The thing about experience is it lets you see current situations in context—opportunities are more apparent when you've gone through the experience before.

Libero Copper Corp. (LBC:TSX.V:, LBCMF:OTCQB) was established in 2016 for exactly this reason. A group of geologists and mining executives looked at the nascent bull market through the lens of their past successes and decided to start accumulating copper projects.

The team started with two people: Leo Hathaway and Ian Slater. Both deserve some comment.

Hathaway was Ross Beaty's main geologist in the Lumina Group. He vetted projects as Lumina built up its copper portfolio in 2004 and 2005, and he managed exploration on the assets they did acquire.

As the market strengthened, Lumina was "star burst" into six separate companies, each with one key project. Five got bought out in the last bull market; the fifth sold in 2014. Together these projects brought in $1.6 billion, generating a 20-for-1 return on capital for shareholders.

Lumina is the stuff of legend in the mining space. It's incredibly rare for one company to attract $1.6 billion in buyouts. But the logic was straightforward:

- Buy copper projects when no one cared about copper;

- Ensure projects were free of fatal flaws, be it metallurgy or social issues or grade or infrastructure;

- Focus on projects with known mineralization but also significant exploration potential;

- Grow and de-risk each deposit as the market strengthened so that they stood out as advanced, clear opportunities when a strong market put mining companies on the hunt for acquisitions.

Ross Beaty gets most of the attention for Lumina's incredible success but he certainly didn't do it alone. Beaty certainly had the vision, but he relied on experts to enact the plan.

Hathaway was central in that expertise. He vetted each project that Lumina considered and bought. He helped craft each project deal. Once projects were in the Lumina fold, he ran the exploration programs and directed the de-risking, which ran from permitting and social license to water and roads.

Success on the Lumina scale is addictive. So I was not at all surprised when Leo told me that he was started a new Lumina-model company, for the next bull market.

Lots of people are trying this. Hathaway is way ahead of all of them because he has done it before.

But Hathaway couldn't set up Lumina 2.0 on his own—he is a geologist, not a junior mining executive. He needed someone else to fill those shoes, which is where Ian Slater fits in.

Maven readers might recognize Slater's name. . .and not for the best reason. Slater was the head of Red Eagle Mining, which stands as the worst investment I have made in the Maven portfolio. Red Eagle built an underground gold mine in Colombia, but insufficient engineering based on poor rock-type understanding meant the mine failed and Red Eagle went bankrupt.

Responsibility for that failure rests with Slater and the Red Eagle board of directors. Slater is an accountant by training. He knew he lacked the knowledge to build a mine so he built a team to get the job done. A few key members of that team overpromised and underdelivered.

Slater didn't have the technical background to realize the errors in time. When he did, he tried hard to salvage the operation but leverage on the construction debt took Red Eagle down before he could make it work.

To be honest, when it happened I thought I would never back an Ian Slater deal again. Complete losses really burn. Yet here I am investing in Libero. What gives?

Two things. First, Libero is an explorer, not a developer. I would not back Slater again were he planning to build another mine, but that is not what he's doing. He's running a gold exploration company, which is a very different—and much easier—gig. I don't mean to say that running a junior explore-co is easy, because it is not, but it is easier and far less technical than building a mine.

Second, I just said that running a junior explore-co is not easy. It takes a particular kind of person to do it successfully—and even despite the Red Eagle failure, Ian Slater is that kind of person.

Slater raised over $100 million during the bear market to build Red Eagle's mine. He convinced investors to have faith in Colombia. He guided a social outreach program that generated true support for the mine within the local community. He never shied away from questions, even as bankruptcy drew near.

He has the tenacity, vision, salesmanship and network to led a junior, and it's a combination of characteristics that's hard to find. I think the Red Eagle effect will dog Libero to some extent, but as several friends reminded me as I thought through this situation, bull markets make investors forget past mistakes. In fact, most of mining's most famous and successful executives have at least one failure on their resumes that gets forgotten amid the successes. So if Libero does hit into something exciting at Big Red, Slater's failings will fade into the background.

Slater's success raising capital for Libero to date shows that many have already decided to give him another chance. Libero has quietly raised money and acquired projects for several years now. The company also attracted some good people: Rob Pease, the geologist who founded and led Terrane Metals for years until it was acquired by Thompson Creek Metals Co. Inc., and who managed the process by which New Gold Inc. (NGD:TSX; NGD:NYSE.MKT) bought the Blackwater project for $550 million, is on the board. So is Jay Sujir, a well-known Vancouver mining lawyer.

Speaking of people, I should also note that Bill Bennett is on the board of directors. Bennett was the minister of mines in British Columbia for 16 years and offers truly unparalleled knowledge of government processes and First Nations relations.

Back to the story. Slater and Hathaway have been driving the Libero story forward for the last few years. Together the pair of them own 35% of the stock. B2Gold Corp. (BTG:NYSE; BTO:TSX; B2G:NSX) owns 15%, stock it acquired when Libero bought its Mocoa project. High-net-worth individuals from Slater and Hathaway's networks hold a big chunk of the rest.

And some good new shareholders are coming in with the current financing. I can't name names but some well-respected geologist executives put money into this raise because they're excited about the opportunity at Big Red.

Big Red

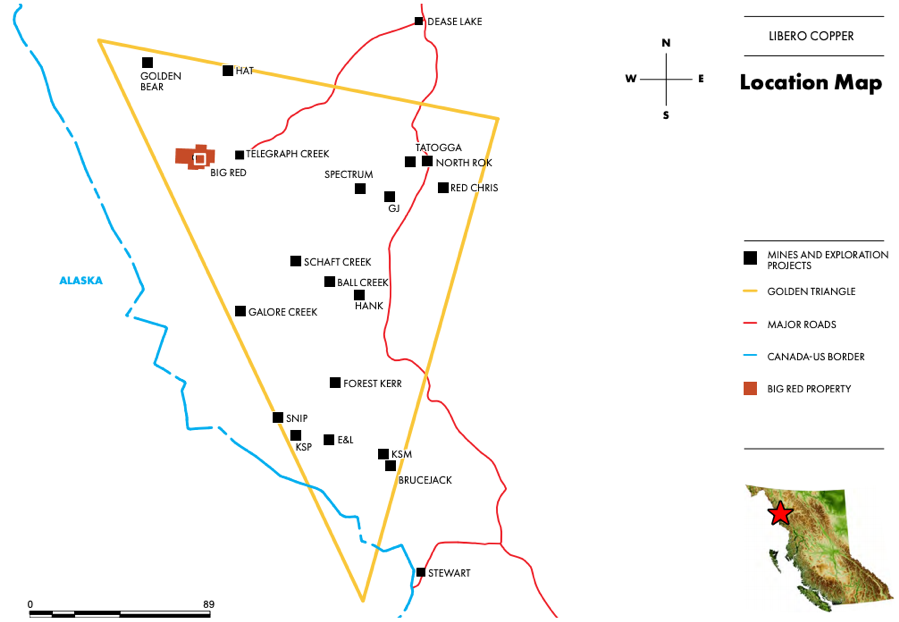

Big Red is a large land package in BC's Golden Triangle. Importantly, the project is road accessible: A paved road reaches within 18 kilometers (18 km) of the property and dirt roads extend onto the claim block.

The Golden Triangle hosts immense copper and gold, from deposits styles ranging from porphyry copper-gold to epithermal gold-silver and volcanogenic massive sulphide (VMS).

At Big Red there is evidence of all three kinds of mineralization, which suggests the presence of a large mineralizing system that has not been eroded.

Big Red is not a new target area. In fact, prospectors first noted evidence of gold and copper over 150 years ago. From the 1960s onward the ground saw scattered exploration but the project, as it stands today, was divided into a bunch of small properties. The combination of divided ownership and scattered work programs meant nothing exciting ever emerged.

The work did reveal some interesting results, though—enough that in 2014 a local geologist started working to consolidate the land. It took him four years but he eventually succeeded, establishing the Big Red project as we now know it.

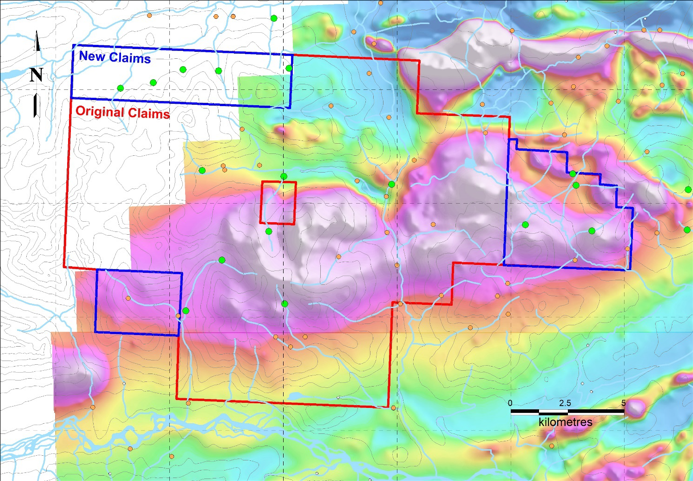

Shortly thereafter Libero optioned the project from him. Libero's first step was to understand what work had, indeed, already been done. The company tracked down 35 old assessment reports (files that project owners have to submit to the government outlining work completed) for each claim within the project and then digitized everything. They also flew a high-res magnetic and radiometric survey to add to the data.

Hathaway obviously liked what he saw at Big Red before seeing all the old data, but even he was impressed when the digitization and compilation effort wrapped up. Old data plus one airborne survey generated multiple porphyry copper-gold and epithermal gold-copper targets—in short, 50 years of exploration outlined a host of strong targets at Big Red but no one had pulled the data together until now.

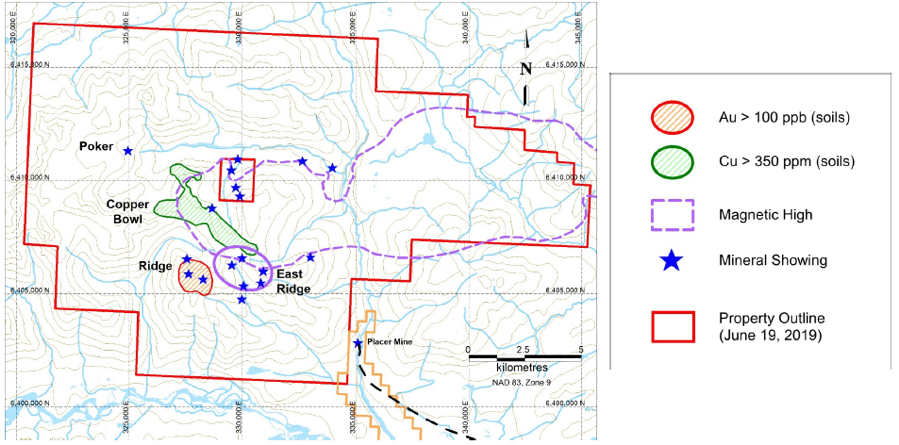

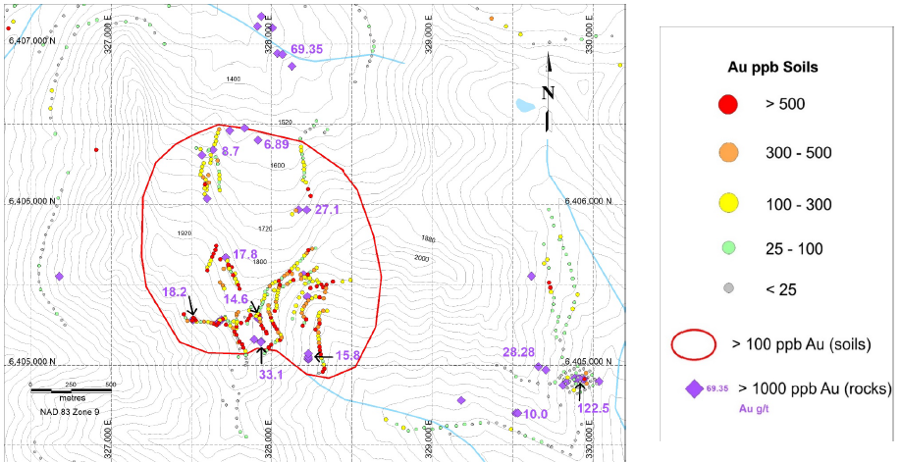

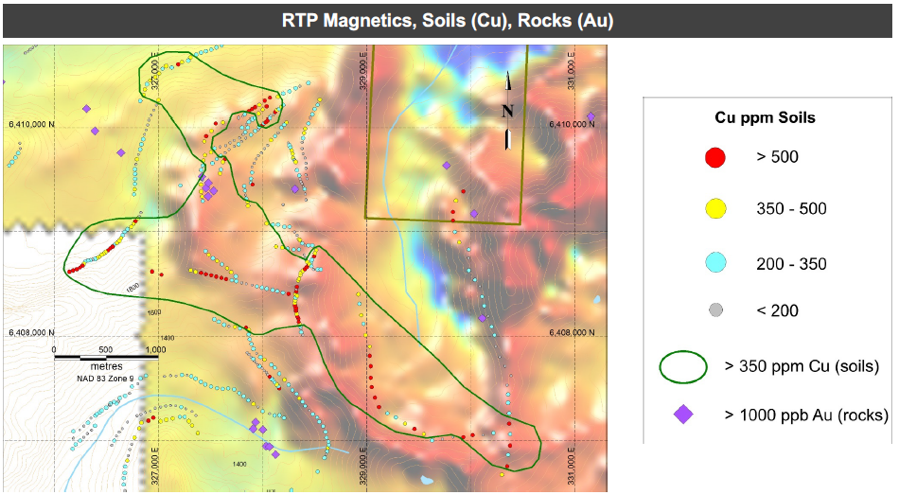

I'll take you through the targets briefly. First off, the project is centered around a clear magnetic high, as shown in warm colors below.

Mag highs can outline intrusions. The best places to find mineralization associated with such intrusions are around the edges. And that is exactly where Big Red offers gold- and copper-in-soil anomalies.

Copper Bowl is a large, strong copper anomaly, one where copper in soil grades better than 500 ppm across more than 3 square kilometers.

Ridge is the standout gold target. If you remember just one thing about Ridge, remember this: The soil anomaly covers more than a square kilometer and averages 1 g/t gold in soil. A good number of soil samples returned better than 5 g/t gold, especially in the southern part of the target area, and the target offered up dozens of rock samples carrying at least 1 g/t gold and up to 69 g/t gold.

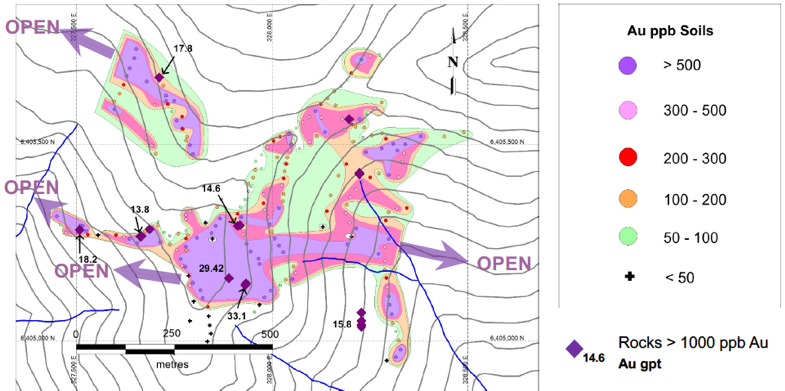

Below is a zoom-in on the southern part of the soil anomaly. Pay attention to the legend: Purple denotes soils averaging better than 5 g/t, pink where they average 3 to 5 g/t, on down. Importantly, 5 g/t in soil is exceptional.

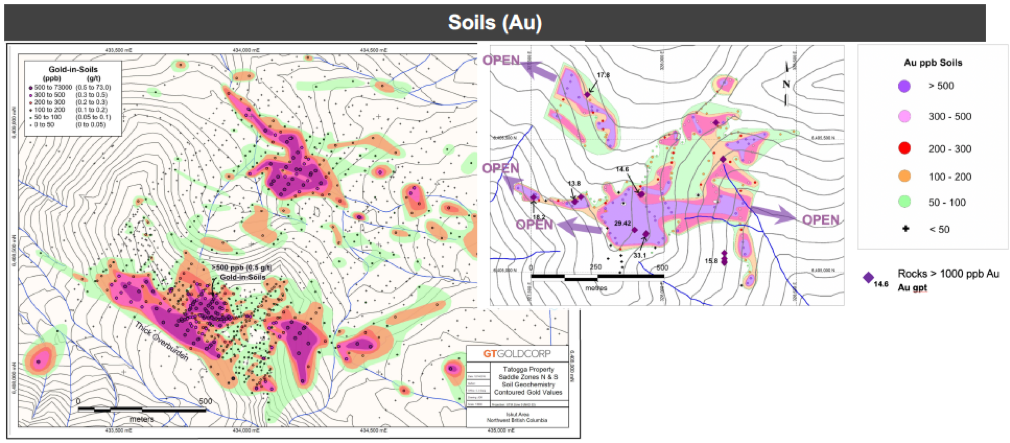

I can recall few soil anomalies that strong; the one that stands out is the soil anomaly above the high-grade discovery at GT Gold Corp.'s (GTT:TSX.V) Tatogga project.

Because of the similarity, Libero put its Ridge soil anomaly beside that from Tatogga, with both on the same scale.

The high-grade discovery at Tatogga sits underneath the lower soil anomaly; the huge porphyry discovery sits under the upper (northern) anomaly. The target at Big Red is very comparable, to both.

Ridge is the first target Libero will test at Big Red. Copper Bowl is the second. The map below shows magnetics and soil sample results. Note that most soil samples were taken along ridgelines, which means they have to represent in situ mineralization.

As at Ridge, the soil anomaly here is bigger—bigger, in fact—and strong, and sits on the margin of that big mag high.

There are never any guarantees with exploration, but these targets look good. It would be nice to have more soil samples as a way of refining drill targets, but Hathaway has decided he has enough information to start drilling.

And start they will: Drills will turn at Ridge in September. Results will be out within perhaps two months.

Copper Projects

I will not spend a lot of time on Libero's two copper assets because focus is clearly on Big Red for the next while. That said, Mocoa and Tomichi offer enough copper and exploration potential to give Libero a valuation backstop.

Mocoa is in southern Colombia, near the Ecuador border. It's a porphyry system that was initially discovered in 1973.

AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE) owned Mocoa for a time, as did B2 Gold. Historic work outlined 636 million inferred tonnes grading 0.33% copper and 0.04% molybdenum.

I know 0.33% copper doesn't sound like a lot, but Libero is playing a game of scale with no fatal flaws. Mocoa already hosts 4.6 billion pounds of copper and is open for expansion, especially at depth, where grades increase. And 0.33% is a workable grade for an open pit mine if metallurgy and infrastructure are straightforward.

Tomichi is in Colorado, 50 km east of Gunnison. Colorado doesn't stand out to most as a copper region but the state actually hosts several very good copper porphyries. Tomichi is already large, with 711 tonnes of inferred resource. The grade is a bit low, at 0.21% copper and 0.04% molybdenum, but again, we're talking about easy metallurgy, access, and infrastructure, al in a region majors would be happy to operate.

The Wrap

Libero currently has 72 million shares outstanding. As I said earlier, Slater, Hathaway and B2 Gold own half of the count, while another quarter sit in tight friendly hands. So while the count isn't small, it's smaller than it looks.

The current financing will add another 30 million shares, roughly. These shares will not be available to trade until the four-month hold expires in December.

The Ridge target at Big Red is a big, strong soil-and-magnetics target in the popular and prolific Golden Triangle that has never before been drilled. Given that financing shares will not be trading and that the pre-financing count is tightly held, it's likely the price will run in the near term as the market anticipates results.

To get articles like this sooner and with actionable investment ideas, subscribe to The Maven Letter.

With almost a decade of junior resource-focused journalism under her belt, Gwen Preston launched Resource Maven. Preston watches the wires, talks to her network and analyzes economics to identify resource news that matters and figure out how to profit. She focuses on early-stage exploration and development stories. Preston has been interviewed on CBC and in Financial Post.

Disclosure:

1) Gwen Preston: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Libero Copper. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Resource Maven disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this interview are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Libero Copper. Within the last six months, an affiliate of Streetwise Reports has disseminated information about the private placement of the following companies mentioned in this article: Libero Copper.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Libero Copper, a company mentioned in this article.

Resource Maven EDITORIAL POLICY AND COPYRIGHT: Companies are selected based solely on merit; fees are not paid. This document is protected by copyright laws and may not be reproduced in any form for other than personal use without prior written consent from the publisher.

Resource Maven DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Resource Maven (Maven) nor its affiliates assume any responsibility to update this information. Maven is not registered as a securities broker-dealer or an investment adviser in any jurisdiction. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Maven cannot and does not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Maven in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Maven accepts no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Maven does not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites. Maven has not reviewed the Internet website of any third party and takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website's users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of or may have participated in the financings of some or all of the companies mentioned in this publication.