Our researcher team believes a massive global market price reversion/correction may be setting up and may only be a few days or weeks away from initiating. Our team of dedicated researchers and market analysts have been studying the markets, precious metals, and most recently the topping formation in the ES (S&P 500 Index). We believe the current price pattern formation is leading into a price correction/reversion event that could push the US major indexed lower by at least 12 to 15%.

Historically, these types of price reversion events are typically considered “price exploration”. Over time, investors push a pricing/valuation bias into the markets because of expectations and perceptions related to future market valuations and outcomes. What happens when these current valuation levels and future expectations shift perspective from optimistic to potentially overvalued is that a price reversion event takes place. This happens when investors shift focus, determine value exists at a different price level and abandon previous valuation expectations.

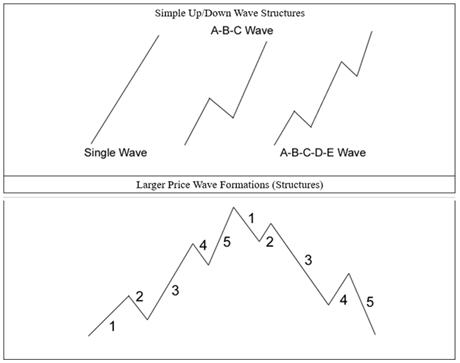

The rotation in price is actually a very healthy process that must take place from time to time. The structure of price waves (for example Elliot Wave, Fibonacci, Japanese Candlestick, Gann and other price theories) are based on this process of price rising to overbought levels, then retracing to oversold levels – again and again as price trends higher or lower. This is the process of “price exploration” - just as we are describing. In order for price to trend higher or lower over time, price must move in the wave like pattern to identify true value (retracement/reversion) and extended value (a rally or selloff) in a type of wave formation.

Here are examples of the typical price wave formations within an extended or intermediate-term price trend, but before you continue quickly

opt-in to our Free Market Trend Newsletter.

These price formations/structure are inherent in all price activity/movement in every financial instrument traded throughout the world. They are the underlying structural foundation of all price activity and the basis of Elliot Wave, Fibonacci, Japanese Candlestick and many other price theories.

Weekly Custom Volatility index

Our Custom Volatility index is highlighting a very interesting pattern/setup currently that suggests a moderate price reversion may take place over the next few days/weeks. We've highlighted these patterns on the chart below illustrating how our Custom Volatility index helps to identify these types of patterns. They form after a moderately deep price decline, the first downside (RED) line shown in these examples, and are followed by a moderate price recovery. Then, a deeper price decline sets up only 3 to 5 weeks after the initial price bottom resulting in what can sometimes be a very broad market decline.

For example, the decline in February 2018 resulted in a very moderate second price decline compared to the initial selloff. The October 2018 price decline resulted in a similar pattern on our Custom Volatility index, but the second price decline was much deeper and more violent than the example in February 2018. This is the type of price correction that we are expecting to see happen within the next 2 to 4 weeks.

The current price rotation on our Custom Volatility index mirrors the previous rotations almost perfectly and the new breakdown event should only be 3 to 10+ days away from starting. The big question is “will this be a moderate price reversion event or a more violent price reversion event like we saw in November/December 2018?”

Weekly Custom Smart Cash Index

Weekly Custom Smart Cash Index

Our Custom Smart Cash Index is suggesting weakness is dominating the global markets right now. We would expect to see our Smart Cash index rise as investor expectations rally and as global stock markets rally. Yet, this index has been steadily moving lower as weakness dominates investor sentiment. We believe we may begin a new price reversion event (a price breakdown) on some news event or economic that could push the global stock market dramatically lower – possibly my 12%+ or more. Our earlier, August 19

th breakdown predictions, suggested a downside breakdown could result in a 16% to 24% market correction – these levels are still very valid.

Weekly Dow Jones Index

Weekly Dow Jones Index

The Dow Jones Index is setting up a DUAL-FLAG (pennant) formation that has kept our researchers entranced over the past few months. This very broad market patter strongly suggests a very violent and explosive price move is just days or weeks away. We've highlighted the “Flag Apex Range” on this chart to show you where and when we expect this explosive move to begin. Investors need to be very aware that these flag/pennant formations are extremely close to reaching the breakout/breakdown APEX and all of our other research tools are suggesting a move lower is the highest probability outcome given the current markets setup.

Concluding Thoughts:

Concluding Thoughts:

As we've stated earlier, the global markets are very much “waiting on news events”. It appears fundamentals and earnings are driving only 30~40% of the market movement recently. NEWS is driving 60% to 70% of the global markets price rotation. Geopolitical news, commodity supply news, war or any other aggression news is also very important in today's world. Pay attention to the news items that hit the markets as the global central banks attempt to navigate the undulating global market environment.

Our advice for skilled technical traders would be to protect everything from risks and prepare for some very extreme volatility over the next 3 to 15+ days. We believe the APEX even is about to happen and it could become a massive price reversion event.

I urge you visit my

Wealth Building Newsletter and if you like what I offer, join me with the 1 or 2-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis. Join Now and Get a Free 1oz Silver Round or Gold Bar!

I can tell you that huge moves are about to start unfolding not only in metals, or stocks but globally and some of these supercycles are going to last years. This quick and simple to understand guide on trading with technical analysis will allow you to follow the markets closely and trade with it. Never be caught on the wrong side of the market again and suffer big losses. PDF guide:

Technical Trading Mastery Guide

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

Chris Vermeulen

www.TheTechnicalTraders.com

NOTICE: Our free research does not constitute a trade recommendation or solicitation for our readers to take any action regarding this research. It is provided for educational purposes only. Our research team produces these research articles to share information with our followers/readers in an effort to try to keep you well informed. Visit our web site (

www.TheTechnicalTraders.com) to learn how to take advantage of our members-only research and trading signals.