MGX Renewables Inc. Goes Public: “The sun doesn‘t shine all the time. The wind doesn‘t blow all the time. MGX Renewables mass storage batteries for the rest of the time.“

“A next-generation smart grid without energy storage is like a computer without a hard drive: Severely limited.” (Katie Fehrenbacher, GigaOm)

In an increasing fashion, people are starting to realize that affordable mass energy storage is the missing bridge between intermittent renewable power (solar, wind, hydro) and reliability.

As per the Environmental Defense Fund: “The [energy storage] market has its challenges, but nothing seems to stand in the way of its explosive growth.”

One of the challenges is to determine whether energy storage reduces emissions or actually creates more. Most battery types are not 100% clean and green, including lithium-ion.

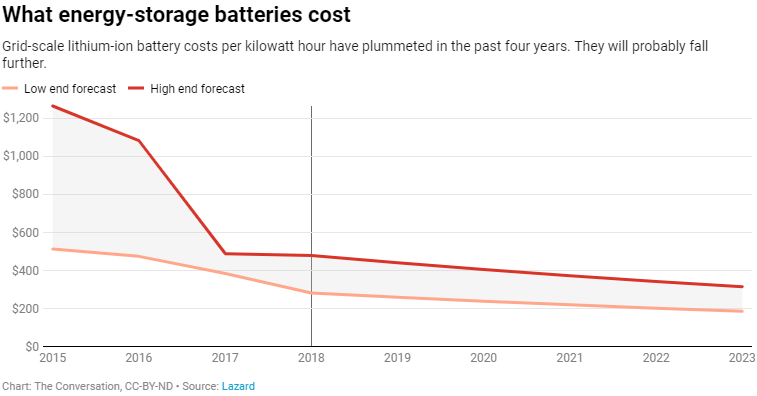

However, the biggest challenge for energy storage is its price. The falling cost of lithium-ion batteries have positioned them for a much broader integration into stationary grid operations as other battery types were not commercially ready or simply to expensive. Grid-scale lithium battery costs have plummeted in the past years and are forecasted to range between $187 and $316 per kWh by 2023.

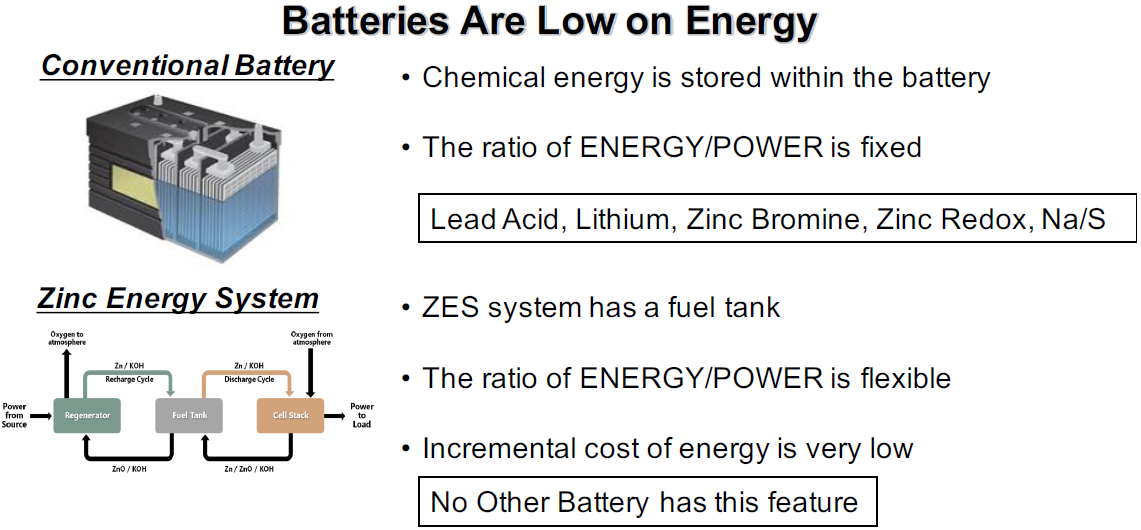

Now imagine a novel, commercially ready battery technology entering the market with a price of less than $15 per additional kWh. How much faster could the energy landscape evolve now? How much bigger could the market become? What new applications would be possible?

The time has come for MGX Renewables to demonstrate that its patented zinc-air flow battery is ready to modernize the energy storage market in a way that other battery technologies can not keep up with. While all kinds of alternative energy stocks are booming and investors are looking for exposure to pure battery stocks, MGX Renewables is the one to take a closer look at now.

“Over the last five years, the world began to experiment with storage; in the next five, storage will become a key grid asset”, says Ravi Manghani, Wood Mackenzie Power & Renewable’s Head of Storage Research. “And much like the renewables that are driving their growth, the batteries that make up the lion’s share of new storage systems being deployed are falling in price. That’s positioning them for a much broader integration into grid operations beyond renewables integration”, Jeff St. John noted in his article.

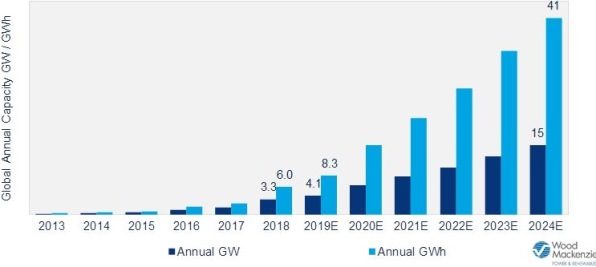

Global energy storage has started an explosive, exponential growth path.

“The energy storage market has caught the eye of a number of stakeholders involved in the power industry, leading to its considerable growth and opening the way for next energy revolution”, says GlobalData, a leading data and analytics company.

Energy storage deployments are expected to grow 13-fold over the next few years, from 12 GWh deployed globally in 2018 to a 158 GWh market in 2024 according to Wood Mackenzie Power & Renewables.

“This is one of the biggest markets in the world – we are in a fundamental paradigm shift to renewables”, says Jared Lazerson, CEO of MGX Renewables.

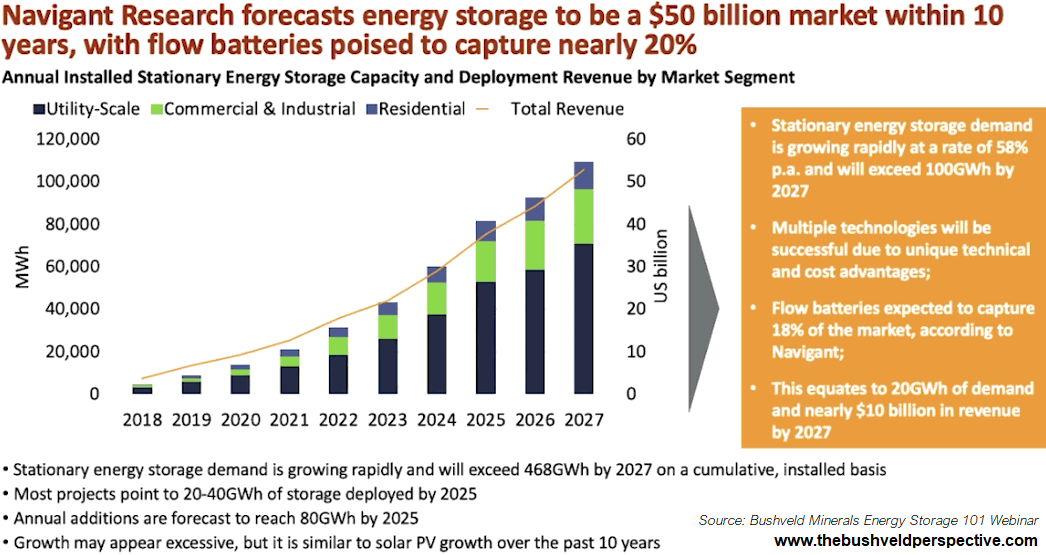

By 2040, the global energy storage market will grow to a cumulative 2,857 GWh, attracting $620 billion in investment over the next 22 years according to BloombergNEF. “Cheap batteries mean that wind and solar will increasingly be able to run when the wind isn’t blowing and the sun isn’t shining.”

By deploying nearly 150 MW in the first quarter of 2019, the US energy storage market grew 232% over the amount deployed in the first quarter of 2018. The US non-residential storage market had its strongest quarter ever according to Wood Mackenzie and the US Energy Storage Association (ESA). “These first-quarter numbers indicate that 2019 will be a banner year for energy storage in the United States,” says ESA CEO Kelly Speakes-Backman. “It’s become clear that states are already unlocking the potential of storage by passing legislation and creating regulatory frameworks to encourage energy storage deployment. The industry is responding by developing storage projects and creating jobs in their states.”

In the context of more than a million MW in total US energy generation capacity, 150 MW constitutes a small drop in a large ocean – but that’s exactly what investors are looking for: Large-scale mega-trends that are changing industrial landscapes. And most compellingly, it’s a global trend.

“We see energy storage growing to a point where it is equivalent to 7% of the total installed power capacity globally in 2040”, says Logan Goldie-Scot, Head of Energy Storage at BloombergNEF. “The majority of storage capacity will be utility-scale until the mid-2030s, when behind the meter applications overtake.”

In other words: Non-residential, utility-scale energy storage is the place to be right now – for investors and technology providers alike.

Today, MGX Renewables Inc. is expected to start trading on the Canadian Securities Exchange (CSE) under the symbol MGXR.

The company aims to deploy its battery technology for utility- and grid-scale energy storage, energy trading/arbitrage and peak shaving, renewables storage (wind, solar, tidal power) as well as stationary and portable energy for military and natural disasters, or anything sizeable that requires long duration energy storage and reliable backup.

Of the around 40 million shares issued, approximately 18 million shares are controlled by MGX Minerals Inc. (CSE: XMG), which company did a spin-out of approximately 12 million shares to shareholders of MGX Minerals. Another 8 million shares have been issued with a $2 million CAD financing at $0.25/share.

MGX Minerals acquired the battery developer ZincNyx Energy Solutions Inc. (now renamed MGX Renewables Inc.) from Teck Resources Ltd. (NYSE: TECK; current market capitalization: $12 billion USD), a major mining company that previously invested approximately $13 million for research and development into this energy storage company, but divested non-core assets in 2017.

With $2 million in government grants received to date, MGX Renewables is an advanced-stage battery development company aiming to enter the energy storage market in the near future with a unique battery technology including an extensive patent portfolio, lead by an experienced and well-connected management team.

MGX Renewables has assembled a capable team to execute the development and commercialization of a dependable low-cost zinc-air battery. This mass storage system offers both environmental and efficiency benefits. MGX Renewables strives to meet the growing need for secure and reliable power. The mission is to provide longest duration, low-cost energy storage for markets in renewables, peak power shaving and diesel generator replacement for backup power.

The plummeting cost of grid-scale lithium-ion batteries over the last years was one of the driving forces why these types of batteries are dominating the grid-scale energy storage market today as other battery types were not commercially ready. However, grid-scale lithium battery costs appear to be bottoming out over the few next years and range between a high-end forecst of $316 and a low-end forecast of $187 per kWh by 2023, making them competitive with natural gas peaker plants. As MGX Renewables aims to commercially deploy energy storage systems with costs of less than $15 per additional kWh in the near future, such an alternative to lithium batteries and natural gas peaker plants could disrupt the energy market in an unprecedented way.

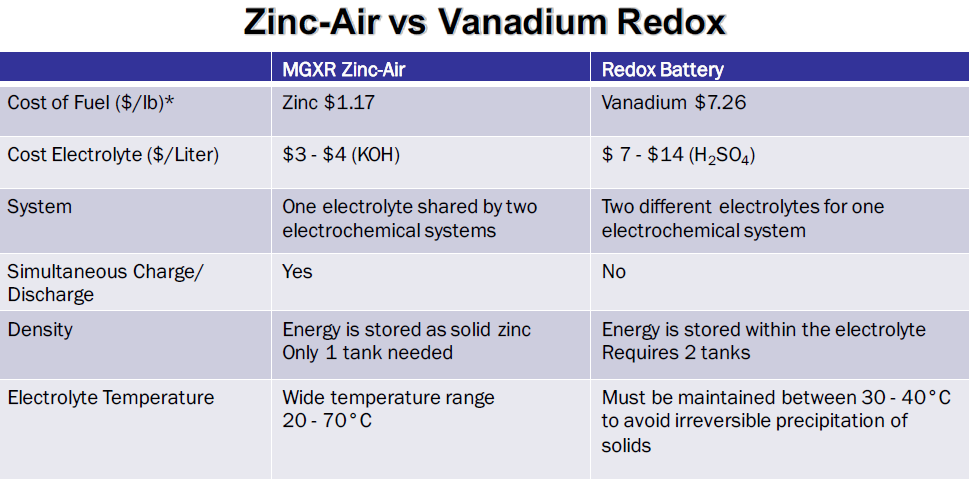

Full size / “Policy has far outstripped technology. There is plenty of solar out there, there is plenty of wind out there, and it will continue to grow... but the bottom-line is that there is just not enough batteries, there are essentially no batteries out there on a large scale – and that is because of cost. Lithium is just too expensive, and vanadium is just too expensive.” (Jared Lazerson, CEO of MGX Renewables in an interview)

In contrast to nearly every commercially available energy storage system, MGX Renewables’ zinc-air flow battery is one of the safest and environmentally cleanest rechargeable energy storage systems ever developed. It uses only zinc and air as fuels, thus running on a safe, non-toxic, non-explosive and non-flammable chemistry.

Moreover, it can deliver both high-power and long-duration energy services, a feature that is extremely important to consider as most other battery technologies can only excel in one aspect, including lithium batteries.

There is no capacity fade over time. And a 100% depth of discharge without affecting system’s longevity or performance. For long-duration applications, MGX Renewables targets the lowest levelized cost of storage (LCOS) of all energy storage systems commercially ready.

The key to understand is that the battery’s energy capacity is easily extended by simply increasing the size of the fuel tank. It’s the modular architecture that allows the system to be scaled from 20 kilowatts to the order of megawatts relatively inexpensive.

According to the article “Utilities are starting to invest in big batteries instead of building new power plants” (2019):

“... we believe that utilities should prepare for the advent of cheap grid-scale batteries and develop flexible, long-term plans that will save consumers money. Peak demand is pricey. The amount of electricity consumers use varies according to the time of day and between weekdays and weekends, as well as seasonally and annually as everyone goes about their business. Those variations can be huge. For example, the times when consumers use the most electricity in many regions is nearly double the average amount of power they typically consume.

Utilities often meet peak demand by building power plants that run on natural gas, due to their lower construction costs and ability to operate when they are needed. However, it’s expensive and inefficient to build these power plants just to meet demand in those peak hours. It’s like purchasing a large van that you will only use for the three days a year when your brother and his three kids visit. The grid requires power supplied right when it is needed, and usage varies considerably throughout the day.

When grid-connected batteries help supply enough electricity to meet demand, utilities don’t have to build as many power plants and transmission lines. Given how long this infrastructure lasts and how rapidly battery costs are dropping, utilities now face new long-term planning challenges...About half of the new generation capacity built in the U.S. annually since 2014 has come from solar, wind or other renewable sources. Natural gas plants make up the much of the rest but in the future, that industry may need to compete with energy storage for market share. In practice, we can see how the pace of natural gas-fired power plant construction might slow down in response to this new alternative... Once utilities can easily take advantage of these huge batteries, they will not need as much new power-generation capacity to meet peak demand... Several utilities are already investing in energy storage.”

“Flow battery in 2018, accounted for over 6% of the global stationary battery storage market share. Technological advancement pertaining to the development of cost-effective and efficient storage solutions coupled with the increasing investment toward integration of sustainable grid infrastructure will stimulate the business growth {of flow batteries]. Higher product efficiency and longer shelf life are some of the prominent features which will make its adoption preferable when compared with other alternatives.” (Global Market Insights Inc., February 2019)

Full size / Source

According to the article “Energy Storage: Next Game Changer“ (2019):

“But like much else in electricity markets these days, cost isn’t the only or even the main driver of future demand growth – it is the mandatory rise of renewables. Governments the world over are requiring ever higher percentages of renewables while pushing for more electric vehicles (EVs) and solar PVs.”

Technological Advances

Since the acquisition in 2017, MGX Renewables achieved significant technological improvements, setting itself apart from other zinc-air flow battery developers:

• Expanding the battery’s capacity (from 5kW/40kWh to 20kW/120kWh)

• Increasing the energy density (from 9 Wh/L to 22 Wh/L).

• Improving fuel cell operation (by simplifying electrolyte channels).

• Improving regenerator operation (by using low-profile, extruded plates).

• Scaling up fluidizer to operate a 1,400-liter tank.

• Solving the long-standing reliability issue caused by the growth of zinc.dendrites, making its zinc-air battery immune to this problem as it uses zinc dendrites as fuel during operation.

• Successful generation of dendritic zinc using a linear regeneration module, completing the development of a zinc regeneration subsystem.

• Reducing production costs (through injection molding and die casting).

• Receiving CSA material attestation following a comprehensive evaluation by CSA including a 60-day immersion test, 90-day temperature test and flammability testing.

• Filing of new patents covering technological advances. MGXR is based on an intellectual property portfolio of more than 20 granted patents with several more patents pending.

Zinc-air fuel cells are flow batteries that are powered by oxidizing zinc with oxygen from the air. As per Wikipedia:

• These batteries have high energy densities and are relatively inexpensive to produce.

• This energy storage system has some properties of fuel cells as well as batteries: The zinc is the fuel, the reaction rate can be controlled by varying the air flow, and oxidized zinc/electrolyte paste can be replaced with fresh paste.

• Zinc–air batteries have higher energy density and specific energy (and weight) ratio than other types of batteries (atmospheric air is one of the reactants).

• Zinc–air cells have long shelf life if sealed to keep air out; even miniature button cells can be stored for up to 3 years at room temperature with little capacity loss if their seal is not removed. Industrial cells stored in a dry state have an indefinite storage life.

Full size / Click here to meet some of people working at MGX Renewables Inc.

Full size / Click here to meet some of people working at MGX Renewables Inc.

Watch the interview with Ron MacDonald, Executive Chairman and Director of MGX Renewables Inc. “Mr. MacDonald’s appointment to MGXR’s board of directors comes at an exciting time“, stated MGXR President and CEO Jared Lazerson. “As we begin rolling out our new lineup of zinc-battery modular storage systems and file the public listing for MGXR, Mr. MacDonald’s vision, experience, and vast global network will be crucial in the sales and energy arbitrage opportunities based on the MGXR product line. As both a great Canadian and global citizen, Mr. MacDonald is well qualified to be entrusted with this low-cost battery technology that can only be described as the missing link in the global shift to renewable energy and on demand distributed power.” Ron MacDonald has over 35 years of both public and private sector experience, ranging from international roles within the Parliament of Canada to serving on the boards of numerous publicly listed resource companies. From 1988 to 1997, he was the Member of Parliament for Halifax, Nova Scotia, during which time he was appointed by the Prime Minister of Canada as Parliamentary Secretary of International Trade. From 1997-2002, Mr. MacDonald was President and CEO of the Council of Forest Industries, a large lumber manufacturing, grading and marketing group, where he developed new markets in China, Korea, India and Japan. In recent years Mr. MacDonald has served as President of NRStor Remote Communities and Mines, a Canadian company focused on partnering with off-grid Indigenous communities and mines to develop renewable energy and energy storage projects.

Entering Battery Competition

According to “Global energy storage market expected to reach 22.2 GW in 2023” (May 2019):

“In its latest report, GlobalData has found that the energy storage market is nascent but fast-growing. The demand for energy storage system (ESS) devices in the power sector is increasing rapidly, particularly after the increase in the renewable energy integration into the grids. Intermittent power supply led to demand for the storage of electrical energy and supply during peak load periods.

ESS devices can help make renewable energy – whose power output cannot be controlled by grid operators – smooth and dispatchable. ‘Battery energy storage system (BESS) is regarded as a crucial solution for overcoming the intermittency limitations of renewable energy sources,’ said Sneha Susan Elias, Senior Analyst of Power at GlobalData... ‘The deployment is expected to grow, due to a large number of countries opting for storage utilization to support their power sector transformation.’ With the global energy storage market becoming one of the rapidly growing segments within the renewable power mix, equipment manufacturers or technology providers of energy storage technologies are focused on innovating their energy storage solutions and offering advanced energy storage systems.

‘Currently, lithium-ion batteries dominate the electrochemical energy storage market but other battery energy storage technologies such as sodium-sulfur, lead-acid, and flow batteries are now getting deployed’, said Elias.”

Lithium-ion Battery

• Environmental concerns (mining and recycling; manufacturing 1 kg of Li-ion battery takes energy equivalent to 1.6 kg of oil; mining of lithium impacts the environment due to water pollution).

• Risk of fire / explosion

• High cost for long duration energy

• Charging temperature limits are stricter than the operating limits (high temperatures during charging may lead to battery degradation and charging at temperatures above 45 °C will degrade battery performance, whereas at lower temperatures the internal resistance of the battery may increase, resulting in slower charging and thus longer charging times).

• Chemistry performs well at elevated temperatures but prolonged exposure to heat reduces battery life.

• Internal resistance increases with both cycling and age.

• Can be a safety hazard since they contain a flammable electrolyte and may become pressurized if they become damaged.

Sodium-Sulfur / Molten Salt Battery

• The anode and cathode are not solid but liquid metals (sodium and sulfur) with an operating temperature of 300-350°C.

• Highly corrosive nature of sodium polysulfides.

• Pure sodium presents a hazard, because it spontaneously burns in contact with air and moisture, thus the system must be protected from water and oxidizing atmospheres.

• In 2011, NGK-manufactured NaS batteries for storing electricity installed at the Tsukuba, Japan, plant caught fire.

• Corrosion of the insulators was found to be a problem in the harsh chemical environment as they gradually became conductive and the self-discharge rate increased.

• Dendritic-sodium growth can also be a problem.

Lead-Acid Battery

• Not popular for grid storage because of their low-energy density and short cycle and calendar life.

• Environmental and health concerns (some lead compounds are extremely toxic).

• Risk of explosion (malfunction, overheating and excessive charging causes electrolysis, emitting hydrogen and oxygen).

• High maintenance

• Short life

• Corrosion problem

• Due to freezing-point depression, the electrolyte is more likely to freeze during winter weather as the battery discharges and the concentration of sulfuric acid decreases.

• Lead–acid batteries lose the ability to accept a charge when discharged for too long due to sulfation, the crystallization of lead sulfate.

• As batteries cycle through numerous discharges and charges, some lead sulfate is not recombined into electrolyte and slowly converts to a stable crystalline form that no longer dissolves on recharging. Thus, not all the lead is returned to the battery plates, and the amount of usable active material necessary for electricity generation declines over time.

• Sulfation also affects the charging cycle, resulting in longer charging times, less efficient and incomplete charging, and higher battery temperatures.

Hybrid Flow (Zinc-Bromine / Chlorine-Carbon) Battery

• Limited duration

• Dangerous fuel

• Dendrite susceptibility (need to be fully discharged every few days to prevent zinc dendrites that can puncture the separator).

• The need every 1-4 cycles to short the terminals across a low impedance shunt while running the electrolyte pump, to fully remove zinc from battery plates.

• Low areal power ( <0.2 W/cm2) during both charge and discharge which translates into a high cost of power.

Redox Flow Battery (Vanadium, Iron-Chromium)

• Huge and heavy

• Expensive fuel

• Comparatively less powerful and lower efficiency.

• Require more sophisticated electronics

• Low energy density (you need large tanks of electrolyte to store useful amounts of energy).

• Low charge and discharge rates compared to other industrial electrode processes, i.e. the electrodes and membrane separators need to be large, which increases costs.

Hydrogen Fuel Cell

• High capital costs

• High energy losses (hydrogen)

• Fuel availability and cost

• Fuel storage difficulties

• In 2016, Samsung “decided to drop fuel cell-related business projects, as the outlook of the market isn’t good”.

Diesel Generator

• Environmental concerns (unacceptable emissions)

• High fuel and logistics costs

Total Flexibility & Safety: MGX Renewables’ energy storage system (ESS) can be housed in a shipping container for deployment at remote locations or installed in free standing racks in warehouse-type environments. Because the oxygen reactant is drawn from the air and does not have to be stored, the system provides almost twice the energy density of comparable systems. The simplicity of the system and the minimal maintenance requirements deliver a cost-effective solution in terms of both initial and operating costs. Unlike conventional batteries such as lithium-ion or lead-acid, the MGXR ESS operates as a flow battery. This enables the energy capacity (kWh) of the system to be increased simply by enlarging the size of the zinc storage tank. The separation of the power generation and zinc regeneration functions also enables the discharge power and recharge power to be separately configurable. Using only zinc and air as the energy storage medium, the system is one of the safest rechargeable energy storage systems ever developed. Unlike other systems, the MGXR ESS uses no molten metals and no poisonous or explosive gases.

Zinc Regeneration Module from MGX Renewables with a recharge capacity of 1.75 kW, a rated input power of 4.5 kW and operating life of 20,000 h.

Power Generation Module from MGX Renewables with a discharge voltage of 24 V DC, a rated output power of 5 kW and operating life of 20,000 h.

Company Details

MGX Renewables Inc.

#1 – 8765 Ash Street

Vancouver, BC, Canada V6P 6T3

Phone: +1 604 558 1406

Email: jared@mgxrenewables.com

www.mgxrenewables.com

Shares Issued & Outstanding: 38,790,200

Reserved for Issuance: 4,357,500

Canadian Symbol (CSE): MGXR

Current Price: $0.xx CAD (07/22/2019)

Market Capitalization: $xx Million CAD

US Symbol: Not Listed

German Symbol / WKN: Not Listed

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, MGX Renewables Inc., MGX Minerals Inc. and Zimtu Capital Corp. cautions investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the MGX Renewables´ and MGX Minerals´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through their profiles on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. MGX Renewables Inc. has paid Zimtu Capital Corp. to provide this report and other investor awareness services.The author, Stephan Bogner, holds a long position in MGX Renewables Inc., MGX Minerals Inc. and is being paid by Zimtu Capital Corp. for the preparation and distribution of this report, whereas Zimtu Capital Corp. also holds a long position in MGX Renewables Inc. and MGX Minerals Inc.