It's been eight months since I have delivered an update on Novo Resources Corp. (NVO:TSX.V; NSRPF:OTCQX). While Novo has put out a fair number of press releases since then I have been waiting for some solid red meat. They have just put out red meat that should satisfy the Novo faithful and really irritate all the naysayers who live to rain on Novo's parade.

In the piece I wrote in December of 2018 I covered the important numbers about alluvial production so any nitpickers should reread the piece. Basically it's really cheap to process alluvial gravel and is always done with heavy equipment so is measured in cubic meters or cubic yards because that's how heavy equipment is used. A dump truck or front-end loader will hold X meters or yards. All you are doing is moving dirt.

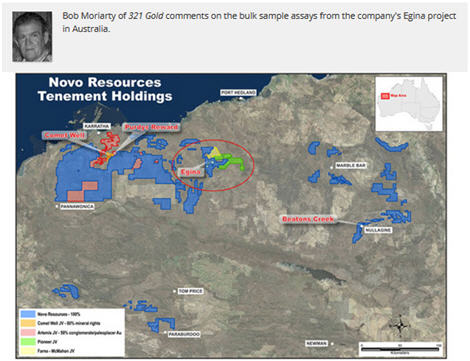

I was at Egina last year. I made it clear that what I saw was exceptional. Novo owns two mining licenses that cover 5 square km apiece.

Due to very sensitive issues about native title and control, you simply cannot just wander about the desert taking samples. Illegal prospectors will often sneak onto the reserve at night with metal detectors to snipe. If the locals catch them in the act they will give them a thumping, destroy their equipment and throw them off the property. So Novo has been highly limited in what they can and can't do before coming to an arrangement with the native people.

I think I did a good job of explaining the theory last year but now that Novo has delivered solid numbers I can talk about the practice.

Novo used GPR (Ground Penetrating Radar) to identify a swale or depression in the subsurface terrain on one of their two concessions. In theory that is where you should find the richest gold.

As I write the bid on gold is $1498.70 making a gram of pure gold worth $48.19 USD. In their initial tests, Novo found 292.38 grams of 89% to 95% purity gold nuggets out of 281.9 cubic meters of gravel from surface. Please note that these were gold nuggets of 1 mm or larger. There will be some small gold but Novo has not determined the quantity yet.

If you use a nice conservative 90% purity for the gold and an even 1 g/m at $48 a gram, I come up with a total value of $43.20 per cubic meter. You can add the small gold later but I would be astonished if it were over 5% of the total weight so I will ignore. I love being conservative so I will say in that swale the processed gravel was $40 a cubic meter in gold values.

I could process that for $8 a cubic meter, Keith Barron could process it for $10.70 a cubic meter in Montana but let's be really conservative and say you aren't very good at this and it costs you $20 a cubic meter because you are so ham fisted.

A 50% margin on an alluvial project would be a home run out of the park in any alluvial project on earth and half of Mars.

Those who want to whine about everything Novo does will sputter and explain that just because this swale is wildly profitable, not all of the 1,000 square km that Novo owns around Egina would be as profitable. But those people couldn't get permits to strip mine 1,000 square km in a lifetime of lifetimes.

Just because something is true doesn't mean it is meaningful. I'm wearing blue socks and there is no elephant in the room. Both statements happen to be perfectly true but are perfectly meaningless.

But by using the GPR to narrow down the most attractive and prospective 5% Novo or whoever buys Novo will be producing gold at a good margin for twenty years past when I am pushing daisies just with their current land position. And who knows, there might be another 25% of that land position that is still economic below $40 a meter.

I've been a Novo shareholder since before they were Novo. I've participated in almost every private placement and clearly I am biased. Novo is an advertiser so do your own due diligence.

Novo Resources

NVO-V $2.52 (Aug 22, 2019)

NSRPF $1.90 OTCQX 178.8 million shares

Novo Resources website.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Novo Resources. Novo Resources is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.