As Newrange Gold shifts its focus to Nevada, it is monetizing its Colombian properties to fund exploration.

Newrange Gold Corp.'s (NRG:TSX.V; NRGOF:OTC) focus is squarely on Nevada, where it acquired the high-grade Pamlico gold project in 2016. The company is in the process of monetizing its Colombian assets to fund Pamlico's exploration and recently announced the sale of its Yarumalito gold project to GoldMining Inc., while retaining a 1% net smelter returns royalty.

"This now paves the way for us to conclude the sale of Newrange's subsidiary and remaining projects in Colombia, Newrange CEO Bob Archer said. "The combined proceeds from both transactions will provide significant non-dilutive funds for exploration on the company's flagship Pamlico Project in Nevada."

The company expects the sale of its subsidiary and Yarumalito to bring in between $2 and $3 million—both deals are a mix of cash and shares—over the course of the next 12 to 18 months.

The company made its move into Nevada, where Robert Carrington, the co-founder and chairman of Newrange, who is Nevada born and raised, was able to option the Pamlico project through a family connection. "It encompasses an old mining district that goes back to the late 1800s. At that time, it was known as one of the highest-grade gold districts in Nevada," Archer explained.

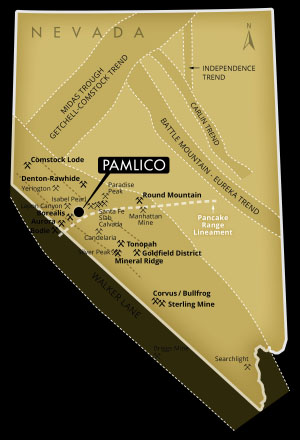

Pamlico is on the Walker Lane Trend, a northwest-southeast oriented trend that is home of many historical and current gold and silver mines, and has produced more than 53 million ounces of gold and 519 million ounces of silver. Nevada is known as "Elephant Country." The state is the world's fifth largest gold producer and rated the top jurisdiction for investment on the Fraser Institute's 2018 survey of mining companies. Nevada produced 5.6 million ounces of gold in 2018 and 169 million ounces from 1835 until the present.

Newrange's Pamlico property has been in private hands since 1896, passing through three families during this time, and has been optioned out only twice, so the property has seen very little modern-day exploration.

"We have realized that the very high-grade veins and fractures are surrounded by lower grade halos of gold mineralization, and you end up with larger pockets of mineralization that are at surface and amenable to open-pit mining," Archer said. "Taking it one step further, preliminary metallurgy discovered that the mineralization is also very amenable to heap leaching. So with low-cost mining, low-cost processing and being close to surface, we can approach this project from a very different perspective than others might have in the past."

The company is now using a new technology, a handheld laser scanner called LIDAR, to survey the inner workings of the old mine tunnels, enabling the company to plot three dimensional models and maps of the underground workings, as well as collect spatially accurate assay data that can be used as part of an NI 43-101 resource. "It's a very important exploration tool for us and very cost effective in that instead of having to spend hundreds of thousands of dollars or even millions of dollars on drilling, we can go into the mine tunnels and sample them like horizontal drill holes," Archer explained.

The company has released exploration results for the Good Hope Mine, confirming continuous gold and silver mineralization between the 5570 and 5518 levels of the mine. "Results of sampling in stopes and raises between the two levels show a higher-grade core of mineralization averaging 4.08 grams gold per metric tonne (g/t Au) and 51.5 grams silver per metric tonne (g/t Ag) ranging from 0.3 to 1.0 meter wide, with an average width of 0.7 meters, within a larger mineralized envelope that averages 1.2 g/t Au and 21.8 g/t Ag," the company reported.

Newrange plans on doing an IP (Induced Polarization geophysics) survey, as well as continuing underground surveying, mapping and sampling.

Archer points out that the old mine tunnels were built into the hills because of ease of access, but there hasn't been anything done in the little valleys and gulches in between those hills. "One of the zones that has been found in one of those valleys was a blind discovery and never mined by the old-timers. We will be looking for more of those zones."

The main trend is about 1.5 km by 1 km. "If our exploration model holds true and we are looking at pockets of mineralization in the area, we could end up with an open pit 1.5 km by 1 km and selectively mine these pockets. That's the theory that we are trying to prove up," Archer explained.

Newrange has about 97.5 million shares and outstanding, 117 million fully diluted. Insiders own 9%.

Technical analyst Clive Maund wrote on November 12, "This looks like an excellent time to take positions in Newrange Gold. . . The company is continuing to advance towards its objectives in a satisfactory manner and so the stock should do well once gold takes off on the next leg of its new bull market."