Full size / The Aznalcóllar open-pit near Seville in southern Spain (source).

Good news for Emerita Resources Corp. as the company today announced favourable ruling on the Aznalcóllar Zinc-Lead-Silver Project appeal. This is making headlines in the news at national level in Spain and Emerita is now in a favourable position to get awarded this major zinc mining asset.

Aznalcóllar is a past producing zinc-lead-silver mine that operated in the 1990s for only about 18 months and was closed due to a combination of low metal prices and a severe tailings failure. The government subsequently rehabilitated the site and, due to the demands of the community for employment, initiated a public tender to re-develop the mine – the tender was unanimously supported by all political parties.

In late 2014, Emerita participated in the tender process, which was run in 2 stages; the first was a financial qualifying round after which Emerita and a Minorbis were the only companies qualified for the second round, which required a detailed technical plan for the development of the project. Emerita completed a full mine plan, environmental management plan, water management plan (which the Federal Water Authorities endorsed), and public hearings in the community. Minorbis had a significantly inferior proposal.

In 2015, the tender was awarded and there was complete shock when, by a very slim margin, Minorbis’ bid was chosen as the winner. Upon examining the details, Emerita challenged the decision and filed charges of corruption against the panel. As per Spanish law, if there is a commission of a crime in a public tender process, the award must be negated and the tender goes to the next qualified bidder. In this case, Emerita is the only other qualified bidder and with today’s announced ruling in favor of Emerita, the company could be on the verge of being officially awarded the project.

According to latest media coverage in Spain, making headlines in the news at national level, the re-opening of the Aznalcóllar Mine in southern Spain could be in the offing and Emerita should get awarded the project, whereas the President of SEPI, a Spanish state holding company controlled by the Ministry of the Treasury, has resigned:

Latest News Articles

“Judge Alaya reopens the case of the Aznalcóllar mine and cites Pedro Sánchez as being under investigation“

www.eldiario.es/andalucia/Aznalcollar_0_948055491.html

(See English translation here)

“The Hearing reopens the criminal case against the award to Minorbis of the Aznalcóllar mine“

www.sevilla.abc.es/economia/sevi-audiencia-reabre-causa-penal-contra-adjudicacion-grupo-mexico-mina-aznalcollar-201910011220_noticia.html

(See English translation here)

“Alaya reopens the award of Aznalcóllar to investigate the president of SEPI“

www.diariodesevilla.es/juzgado_de_guardia/actualidad/mina-Grupo-Mexico_0_1396660474.html

(See English translation here)

“The Government will dismiss the president of SEPI this Friday after his accusation for the sale of a mine“

www.elpais.com/politica/2019/10/01/actualidad/1569928295_155144.html

(See English translation here)

“Sepi president resigns over Aznalcóllar case“

www.elmundo.es/andalucia/2019/10/01/5d93196421efa00d3b8b45f2.html

(See English translation here)

Latest Videos

www.rtve.es/alacarta/videos/noticias-andalucia/noticias-andalucia-2-1-10-19/5399776/

www.publico.es/politica/dimite-presidente-sepi-reapertura-causa-aznalcollar.html

www.larazon.es/economia/dimite-el-presidente-de-la-sepi-por-la-causa-de-la-mina-de-aznalcollar-LF25139651

About Aznalcóllar and Los Frailes

• There exist 2 discontinued open-pit mines on the property: Aznalcóllar (see pictures below; source) and Los Frailes.

Full size

Full size

• Los Frailes was operated by the Swedish mining giant Boliden in the late 1990s for approximately 18 months until it had a tailings failure (see picture below; source) at a time of low zinc prices, which resulted in closure of the operation.

Full size

Full size

• Boliden ultimately left Spain and the Government took over and rehabilitated the site.

• Most of the deposit remains in the ground due to the short time it was operating.

• Boliden’s mine plan included a low-grade but large open-pit estimated at 71 million tonnes grading 3.8% zinc, 2.18% lead, 0.34% copper and 60 ppm silver (see picture below; source).

Full size

• Reports by the operation’s mine department and a review of the diamond drilling data for the mine indicate the existence of a higher grade portion of the resource that was estimated by the previous operator to contain 20 million tonnes grading 6.66% zinc, 3.87% lead, 0.29% copper and 84 ppm silver.

• Emerita proposes to first mine the higher grade portion of the deposit with underground methods (benefits: no huge waste rock piles, tailings go back underground as paste fill, lower capital, smaller mill, etc.).

Full size / The Aznalcóllar open-pit (source).

Full size / The Aznalcóllar open-pit (source).

Full size / Looking at the Los Frailes open-pit (source).

Full size / The Los Frailes open-pit (source).

Full size / The abandoned Aznalcóllar open-pit (source).

Full size / Mining at Aznalcóllar prior to tailings failure (source).

According to today‘s news from Emerita announcing “favourable ruling on the Aznalcóllar Project appeal, Spain“:

TORONTO, Oct. 04, 2019 (GLOBE NEWSWIRE) -- Emerita Resources Corp. (TSX-V: EMO) (the “Company” or “Emerita”) is pleased to announce that five judges of the Appellate Court of Seville (the “Appellate Court”) have unanimously ruled in favour of Emerita’s appeal of the lower court’s decision to dismiss a criminal case against the Andalusian government panel (the “Panel”) responsible for awarding the Aznalcóllar project (the “Project”) and the former Director of Mines of the Government of Andalucía (collectively, the “Accused”). The Project was the subject of a multistage public tender process that the Appellate Court has concluded, based on a lengthy and detailed police investigation, was wrongfully awarded to Minorbis-Grupo Mexico (“Minorbis-GM”). According to Spanish Counsel, laws relating to public tenders in Spain stipulate that if there is commission of a crime in the awarding of a public tender the bid shall be disqualified and the tender will be awarded to the next qualified bidder. In the case of the Project, Emerita is the only qualified bidder. Among other points raised in the lengthy ruling by the Appellate Court were the following:

-- Minorbis-GM was patently in breach of the requirements of the first phase of the tender, for various reasons, such that their bid should have been disqualified and not allowed to proceed to the next phase. The Panel committed an illegal act in allowing the incomplete bid to proceed to subsequent steps in the process.

-- Refers to facts as ´patent illegality´ and ´gross and crude illegality’, in that Minorbis was nothing more than an instrument for delivering the Project to a third party for financial consideration, in a manner contrary to the law and that members of the Panel were aware of this maneuver from the beginning.

-- In addition, the Appellate Court indicates there is ample evidence of not only the crime of prevarication, but that of influence peddling, fraud, bribery and embezzlement. The last of which is important because it states that Emerita´s bid was the most beneficial offer in terms of higher return with respect to taxes, social fees and benefits, and improvements for the community and that the Panel choosing the worst offer would be an illegitimate use of public resources which is a criminal offence.

David Gower P.Geo., CEO of Emerita, states: “We are highly satisfied with the detailed ruling presented by the Appellate Court and agree in full with the findings. It is unfortunate that the Project has been delayed as a result of the illegal actions of those implicated during the public tender. It is also important to acknowledge that these crimes occurred under the previous political regime and we look forward to working with the present administration to develop this important resource, with the utmost care for the local environment and for the safety of the community and the workers employed on the Project. The ruling in its entirety is lengthy and detailed and the Company continues to consult with counsel and will consult with government officials to fully understand the process going forward and will report further as information becomes available.”

Joaquin Merino P.Geo., President of Emerita notes: “Emerita remains fully committed to responsibly developing the Project and working closely with all of the stakeholders. Our approach to the public tender was very serious and included approximately $1,000,000 spent on technical studies to articulate the most effective and responsible way to develop the Project into a modern and safe operation. The detailed submission which amounted to almost 10,000 pages puts Emerita in an excellent position to advance the Project efficiently as a significant amount of work and planning has already been completed by the Company. We look forward to working with the government and community in the development of the Project.”

The Appellate Court has ordered that the lower court reconsider and investigate the claims against the Accused as well as ordered the lower court to investigate certain representatives of Minorbis-GM, the party that was ultimately awarded the Project. This is the second time that the Appellate Court has ordered the lower court to reopen its investigation. The Appellate Court reiterated its findings from its original decision, namely that there is strong evidence of gross negligence and misconduct by the Accused and that it is necessary to continue investigating whether criminal acts were committed by the Accused, but also added that Minorbis-GM failed to comply with the requirements of the first stage of the tender process and should never have been eligible to participate in the second stage of the tender. Further, the Appellate Court has ordered the lower court to investigate whether the Accused committed fraud, bribery, influence peddling, abuse of power and embezzlement.

Emerita was the only qualified bidder in the Aznalcóllar tender process and under Spanish law should be awarded the Project. Emerita remains committed to working with the community of Aznalcóllar to develop the Project in an environmentally responsible manner to benefit all stakeholders.

About the Aznalcollar Project

Emerita was one of only two companies to qualify for the final round of bidding for the Project. The Government of Andalusia and the Province of Seville announced the public tender for the past producing property (Concurso público para la adjudicación de la explotación de la reserva de Aznalcóllar en la provincia de Sevilla) in 2014 (see news release dated May 22, 2014). On December 16, 2014, Emerita submitted a detailed technical proposal, which was the final requirement for the public tender process.

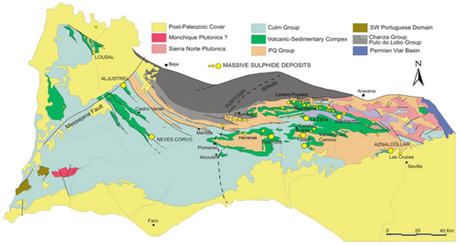

The Aznalcóllar Project is a past producing property within the famous Iberian Pyrite Belt that hosted the Aznalcóllar and Los Frailes open pit zinc-lead-silver mines (see Figure 1).

Full size / Figure 1: Iberian Pyrite Belt. Aznalcóllar Location Map.

Historical Estimates

The focus of the Project is re-development of the Los Frailes deposit which was developed in the mid 1990s. The historical estimate as calculated by the previous operator of the mine was estimated to be 71 million tonnes grading 3.86% zinc, 2.18% lead, 0.34% copper and 60 ppm silver (see Figure 2).

Full size / Figure 2: Deposit locations at the Aznalcóllar Project. The Los Frailes deposit is the mineralized zone in the center of the model and comprises the historical resources referred to herein.

Full size / Figure 2: Deposit locations at the Aznalcóllar Project. The Los Frailes deposit is the mineralized zone in the center of the model and comprises the historical resources referred to herein.

Reports by the operation’s mine department and a review of the diamond drilling data for the mine indicate the existence of a higher-grade portion of the historical estimate that was estimated by the previous operator to contain 20 million tonnes grading 6.66% zinc, 3.87% lead, 0.29% copper and 84 ppm silver. The Aznalcollar and Los Frailes deposits are open for further expansion by drilling at depth, as historical drilling was primarily constrained to depths accessible by open pit mining. A qualified person as defined in National Instrument 43-101 has not done sufficient work on behalf of Emerita to classify the historical estimate reported above as current mineral resources or mineral reserves and Emerita is not treating the historical estimate as current mineral resources or mineral reserves. A summary of the historical resource estimate is available from the Government of Andalucía in a report prepared by the prior operator of the Aznalcóllar Project entitled “Proyecto de Explotacion Yacimiento Los Frailes, Memoria Andaluza de Piritas, Boliden- Apirsa, Octubre 1994” (Los Frailes Development project Report, Boliden-Apirsa, October 1994) along with subsequent resource estimate updates, the latest being from 2000. The Los Frailes operation was only in production for approximately 1.5 years when a tailings dam failure along with low metal prices caused the former operator to shut down the Project. The Government subsequently completed reclamation and took ownership of the site.

Emerita would be prepared to commence work immediately upon receiving appropriate permits to carry out drilling on the property and complete an NI 43-101 mineral resource estimate required for the completion of a feasibility study in support of development of a mining operation at the site.

The Company developed the technical proposal based on a database collected from a number of sources including data provided by the Government of Andalucía comprising drill hole information, environmental data, and geotechnical and metallurgical data. Emerita understands the importance of community support for the project and had presented its proposal to the local community of Aznalcóllar, local and national union representatives, the Andalusia business community and local and national government agencies, among other institutions during the public tender process.

According to Joaquin Merino, P.Geo, Emerita’s President: “Emerita’s team has a great deal of experience with deposits similar to the Aznalcóllar deposits, including successful mine developments in the Matagami and Bathurst mining camps in Canada. We have a strong technical team that put together an excellent proposal incorporating the most innovative technology and processes available to the industry globally. The Company paid close attention to the technical aspects but more importantly also the social and environmental aspects of the project. Emerita’s team is confident that Aznalcóllar can be developed in a responsible manner that benefits all stakeholders.”

No current mineral resources have been estimated on the property. In addition, it should be noted that mineral resources that are not mineral reserves do not have demonstrated economic viability.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Mr. Joaquin Merino, P.Geo, President of the Company and a Qualified Person as defined by National Instrument 43-101 of the Canadian Securities Administrators.

About Emerita Resources Corp.

Emerita is a natural resource company engaged in the acquisition, exploration and development of mineral properties in Europe, with a primary focus on exploring in Spain. The Company’s corporate office and technical team are based in Sevilla, Spain with an administrative office in Toronto, Canada.

For further information, contact:

Helia Bento

+1 (416) 566-8179 (Toronto)

Joaquin Merino

+34 (628) 1754 66 (Spain)

info@emeritaresources.com

Cautionary Note Regarding Forward-looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, statements regarding the Company’s ability to be awarded the Project, the mineralization of the Project, the Company’s ability to develop the Project, the prospectivity of the Project, the Company’s ability to complete a NI 43-101 resource estimate and feasibility study, the timing of legal processes in Spain and the Company’s future plans. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward- looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Emerita, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to: general business, economic, competitive, geopolitical and social uncertainties; the actual results of current exploration activities; risks associated with operation in foreign jurisdictions; ability to successfully integrate the purchased properties; foreign operations risks; and other risks inherent in the mining industry. Although Emerita has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Emerita does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Company Details

Emerita Resources Corp.

Suite 800 – 65 Queen Street West

Toronto, Ontario M5H 2M5 Canada

Phone: +1 416 566 8179 (Toronto)

Phone: +34 628 1754 66 (Spain)

Email: info@emeritaresources.com

www.emeritaresources.com

Shares Issued & Outstanding: 50,614,165

Chart

Canadian Symbol (TSX.V): EMO

Current Price: $0.07 CAD (10/03/2019)

Market Capitalization: $4 Million CAD

Chart

German Symbol / WKN (Frankfurt): LLJA / A2PKVQ

Current Price: €0.0395 EUR (10/02/2019)

Market Capitalization: €2 Million EUR

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Emerita Resources Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Emerita Resources Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through the Emerita Resources Corp.´s profile on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds a long position in Emerita Resources Corp. and Zimtu Capital Corp., and is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital also holds a long position in Emerita Resources Corp. Note that Emerita Resources Corp. pays Zimtu Capital Corp. to provide this report and other investor awareness services.

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com