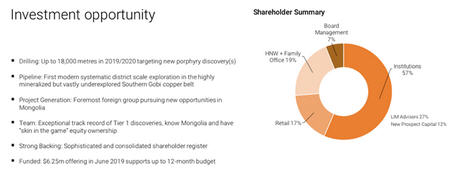

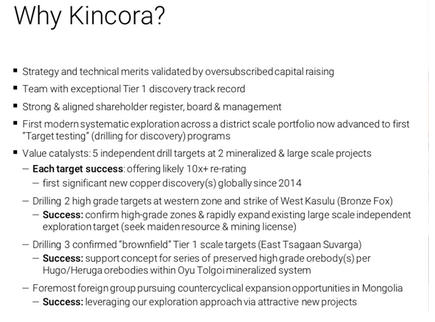

On September 10th Kincora Copper Ltd. (KCC:TSX.V) provided the first drilling update at its 100%-owned copper-gold porphyry projects in the Southern Gobi region of Mongolia. This update comes after an oversubscribed $6.25 million equity raising in late June.

First phase drilling at Bronze Fox consisted of 4,264 meters at two targets. Results for 2,876 meters were announced in the press release. To put this into content, that's ~16% of a total of 18,000 meters planned across multiple projects/prospects in multiple phases.

The market did not like initial results…..

I understand the disappointment, but was the very negative share price reaction warranted for results that although not great, were not horrible? Readers should know that 84% of the estimated meters to be drilled and assayed, on programs that stretch well into 2020, are yet to be reported.

Three drill holes at Bronze Fox's West West Kasulu (WWK) returned extensive lower-grade mineralization and a few higher-grade zones increasing towards the west. Some shareholders exited stage left on these mediocre results, sending the share price 50% lower in subsequent days to $0.07.

Highlights include drill hole F103, which returned 20m @ 0.64% CuEq from 140m; and 120m @ 0.41% CuEq from 700m. While 0.64% CuEq is a decent grade, the 20m width hardly stands out. And, while a 140m intercept is wide, 0.41% CuEq is nothing to write home about.

Partial results from drill hole F107 at WWK showed more of the same, no blockbuster, conclusive, "discovery" type intervals combined with high-grade copper. F107 contained 8m @ 0.25% Cu (1.26% CuEq) from 528m; 10m @ 0.54% CuEq from 630m; 22m @ 0.55% CuEq from 654m; 30m @ 0.50% CuEq from 702m; 10m @ 0.79% CuEq from 828m and 2m @ 0.22% Cu (1.14% CuEq) from 880m.

The market is looking to see intervals boasting 1%+ CuEq, that are much wider than the 2–8 meter higher-grade segments reported in hole F107, and/or tens of meters of 0.5%+ CuEq near-surface.

Gold's not driving this story, but at ~1/6 the economics, it's not trivial

Something worth remembering is that Mining Associates stated about 16% of the in-situ value is represented by gold from the WWK mineralized system, defined before this drill program started, as a total conceptual exploration target of 1.3–1.5 million tonnes of CuEq metal.

Otherwise mediocre drill results showed pockets of fairly strong gold mineralization. For instance, hole F107 was gold-rich. It had an eight meter intercept grading 0.25% Cu that was 1.26% CuEq.

About 16% of overall value is being driven by a gold price that's up 16% year-to-date, and 23% in the past 12 months. In US$, gold is near a 6.5-year high. Perhaps weighing on bullish gold sentiment is a weak copper price.

I remain bullish on copper due to its essential need in multiple new paradigms (green energy, high-tech, the building/rebuilding of global infrastructure, and the electrification of passenger and commercial vehicles).

Kincora's wholly owned East TS project is 10 to 15 km east of the Tsagaan Suvarga porphyry Cu/Au project, under development on the western margin of the Tsagaan Suvarga intrusive complex. TS has had over US$370 million invested in it and is forecast to produce 316,000 tonnes copper per year.

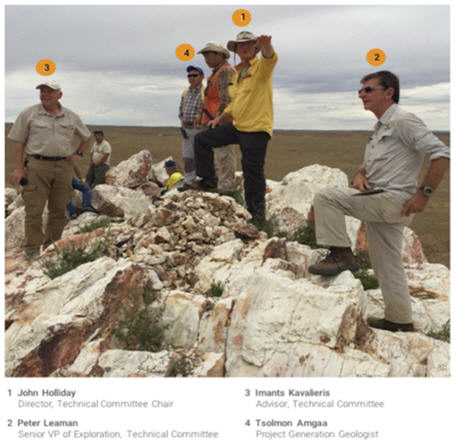

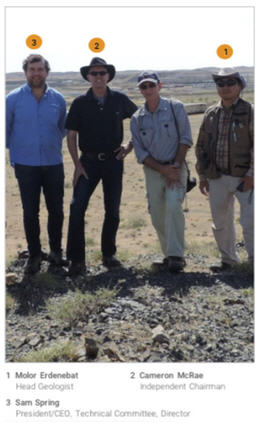

The market has heard a great deal about Kincora from its CEO Sam Spring. I reached out to SVP of Exploration Peter Leaman to learn more about his views on the projects, and new drilling to date.

Peter Epstein: Can you please provide an overview of your background and your role at Kincora?

Peter Leaman: Yes. I have 40 years' exploration experience, 28 with BHP, and I'm still involved with PanAust (since 2010). I've witnessed firsthand multiple copper and gold discoveries, including the Reko Diq deposit. My current role at Kincora is senior vice president of exploration.

I joined Kincora in late 2016, after the company consolidated the dominant position in the Southern Gobi copper-gold belt and regained full access to the Bronze Fox project. I am a member of the technical committee including Chairman John Holliday.

John is a very seasoned and successful explorer. He, CEO Sam Spring and I oversee a hard-working, skilled Mongolian team of geologists. We also have a strong network of technical advisors, including my old colleague Barry de Wet.

I feel I have unfinished business in this belt and in Mongolia. I ran the BHP Falcon JV with Ivanhoe in the 2000's, which was the last district-scale exploration in the region (before Kincora). I was involved, at the development stage, in the BHP review team of Oyu Tolgoi.

In carefully reviewing the data on Kincora's projects, I saw, and continue to see, the potential for globally significant discoveries.

Peter Epstein: Thanks Peter, what are your thoughts on the current Kincora exploration program?

Peter Leaman: Kincora announced initial exploration results from the first phase of drilling at Bronze Fox, and drilling has commenced at our second priority target, a brownfield project, East Tsagaan Suvarga. Multiple-phase programs are underway at both projects. We are undertaking the first modern, systematic exploration and drilling at district scale in the Southern Gobi.

Kincora is implementing a sophisticated exploration approach, testing targets in a way that the majors would. We are testing targets with significant scale potential and improving the odds, as best we can. Importantly, we are using methods that are significantly improved from my time at the Falcon JV period.

That said, we are all very mindful of the fact that, as a junior, the market judges you press release by press release. We are undertaking high-risk, high-reward exploration, and we recognize that we need to get good results with the current 12-month program and budget.

Peter Epstein: How do you see last weeks' exploration update? Were first phase results at Bronze Fox disappointing? Have you drilled the best targets?

Peter Leaman: Bronze Fox is a large, lower-grade system with zones of higher-grade copper and gold. Its size and relative lack of extensive drilling, with complementary geophysics done since the last drill campaign, suggests that a deeper and higher-grade core could be present at depth. An analogy is the Red Chrisdeposit in British Columbia, Canada.

We have better defined the system and greatly improved our understanding of the new geophysics, lithological controls and depth profile of the target zone. Like all shareholders, we wanted to see more high-grade from the initial results. Everyone wants a discovery yesterday—that's what we're looking to do—discover a new high-grade zone.

But, we have to continue in a systematic and unemotional way. Merely adding confidence and tonnage to the system is not our goal, the clear goal is to provide compelling evidence of a high-grade system and core.

In the end, we don't have to drill hundreds of holes ourselves, just tee it up for bigger players to take notice. SolGold in Ecuador is a prime example of a tier 1 discovery that attracted cornerstone investments by BHP and Newcrest.

I will shortly lead the team reviewing these results in the field, with the critical element being the area to the west where there is sufficient scale for a large system. We want to revisit the original concept of a preserved monzodiorite system being an attractive and higher grade target. So far, Phase 1 drilling supports the most prospective part of the system being away from the regional fault to the west.

Phase 1 is providing valuable results and insights to help us better understand the system correlating to the new geophysics, thereby assisting and informing our plans for phase 2. Our focus on Mongolia is to find globally significant new discoveries, not average-to-low-grade results or deposits.

Peter Epstein: Can you provide an update on current activities?

Peter Leaman: Yes, we have drilled ~4,200m of up to 18,000m, with assay results outstanding on a third of the initial ~4,200m at Bronze Fox, and we have moved the rigs to a project that we call East TS—East Tsagaan Suvarga.

We are now testing a number of large-scale targets that may be caused by blind and potentially high-grade porphyry copper mineralization. This is a project that has me very excited given its location, age and scale potential, but it's early stage.

In addition to drilling at East Tsagaan Suvarga we are also continuing with project generation activities, which we believe is very important for any sustainable exploration strategy at our stage.

With that in mind, in the next several weeks I will be reviewing various projects identified by our team that could strategically fit within our exploration portfolio. In the past 18 months, we have walked over 200 projects/targets in the field as part of our due diligence.

Separately, we have just made an application for a new exploration license prospective for gold-rich copper porphyries—large size, good location, previous drilling (limited), but including a >1% copper hit, that was inadequately followed up on. We are looking to leverage the strong team we have in place and our systematic exploration approach.

Peter Epstein: What final message would you like to pass on to investors?

Peter Leaman: I am a significant shareholder in Kincora, as is most of our senior team. We are true believers in new discoveries continuing to be made in Mongolia. I have confidence in the rigorous, systematic exploration approach the company has adopted for undercover exploration.

We have assembled a strong team, particularly for a junior with our tiny enterprise value, and our demonstrated ability to make globally significant discoveries. We have a highly prospective portfolio of targets that are finally getting the meters they deserve, and a project generation strategy that I am confident will yield positive results with continued hard work.

Peter Epstein: Thank you, Peter. I look forward to seeing the results from drilling over the next year!

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Disclosures / disclaimers: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Kincora Copper, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Kincora Copper are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned stock in Kincora Copper, and the Company was an advertiser on [ER].

While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article have a digital marketing program through Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.