Technical analyst Clive Maund details the fundamentals for this oil & gas firm and explains why he sees it as a strong speculative buy.

After a prolonged period of adversity and depression it looks like Amazing Energy Oil & Gas Co. (AMAZ:OTCQX) has at last "cleaned the clock" with respect to the obstacles that have been blocking its way until recently. In the first place, it has sorted out the problematic situation with the Miesners. As published on the 13th in the company's 10K…

"In November 2019, the company came to terms on a proposed agreement with Jed and Lesa Miesner (the "Miesners"), and their affiliated companies JLM Strategic Investments, LP ("JLM"), Petro Pro, Ltd. ("PPL"), US Petro, LLC ("US Petro"). Pursuant to the agreement, the Company will pay the total sum of $1,750,000 to the Miesners and/or their affiliated entities.

"The proposed agreement provides that the Company will acquire all right, title and interest in and to three notes and mortgages/deeds of trust, with a value of approximately $4,200,000 held by the Miesners, JLM, and PPL, respectively. Furthermore, the parties have agreed that the Miesners, and their related affiliates, will surrender all of the shares of the Company's common stock held by them, forgo any claims to all options to acquire shares of the Company’s common stock, all warrants to purchase the Company's common stock, and any claims for compensation and wrongful termination pursuant to Jed Miesner's former employment agreement with the Company, as well as a release of any and all other claims the Miesners, and/or any of their affiliated companies, may have against the Company and/or any of its subsidiaries. In exchange, the Company will forgo any claims it may have against Jed Miesner pursuant to his former employment agreement with the Company and any other additional claims the Company, and/or any of its subsidiaries, may have against the Miesners and/or any of their affiliated companies. As a part of the proposed agreement, Jed Miesner will also resign from the Company’s board of directors."

Next it has just announced that it has closed a substantial US$4,500,000 financing and also that it has acquired assets in Mississippi known as the Denver Mint Project.

So, with the these major steps behind it and significant obstacles removed, the company looks better placed to advance towards its goals, which means that the stock is now much more likely to advance. That makes it interesting to us, for as we will now see on the charts, it is exceedingly cheap here and in a very good position to begin a major new bull market.

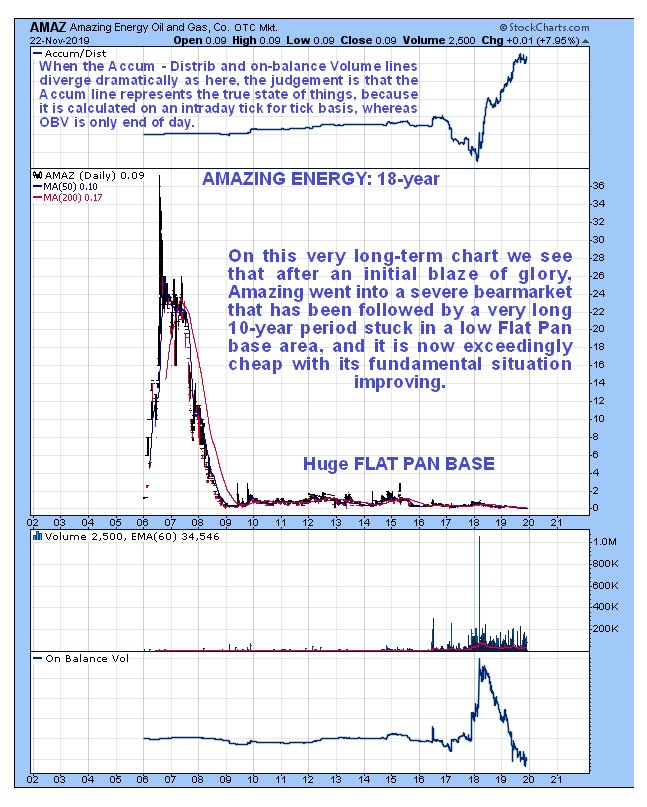

We’ll start with the very long-term chart to gain an overall perspective and quickly "drill down" to recent charts to get a handle on what’s going on with this stock.

On the very long-term 18-year chart, we can see that, after an initial blaze of glory in 2006, the stock came crashing right back down in a severe bear market to almost zero by the end of 2008, after which it has trundled sideways for over 10 years within a gigantic Flat Pan base.

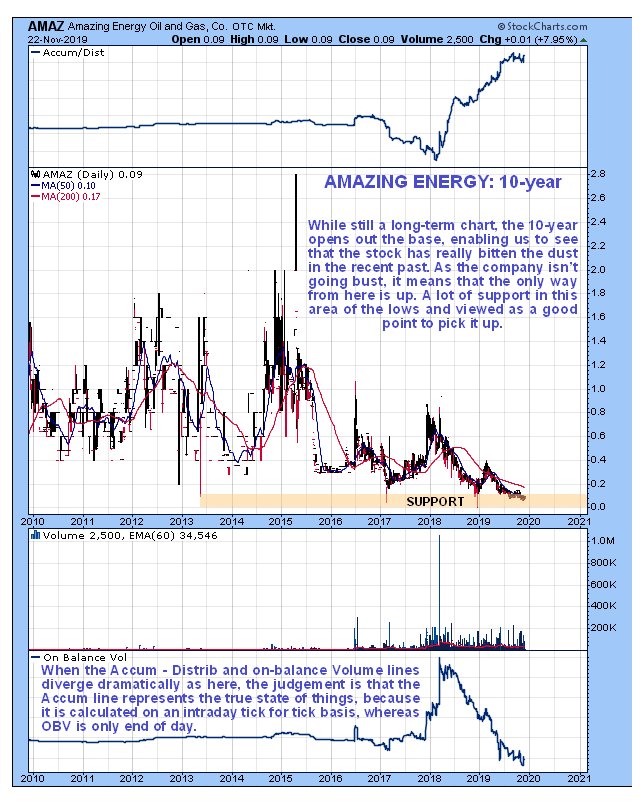

Because the 10-year chart does not include the early spike, it opens out the base pattern and on it we can see that after the recent decline, Amazing is at quite strong support right at the bottom of the trading range that comprises the Flat Pan base. The Accumulation line has been persistently strong for a long time, and it takes precedence over the weak On-balance Volume line as a reliable indicator, because it is calculated on an intraday tick for tick basis, whereas On-balance Volume is only end of day. It suggests that new bull market is incubating. What this chart makes dramatically clear is that this stock is remarkably cheap here—you can buy bucketloads of it for almost nothing, and it only has to go up to 20 cents, a modest objective, and you will doubled your money.

The 3-year chart is also interesting because it shows that the downtrend in force from late 2017 has this year morphed into a bullish Falling Wedge, and with the Wedge rapidly closing up at support as the fundamentals improve significantly, a breakout into a new bull market looks set to occur soon, and given how persistently negative sentiment towards this stock has been in the recent past, we could even see a spike after it does break out.

On the latest 13-month chart we can see upside volume improving in the recent past as downside momentum (MACD) drops out.

Amazing Energy therefore looks like an immediate strong speculative buy here.

Amazing Energy Oil & Gas website.

Amazing Energy Oil & Gas Co, AMAZ on OTC, closed at $0.09 on 22nd November 2019.

Originally posted on CliveMaund.com at 8.00 am EST on 25th November 2019.

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Amazing Energy, a company mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.