Thibaut Lepouttre of

Caesars Report profiles this company exploring its large land package in Finland's greenstone belt.

.jpg)

Introduction

Finland would hardly be a country you'd think of when considering exploration companies. However, it's not such a far-fetched idea as senior producer Agnico Eagle Mines (AEM, AEM.TO) has been a successful producer in Finland for years now and its Kittila gold mine is the largest gold producer in Europe.

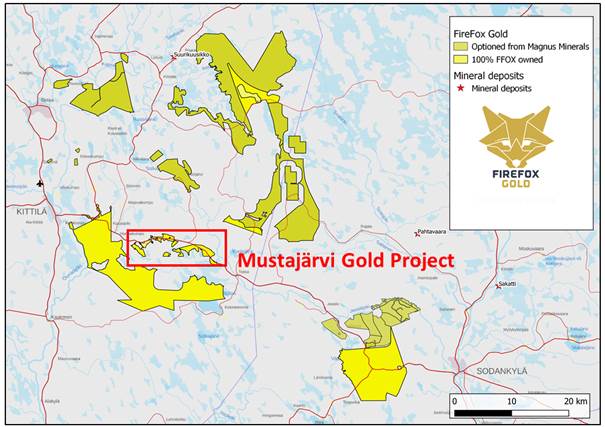

Firefox Gold Corp. (FFOX:TSX.V) has assembled a large land package in Finland's greenstone belt. Two properties are drill ready and after having completed a phase 1 drill program earlier this year, Firefox is gearing up for a follow-up winter exploration program, and drilling has already started on the Mustajarvi project.

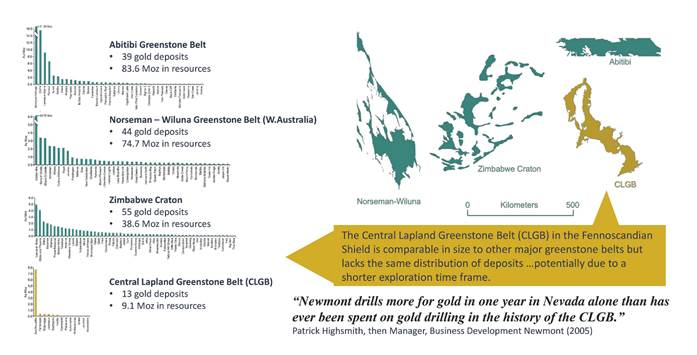

The Central Lapland Greenstone Belt: one of the last un(der)explored greenstone belts

The main area we will focus on in this article is the Central Lapland Greenstone Belt (CLGB).

The CGLB hasn't been thoroughly explored yet (due to a lack of expertise, the semi-duopoly of mineral exploration in Finland, and the focus on non-precious metals), and in the past 30 years of exploration activities on the Lapland Belt, approximately 13 deposits holding a combined 9 million ounces of gold have been discovered. Nice, but not jaw-dropping. Especially not when compared to the Abitibi Greenstone Belt, which hosts 100 mines with a combined production coming up close to 200 million ounces.

Does this mean the CLGB is a copy of the Abitibi with a similar amount of gold waiting to be uncovered? No. But it does indicate that if you're exploring for gold in Finland, that greenstone belt probably is "the place to be" due to it being underexplored. In fact, the main focus on gold only started just 5–6 years ago, so this is a virtually untouched greenstone belt.

Additionally, there's an interesting historical angle here as well. Once the mining sector in Finland was opened up for foreign investment, the CLGB was staked by companies that were pursuing base metals: First Quantum Minerals and Anglo American were the dominant land owners. They couldn't care less about the gold as they were looking for large base metal deposits just like Boliden's Kevitsa mine, a copper-nickel mine with platinum and palladium as by-product credits, and Anglo American was actually successful as it discovered the Sakatti project (also a Cu-Ni-PGM project).

So it's really just since about 5 years that exploration companies have had a dedicated gold-focused approach in Lapland. And that means the entire greenstone belt is in its infancy with regards to exploration.

Zooming in on the two main properties: Mustajarvi and Jeesio

1. Mustajarvi

The Mustajarvi project is a 1.5 square kilometer area in the Kittila region of Finland, the town that lent its name to the Agnico Eagle gold mine in the Central Lapland Greenstone Belt.

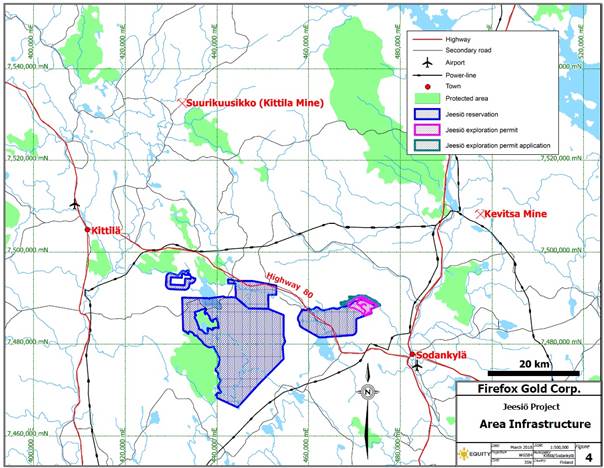

One of the main reasons why the Central Lapland Greenstone Belt is so attractive is the presence of existing infrastructure. Highway 80, which connects the cities of Kittila and Sodankyla, runs right through the Mustajarvi claims. Additionally, the entire region is very much pro-mining as both Agnico Eagle (Kittila Gold mine) and Bolliden (Kevitsa nickel-copper mine) have active operations within a 60-kilometer radius from both Kittila and the Mustajarvi project.

The gold mineralization at Kittila was originally discovered in the late 1980s when Outokumpu detected anomalous gold values in till samples where after a more methodic till sampling program confirmed the existence of gold mineralization. Enough evidence for Outokumpu to direct a drill rig to the property and 12 very short holes (averaging less than 60 meters) were drilled on the gold-in-till anomaly. Surprisingly, although they were very shallow, 11 of the 12 holes did encounter gold with an average grade of in excess of 1 g/t and two intervals really stood out: hole 1 encountered 2.7 meters at 14.58 g/t gold and hole 4 encountered a stunning 12 meters at 2.68 g/t gold.

Since Outokumpu walked away from the property, a few companies poked around and left. One of the previous owners of the property was Agnico Eagle, which tried to drill three holes but encountered numerous problems, abandoned the holes and dropped the property. Mustajarvi was recently held privately by the chairman of the gold panning association before it was added to Aurora Exploration and subsequently rolled into Firefox Gold. So Mustajarvi was basically "virgin territory" until Firefox started working on the claims.

It completed a first drill program in 2018 and the summary of the drill results is another reason why we enjoy Firefox's transparency. Of the eight holes that were drilled as part of a 1,100-meter drill program, six holes contained gold. A 75% success ratio is excellent, but Firefox also still mentions the "empty" holes in its corporate documentation whereas most other exploration companies would just not refer to those holes.

So, a high level of transparency at Firefox Gold, and the six remaining holes encountered interesting zones of 4.1 meters at 1.87 g/t gold (including a very narrow 35 centimeters of 11.63 g/t gold, which means the remaining 3.75 meters contained about 0.96 g/t gold) as well as 3.65 meters of 0.97 g/t gold, and 2 meters containing 45 g/t gold and 0.16% cobalt.

Most of the 2018 gold-bearing drill intervals were quite short (in general between 0.5 and 2 meters), but Firefox is still just zeroing in on its targets. The grades are absolutely excellent for mineralization this close to surface, but it would be nice to see some thicker intervals.

2. Jeesio

The Jeesio property is substantially larger than Mustajarvi as it consists of a total of 460 square kilometers. Similar to Mustajarvi, the access to existing infrastructure is absolutely excellent as parts of the land package are actually overlapping highway 80 while there are two powerlines readily available on the north and south side of the Jeesio project.

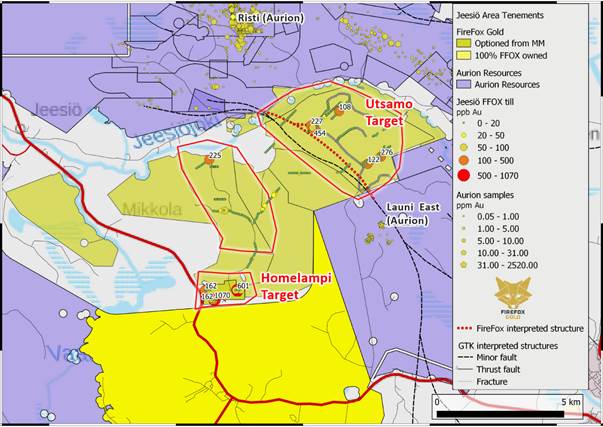

There's one specific area of the Jeesio project that looks quite interesting. The Utsamo zone, which is a part of the Jeesio target, is located literally in between the two gold discoveries made by Aurion Resources. As you may remember, Aurion found gold at both Risti (with intervals of for instance 28 meters containing 9.42 g/t gold and 31 meters containing 3.51 g/t gold) as well as Launi East (which hasn't been drilled yet, but the recent sampling program returned high grade gold assays, not unsimilar to what Aurion discovered at Risti).

Of course, that doesn't mean the gold zones continue through the Utsamo target, but as far as a "nearology play," the Utsamo zone is a very interesting piece of real estate as it could be the missing link between Risti and Launi as a magnetic survey has identified a 2.8 kilometer long target which Firefox' geos think is a part of the Sirkka shear zone that does look like it's continuing onto the Aurion properties:

This exploration target was further validated by Firefox' sampling program, which outlined several gold in till anomalies, while the structural interpretation appears to be following the contact between the meta-sediments and mafic intrusive rocks.

Again, there's absolutely no guarantee Firefox will find anything economic. But having all these elements and knowing another exploration company actually did find (high-grade) gold on both sides of the structure makes this a very juicy exploration target, and we are happy to see Firefox is planning to drill-test the Utsamo target this quarter. As we are very impressed with the methodological drill program at Mustajarvi (see later), we expect Firefox to have a well thought out plan for Utsamo as well once it solves its luxury problem.

And Utsamo does create a luxury problem for Firefox as it looks like there are several promising targets (and we expect additional groundwork to unveil even more targets). So even if the first holes don't intersect (high-grade) gold mineralization, the Utsamo zone should definitely not be written off. It's a large zone and we can't really expect the company to make a discovery with the first few holes.

Drilling has already started at Mustajarvi

Drilling is actually already underway as Firefox has initiated a nine-hole drill program on the Mustajarvi zone, where up to 1,500 meters will be drilled. The first four holes will zoom in on the high-grade results that were encountered in last winter's exploration drill program (with, for instance, 2 meters containing just over 45 g/t gold) and two holes will test the ground for mineralization an additional 25 and 50 meters down dip, while the remaining two holes will try to expand the mineralization by 25 meters both to the east and the west. Small steps, but these four holes will provide Firefox with a lot of geological data that could then be used to design additional exploration programs.

In fact, the entire drill program is mainly about gaining more knowledge of the deposit as holes 5 and 6 will focus on the areas that have previously been drilled by Outokumpu, which encountered additional high-grade zones. One hole will test for the continuation of this mineralization, while hole 6 will try to twin one of the historical holes in an attempt to recover more of the core (which will help with the interpretation of the structures) as Outokumpu's drill program had very poor core recovery results due to faults and fractures in the rock.

Holes 7-9 will be the bigger stepout holes as Firefox would definitely like to test whether or not it has a potential elephant by its tail. Two of the three final holes will be drilled almost half a kilometer away toward the northeast while the final hole will be a stepout hole 250 meters in the opposite direction (southwest). As such, these three holes will provide a preliminary indication of the mineralized zone over a 700-meter strike zone.

Running a tight ship with a low G&A

We are always very impressed when a company is able to keep its overhead expenses low. While some exploration stage companies have a corporate overhead of millions of dollars per year, Firefox Gold has applied the correct mindset right from the beginning.

In the first six months of the year, Firefox's total expenses were C$711,000. This doesn't sound low but once we filter out the C$418,000 in exploration efforts that were expensed rather than capitalized, the true corporate overhead was less than C$300,000 for the first semester. Remarkable, and 60% of the total expenses were spent on the properties. That by itself is already a good ratio but in a recent phone call with CEO Carl Löfberg, he indicated he wants to see that ratio increase to at least 70%. That shouldn't be too difficult as a C$250,000 hike in exploration expenses would already accomplish that. But honor where honor is due, and Firefox scored some bonus points with us for its excellent financial stewardship.

As of the end of June, Firefox had a working capital position of around C$350,000 (including C$430,000 in cash) and the recent raise, which was completed last month, didn't come as a complete surprise.

Within two weeks after announcing a financing of "up to C$1M" Firefox already closed its second and final tranche, raising a total of C$570,500 by issuing 3.8 million units. Each unit consisted of one common share as well as a full warrant allowing the warrant holders to purchase an additional share at C$0.20 during a two-year period.

The financing was "priced to sell" with a very attractive warrant (which could act as some sort of "secondary financing" further down the road as the 3.8 million warrants would bring in an additional C$760,000), and although Firefox initially mentioned a raise of up to C$1M, it was happy to close on just over half of that amount instead of leaving the financing open. After looking at the company's financial statements, Firefox appears to have a very low overhead cash burn with almost 70% of the expenses effectively being spent on the project to make more targets drill ready.

And although Firefox raised just over half a million Canadian dollars, CEO Löfberg appears to be very confident this will carry the company to January/February and by then, the assay results from the fall drill program should be out. If those drill programs are successful, Firefox should be able to top up its treasury on the back of those results.

Conclusion

It doesn't happen very often that an entire greenstone belt was up for grabs. Aurion Resources has the first mover advantage, but Firefox Gold is benefiting from the second mover advantage: Aurion has proven it is possible to make new gold discoveries on the greenstone belt, which will make it easier for Firefox to tell its own story and pre-prepare the market for exploration updates.

Drilling has started at Mustajarvi and as last year's drill program already had a 75% success ratio, Firefox can just build onto that success in its pursuit to expand the gold system on the property. And with a current market capitalization of just over C$5 million, the risk-reward ratio appears to be very interesting at Firefox Gold.

Thibaut Lepouttre is the editor of the Caesars Report, a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.

Disclosure:

1) Thibaut Lepouttre: The author has a long position in Firefox Gold. The author's company has a financial relationship with Firefox Gold. The author determined which companies would be included in this article based on his research and understanding of the sector. Additional disclosures are available here.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.