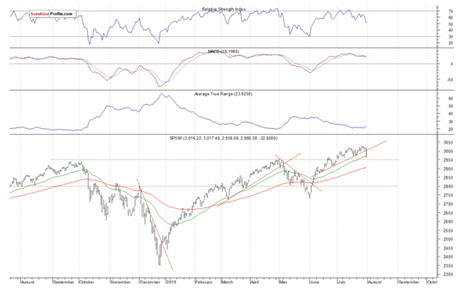

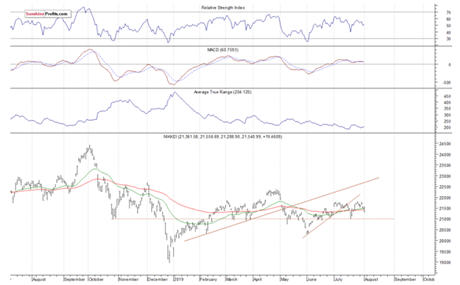

Stocks turned lower on Wednesday, as investors reacted to the Fed’s interest rate cut. The S&P 500 index broke below the 3,000 mark and it got closer to the early May local high of around 2,954. Then the index slightly bounced before closing 1.1% lower. So is this a new downtrend or just a quick correction within an uptrend?

The U.S. stock market indexes lost 1.1-1.3% on Wednesday, as investors reacted to the Fed’s interest rate cut decision release. The S&P 500 index broke below the 3,000 mark. It

fell almost 70 points of its Friday’s new record high of 3,027.98, before bouncing off the support level and closing more than 20 points above the daily low. The Dow Jones Industrial Average lost 1.2% and the Nasdaq Composite lost 1.3% on Wednesday.

The nearest important resistance level of the S&P 500 index is now at 2,995-3,000, marked by the recent support level. The resistance level is also at 3,020-3,030. On the other hand, the support level is at 2,950-2,960, marked by the early May local high of around 2,954, among others.

The broad stock market

broke below its two-month-long upward trend line yesterday, and then it accelerated lower towards the early May local high. Is this a downward reversal or just another correction within an over half-year-long medium-term uptrend? For now, it looks like a downward correction:

New Short-Term Uptrend or Just Retracement?

New Short-Term Uptrend or Just Retracement?

The index futures contracts trade 0.1-0.4% above their Wednesday’s closing prices, so expectations before the opening of today’s trading session are slightly positive. The European stock market indexes have been mixed so far. Investors will wait for some economic data announcements today: Unemployment Claims at 8:30 a.m.,

ISM Manufacturing PMI, Construction Spending at 10:00 a.m.

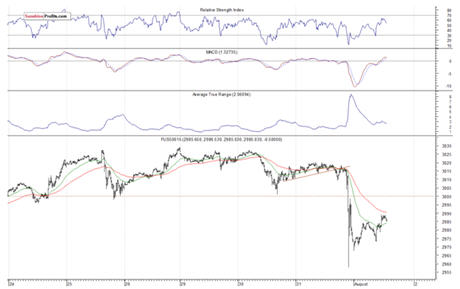

The S&P 500

futures contract trades within an intraday uptrend, as it retraces some of its yesterday’s decline. The nearest important resistance level is now at around 3,000, marked by the previous support level. On the other hand, the support level is at 2,970-2,975, among others. The futures contract is

within a short-term upward correction this morning, as the 15-minute chart shows:

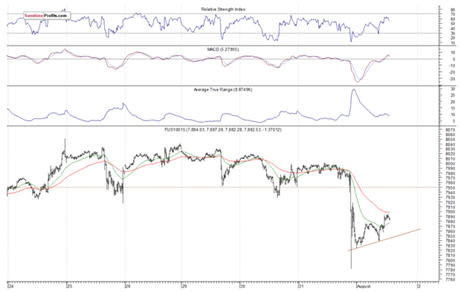

Nasdaq 100 Slightly Below 7,900

Nasdaq 100 Slightly Below 7,900

The technology Nasdaq 100 futures contract follows a similar path, as it trades within an intraday uptrend this morning. The resistance level is at around 7,900-7,950. On the other hand, the support level is at 7,800-7,850. The Nasdaq futures contract is

way below its recent trading range, as we can see on the 15-minute chart:

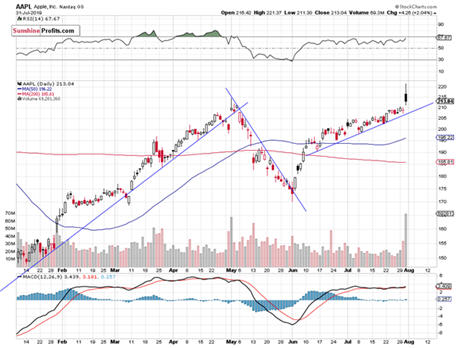

Apple’s Reversal?

Apple’s Reversal?

Let's take a look at the Apple, Inc. stock (AAPL) daily chart (chart courtesy of

https://stockcharts.com). The stock continued to trade at the resistance level of $210-215 recently. It was the highest since the early May on Monday. But it broke higher following Tuesday’s quarterly earnings release. However, we can see a short-term topping pattern here:

Now let's take a look at the daily chart of Microsoft Corp. stock (MSFT). The stock reached the new record high of $141.68 on Friday following the recent quarterly earnings release. But yesterday it retraced most of the recent advance and it

broke slightly below the two-month-long upward trend line. Is this a new downtrend? For now, it looks like a medium-term consolidation:

Dow Jones Broke Below the Trend Line

Dow Jones Broke Below the Trend Line

The

Dow Jones Industrial Average broke below its upward trend line on Wednesday. So the recent consolidation was a topping pattern. However, the market bounced off its previous medium-term high yesterday. Is the decline over? There have been no confirmed positive signals so far:

Nikkei Keeps Going Sideways

Nikkei Keeps Going Sideways

Let's take a look at the Japanese Nikkei 225 index. It broke below the over month-long upward trend line recently and then it bounced off the 21,000 mark again. The market extends its half-year-long consolidation:

The S&P 500 index broke below the upward trend line yesterday, as investors reacted to the Fed’s Rate Decision release.

We saw technical overbought conditions along with negative technical divergences recently. And the market turned lower. But is this a new downtrend or just another downward correction within a medium-term uptrend? For now, it looks like a downward correction. However, if the index gest back below the early May local high, we could see more selling pressure.

Concluding, the S&P 500 index will likely open slightly higher today. The market may retrace some of its yesterday’s decline. However, it may be hard to reverse the negative effect of the post-Fed decline.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Stock Trading Alerts to also benefit from the trading action we describe. Check more of our free articles on our website, including this one – just drop by and have a look. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts.

Sign up for the free newsletter today!

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Paul Rejczak and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Paul Rejczak and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Rejczak is not a Registered Securities Advisor. By reading Paul Rejczak’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Paul Rejczak, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.