Note: Figures are in Canadian dollars (CA$). Mentions of peer group revenue are for trailing 12-month periods ended January, February, March, April or May 2019, depending on fiscal year end. Data compiled from SEDAR, SEC.gov, the CSE website, TMX Money, OTC Markets and Yahoo Finance. Note: I compare California Gold Mining Inc. to my own peer group of 305 hemp, CBD, MSO, cannabis, extraction, etc., names. Ranked by Enterprise Value, CGM.CSE was #175 as of July 19.

The news of July 16 was pretty big and really good. In addition to an update on the previously announced, fully funded, 27,000-square-foot greenhouse, California Gold Mining Inc. (CGM:CSE; CFGMF:OTCQB) completed the purchase of a private 82.42-acre contiguous parcel of farmland in Illinois. Earlier this month, management successfully commenced outdoor cultivation of high-CBD hemp biomass (plants) on about 40 acres.

Immediately following the $0.50 warrant acceleration in June, the company had approximately $2.5 million in cash and just shy of 60 million shares outstanding, for an enterprise value (EV; market cap + debt – cash of $39 million. The average number of shares outstanding for a peer group of 305 hemp/CBD/MSO/cannabis/extraction, etc., names that I'm tracking is 170 million.

High CBD hemp seed propagation greenhouse project moved to Illinois

Illinois. . .why does that ring a bell? It's the latest state, #11, to legalize recreational use of cannabis and is expected to be in the top eight U.S. markets over time. There's tremendous interest in getting a foothold there. Look no further than last week's major headline: Curaleaf Holdings (CURA:CSE) is acquiring privately owned GR Companies Inc. for US$875 million. GR is based in Illinois and has a leading presence in the state.

CGM is going to build its greenhouse in the state of Illinois instead of in California. Importantly, the company's cultivation expert and partner on this first greenhouse, Delta Valley Hemp (private), is based in Chicago, Illinois. Both the 40 acres of hemp plants and seed propagation operations are in Illinois.

Regarding the question that many investors have about the likelihood of additional greenhouses, here's a quote from company president and CEO Vishal Gupta, from a James West video interview: "I don't want to be too forward looking here, but, you know, if things go well, you can reasonably expect us to have a rapid expansion of our plans in the 2020 season. . ."

A successful greenhouse project, and one or more to follow, in Illinois, California or other states, would not necessarily be the end of the line. I estimate there are as many as 100 multiple state operators, (MSOs), including private entities with more than four retail stores (dispensaries), that cultivate and sell medical and recreational cannabis across the U.S.

In addition to greenhouses for high-CBD, feminized hemp seed propagation and outdoor hemp cultivation, management is wide open to the highly lucrative CBD extraction/isolation business. By next year, CGM could become one of the first true seed-to-sale companies (most companies don't propagate their own seeds).

Management is scouting for new farmland to plant additional outdoor hemp crops. I would not be surprised to see one or more transactions by year-end, especially if the current 40-acre project is a success. Investors will know in two to three months the outcome of CGM's maiden crop voyage.

If CGM can execute, MSOs could be interested in acquiring the company

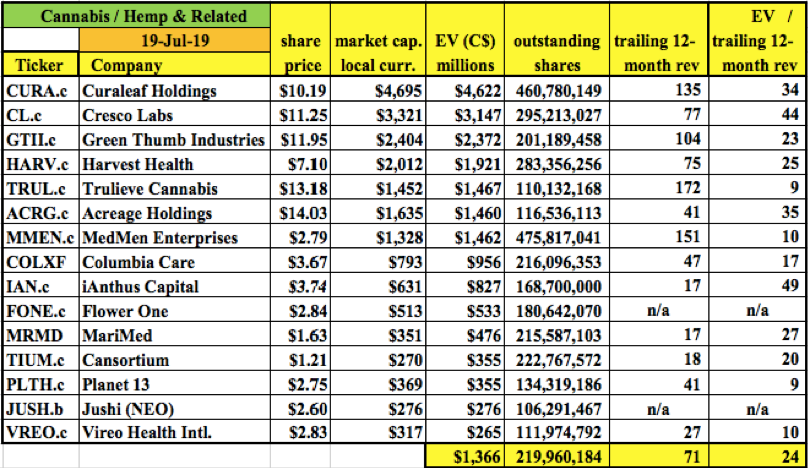

Fifteen of the top 50 largest hemp/cannabis and related companies are MSOs (see chart below). The average EV to revenue multiple of those MSOs is 24 times on average revenue of $71 million. The average EV of the top 15 is ~$1.3 billion. By contrast, CGM's EV is $39 million (July 19th close).

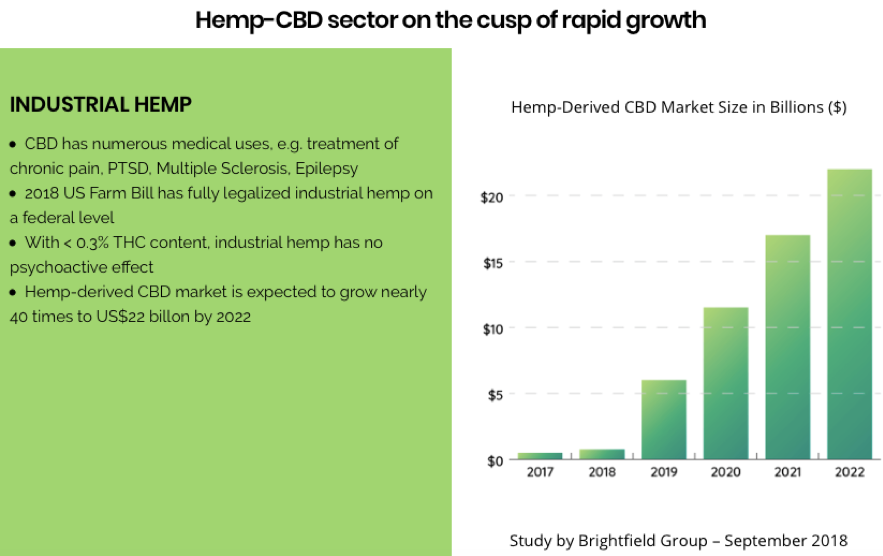

MSOs might be interested in the vertical integration and business diversification benefits of owning established hemp seed propagation operation(s), plus outdoor hemp capacity, plus (possibly) extraction capabilities. More and more pundits, analysts and consultants are proclaiming that growth in hemp/CBD consumption in the years ahead will outpace that of cannabis.

Yet, MSOs sell almost entirely cannabis products in their retail stores, not hemp-derived CBD products (oils, edibles, topical lotions, etc.) or flower. This is a no-brainer opportunity. . .MSOs would generate increased traffic from customers who wouldn't enter their stores otherwise, to buy health and wellness products with THC levels below 0.30% and CBD levels above 10%.

Outdoor hemp cultivation on ~40 acres has commenced

Investors were waiting for an update on greenhouse construction in California. . .now it's going to be in Illinois. Illinois is a better location for the company because it's an easy drive from hemp cultivation specialist and partner Delta Valley Hemp's Chicago headquarters.

In a new development, CGM announced that it acquired and successfully planted 130,000 hemp plantlets. The crop takes up about half (40 of the 82.42 acres/33.4 hectares) of the newly acquired farmland. Rest assured, there's ample room for multiple greenhouses, as each 27,000-square-foot structure occupies less than one acre.

California Gold's president Gupta stated: "The acquisition of the Grove Road Farm provides California Gold with an opportunity to take advantage of the outdoor cultivation season this year, in addition to the development of the Company's first greenhouse for industrial hemp seed propagation scheduled for completion in Q3 2019. The close proximity of our Chicago-based cultivation consultants Delta Valley Hemp, highly fertile soil, access to abundant water, proximity to three-phase power, and available skilled labor, make the Grove Road Farm an ideal launching pad for the Company's industrial hemp division. The field has been successfully planted and harvest is anticipated in late- September. We expect revenue realization in October 2019."

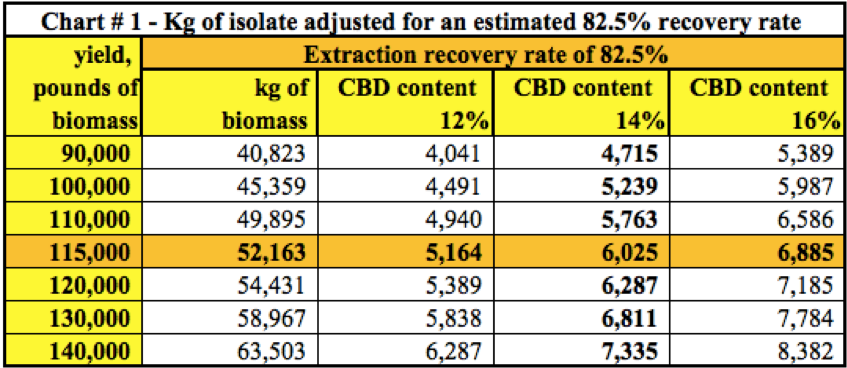

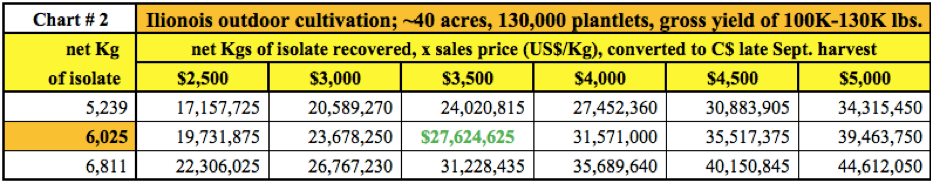

The press release indicated a potential yield of 100–130,000 pounds of biomass from the initial crop. In chart #1 below, I calculate how many kilograms (kg) of isolate that might be, assuming an 82.5% recovery rate. In chart #2, I list gross revenue possibilities based on a range of potential isolate prices.

Tens of millions in revenue could be months away

The industrial hemp project has been meaningfully de-risked (but is still risky), because hemp plants are in the ground and operations are fully funded. CGM is officially "in production," with first revenue expected in October. If all goes reasonably as planned, CGM should have two revenue streams in Illinois.

The timing of the hemp seed propagation project remains on track for revenue by year-end. That would be awesome, but the real prize is 2020, when the two operations alone (there might be more acquisitions) could generate revenue of up to $100 million.

Management believes this is just the beginning of what could come. They are looking at many hemp/CBD/extraction opportunities in many states. A single successful hemp seed cycle, or outdoor harvest this year in Illinois, would generate meaningful cash flow for CGM to go on a hemp/CBD shopping spree.

If CGM can approach $100 million in gross revenue next year, that would move the needle for any MSO—especially if CGM's two operations are profitable. Only six (15%) of the top 40 peer group names were earnings before interest, taxes, depreciation and amortization (EBITDA)-positive on a trailing 12-month basis.

The crop is being tended to by Delta Valley Hemp and management is negotiating toll extraction contracts. Before year end, shareholders could have a company trading at under two times 2019 revenue, and well under one-time 2020 prospective revenue. Just eight (2.6%) in the entire peer group trade at under a two-times EV/revenue multiple. Three of those eight were EBITDA-positive.

How much might a company with tens of millions of high-quality, profitable revenue be worth? I don't know. I imagine that CGM could be worth significantly more than $39 million if things go reasonably as planned. As it stands, CGM is ranked #175 in the peer group.

Revenue and profitability—positive EBITDA—are hugely important

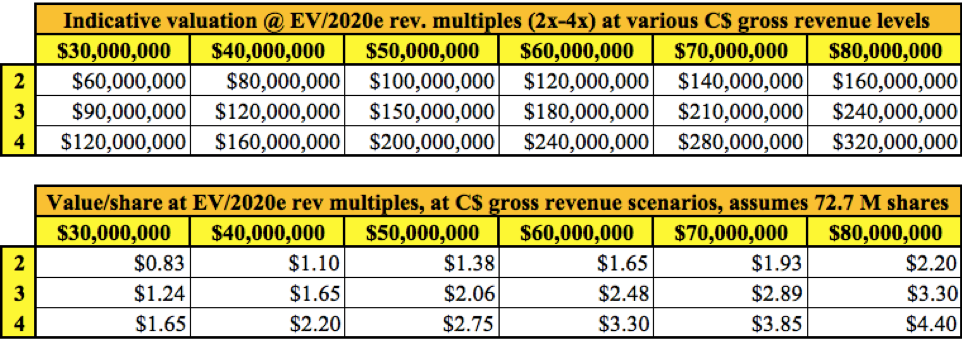

In the chart above are indicative company valuations at various 2020 estimated annual gross revenue scenarios ($30–80 million) and EV/revenue multiples (2x–4x). The valuations use the fully diluted 72.7 million shares versus 59.6 million currently outstanding. All scenarios are possible with existing operations. Importantly, these are not share price predictions. Share prices almost always trade below, or even well below, their theoretical "values."

Just like early-stage mining companies trade at a fraction of net asset value (NAV), readers should apply a haircut to the "values" to account for risk. Main risks include product prices, a failed or damaged crop, lower CBD concentrations than expected (in the seed propagation project and in the biomass from the 40-acre crop) greenhouse construction risks, cost overruns and project delays.

Fifty companies with higher EVs than CGM had zero or less than $1 million in revenue. Readers might be surprised to learn that only 24 (7.8%) of the companies in the peer group had more than $50 million, and just 60 (19.5%) more than $20 million in revenue. Consider this: If full year 2020 revenue for my entire database were to sextuple from current levels, there would be 59 names with greater than $100 million in revenue.

This just goes to show how incredibly important revenue and profits will be going forward. The top 50 players account for 85% of the combined 305 EVs and have an average EV/revenue multiple of 41 times. There's going to be a tsunami of merger and acquisition in coming years.

Conclusion

If management can execute on plans that are well underway and fully funded, California Gold Mining Inc. has a shot of leaping into the top quartile or tercile (as measured by annual revenue) next year. Yes, tercile is a word. While large revenue numbers are far from a sure thing, a hemp crop is in the ground and construction of a fully funded, brand-new, state-of-the art greenhouse begins in August.

With less than 60 million shares outstanding, a free float of roughly 15 million, and no need to issue new shares anytime soon (unless for a compelling acquisition), the next several months promise to be quite exciting!

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about California Gold Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc., is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of California Gold Mining are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned shares of California Gold Mining and the Company was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by the author.