Technical analyst Clive Maund believes this stock could gain traction soon.

Avivagen Inc. (VIV:TSX.V) is an interesting company because it makes farm animal feed that is free of antibiotics, which is becoming a hot topic now that over half of China's swine herd is set to be killed due to a massive outbreak of African swine fever, an illness that may be made much more prevalent by the widespread excessive use of antibiotics, to which diseases like this develop resistance.

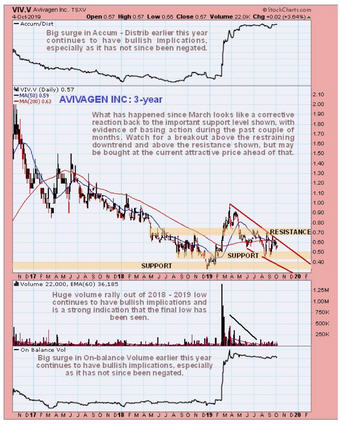

We had traded Avivagen well on the steep rise out of its early 2016 lows, but then our luck ran out when we bought it back early in May at the point shown on its six-month chart below—too early in the event, as it ran off sideways/down into a longer reaction that now looks to have ended with the double bottom that formed in August and September. While the action from the August low strongly suggests that the correction is over, it has yet to gain any serious traction.

However, it looks like it should do soon, and thus the reactions of the past couple of weeks look like the stock has thrown up a good entry point, especially as the accumulation line has shown strength during it.

On the three-year chart, the surge on very big volume early this year certainly looks like a breakout, especially given how both volume indicators also spiked higher and have barely dropped as the price has since corrected back. This suggests that this reaction is simply a correction to the preceding sharp rally that will, in due course—and perhaps soon, be followed by another up-wave. We can see the proximity of quite strong support that should put a nearby floor under the price, and how it is not far off breaking out of the downtrend—and also how, if it succeeds in doing so, it should accelerate to the upside if it can break above the resistance in the CA$0.70 area.

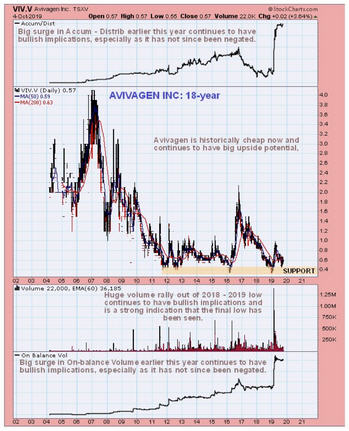

On the long-term 18-year chart, which shows the entire life of the stock, we can see how the price is not far above strong support at multiyear lows. With the strong volume pattern and volume indicators suggesting that a new bull market is incubating, this looks like a good point to accumulate the stock. Avivagen trades in very light volumes on the U.S. OTC market, where, for this reason, it should be avoided.

Avivagen Inc. website.

Avivagen Inc. closed at CA$0.57; $0.453 on 4 October 2019.

Originally posted on CliveMaund.com at 9.10 p.m. EDT on 6 October 2019.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.