First Cobalt Corp. (FCC:TSX.V; FTSSF:OTCQX; FCC:ASX) announced it has entered into a US$5 million loan facility with Glencore International Plc (GLEN:LSE) to complete advanced engineering, metallurgical testing, field work and permitting associated with the recommissioning and expansion of its 100%-owned cobalt refinery in Canada. The loan facility bears interest of LIBOR + 5%, and has a two-year term, extendable by one year, at the company's election.

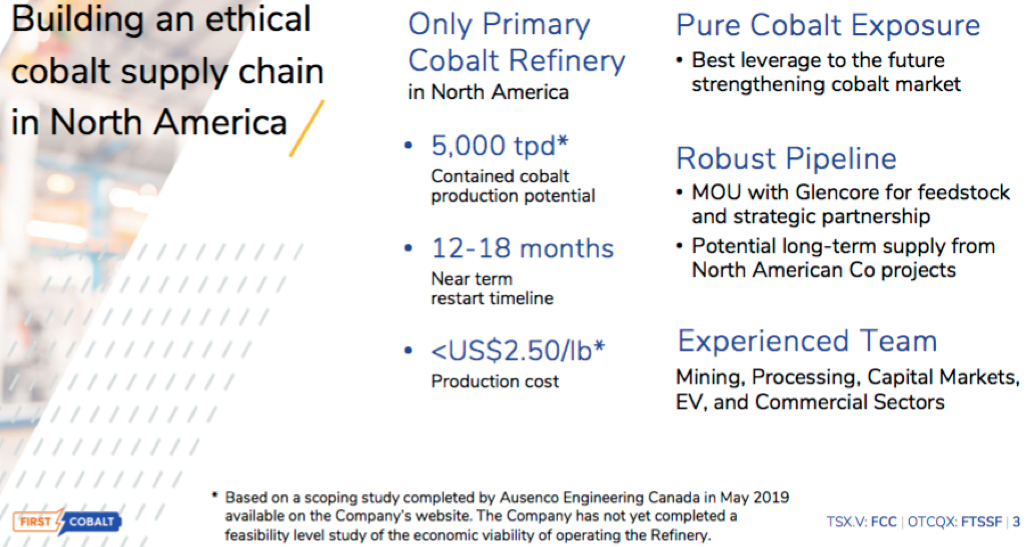

The First Cobalt refinery is a hydrometallurgical facility in the Canadian Cobalt Camp of Ontario, Canada, roughly 600 km from the U.S. border. It's the only permitted primary cobalt (Co) refinery in North America. It can produce either a Co sulfate for lithium-ion batteries or a Co metal for the aerospace industry. This is a long-lasting, very valuable, hard asset with decades of use ahead of it.

Upon completion of a positive definitive feasibility study (DFS) for a 55 tonnes per day (tpd) facility, and subject to other terms and conditions, Glencore has agreed to advance an additional $40 million (all figures in US$ unless indicated otherwise) in three stages. However, not all of the $45 million in funding will necessarily be needed. A 30% contingency is built into that figure.

On Sept. 4 the company announced it has awarded key contracts to complete a DFS on a 55-tpd operation. Fieldwork commences this month, with expected delivery of a DFS in Q1 2020. Ausenco is leading the effort, supported by SGS for advanced metallurgical testwork, Knight Piésold Consulting for tailings studies and Story Environmental and Geomatics for environmental services and permitting.

Glencore will provide technical support through its affiliate, Expert Process Solutions. Deliverables from these esteemed groups include a NI-43-101-compliant DFS on a 55-tpd refinery restart and a prefeasibility study (PFS) on a 12-tpd interim operating scenario. [Note: A conference call will be held Sept. 9; details to follow.]

Three-phased approach to get refinery up to 55-tpd (5,020 tonnes/year Co sulfate)

In phase one, the initial loan amount will be used to assess the suitability of the refinery to treat Glencore-sourced material under a long-term supply agreement to produce Co sulfate for the North American electric vehicle (EV) market.

Also in phase one is the completion of advanced engineering and estimating, metallurgical testing, fieldwork and permitting—including delivery of a PFS for a 12-tpd recommissioning next year, and a DFS for an expansion to 55 tpd.

Phase two entails the actual recommissioning of the refinery by late next year, under existing permits, at a feed rate of 12 tpd. This will allow the parties to prequalify products with customers in the EV supply chain.

Phase three contemplates an expansion from 12 tpd to 55 tpd in 2021, using existing buildings and infrastructure.

Ausenco scoping study shows attractive refinery economics

An Ausenco conceptual study for the First Cobalt Refinery Restart Project (available on the company's website) estimated that using hydroxide feed grading 30% Co, at 55-tpd throughput, the refinery could produce 5,020 tonnes/year (11.067 million pounds) of cobalt sulfate.

That would be a meaningful proportion of total finished (refined) Co coming from friendly, reliable, safe countries. It's estimated that 5,020 tonnes/year would be about 5% of global refined Co supply. The refinery would be a globally significant suppler, and even more so in North America, as soon as 2021.

At the current (Sept. 2) InfoMine Co price of $16.10/pound ($16.10/lb), 5,020 tonnes would generate annualized gross revenue of ~$178 million. Importantly, Ausenco recently lowered its operating cost estimate contained in the scoping study by about 30% due to lower reagent costs. Therefore, annual opex at 55 tpd is now expected to be ~$25.4 million.

Cobalt prices up ~35% in past month on Glencore mine closure news

Each $1/lb change in the Co price amounts to nearly CA$15 million in annualized gross revenue at the refinery level. According to InfoMine, the Co price is up $4.30 to $16.10/lb from its 52-week low of $11.80/lb. That increase would equate to ~$47.7 million in incremental revenue. Yet, despite the Co price being up ~37%, First Cobalt's share price is up just 12.5% from its low of CA$0.12 to CA$0.135.

As the refinery project continues to be de-risked, there could be a nice move upward in the share price. First Cobalt could be one of the best remaining pure-play bets on Co prices, and certainly one of the very best, if not the best, North American junior.

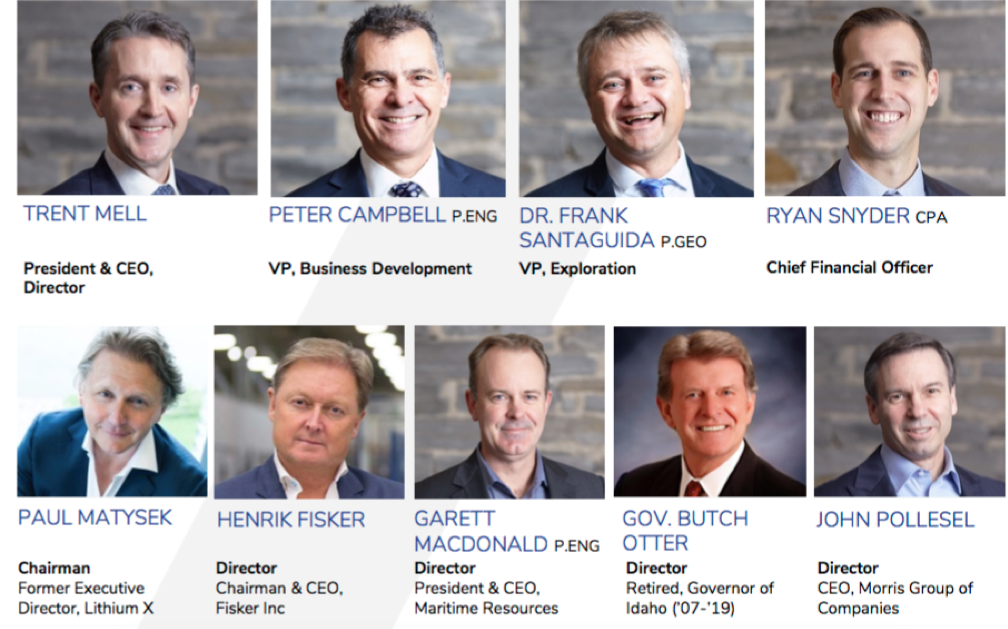

Trent Mell, First Cobalt's president and CEO, commented, "We are delighted to be working with Glencore to bring a domestic supply of battery-grade Cobalt to the North American market. Subject to results over the next six months, first production is targeted for late 2020, followed by the commissioning of an expanded 55-tpd facility in 2021. Cobalt prices have increased considerably over the past several weeks and the outlook for the EV market remains exceptionally strong."

Experts like Benchmark Mineral Intelligence are calling for significant increases in demand for cobalt, lithium and graphite in the early 2020s, when hundreds of new EV models hit the road.

I asked senior cobalt analyst Caspar Rawles of Benchmark for his view on the news of Glencore shutting the Mutanda mine. Mutanda is the world's largest cobalt/copper mine, accounting for approx. 20% of cobalt supply.

"The Glencore announcement is significant, the reaction has seen prices rise by ~35% for some cobalt products. This increase might sound significant, but it has just seen prices pushed back in to the historical range in most cases. Whilst the market has reacted, there is no change to supply in the near term, as the closure doesn't take place until year-end," Rawles said. "This closure, assuming it happens, would pull Benchmark's forecasted supply deficit forward by 12–18 months. That, in turn, could lead to higher pricing sooner than many were expecting. However, the exact impact won't be known until we see how other producers in the industry reacts to the shutdown."

Low cobalt prices are the cure to low cobalt prices

In a recent article, Eurasian Resources Group's (ERG) senior management stated that at the current cobalt price, 20% to 30% of global mine supply is at risk of disappearing next year. They say that in the longer-term, US$20+/lb is required to attract much-needed capital to the industry.

On top of the huge Glencore/Mutanda mine shutdown news, in mid-August, Reuters reported that China's largest cobalt refiner, Zhejiang Huayou Cobalt's overseas unit, is pulling out of a deal to invest in a cobalt mine in the Democratic Republic of Congo (DRC). In July, Mining.Com reported that production of hand-dug cobalt (artisanal mining) in the DRC is falling due to the plunge in Co prices.

Thousands of artisanal miners are said to be switching their focus to copper. In addition to much lower cobalt prices, mining cost inflation (such as sulfuric acid) and higher taxes in the DRC are kicking in to squeeze profits.

Payback of Glencore debt over six years from 2022?

There will be some sort of revenue or profit split between First Cobalt and Glencore, the terms of which are still being negotiated. In a tolling scenario I estimate debt advanced to the company could be paid off in six years, 2022–2027 ($7.5 million/year).

That assumes First Cobalt retains 25% of the economics until the debt is repaid. I assume a $20/lb Co price, cobalt sulfate production of 11.067 million pounds/year, $25.4 million in operating expenses, 95% recoveries and a 70% payable rate on feedstock costs.

Conclusion

What more can I say? First Cobalt is one of the only companies moving forward in a battery metals market, where investment sentiment is very weak—not just for cobalt, but for lithium, graphite and vanadium as well.

However, unlike so many battery metals peers with capex hurdles in the hundreds of millions or billion dollar+ ranges, First Cobalt is fully funded through commercial production in the fourth quarter of 2020, and maintains 100% ownership of its valuable primary cobalt refinery.

Glencore is not busy de-risking or funding a lot of other junior cobalt companies/assets, but it's strongly backing First Cobalt Corp. on the refinery. That says a lot about the long-term value of this key strategic facility in North America.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about First Cobalt Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of First Cobalt Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares of First Cobalt Corp., and the company was an advertiser on [ER].

While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by the author.