We are coming into the traditional season for intense silver rallies. With silver recently making a really important breakout, things are setting up for a memorable period in the silver markets.

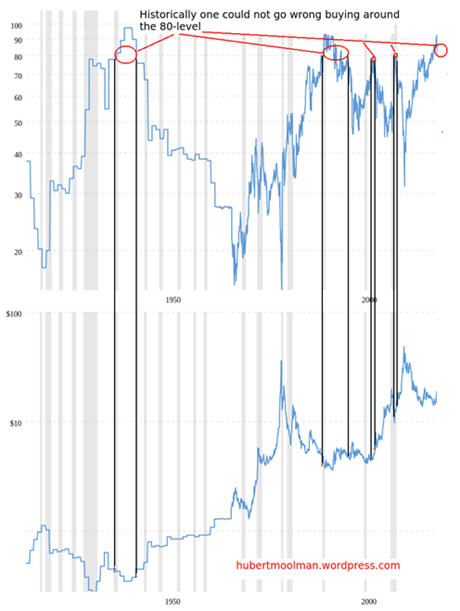

Furthermore, the decision to buy silver for the long-term is basically a no-brainer given that the Gold/Silver ratio is still around 80. Below, is a long-term Gold/Silver ratio chart as well as a Silver chart (from macrotrends.net), to illustrate this:

On the Gold/Silver ratio chart, I have indicated the areas (in red) where the ratio was at around 80 or higher. As you can see, when referring to the aligned silver chart, it was basically always a good time to buy for the long-term.

With the ratio still being around 80, it is still currently a great time to load up for the coming years.

Here is a chart I featured months ago that shows why the recent breakout is so important.

On the chart, the first phase of the silver bull market was from 1993 to the end of 2001, and the second phase is potentially from 2001 to the end of 2015.

It appears that there is a similarity between the two phases. I have drawn some lines, and marked some patterns to show how they could be similar.

The first phase is marked 1 to 3, in black, and the second 1 to 3, in blue. Both of the phases appear to occur within in a broadening channel, from which they both broke down, after point 2.

After breaking down from the channel there was a consolidation that ended at a new point 1. The first phase managed to get back inside the broadening channel again. If the current pattern follows and do the same, then we will see some high silver prices.

Now price appears to be after the start of a new point 1, and a breakout from the wedge has been confirmed.

If the comparison holds true, then we could see a massive rally over the coming months that would likely make new all-time highs.

For more of this kind of analysis, you are welcome to subscribe to my

premium service. I have also recently completed a

Silver Fractal Analysis Report as well as a

Gold Fractal Analysis Report.