Yesterday, that was already the third time this year when the Fed cut interest rates. In response, the price of gold erased earlier losses. That sounds a bit fishy. What is going on?

Fed Lowers Interest Rates by 25 Basis Points

Yesterday, the

FOMC published the

monetary policy statement from its latest meeting that took place on October 29-30th. In line with expectations,

the U.S. central bank cut the federal funds rate by 25 basis points, for the third time in 2019 already:

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 1-1/2 to 1-3/4 percent.

Just as previous times,

the decision was considered to be an insurance against ongoing risks. But not all Committee members were convinced that the U.S. economy needed such an insurance. Esther L. George and Eric S. Rosengren wanted to maintain the interest rates unchanged. It suggests an important internal opposition to further cuts in

interest rates.

No More Cuts. For Now…

Indeed, it seems that

the Fed has exhausted its potential for further interest rate cuts in the near future. This is what the U.S. central bankers signaled in the statement. In September, they wrote:

As the Committee contemplates the future path of the target range for the federal funds rate, it will continue to monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2 percent objective.

But this time,

they removed the phrase “act as appropriate” to sustain the expansion, which had been used to signal further monetary easing.

The Committee will continue to monitor the implications of incoming information for the economic outlook as it assesses the appropriate path of the target range for the federal funds rate.

The changed statement is more

hawkish and

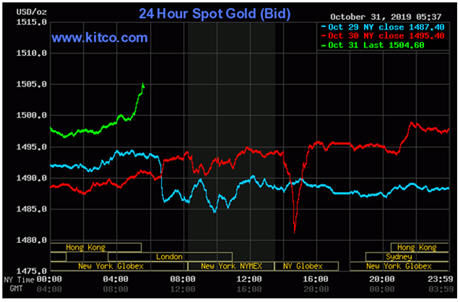

indicates that the FOMC has completed a “mid-cycle” rate adjustments yesterday. Hence, the Fed implied not to expect more cuts for now. This is bad news for the gold market. And indeed, the price of the yellow metal has initially plunged, as the chart below shows. But it quickly rebounded.

Chart 1: Gold prices from October 29 to October 31, 2019.

Implications for Gold

Implications for Gold

Gold reversed its downward course thanks to

Powell. You see, the Fed Chair excluded the next hikes for some time. He said that

inflation would have to soar to force the Fed to increase the federal funds rate:

We are not thinking about raising rates right now (…) I think we would need to see a really significant move up in inflation that is persistent before we would consider raising rates to address inflation.

This is great news for the gold bulls, as it means that the Fed will not exert any downward pressure on the gold market in the near future. The U.S. central banks sees its monetary policy as neutral now, so it will not change its course. At least, we do not expect any moves in December.

Of course, the Fed’s ‘wait and see’ mode also means no further cuts in interest rates and no upward pressure on the

bullion. But don’t be deceived! The history of the Fed clearly shows that it has a

dovish bias. If the economy slows down next year, which is not unlikely given the inversion of the

yield curve and the slowdown in the industrial sector and business investments, the U.S. central bank will ease its

monetary policy further.

For the benefit of gold.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly

Gold Market Overview reports and we provide daily

Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe.

Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘

Gold News and

Gold Market Overview Editor

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.