Technical analyst Clive Maund charts the stock of this company that has developed a device that uses a special light that visualizes cancer during minimally invasive surgery.

This is an interesting story. Without going into more detail than is necessary, Imagin Medical Inc. (IME:CSE; IMEXF:OTCQB) has developed a rectal (and bladder) endoscopy device that utilizes a stereoscopic blue light which immediately detects cancerous tissue. It is believed to be something of a breakthrough that has generated a lot of interest amongst doctors and the medical profession and is looking set to become widely used.

The reasons for the stock plunging back to low levels again over the past 18 months, as we can see on its latest 4-year chart, are believed to be a lethal combination of capital markets chicanery and investor impatience, but from the way the charts look now, this prolonged selloff looks to have run its course, which is why the stock is now viewed as increasingly attractive—this and the fact that the company's products are looking set to do well.

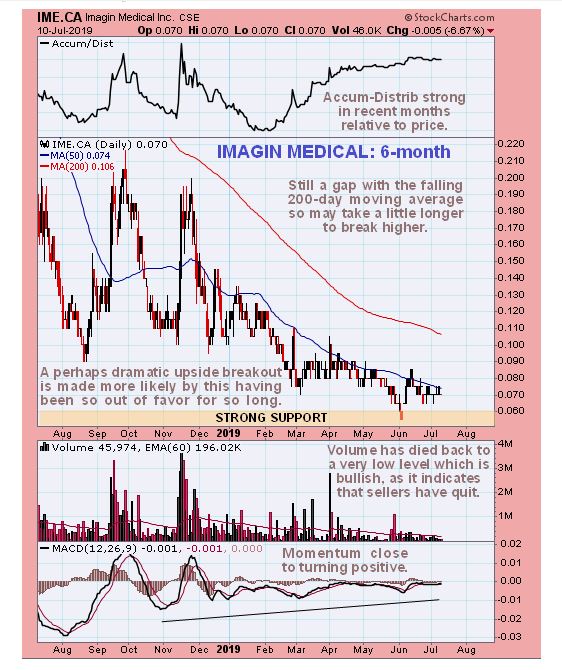

The severe downtrend since January last year has brought the stock price down from a peak at over 42 cents to just 7 cents at last night’s close—so it was 7 times more expensive at the start of last year than it is now. Factors that are pointing to a reversal to the upside soon include an easing of downside momentum, made clear by the MACD indicator at the bottom of the chart trending back to the zero line, volume dying back to a relatively very low level as the downtrend has progressed, the relative buoyancy of the Accumulation line, which is a sign that stock has been transferring from weak to stronger hands, and the arrival of the price at a zone of strong support near to the 2017 lows so that it looks like it is at a cyclical low. The convergence of the downtrend is a positive factor too, and the fact that the price is easing out of this downtrend by virtue of moving sideways puts it in position to break higher at any time soon.

We can see all of these factors at work in much more detail in the recent past on the 6-month chart, where positive points to observe are the slowing of the decline as the price arrives at the important long-term support and the strong accumulation line in recent months and the 200-day moving average dropping down closer to the price with passing time, although as there is still a significant gap with it, the price might need to base here for a little longer before an upside breakout can occur, but the picture is now sufficiently positive for a reversal and upside breakout to occur at any time from now on.

The conclusion is that Imagin Medical is an attractive medical device stock here, although at this low price it must of course be classed as a speculative investment. The placing of stops is difficult with such a low priced issue and is a matter of personal preference.

Imagin Medical website.

Imagin Medical Inc, IME.CSX, IMEXF on OTC, closed at C$0.07, $0.05 on 1oth July 19.

Originally posted on CliveMaund.com at 9.00 am EDT on 11th July 2019.