Almost a decade ago, the global financial crisis of 2008-09 exposed billions of people to the risks within the global financial/banking sector. With all this money flowing around the globe and with banks able to facilitate greater and more diverse risk/derivatives investments, the central banks and insurance companies are left with an incredible “black hole” of exposed risk that is almost impossible to quantify. When we add the shadow/gray market banking risks into this equation and begin to understand the complexity of commodity-backed or Purchase Order backed financing that has become commonplace throughout the planet, we have to ask ourselves one question - “what would it take for these risks to become another crisis?”

Deutsche Bank Massive Exposure Could Cripple Europe

A recent article we found on

ZeroHedge highlights the risk exposure from Deutsche Bank and how that derivatives/banking risk could spill over into another global financial market crisis again.

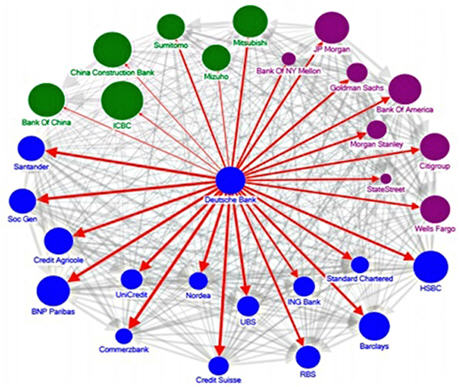

The ZeroHedge article stated that Deutsche Bank has $49 trillion dollars in derivatives exposure, making it the single greatest danger to Europe and global financial institutions imaginable at this time.

This additional

article from TheStreet, from May 2016, highlights the continued risks associated with the global financial system and the level of derivatives risk that is inherent in the system.

Here is a quote from that article that attempts to rationalize debt exposure...

”Let's take the latest data in Deutsche Bank's annual report for 2015. It shows that the bank's total, notional exposure to derivatives transactions is 41.9 trillion euros ($46.8 trillion). While that's more than 35% lower than its 2013 exposure, it still looks huge.

However, after offsetting the positive and negative exposures against each other, the net exposure is a much more manageable 18.2 billion euros ($20.3 billion).”

The data that we've been able to find regarding US exposure to the global derivatives market is rather limited in scope.

The Federal Reserve Bank of St. Louis provides some data, but we believe this data fails to include shadow/gray banking risks. Traders must be aware of the fact that the global economy has been running on ether after the 2009 market collapse. Global central banks have poured capital into the markets and foreign economies have consumed vast amounts of easy-money capital to run up huge debt levels while creating massive shadow/gray level financial systems.

In our opinion, the current global banking situation is far more fragile now than it was 10 years ago. The US is in a far better position to handle risks and exposure to risks than it was in 2008-09 and the real issue before us is the level of unknown risks that are a complete black hole in the foreign markets.

Ray Dalio Says Gold Is the Best Asset During Global Financial Reset

And Eric Sprott Likes Gold Also.

A recent article by

Ray Dalio, he stated gold is the asset in which we should all be accumulating as it will be a top performer globally when things start to fall apart. On May 31st

Eric Sprott talked about my gold forecast in detail. Since then I have accumulated more gold and silver from

Eric Sprott's company

https://www.SprottMoney.com/ and you should too.

Federal Reserve Bank Data Is A Warning Sign

Federal Reserve Bank Data Is A Warning Sign

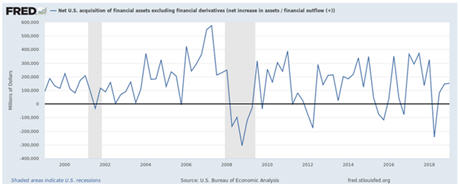

Ok, now take a look at these graphs from the Federal Reserve Bank of St. Louis to see the data that is currently being reported.

Net US Acquisitions of non-derivatives assets have been relatively tame over the past 6+ years. We can see from this chart the continued acquisition of assets from 2002 through 2007-08 – just before the credit crisis event. Then, we can see how dramatically the assets were dumped between 2007 and 2009. We're not seeing that type of setup or event play out currently in the US.

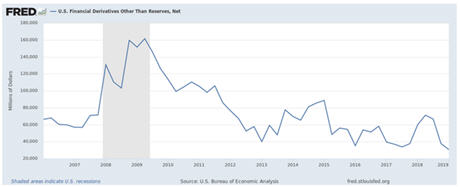

This next chart highlights the US financial derivatives net position and we can see the peak in 2008-09 and the dramatic deleveraging that has taken place over the past 8+ years. This chart shows the US financial derivatives levels are less than 25% of the levels from the start of 2008. ($31B vs $125B).

This last chart highlights the fact that US investors and institutions have been deleveraging from derivatives recently – as shown by the net negative transactions data on this chart. This suggests that investors are worried about the future and have been attempting to remove risk from their investments since the peak in early 2018. Notice similar net transaction declines in 2014-15 and 2009-10.

We believe the dips in these assets are related to US Quantitative Easing actions and investor concerns regarding the elimination of easy money policies. We will take a look at when and how these correlations to risk aversion and QE actually take place in Part II.

In the second part of this article, we'll explore how the US economy, US Fed and global banking sector could be complicating this derivative risk exposure and how traders need to prepare for this event – if it takes place as we suspect.

If you want to see 5 other crucial warning signs about the US markets and global economic downturn just take a look at this short video and charts.

In early June I posted a detailed video explaining in showing the bottoming formation and gold and where to spot the breakout level, I also talked about crude oil reaching it upside target after a double bottom, and I called short term top in the SP 500 index. This was one of my premarket videos for members it gives you a good taste of what you can expect each and every morning before the Opening Bell.

Watch Video Here.

I then posted a detailed report talking about where the next bull and bear markets are and how to identify them. This report focused mainly on the SP 500 index and the gold miners index. My charts compared the 2008 market top and bear market along with the 2019 market prices today.

See Comparison Charts Here.

On June 26

th I posted that silver was likely to pause for a week or two before it took another run up on June 26. This played out perfectly as well and silver is now head up to our first key price target of $17.

See Silver Price Cycle and Analysis.

More recently on July 16

th, I warned that the next financial crisis (bear market) was scary close, possibly just a couple weeks away. The charts I posted will make you really start to worry.

See Scary Bear Market Setup Charts.

On June 17th I showed my chart of the transportation index forming a double top formation. It’s known that the transportation index leads the broad stock market and if the transports are breaking down then we must expect the bear market is close. I then went on to talk about the precious metals breakout with silver and silver miners leading the way. Gold miners broke out as well while gold continued to hold its bullish formation.

See Transportation index double top.

CONCLUDING THOUGHTS:

In short, you should be starting to get a feel of where stocks are headed along with precious metals for the next 8-24 months. The next step is knowing when and what to buy and sell as these turning points take place, and this is the hard part. If you want someone to guide you through the next 12-24 months complete with detailed market analysis and trade alerts (entry, targets and exit price levels) join my

ETF Trading Newsletter.

This bear market has been a long time coming, but finally, almost all the signs are showing that it’s about to start. As a technical analyst since 1997 having lost a fortune and made fortunes from bull and bear markets I have a good understanding of how to best attack the market during its various stages.

Be prepared for these incredible price swings before they happen and learn how you can identify and trade these fantastic trading opportunities in 2019, 2020, and beyond with our

Wealth Building & Global Financial Reset Newsletter. You won’t want to miss this big move, folks. As you can see from our research, everything has been setting up for this move for many months – most traders/investors have simply not been looking for it.

Join me with a 1 or 2-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities starting to present themselves will be life-changing if handled properly.

FREE GOLD OR SILVER WITH MEMBERSHIP!

K

ill two birds with one stone and subscribe for two years to get yourFREE PRECIOUS METAL and get enough trades to profit through the next metalsbull market and financial crisis!

Chris Vermeulen –

www.TheTechnicalTraders.com