This year marked the 30th anniversary of the Denver Gold Forum (DGF), the world’s most prestigious precious metal equities investment conference. The invitation-only event, held last week, was attended by an incredible seven-eighths of the world’s publicly traded gold and silver companies by production, as well as leading metals and mining executives, money managers, analysts and investors.

Much has changed in the precious metals and mining industry in the past 30 years, as we were all reminded by my longtime friend and mentor Pierre Lassonde. Pierre, as many of you know, is the legendary co-founder, along with Seymour Schulich, of Franco-Nevada, the first publicly-traded gold royalty company. What you may not know is that Pierre is also one of Canada’s most gracious philanthropists and currently serves as the chairman of the Canada Council for the Arts Board of Directors.

According to Pierre, annual global gold demand has exploded in the years since the first DGF was held. Demand grew more than fivefold, from a value of $32 billion in 1989 to $177 billion in 2018.

Today’s central banks are net buyers of gold as they seek to diversify away from the U.S. dollar. But 30 years ago, they were net

sellers. In 1989, banks collectively unwound as much as 432 tonnes from their reserves. Compare that to last year, when they ended up buying some 651.5 tonnes, the

largest such purchase since the Nixon administration, with Russia and China leading the way.

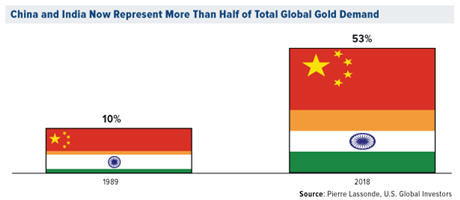

Speaking of China… Pierre pointed out to us that we’ve seen a significant shift in gold demand over the past 30 years, from west to east, as incomes in China and India—or “Chindia”—have risen. In 1989, Chindia’s combined share of global demand for the precious metal was only about 10 percent. Fast forward to today, and it’s 53 percent.

“Don’t forget the Golden Rule,” Pierre said. “He who has the gold makes the rules!”

The Gold Price in 2049 Will Be…

One of the highlights of Pierre’s presentation was his forecast for the price of gold in the next 30 years. After analyzing gold’s historical compound annual growth rate (CAGR) over the past 50 years, ever since President Nixon formally took the U.S. off the gold standard, Pierre says he sees an average price target of $12,500 an ounce by 2049. And under the “right” conditions, it could go as high as $25,000!

“I think gold is in a good place,” Pierre told

Kitco News’ Daniela Cambone on the sidelines of the DGF. “The financial demand is being driven by negative interest rates. Should the U.S. Treasury 30-year bond yield ever, ever go negative, like in Germany and France, God bless, we’re looking at $5,000 gold.”

ESG Investing Goes Mainstream

One of my own observations of how the DGF has changed over the last 30 years is the way in which mining companies pitch their stock to investors. Before, they would jump right into financials, production costs, mining feasibility and the like. Today, however, they begin by discussing topics such as sustainability and environmental impact.

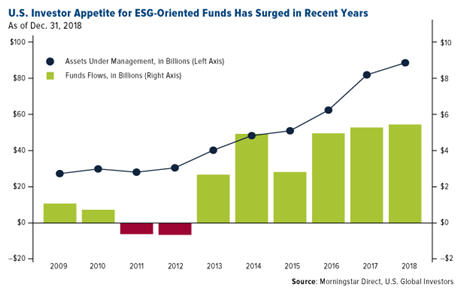

ESG investing stands for environmental, social and governance. This set of criteria has grown in importance among “socially conscious” investors over the past decade, as you can see in the chart below. In the U.S. alone, assets under management (AUM) in ESG-oriented funds and ETFs have more than doubled from approximately $40 billion in 2013 to $90 billion in 2019, according to Morningstar data. In Europe, where institutional investors and money managers must now comply with certain ESG standards, the figure’s likely even higher.

Gold’s “Green Credentials” May Be Understated: RBC

Gold’s “Green Credentials” May Be Understated: RBC

The good news is that gold and gold mining look very attractive from an ESG perspective. Gold’s “green credentials,” in fact, may be understated, according to a recent report by the Royal Bank of Canada (RBC). For one, owning physical gold—in coins, bars or jewelry—has absolutely no environmental impact and actually increases a portfolio’s ESG rating.

As for gold mining, the process gives off significantly less greenhouse gasses (GHG) on a per dollar basis relative to some other mined products, including aluminum, steel, coal and zinc. What this means is that gold has a much smaller “carbon footprint” than what some people might think.

Many mining companies are also working to meet some investors’ changing attitudes. IAMGOLD, for instance, is investing heavily in solar infrastructure, and its mine in Burkina Faso is the world’s largest hybrid solar/thermal plant, according to RBC. Newmont Goldcorp is moving forward with its “Smart Mine Initiative,” which uses optimizer software to maximize ore recovery and minimize waste. And Torex Gold has developed what it calls the “Muckahi Mining System,” which alleges to limit surface disruption and reduce the use of fossil fuels underground.

In the same report, RBC says it remains “positive on gold,” writing that the metal’s “deep liquidity, near global acceptance and role as a ‘perceived safe haven’ and ‘store of value’ make it very difficult to displace” as an investment.

Want more on the Denver Gold Forum? Find out why investors are cautiously bullish on the yellow metal by watching my latest video!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2019): IAMGOLD Corp., Newmont Goldcorp Corp., Torex Gold Resources Inc.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC. This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.