Going back to the Bowl Zone yields the desired results

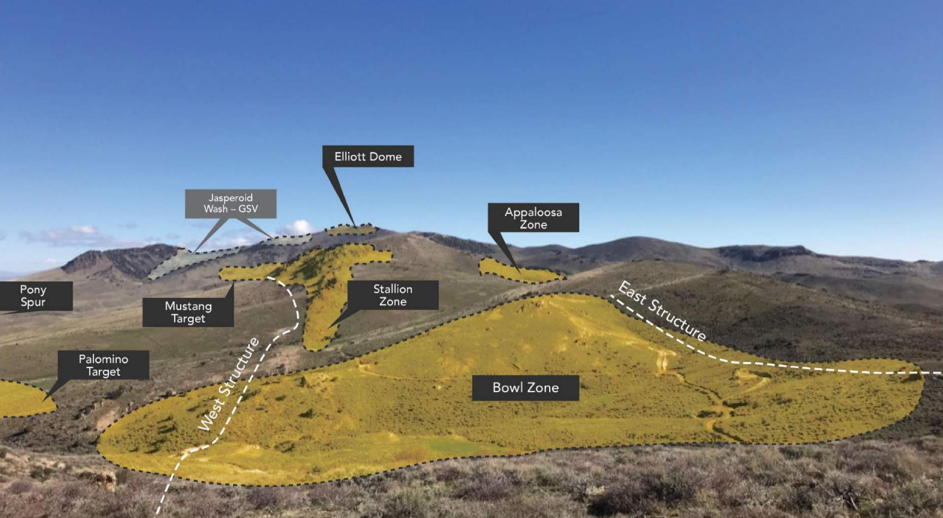

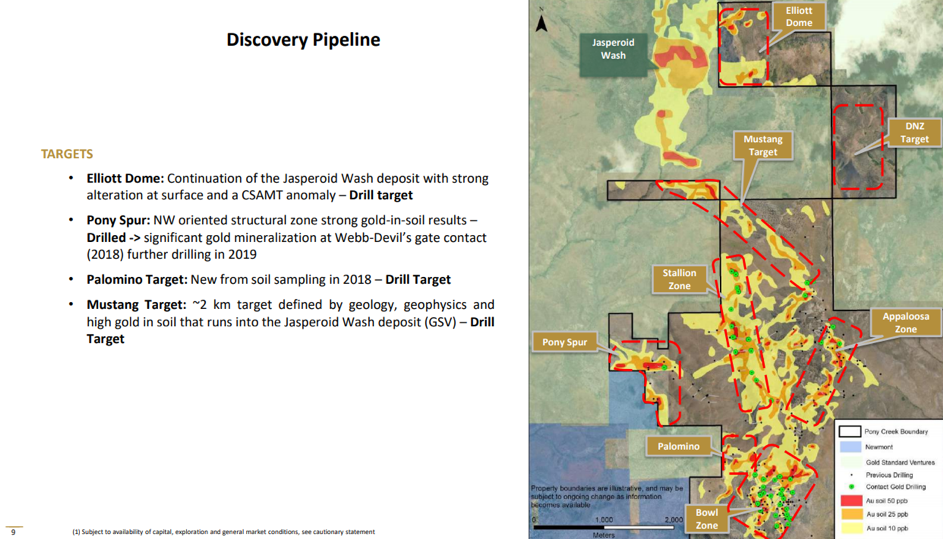

After a successful exploration campaign in 2018, wherein Contact Gold Corp. (C:TSX.V) confirmed the widespread presence of gold mineralization on its greater Pony Creek area (with very thick intervals such as 93 meters at 0.33 g/t gold), the company decided to go back to the main Bowl Zone, which hosts the majority of the historic resource estimate (1.4 million ounces at 1.5 g/t gold). We aren't sure that historical estimate is very reliable, so perhaps it's safer to assume there's around 0.7-1 million ounces at the Bowl Zone.

Nevertheless, this zone could be the kick starter for all future exploration and development programs at Pony Creek. While we totally understand the company's desire to go out there and kick the rocks to figure out what Mother Nature has hidden on the property, it could make more sense to have some sort of "main" zone that could be developed, where the cash flows from mining that zone could then be used to go hunt for more discoveries. After all, you can run a mine with 93 meters at 0.33 g/t (especially with Contact Gold's excellent metallurgical test results) but you can't build a mine with those grades.

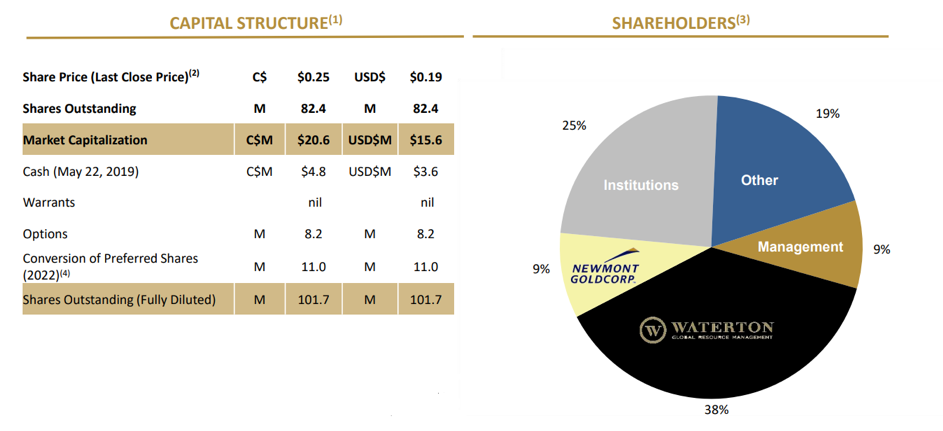

Now that Contact Gold's bank account has been cashed up with the proceeds of a CA$4 million (CA$4M) public offering (and the CA$2.85M private placement that closed in March), the company went back to the Bowl Zone, and the initial results are very pleasing.

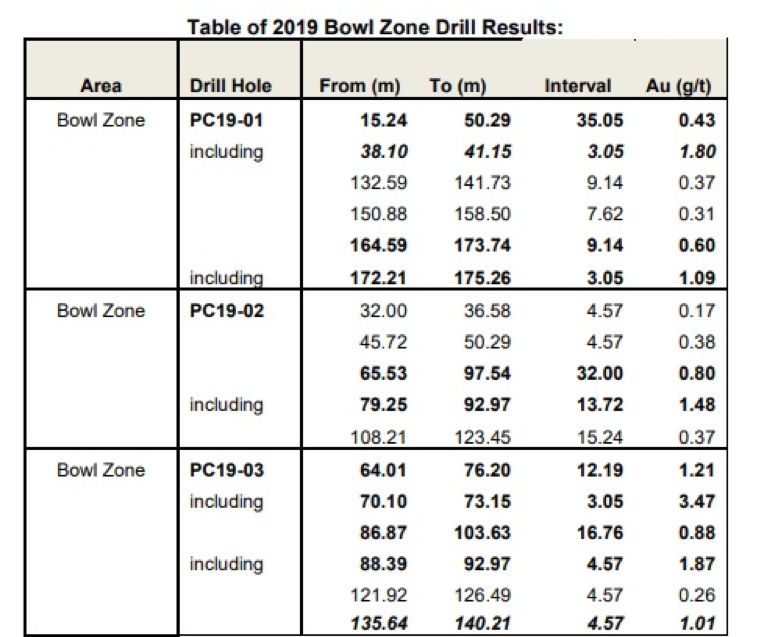

Only three holes have been reported so far, but with 35 meters containing 0.43 g/t gold almost starting at surface (the interval stated just 15 meters downhole), 32 meters at 0.8 g/t, and 12 meters at 1.21 g/t gold, immediately followed by almost 17 meters containing 0.88 g/t gold starting just 10 meters below the previous interval, Contact Gold has confirmed the higher grade gold mineralization at the Bowl Zone. Some of the reported intervals are relatively deep, but that's not necessarily an issue, as you'd obviously design the open pit so that you can excavate the tonnes that are the closest to the surface first.

Surprisingly, the market didn't seem to care at all about these intervals—surprising, considering even the near-surface 0.43 g/t gold over 35 meters would result in healthy operating margins. Applying Contact Gold's average recovery rate of 85–90% (as published in May 2018), the recoverable gold value would be around 0.37 g/t for a rock value of $16.6 per tonne using a gold price of $1,400/ounce.

Low? Absolutely. But the processing costs of a heap leach operation in Nevada are low as well. Fiore Gold Ltd. (F:TSX.V; FIOGF:OTCQB), for instance, has a mining cost of $1.50/t and a processing cost of $1.22/t. Even with a 3:1 strip ratio, the operating expenses would be just $7.5/t, leaving a margin of $9/t on the table. Although we agree the head grade of 0.43 g/t appears to be only marginally better than last year's 0.33 g/t interval at the Stallion Zone (previously called the West Zone, a few kilometers away from Bowl), the latter has a recoverable value of just $12.6/t, indicating the margins would be approximately 40% lower.

Ten holes have already been drilled to offset the higher grade (and more oxidized) corridor that was encountered in 2018, and we should see more exploration results come in over the next few weeks.

Contact Gold is now fully cashed-up for the season

As of the end of March (the financial statements for the June quarter should be filed in a few weeks), Contact Gold had in excess of CA$2.2M in cash on its balance sheet, thanks to closing a CA$2.85M financing in March. That round was priced at CA$0.29, and rather than attaching a warrant to the share, Contact Gold's management team came up with a refreshing idea: it would issue "bonus shares" rather than warrants.

The reason behind this was simple: Warrants do create a certain overhang, but on the other hand, the participants in that private placement deserved some sort of kicker, as the hold period was 12 months (which will be reduced to six months once Contact Gold completes the paperwork related to its public offering of shares in May).

Indeed, subsequent to the end of the quarter, Contact Gold completed a larger offering, raising CA$4M by issuing 20 million shares at CA$0.20. This means that we can reasonably expect the company's cash position to exceed CA$3.5M as of the end of June, and the cash will go a long way to fund the planned exploration activities in 2018.

Interestingly, insides of the company took care of almost half of the March placement at CA$0.29. CEO Matthew Lennox-King acquired almost 259,000 shares (for a total investment of CA$75,000) while CFO John Wenger and director John Dorward invested an additional CA$15,000 and CA$50,000 in that CA$0.29 placement. Other directors also participated in the financing, so it's clear they continue to keep their interests aligned with the shareholders. CEO Lennox-King basically reinvested (more than) his bonus of fiscal year 2018 back into the company, a gesture we certainly can appreciate.

Conclusion

2019 will be a very interesting exploration year for Contact Gold, as the company is planning a step-out drill program at the Bowl Zone and the Appaloosa Zone, which should result in a first NI-43-101-compliant resource estimate (we would be fine if this maiden resource estimate would just focus on the Bowl Zone if this means Contact Gold would be able to achieve the "critical mass" status at Bowl to advance the zone toward a preliminary economic assessment).

2019 will also be a busy year for Contact Gold, and thanks to the two raises earlier this year, the company's treasury is fully prepared for this year's exploration program.

Thibaut Lepouttre is the editor of the Caesars Report, a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.

Disclosure:

1) Thibaut Lepouttre: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: a long position in Contact Gold and participated in the CA$0.29 placement. My company has a financial relationship with the following companies referred to in this article: Contact Gold. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are available here.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.