"The desire for gold is the most universal and deeply rooted commercial instinct of the human race."—Gerald M. Loeb

One of the finest books ever written on investing was "The Battle for Investment Survival," by Gerald M. Loeb, the provider of today's quote and a true legend in the distant, long-forgotten world of free market capitalism. Also credited with "Put all of your eggs in one basket and watch the basket," it was an obvious slap-in-the-face to those who eat, drink and breathe the diversification mantra.

Having avoided disaster in the 1929 market crash, Loeb was deeply affected by the devastating swath it cut through the economic field of vision and was one of the first of his era to debunk the "long-term investing" track record, choosing instead to trade positions rather than hold. I remember reading the book in 1974 and marveled at how, thirty-nine years after its initial publishing run, it still retained relevancy, a quality that many professional investors lack given the rapidly changed/changing universe of financial products available to generations of new investors around the globe. From time to time, I will take it down from the bookshelf in my study, pour a glass (or two) of fine wine and browse the many chapters in search of old, time-honoured lessons and rules that I deem still absolutely relevant here in the Year of our Lord 2019.

The fact that gold remains "the most universal and deeply rooted commercial instinct of the human race" defines the reason why the paper merchants (bankers, brokers) detest its very existence. Since 1977, when I joined the Canadian securities industry, I have watched with abject horror the concerted campaign of misinformation, disinformation, propaganda and fraud condoned, promoted and executed by the "destroyers" (as Ayn Rand called them) as a means of swaying the "desire" mentioned by Loeb from gold to"financial assets" (including stocks and bonds). Financial news networks, not to be found anywhere until the 1980s, served to deify stock ownership, and the proof of that is the rise in household ownership of stocks from 4% in 1974 to over 50% by the year 2000.

In light of the intensity of the message being broadcast by the elitist bankers and politicians, gold has been an unwanted house guest, rarely if ever to be invited to any of the celebrations such as the "all-time highs!" or "Dow 30,000" parties so common in this period of insane currency debasement operating under the alias of "easy money." Today, there is a generational tendency that allows the "most universal and deeply rooted commercial instinct of the human race" to be the desire for paper wealth through stocks, a trait held by over 65% of all Millennials, who in a recent survey said that they preferred computer-generated "BUY" recommendations rather than those by highly educated, brilliantly trained carbon units.

The reason I write this missive is that being a gold or silver "expert" provides a function to an increasingly shrinking market, in the same sad manner in which buggy-whip manufacturers were forced from relevancy by the invention of the automobile. Being brilliantly trained by brilliant mentors in the importance of anchoring one's wealth in solid, time-tested stores of value such as gold and silver carries little or no usefulness in a world managed, manipulated and molded by the paper merchants, as year upon year upon year the suppression of precious metals marches on.

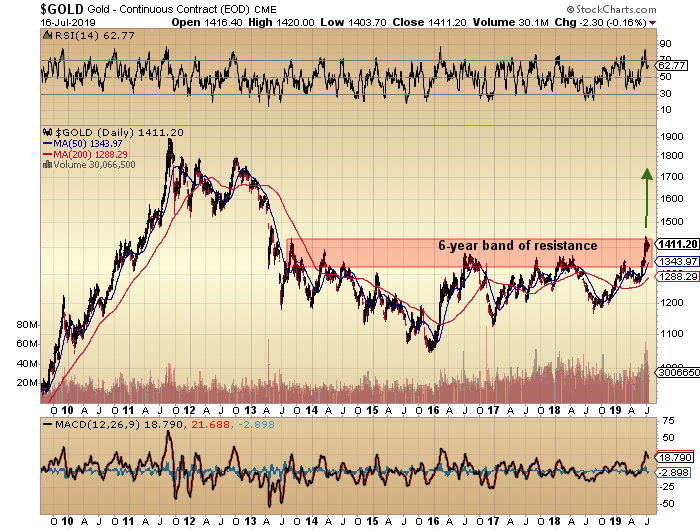

However, in June 2019, there was an event that broke the shackles of price management for gold with the near-magical surge to $1,442/ounce, finally vacating a six-year band of resistance despite heavy shorting by the Commercials and a seriously underperforming silver market. With the HUI now above 200 for the first time since January 2018, it needs to get above 225 to set up the assault on 280, the August 2016 high. Of major significance to the physical metals is this: The miners must lead the charge to the 2016 highs, assuming the leadership role and the gold-to-silver ratio (GTSR) must be in full descent as it happens.

This brings us right back to the term "relevancy," and the debate over whether any real bull market in gold can sustain itself without participation by silver. You notice I use the term "participation" as opposed to"outperformance," and that is noteworthy because integral to any sustainable and trustable advance in gold has historically been silver's role as the superstar.

In 2009, I was long gold, and every morning I looked at the percentage gain in both metals and was delighted to see silver consistently outperforming gold on its advance post-GFC from under $9/ounce to nearly $50/ounce by 2011. The great debate going on with technical types, fundamentalists, CTAs, and historians (like me) is whether or not the silver price is today relevant to gold's future performance. It is no longer a question of why silver has lagged so dreadfully; everyone points to JP Morgan or China or base metal byproduct supply as possible answers. But for me, anchored perhaps incorrectly in the biases of past bull markets, it is especially difficult to charge into a 50-car position in August gold with the GTSR over 90. For me, the silver price is absolutely relevant to the gold price, but more so to the gold price risk—and for all of us so unmercifully bludgeoned by precious metals drawdowns over the years, no amount of megaphone-fueled, pom-pom waving, siss-boom-bah cheerleading will remove silver's relevancy from my analytical cement mixer.

To wit, the one argument to which I am oh-so-slowly swinging is that gold can be a leader in the early stages of precious metals bulls, with silver being the late-cycle bloomer that at once captivates the retail hordes and signals the maturity of the bull move. Since 2015, I have been using a set of rules that blissfully allowed me to avoid the drawdowns that have sent so many gold/silver bulls to the emergency room with terminal injuries to net worth, from which recovery would be impossible. While the rules worked wonderfully, the June skew in their predictive value was an important omen for me, so I have no choice but to revert back to "full-on" bull market tactics, as opposed to "protect-principal" trading range tactics.

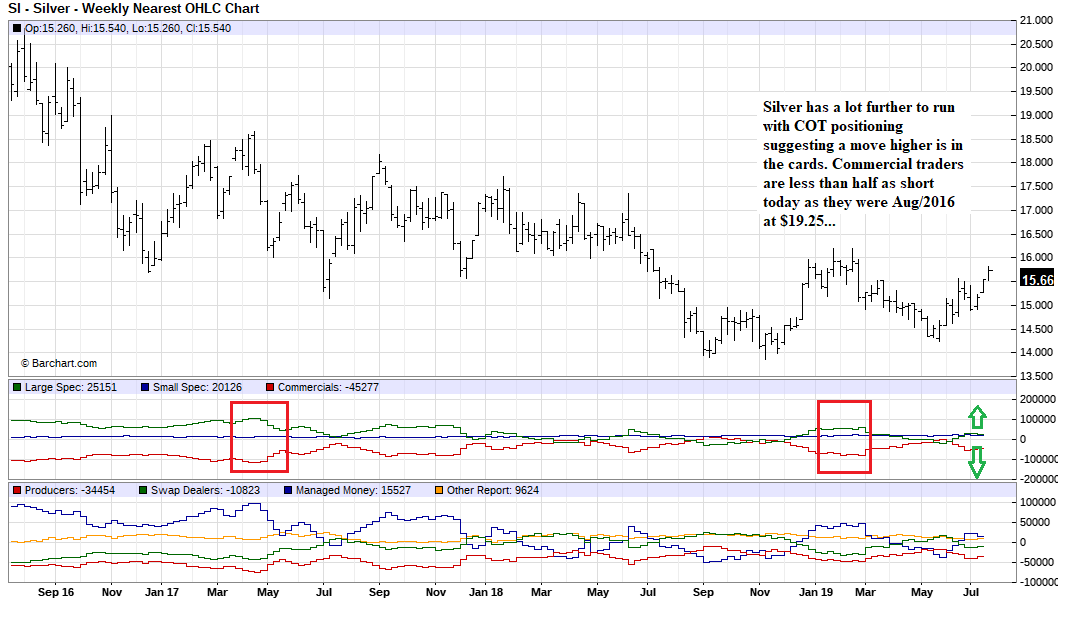

So, here is what I am driving at: The trade that I am slowly teeing up is in silver. Gold is in an unbridled, unassailable, accelerating bull market and one that will drag silver, irrespective of JPMorgan or China or base metals supply, to new recovery highs above the 2016 highs at $20.26. Gold is the fleeting leader that will forfeit its dominance to silver as the second major up-wave kicks into gear. Silver should be able to seize the mantle of dominance by the end of the summer, and the key will be its performance during the seasonally weak month of July. So far, it has been a distinct improvement over the May-June window.

The COT structure for silver is far friendlier than it is for gold; Commercials appear poised to let silver advance while they are markedly hostile to gold. As you can see from the red rectangles shown above, the alligator jaws depicting heavy Commercial shorting into heavy Large Spec buying in April 2017 and February 2019 are today muted and indicative of a price shock to the upside.

That is what I am predicting and that is why I am accumulating the iShares Silver Trust (SLV:US), as well as the August and December $15 calls. Now, the true silver aficionados would tell you that SLV has zero physical silver and therefore is devoid of purpose relative to our mission to protect against the debasement of purchasing power of currency. However, if in U.S. dollar-denominated terms SLV moves from $14.54 to 24.54, the trade will be satisfactory to the extent that the profits from the paper trade will allow me to exchange paper for physical silver, thus enabling the safe-haven utility while increasing the number of silver ounces sitting instructively idle in my safe.

The time to have been aggressive was in that first explosive shot to $1,375 off the December 2015 bottom at $1,045, and make no mistake, I was. I rode the wave until mid-May 2016 and then exited when the Commercials decided to lower the boom, which they certainly did by August. Four more times the cretins capped assaults to $1,350–1,375 and all four times, I was flat all of the leveraged positions before they took them right back down.

Since the top in 2016 at 280 the HUI has tried to rally four times, and all four times, the HUI crashed right back down again. For this advance to be truly different, silver must take the reins of the beast and simply take off, and therein lies the speculative shot I am taking. Tactics from pre-June 2019 are to be discarded in favor of those from pre-August 2011. Dips—any and all—are to be bought, with sales only into relative strength index (RSI) spikes into the 85-90 ranges.

Ladies and gentlemen, conditions have changed; the tone and texture of the market has changed; and I have changed in all aspects related to strategy as we move forward. The current consolidation for gold is more so a particularly compelling buying opportunity for silver, on the expectation that silver rejects the gold correction and instead leads the entire complex out of this pregnant pause and upward to new recovery highs, flipping the algobots and the Millennial traders to "bullish" while forcing tens of millions of social media sheep into the silver trade thanks to their undying loyalty to the "safety of crowd investing."

With the Fed about to cleave another fifty beeps off the funds rate in an effort to drive down the U.S. dollar, aiding U.S. exports while attempting to steepen the yield curve, it is obvious to me that they are completely out of control as to policy, as to purpose, and as to implementation. The conclusion I draw is that it is not the hard assets investor that is rapidly becoming irrelevant; it is the Fed. Once recognized, it is important. Once acted upon, it is crucial.

I leave you with a memorable quote from Ayn Rand, with the suggestion that everywhere you see the word "gold," simply insert "silver":

"Whenever destroyers appear among men, they start by destroying money, for money is men's protection and the base of a moral existence. Destroyers seize gold and leave to its owners a counterfeit pile of paper. This kills all objective standards and delivers men into the arbitrary power of an arbitrary setter of values. Gold was an objective value, an equivalent of wealth produced. Paper is a mortgage on wealth that does not exist, backed by a gun aimed at those who are expected to produce it. Paper is a check drawn by legal looters upon an account which is not theirs: upon the virtue of the victims. Watch for the day when it bounces, marked: 'Account Overdrawn'." —Ayn Rand

Buy silver.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.