"Destroyers seize gold and leave to its owners a counterfeit pile of paper." —Ayn Rand

Why don't we start things off a tad differently this evening? Let me relate to you all a parable from the Book of Quantitative Easing where all is good and noble in the world of government oversight, the most widely used oxymoron in the history of mankind.

Granny Smith, now in her late nineties, wakes up one morning and finds that her dear husband for nigh-on seventy years has gone on to meet his Maker. But alas, as distraught as one would expect her to be, she is covertly delighted because, well, old Egbert Smith was not exactly the man she married and being forced to change his diaper and his bedsheets each night had grown both tiresome and difficult.

When the lawyer had finished probating the will after eight meetings that could have been just as effective with one, it was learned that Granny was in possession of a sizeable pool of capital, on the order of US$5,000,000. She immediately ordered a meeting with that nice young man from the bank that "smiles at me and always smells good" in an effort to determine what she should do with her money.

You see, for the past fifty years, husband Egbert handled the family finances because, well, women were not expected to understand money. But prior to marriage, Granny had a job in a bank and was quite proficient in helping "customers" (as opposed to "clients") understand how the bank was trying to screw them. She understood fully the "Power of Compounding" long before some wannabe-evangelist-cum-motivational-speaker windbag decided to sell a million copies of his latest (plagiarized) book. However, I digress. . .

She enters the mahogany-walled offices of the bank CEO with her handbag full of post-it-note reminders of just how he is going to try to make her $5,000,000 work for him instead of her and sits down in the largest, plushest, most expensive, high-backed chair in banker history.

"Five mil is a lot of money" is the opening salvo of this former drug-dealer-car-salesman-turned-bank-CEO as he shows her a chart of the five top banks' CD (certificate of deposit) rates. "The range for a 5-year CD is minus 0.23 to minus 0.29 with the our bank, highlighted in yellow. Remember, we value your money," he says and then asks his "administrative assistant" to fetch them some tea and cookies. "And I want you to know that safety is paramount."

Granny Smith looks at Mr. Bank CEO and says, "Forgive me, Mr. Morgan, but I am an old lady trying to understand your business so please describe to me what is meant by the minus sign before those figures."

"Well, Mrs. Smith, it's pretty simple. We protect your money from thieves and corporate raiders and the government so that you can live the rest of your life stress-free."

Granny looks up at him quizzically from a half-knitted tea cozy and two very intimidating needles as she says, "Well thank you, but what I meant to ask was what return I will have on my money if I deposit it at your bank in your government-insured Certificate of Deposit?"

At this point the banker starts fiddling with his tie and perspiring heavily as he goes on for another fifteen minutes about "global uncertainty" and "government guarantees" and "bank safety," and at the exact moment he decides to launch into his "final close," to get $5,000,000 cash into his bank, which desperately needs to shore up the $6 billion in bad car loans, little Granny Smith interrupts him with this, the most innocent of all questions: "Mr. CEO, if I give you and your wonderful bank all of my five million dollars, how much will I get back after five years?"

Now choking on the ramifications of a truthfully answered question, Mr. Bank CEO pivots into the "You-don't seem-to-understand" defensive formation, followed by yet another twenty minutes of diatribe.

At this point of the early evening, Granny has been transformed from an "innocent and quite defenseless elderly lady" to "totally pissed off and ready-to-rumble granny-goon," and decides to ask the banker the ultimate question. Holding a Hewlett Packard financial calculator in her left hand while pointing one of her knitting needles at his throat with her right, she snarls "How much freakin' money do I get back on September 12, 2024, if I give you my $5 million today?"

The banker stands up; he straightens his tie; he wipes his brow; and he says to the now openly hostile granny, "$4,290,435, my dear, but with the full safety and security of our bank."

Granny: "So, let me get this straight. I give you five million dollars today and five years from now, when I’m 103, you give me back less than i started with???"

The banker CEO smiles bravely and says, "Welcome to the New World Order, Mrs. Smith."

She grabs her bag, rising quickly from the high-backed chair, and says with the utmost of decorum, "Welcome to the World of f-you, Mr. Banker." And leaves the building.

And so ends the first parable.

Why, pray tell, would anyone in their right mind, let alone a fiduciary entrusted with the prudent stewardship of client capital, ever buy a financial instrument from a high-risk institution (remember subprime?) that guarantees a negative yield to maturity? Now, I don't pretend to be a balance sheet genius, nor do I profess to understand all the financial engineering that is practiced these days but it seems to me there is a checklist of possible reasons. Here are but a few:

- You have borrowed money from the financial institution and they demand you put up collateral in the form of a bond yielding negative returns. In other words, they layer a second level of "fees" on you, jacking up your effective cost of borrowing to inflated levels;

- Your financial institution uses government securities as a reserve requirement in order to soften the interest expense to the government. Since the government regulates your financial institution, they are forced to play ball and the added inconvenience is passed along to the customer,

- You are a professional money manager that sees rates going from –1% to –2%, thus opening up a potential capital gain in the price of the bond. As there is an inverse relationship between yield and price, declining yields are accompanied with rising price, hence the rationale for playing the "Greater Fool" game. The early idiot sells the useless bond to a bigger idiot and banks the gain;

And finally,

- You were walking to work this morning and were hit on the head by a falling quote machine thrown by an incensed gold trader and were senseless when you made the decision to buy a bond that ensures that you will lose money.

I am sure there are many, many more reasons someone buys a negative-yielding financial instrument, and reasons that are quite possibly more sophisticated than the ones listed above. The point I make is that when you really think about the symptoms of a collapsing global banking system, one needs look no further than the 65% of all global bonds that are delivering a negative yield.

Strong economies are found in regions and countries that are sporting strong balance sheets, just as strong companies are able to cover interest costs from existing cash flow with ease. After several decades of mercantilist behavior fully supported by governments across the globe, with the exception of those countries (Russia, China, Cuba, Zimbabwe, and now Venezuela) that attempted to function under socialist/communist systems of government, we have now arrived at the ultimate tipping point, where government spending now not just exceeds, but dwarfs, tax receipts.

In the case of China, where the shadow banking system cloaks much of their toxic debt, they do not have the additional burden of entitlements, which are the Achilles heel of the American government, military, and banking system. Whenever I look around and try to find a country living within its means, I am hard-pressed to find one. Maybe the Sultan of Brunei could offer lessons as his country sports the lowest debt-to-GDP (gross domestic product) ratio on the list, and while Japan is the worst offender, their total debt at $9 trillion pales in comparison to United States' $19 trillion debt load. What the U.S. dollar bulls fail to take into consideration is that the entitlements of Medicare, Medicaid and Social Security have to be added to that figure, and the reason they don't is that they can't figure out the numbers.

Falling into the realization category of The Emperor's New Clothes, I contend that we are today at the precipice of a massive drop in global living standards brought on by the final reconciliation of debt. Individual citizens who take advantage of generous lending practices and pile on layer after layer of debt always encounter that point in time where bankruptcy arrives first slowly, then suddenly (thanks to Ernest Hemingway), because cash flow from earnings or dividends and interest falls disastrously short of cash outflow.

At that point, assets must be sold to reduce debt, and while individual citizens can sell things like homes or automobiles or cottages, governments can only sell land. And as any politician knows (think the Greek Islands), the mere mention of carving off a piece of Hawaii or Vancouver Island to pay down someone else's obligation is certain career suicide. Hence, and with good reason, governments are moving—no racing—to get the trillions upon trillions in toxic bonds to a negative yielding setup, because just as interest expense is a charge upon the government income statement, interest earned (by negative yielding bonds) is a credit. In this manner, there suddenly exists an accounting function whereby debt becomes an asset, and in this manner, the deadbeat global central banks and criminally compromised treasury departments are able to prolong the largest Ponzi scheme in history.

I further contend that the public is coming to the realization that the smartest people in the room are rarely politicians and never central bankers. However, the best communicators in the room from a political perspective are those who can speak to the masses in a language and style foreign to most educated people (think Donald Trump). After fifty or so years of movie star orators like Ronald Reagan, Bill Clinton and Barack Obama, public perception within the lunch-bucket crowd has now swayed away from "slick" and is gravitating to "blunt" with factual accuracy in the message a mere bonus.

I refer to this growing malaise of disenchantment and unrest as being rooted in one word—mistrust. That mistrust is going to manifest itself within large pools of investible capital fleeing the 10-year safety-net investment strategy, where every 10% drop is met with Fed intervention and jawboning, winding up in alternative investments such as gold and silver. We have already witnessed the impact of the Millennials and GenY-ers on cryptocurrency deals in 2013–2017 and then cannabis deals from 2013–2019. The moves in those two sectors were mind-blowing because, as a generation, with thanks to the wonderment of social media, their access to timely information allows them to move in swarms, not unlike bee colonies, chasing deals in mob-like fashion while exiting with the same virulence.

This impulsiveness is the reason we are getting such wild swings in everything, and no better example of that than in the recent June–September advance in silver from $14.50 in late May to $19.75 on Sept. 4. It took three months for silver to get through $17/ounce, but only three more weeks to peak at $19.75, as the last $2.75 was a wholly new breed of investor arriving into the precious metals markets. Having never been laid out by the bullion bank traders before, they were like sheep being sent to the corral, and just as quickly as they inhaled every share of GDX and GDXJ above $30 and $42 respectively, bludgeoning their way in, today they are all bludgeoning their way out. Same drill over at the Crimex; late longs in silver and gold are being beaten like rented mules.

I sounded the alarm back in June, when gold first attempted to surmount the five-year resistance at $1,350–1,375 and while I stand behind the reasoning, I was overly cautious and exited the GLD call options, NUGT, and JNUG way early. I kept 100% positions in the GGMA portfolio in physical gold and silver and held on (for dear life) as the GDX and GDXJ positions screamed ahead until late August, when I sold 50% positions in the $30 and $43 range (GDX and GDXJ respectively), with the balance jettisoned on Sept. 4.

Also sold at or near the top was Great Bear Resources Ltd. (GBR:TSX.V; GTBDF:OTC) (at $9.02) for a 292% profit from Jan. 2. So, between the leveraged and non-leveraged trades, the GGMA portfolio is ahead 163% for the year and is sitting on a 53% cash position, looking for a reentry point to the unleveraged miner ETFs as a starter, followed by the leveraged ones (including GLD and SLV calls) if and when we get to a deeply oversold position.

Now, I’ve had a number of people message me with congratulatory salutations on some of the trades but make no mistake about it: I am terrified to be without positions in the GDX and GDXJ, or, as they say, "flat and nervous." In fact, I feel more anxiety being underinvested and cashed up than I did when I was fully invested and down 15%.

On that note, let me clarify. We are finally in the throes of angst that accompany all bull markets in their early stages. My favorite is silver for all of the reasons you have been reading for the past forty-six months, since I opined in December 2015 that we had just ended the 2011–2015 bear market and were about to embark on a brand new bull, one that would (and will) change fortunes and lifestyles for all on board.

That opinion has not changed. In fact, for reasons well documented in this publication and others, conditions are ripe for a hyperinflationary conflagration that will, based upon the sheer magnitude of scurrilous counterfeiting of sovereign currencies around the world, make 1921 Weimar Germany look like a tea party. There is only one sanctuary for savings in a world of monetary madness, and that sanctuary absolutely must reside outside of the banking system, because the tattered tentacles of Deutsche Bank are intertwined with the shadow banks in Shanghai, which are, in turn, part of a global labyrinth of debt and collusion and intervention and fraud.

I will repeat analogy from years past. When you visit a pig farm, you see brown pigs and white pigs and pink pigs and even mottled pigs, but at day's end and the bell is sounded, every pig in the sty sullies up to the feeding trough regardless of color. Similarly, banks can be from the United States or the UK or China or Brussels; they all depend on "fiat" (decree or mandate) and when this growing mistrust of the system finally embodies itself in the daily decisions of investors around the world, all banks will topple, regardless of their locale. At that point, and fear explodes, there will be simply not enough gold and silver to satiate demand. Where infinite and urgent demand meets limited and tightly held supply, pricing chaos ensues. That is what I expect, and that is why I am "flat and nervous."

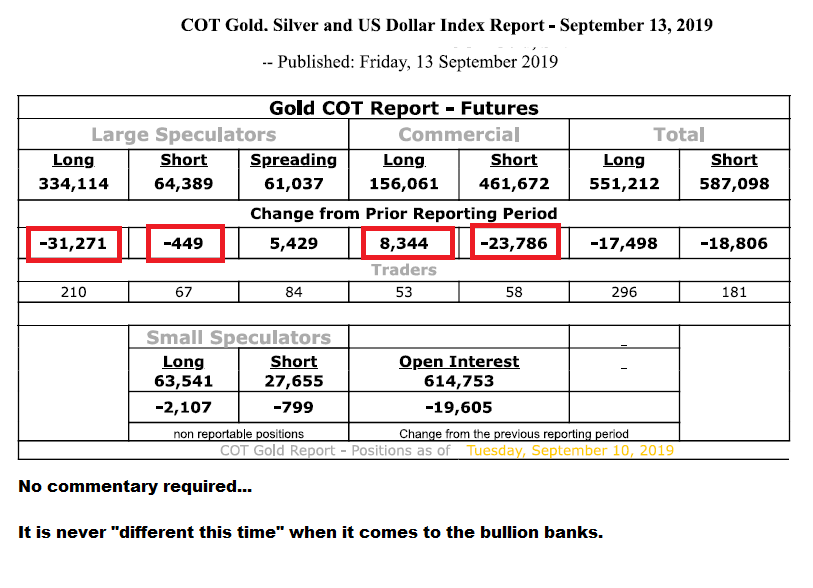

I close out the week by reminding you all that despite what you are being fed about a "new paradigm" and that "it's different this time," take one look at the COT Report and realize that the 33,130 contracts covered during the last COT reporting period probably involved a $30–40 per ounce clip that represents 100 ounces per contract or $100-125 million in profits taken by bullion banks from the pockets of investors and speculators. At the top in very early September, I counted no fewer than fifty articles in the blogosphere that finger-wagged their conviction that the forces of good had finally and convincingly defeated the "cartel" and it was now "safe" to ignore the bullion banks and go "all in."

It is late in the Friday trading session, and with the weakness in today's session in silver, it has now corrected back to a level where, while not egregiously oversold yet, it represents a decent reentry with a small amount of capital into the SLV December $18 calls at $0.42 for a trade to $2.50 by expiry. I will probably be bidding for 25% positions in the GDX at $26.50 and GDXJ at $36 on Monday morning, after which I will overmedicate myself and take a bold swipe at the diabolical duo of NUGT and JNUG. Edging one's toe into the waters has always served me well because averaging up is a far wiser strategy than averaging down. (Just ask my bank manager, accountant, psychiatrist and pharmacist).

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.