Technical analyst Clive Maund describes how the takeover deal has and will affect stock prices for both companies.

Our assessment of Terraco Gold Corp. (TEN:TSX.V; TCEGF:OTCPK) in prior updates was that it was undervalued and a takeover candidate, an assessment that has since been proven correct as it is merging with Sailfish Royalty Corp. (FISH:TSX.V; OTC:SROYF) , to the advantage of the shareholders of both companies.

When the deal is completed, probably later this month, Terraco shareholders will receive an appropriate quantity of Sailfish shares in place of their current holdings, and the company will trade under the Sailfish name. In addition, Terraco shareholders will have the advantage that they will have a stake in a company with a more diverse range of assets and less risk.

The reason for this update, in addition to commenting on the merger, is to point out that, even though the merger is imminent, there appears to be more immediate mileage in Terraco shares, which from their current position could quickly tack on another $0.04 or so, perhaps more, before the merger is completed. This makes them of immediate interest to speculators.

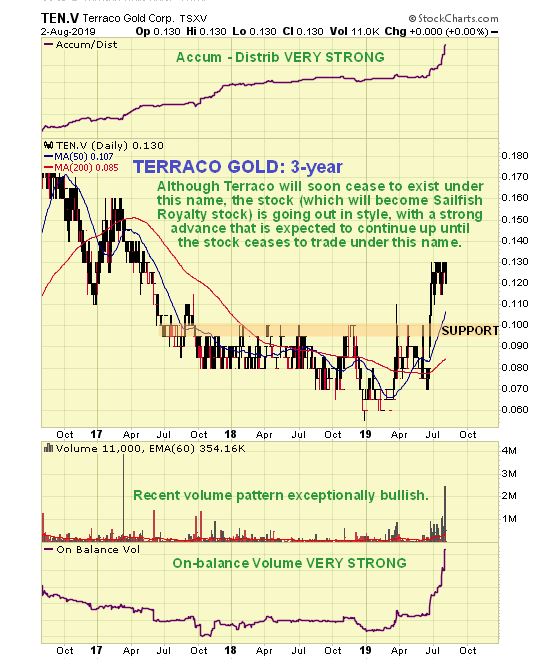

On the latest 6-month chart for Terraco we can see how it spiked to $0.13 in June on news of the merger , and has since run off sideways in an increasingly tight consolidation pattern-a bullish ascending triangle that has allowed its earlier overbought condition to unwind. This triangular pattern has been accompanied by an exceptionally bullish volume pattern-almost all volume was upside volume-and very strong volume indicators (on-balance volume is not shown). The volume buildup of recent days a sign that it is about to break higher again, and even without any knowledge of the fundamentals, this chart suggests an imminent $0.04 to $0.05 hike in the share price, which would result in a good percentage gain from here.

The 3-year chart shows recent action in the context of what came before, and this chart makes clear that there is potential for significant further upside before the transaction is completed. This chart also shows the very strong on-balance volume indicator.

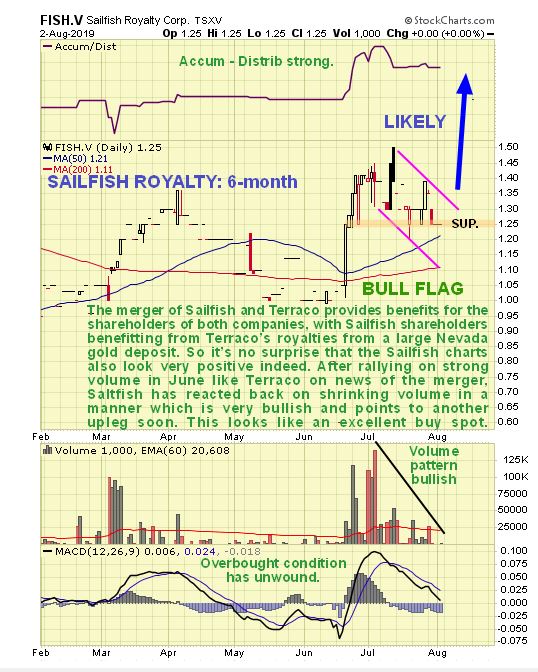

If the merger is beneficial to both companies, then it follows that the charts for Sailfish should look positive too, and as we will now see, they do. The 6-month chart for Sailfish shows that both its moving averages swung into bullish alignment as a result of the initial surge on the June announcement of the merger. After this sharp rally it reacted back in a leisurely manner during July, with volume dying right back, which is bullish. The pattern that has formed looks like a smallish bull flag, and the current very light volume, both in this and Terraco, suggests that another up-leg is imminent-although it might be a week or two before it occurs on more definite news regarding the finalization of the merger.

The 30-month chart is most useful as it shows us what is really going on. On this chart, we see that after spiking to just above CA$3.00 right after coming to market at the start of last year, it collapsed back in a long and stubborn downtrend that took it all the way back down to hit a low at CA$0.70 last November. But it is only in retrospect that we see that it actually started the base-building process as long ago as May of last year, because that's when it started to mark out the left shoulder of what we can now see is a head-and-shoulders bottom pattern. The volume pattern and exceptionally positive volume indicators powerfully support the contention that it is marking out a genuine base pattern. If it is, then it is clear that we are at a excellent entry point here, with the price getting ready to break out after its minor reaction of the past month or so.

Once it succeeds in breaking out of the resistance shown at the upper boundary of the pattern, it is likely to accelerate, possibly dramatically, especially given the rapid improvement in gold's fortunes. We therefore have no choice but to rate Sailfish an immediate strong buy here, in addition to the same rating for Terraco.

Terraco Gold website

Terraco Gold Corp. closed at CA$0.13, $0.098, on 2 August.

Sailfish Royalty Corp. website

Sailfish Royalty Corp. closed at CA$1.25 on 2 August, trading at $0.96 at 11:13 a.m. on 5 August (Canadian market closed). There are 38.4 million shares in issue and according to Yahoo Finance, of these, only 8.5 million are freely trading. If this is true then it will increase price sensitivity to increased demand. The stock trades in generally light volumes on the U.S. OTC market, but this is expected to improve.

Originally posted on CliveMaund.com at 6.40 a.m. EDT on 5 August 2019; Sailfish added at 12.15 p.m. EDT.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREEStreetwise Reports' newsletter.

Newsletter Sign-Up Newsletter Sign-Up |

|

|

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Terraco Gold. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer . This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports (including members of their household) own securities of Terraco Gold, a company mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.