Rudi Fronk and Jim Anthony, cofounders of Seabridge Gold, discuss recession, central bank panic and an outrageous gold price.

In our view, gold investors should settle back with some popcorn and enjoy the coming fireworks, which will include the best gold bull market ever, with all the volatility that implies. We see new all-time highs just around the corner. The challenge is to take a position and stay the course. Central banks are about to pay for decades of bad policy and gold will reap the dividends.

Let's be clear about one thing: the global economy is falling into a deep recession but it is NOT due to the U.S.-China trade war, and a resolution of that war, no matter what it is, will not avoid the inevitable. Inverted yield curves and an historic collapse in bond yields are the clearest message that markets can send on the economic outlook. The trade war does not explain why Europe and Japan have been on the brink of recession for more than a year. Nor will central bank easing prevent a recession when monetary conditions are already the loosest in 25 years. Central bank monetary policy is part of the problem, not the solution. In our view, the economy and the stock market are not going to be saved by trade deals and monetary policy.

The problem is the debt…way too much of it, mostly unproductive and at ultra-low interest rates. In a recession, this is extraordinarily precarious, especially the hugely inflated corporate debt. Profits are stagnant, margins are falling, balance sheet cash ratios are severely depleted and liquidity in the corporate bond market is already shockingly poor. Why do you think the three top bond fund managers (DoubleLine, PIMCO and Guggenheim) say they are avoiding corporate debt in their portfolios? The debt is the problem, the reason why economic recovery since the Great Recession has been the weakest on record, the reason why the Fed has failed to ignite the inflation it has so badly wanted and the reason why every central bank on the planet is now aggressively looking to prevent an economic slowdown any way they can.

A recession now means a vicious debt deflation: a collapse in new lending, refusals to roll over debt, an inability of borrowers to pay higher rates, soaring bankruptcies and much higher unemployment. Central banks want anything but that. So we are going to see more negative interest rates, more QE and more central bank monetization of sovereign and corporate debt. In a choice between stable currencies and avoidance of a debt deflation, central banks will weaken their currencies. Therefore, the title of this article: Will we get inflation (as currencies are intentionally devalued) or deflation or both at once? We don't pretend to know. Gold, as the only universally accepted instrument of final settlement and as a physical element in the Periodic Table that cannot be printed, does not care.

The inherent conflicts and confusion in central bank policy will now be exposed. They want more lending. Please do not choke on your popcorn when ZIRP (zero interest rate policy) and NIRP (negative interest rate policy) destroy the incentive to lend, hollow out bank liabilities (why let them keep your cash?) and generally make banking a bad business. As a gold investor, you can cheer on a falling LIBOR, which could eventually collapse the term structure in the futures market and bring all demand for gold (and commodities?) into the spot market where only the real physical item will do.

The Corporate Debt Bubble

U.S. nonfinancial corporate debt of large companies now stands at about $10 trillion, 48% of GDP. This represents a rise of 52% from its last peak in the third quarter of 2008 when corporate debt was at $6.6 trillion, about 44% of 2008 GDP.

Total corporate debt is actually much higher. The debt of small and medium-sized enterprises, family businesses and other companies not listed on stock exchanges ads another $5.5 trillion, bringing total U.S. corporate debt to $15.5 trillion, 74% of U.S. GDP. The International Institute of Finance in its Global Debt Monitor has an "amber light for the U.S. corporate sector."

Earnings are not keeping pace. The latest GDP revisions show U.S. operating profits fell $93 billion (4.4%) in 2017 and a whopping $188 billion (8.3%) in 2018. Operating earnings screen out the effect of tax changes, financial engineering and buybacks. The stock market is up 50% over the last five years but GDP data shows no growth in corporate operating profits over the past five years. The Q2 report says profits totalled $1.9 billion, down 7% from a year ago. Meanwhile, 60% of S&P companies have cut Q3 EPS expectations in recent weeks but distributions to shareholders continue at record levels…37% of capital is going to Capex & R&D while 47% goes to buybacks and dividends, which do not strengthen ability to meet debt obligations.

Cash held by U.S. non-financial corporations fell $272 billion over the last 12 months, the largest decline (-15%) since at least 1980. As a percentage of assets, cash balances have declined from 12.7% in June 2018 to 10.4% today. Jeffrey Gundlach of DoubleLine notes that using leverage ratios alone "45%, not just of the BBB but the entire corporate bond market, would be junk right now."

The Federal Reserve's Real Job 1

Let's look at the bigger picture. U.S. credit market debt now exceeds $72 trillion, which is secured against an economy of just $18.8 trillion. Assuming an average interest rate of 3% (likely too low), the debt eats $2.2 trillion per year...11.5% of real GDP. That's why economic growth after the Great Recession has been so poor...the economy is choking on too much debt. And that is why the Fed's one and only policy...growing the economy by growing the debt...is unsustainable. In 1984 it took $1 of additional debt to create an additional $1 of Real GDP. As of the fourth quarter of 2018, it took $3.8 dollars of debt to create $1 of real GDP.

The debt load is growing more than three times faster than the ability of the economy to service it, as the below chart shows. How is this sustainable?

To keep rolling over expiring debt and accrued interest and to finance massive government deficits, which at the federal level are now verging on $1 trillion per year without a recession, total debt must increase at least $3 trillion per year. This is no small task. Banks have to be willing to lend and borrowers have to be willing to take on more liabilities despite already high debt loads.

Perhaps you think that the Fed's priorities are defined by its official mandate...price stability and full employment. Or, if you have been following the news, you may add the third mandate which has emerged in Chairman Powell's statements...continuing the current economic expansion. But there is one more mandate that eclipses all the rest...maintaining the current debt bubble. If the Fed fails in this regard, all the other mandates go down the drain.

For the Fed, this is job 1... keep the debt growing. Once debt begins to contract, the game ends in a massive wave of defaults. The Great Recession of 2008/9 was caused by a small contraction in debt growth...actually more a flattening of the growth curve (see chart above). The Fed CANNOT let that happen again with debt now 32% higher.

The U.S. economy, corporate and individual, has been restructured around ZIRP. When the Fed Funds Rate hit 2.5% and the10-year Treasury yield hit a modest 3.2%, markets went tilt last year. The U.S. Federal Debt absolutely cannot handle higher rates either. Interest rates cannot be allowed to rise, dear reader. The Fed will stop at nothing to keep rates low and real yields even lower which supports a huge bid under gold.

How dependent on debt is the U.S. economy? Do you have your popcorn in hand? "Nominal GDP growth over the past five years would have been negative if U.S. public debt had not increased," says DoubleLine's Jeffrey Gundlach. "The growth in the GDP…is really based exclusively on debt, government debt, also corporate debt and even now some growth in mortgage debt."

If the U.S. Treasury had avoided increasing its debt, nominal GDP would have been negative in three of the last five years "even with all of the exact mortgage, corporate, and student loan growth that occurred," Gundlach told Reuters in an email. "If those non-Treasury debt categories had not grown either, GDP would have been very negative." Nominal GDP rose by 4.3% (annually) but total public debt rose by 4.7% over the past five years, Gundlach noted. Does this sound to you like a strong, recession-proof economy?

Negative Rates Are Positive for Gold

All central banks globally are thinking the same way. Central banks recorded a net 14 rate cuts in August, the most since policymakers dropped rates to zero after the global crash in 2008/09. August marked the seventh straight month of net rate cuts following a tightening cycle that ended in early 2019.

In our view, rate cuts aren't likely to induce enough new private lending/borrowing to keep the debt bubble expanding, especially as the economy is clearly slowing down. More QE will be necessary to drive yields lower and perhaps even more aggressive policies, even in the U.S.

Do you think otherwise? Former Federal Reserve Chairman Alan Greenspan recently said he wouldn't be surprised if yields on U.S. bonds turned negative and if they do, it wouldn't be "that big a of a deal." We disagree and so does the gold price, the best market indicator of rising risk aversion.

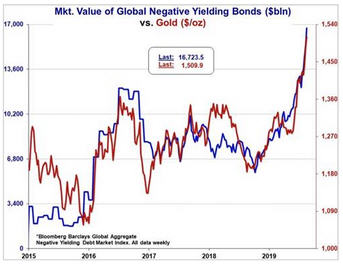

Gold's accelerating performance since October 2018 is due in part to global rate structures crashing below the zero bound. The global total of negative yielding sovereign credit has literally skyrocketed in recent weeks to a more than $17 trillion, triple the $5.7 trillion in October 2018. Note that there were no negative-yielding bonds during the first 5,000 years of financial history until the Bank of Japan started the game in 2015. The below chart should be profoundly disturbing to central bankers who want investors to take on more risk.

In September, sovereign debt yields bounced higher and total outstanding negative yielding debt temporarily fell, not surprising given that we had just seen the most overbought weekly bond RSI readings in history. But none of the risk factors that have recently driven sovereign yields to historic lows have dissipated and a terrorist attack on the world's largest oil terminal brought a powerful bid back into Treasuries, reaffirming the trend towards risk aversion.

Negative interest rates are not confined to sovereign bonds nor do we think the Fed will limit its experiments to the bond market. NIRP also means charging commercial banks to deposit their funds with their central bank, which, in turn, means banks charging interest to their depositors.

In Europe, this form of NIRP was supposed to increase spending, boost inflation and stimulate the economy. According to research from the University of Bath (among others), NIRP actually decreased lending because the additional costs reduced banks' profit margins, leading to a drop in loan growth.

"This is a good example of unintended consequences," said Dr. Ru Xie of the university's School of Management, one of the study's authors. "Negative interest rate policy has backfired, particularly in an environment where banks are already struggling with profitability."

But the biggest impact of negative rates may involve time preference that lies at the heart of the financial system. Assume that you have a certain sum of cash. All things equal, you would prefer to hold the cash or spend it now to meet your needs. To lend this cash, you need an inducement, a payment of interest, which compensates you for the deferred pleasure of holding or spending your cash, an amount sufficient to overcome loss of liquidity, risk of default and sacrifice of immediate satisfaction.

Central banks think that driving interest rates below zero will force you to spend now and borrow to spend more. Goodbye savings and investment, the prime source of future economic growth, better credit ratings and stable balance sheets. We think one of the reasons why the U.S. economy remains stronger than the rest is because it has positive yields.

There is another dimension to time preference. The futures markets exist because of the preference of most investors to hold dollars, the world's reserve currency. If I purchase a gold futures contract, I am stating my preference to hold dollars (which pay interest and have perfect liquidity) while also owning a future call on gold. I value dollars more than gold, otherwise I would buy gold in the spot market. This preference creates contango, which reflects the interest rate paid on dollars and the pre-eminent position of the dollar compared to the euro, yen or yuan.

But if LIBOR heads to zero under ZIRP, why would I prefer to own dollars? As rates fall, the preference will shift to physical gold until we reach permanent backwardation. The futures market would collapse, leaving us with only the spot market for physical and fully backed certificates. In London, where it is said that 95% of all gold deposits are unallocated, there would be tremendous pressure to take possession of physical, leading to exposure of just how much fractional gold banking has been going on for the last few centuries. Now that could really put the cat among the pigeons.

This article is the collaboration of Rudi Fronk and Jim Anthony, cofounders of Seabridge Gold, and reflects the thinking that has helped make them successful gold investors. Rudi is the current Chairman and CEO of Seabridge and Jim is one of its largest shareholders.

Disclaimer: The authors are not registered or accredited as investment advisors. Information contained herein has been obtained from sources believed reliable but is not necessarily complete and accuracy is not guaranteed. Any securities mentioned on this site are not to be construed as investment or trading recommendations specifically for you. You must consult your own advisor for investment or trading advice. This article is for informational purposes only.

Disclosures:

1) Statements and opinions expressed are the opinions of Rudi Fronk and Jim Anthony and not of Streetwise Reports or its officers. The authors are wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation. The authors were not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the authors to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

2) Rudi Fronk and Jim Anthony: we, or members of our immediate household or family, own shares of the following companies mentioned in this article: Seabridge Gold. We personally are, or members of our immediate household or family are, paid by the following companies mentioned in this article: Seabridge Gold.

3) Seabridge Gold is a billboard sponsor of Streetwise Reports. Click here for important disclosures about sponsor fees.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.