Money manager Adrian Day explains why he is a believer in holding royalty company shares in a bull market.

There is a common perception that the royalty—and streaming—companies are defensive in a bear market, but that you don't want to own them in a bull market since they lack leverage. We disagree, and think the major royalty companies should continue to form cornerstones of a precious metals portfolio in a bull market.

No doubt, we do not expect any of the major royalty companies to be the very top-performing stock in a precious metals portfolio during a bull market. But:

- Royalty companies have plenty of leverage from expansions at existing mines and new mines coming into production on higher gold prices; the royalty company contributes no additional capital to see a dormant asset start generating revenue.

- Royalty companies continue to exhibit, on balance, the lowest risk of any precious metals sector, second only to bullion itself.

- Royalty companies tend to pay dividends above the PM universe average, and with tremendous free cash flow generation, have the ability to increase dividends.

- The royalty companies will attract new money in the gold space; generalists will go to Franco, U.S. retail investors to Royal Gold.

- If not necessarily the best performing stocks in a bull market, the returns from royalty companies will be more than satisfactory.

In short, I will put a portfolio of four or five royalty companies against four or five miners any day.

Franco remains the crown jewel

Franco-Nevada Corp. (FNV:TSX; FNV:NYSE, US$92.78) is the crème of the crop; its shares have outperformed the index about 10 times since its re-listing in 2008. It has top management, innovative and conservative; a solid balance sheet, with modest debt only twice in that time frame; a willingness to act counter-cyclically; strong diversification in its portfolio; a low cost structure; and a deep pipeline of assets.

Only two of its assets contribute more than 10% of its revenue, and the top operator is responsible for only 12%. This diversification is broader than for other companies, and means Franco is not at risk from a failure either of an operator or an asset.

As for costs, its G&A is not much higher today than it was a decade ago, despite the tremendous growth in revenue, representing today less than 5% of its revenue.

Strong quarter and stronger year

Franco reported strong revenues, above estimates, in its latest quarter, with oil and gas revenues offsetting slightly weak metals sales. The company expects metals sales to be at the higher end of guidance for the rest of the year, as Cobre Panama, its latest major asset, ramps up. And oil and gas revenues are expected to continue strong as well, including from the recent Marcellus shale acquisition.

First deliveries from Cobre Panama came in July, a little later than expected, and therefore are not contributing to first-half revenues at all. But operator First Quantum is reporting better grades and higher recoveries, leading to expectations for a rapid ramp up, and a strong contribution to second-half revenues. This mine lays the groundwork for five years of revenue growth for Franco, even absent other developments.

Even after final capital contributions to Cobre Panama and the Marcellus shale acquisition, Franco ended the quarter with a strong balance sheet, with virtually $400 million in cash against $385 million in total debt. It has $1.1 billion of available liquidity, more than sufficient to make additional large-scale acquisitions. The next acquisition is expected to be in the precious metals, not oil and gas.

Franco recently implemented an "ATM" program for up to $200 million, allowing the company to issue small amounts of shares from treasury into the market. This tool is better than raising capital in one go, which tends to have a negative impact on the market. Together with cash flow, this new equity could extinguish the debt rapidly.

Royal recoveries strong, though one risk remains

Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX, US$124.64) lost some revenue in the last quarter, both early on from the reduction in operations at Mt Milligan due to water shortages, and from the suspended operations at Peñasquito after a road blockade. Both operations are back up to speed now. The result was revenue slightly under expectations.

Mt Milligan saw sequential improvements and next quarter should be a strong one, but the underlying water issue is unresolved, and operator Centerra has indicated that there may be another stoppage this winter. With both Mt Milligan and Peñasquito up to normal operation levels, and with the resumption of revenue from Voisey's Bay following an agreement with Vale, the balance of the year should see strong revenues.

Royal has a strong balance sheet, with $119 million cash, $220 million recently drawn down on its credit line, and available liquidity of $780 million. This puts them in a strong position for new acquisition; the company indicated they had been receiving numerous requests for financing, many from earlier stage projects. We expect to see some acquisitions in coming months, but perhaps smaller ones that won't move the needle much in the near term.

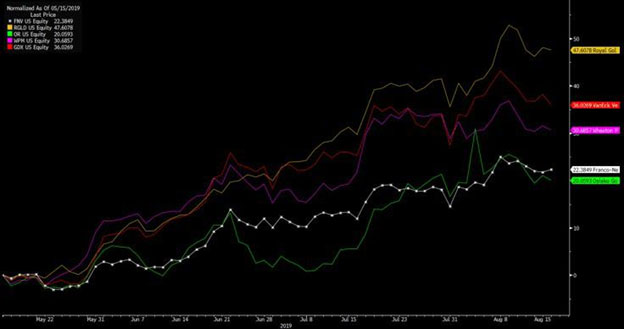

Royalty Companies versus Miners Since May

Source: Bloomberg

The royalty companies have mostly lagged the major miners since gold took off in mid-May, but the picture looks different if we look at the entire year or any longer period.

Osisko sees recovery in revenues

Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE, US$12.15) reported a small beat to expectations, partly due to better-than-expected production at Pretium's Bruejack, though ounces were down on a year ago, partly due to the Renard diamond mine, currently in restructuring. But the company is expecting a significant improvement in ounces in the second half of the year as the new Eagle Mine of Victoria Gold comes on stream, with first production expected next month, as well as improvement in production from the Éléonore Mine.

The most important development in the last quarter was the deal with Orion, a private equity firm. Osisko bought back from Orion shares in exchange for cash and the transfer of several junior investments. The shares repurchased were returned to treasury, resulting in an 8% reduction in shares outstanding, while there was no reduction in the cash-generating assets (but a $2.5 million reduction in dividend payments). Orion is now down to just over 6% ownership.

The result at quarter end was liquidity of $450 million, plus an investment portfolio now valued at $282 million, down from $400 million prior to the Orion transaction.

Osisko tends to be more involved in the companies on which it holds revenues, whether through its accelerator program—there were several advances at such companies owned by Osisko Mining, in which Osisko Royalties owns over 16%--or in helping companies in difficulties. Osisko is taking an active role in the restructuring of the Renard mine.

Undervalued vs peers

As we have said before, the accelerator—or "incubator"—program certainly adds an element of risk, in addition to the greater leverage not in a traditional royalty company. That, plus Osisko's size relative to the "big three," partly account for its lower valuation, but the gap has now become quite extreme. Osisko's price-to-book value, for example, is 1.5x compared with up to 3.8x for Royal; its free cash-flow multiple is 29 x compared with over 1,000x for Franco, and non-existent for Wheaton (both temporary anomalies).

Wheaton down to loss

Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE, US$26.49) reported a financial loss despite strong operating results and higher sales (notwithstanding temporary suspension of operations at Peñasquito during the recent quarter). The higher sales were offset by higher costs—cost per ounce can increase under some streaming deals—and higher G&A.

The financial loss was caused by an impairment charge on its recent cobalt stream (a deal criticized at the time) after a company with a similar stream (on the same mine, Voisey's Bay) was sold, crystalizing the market value). Even without all adjustments, earnings still declined from $72 million a year ago to $45 million in the latest quarter.

Wheaton is looking a strong second half, forecasting record gold production for the year, with Peñasquito back on line.

One asset which was to be one of its medium-term growth drivers, Hudbay's Rosemont Mine in Arizona, received a setback with a district judge issued an injunction against construction of the mine. Wheaton's payment of $230 million only occurs once construction is underway, so the risk is limited.

Wheaton's balance sheet is the weakest of the four major royalty companies—or perhaps we should call it the "least strong," with $87 million of cash against net debt of over $1 billion. Cash flow in the latest quarter was $109 million, so it would take a while to pay down the debt. Available liquidity on the unused portion of its credit line is $900 million.

All the royalty stocks have moved up and we are expecting a near-term pullback in the gold sector, so you should wait before buying. Franco is a core holding, so you should take a position on any pullback if you do not own. Osisko, the least well-valued, can also be bought on a pullback. Royal has moved too far, too fast, notwithstanding prospects for a strong next quarter, and Mt Milligan remains a risk, so we are holding, as are we Wheaton.

Adrian Day, London-born and a graduate of the London School of Economics, heads the money management firm Adrian Day Asset Management, where he manages discretionary accounts in both global and resource areas. Day is also sub-adviser to the EuroPacific Gold Fund (EPGFX). His latest book is "Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks."