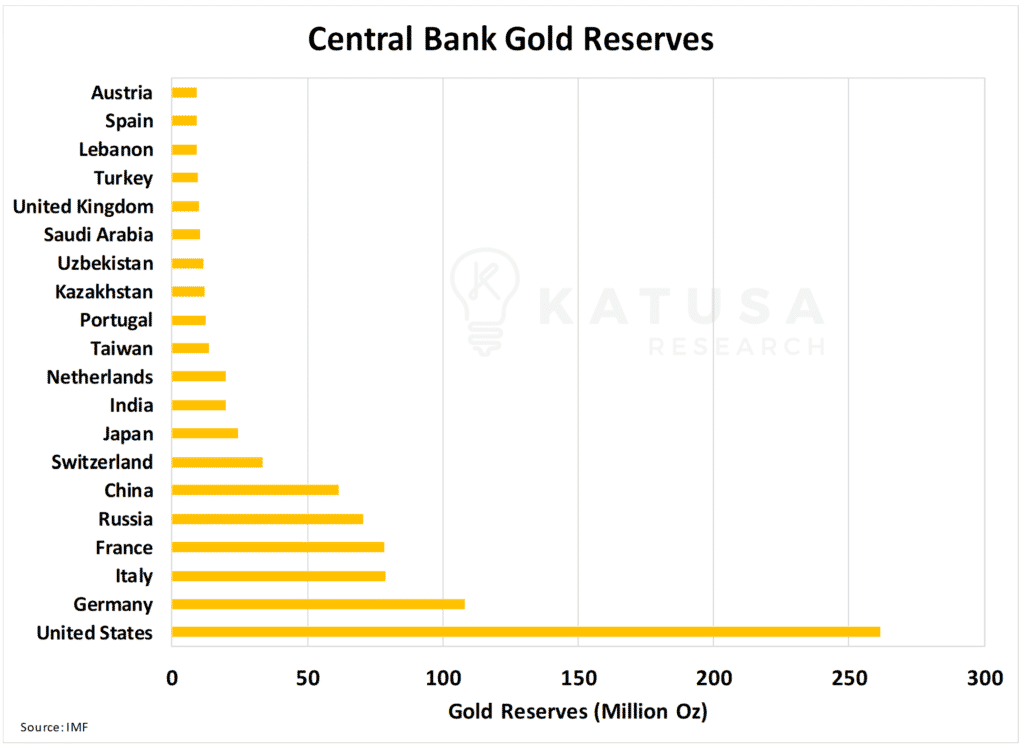

Which Central Banks Own the Most Gold?

Gold is an important part of many central banks’ foreign reserves. Below is a chart which shows the top 20 central bank gold holders.

The Chinese central bank has been a large buyer of gold over the past several years.

And remember, this is only what’s publicly reported.

China’s actual reserves could be much higher.

It makes a lot of sense that China wants to diversify its holdings away from its own currency, U.S. dollars and treasuries, and allocate a portion of capital to gold. Especially when many US treasuries are yielding a negative return.

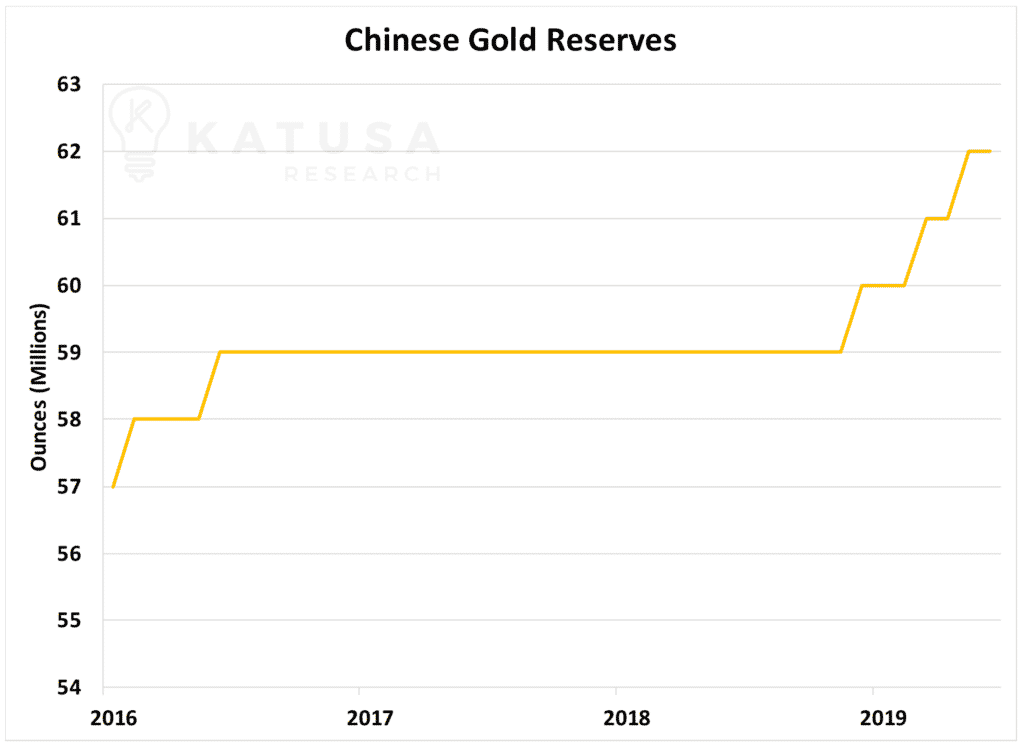

Below is a chart which shows Chinese gold reserves. You can see that roughly 3 million ounces were added in the last 6 months.

But what you may not be aware of is that China is not actually the most aggressive purchaser of gold today.

Which Central Bank Is Buying the Most Gold?

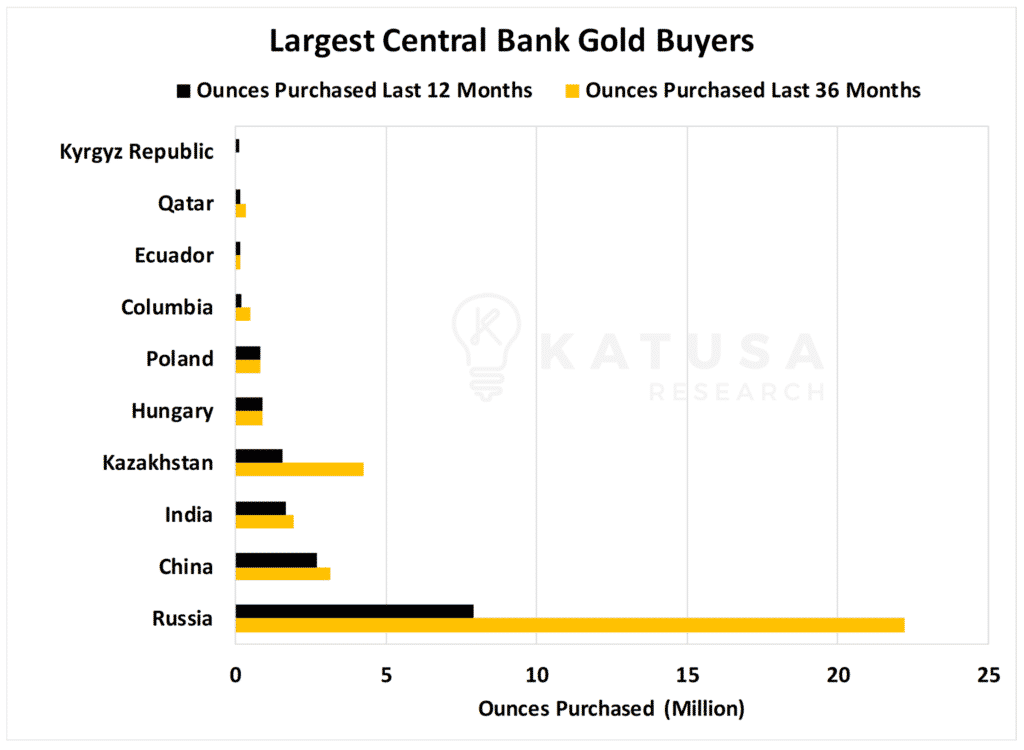

Over the past 12 months, the top 10 central bank gold buyers purchased 16.2 million ounces.

- Using a gold price of $1,300, that’s $21 billion worth of gold.

If you jumped to the conclusion that China was the largest gold buyer, you would be wrong. The most aggressive buyer of gold over the past few years has been Russia.

Below is a chart which shows the largest gold central bank gold buyers over the past 12 and 36 months.

Like the Chinese, the Russians have been swapping U.S. dollars for gold.

And so far, it’s been a great trade for the Russians.

You can side with the likes of the major financial institutions and buy physical gold and likely make a nice return.

However, I’m taking a slightly different approach. I’m investing millions into a handful of gold stocks that I believe will significantly outperform the performance of bullion over the coming years.

I think it’s reasonable that if gold pops even $100 or $200 per ounce, my gold stocks could easily double or triple in value. Just look at the recent Atlantic Gold buyout, for instance. We publicly stated it would be bought out and had the company on our free gold buy out list.

One of my gold stocks is up 40% in the last 6 weeks on the back of gold’s 9% rise. That’s the incredible leverage that certain gold stocks provide.

We’ve done very well so far in 2019, but I think there’s a lot more room for the stocks we hold in Katusa’s Resource Opportunities to run much, much further.

Regards,

Marin