First Vanadium Corp. (FVAN:TSX.V; FVANF:OTCQB) is one of the very few survivors of a brutal sell-off in Canadian and Australian-listed vanadium juniors. Nearly a dozen of the 100+ names I'm tracking are down more than 80% from their respective 52-week highs. Even industry-leading vanadium producer Largo Resources is not immune; it's down 74%.

Since the Chinese vanadium pentoxide (V2O5) price hit an inflation-adjusted 13-year high of US$33.9/lb about 12 months ago, prices have plunged 82%. Few experts expected the price to remain above US$30/lb, or US$25 or US$20 for that matter. But, the current price of $6.2/lb is half or less of what most vanadium juniors were hoping to base their preliminary (PEA, PFS) economic studies off of.

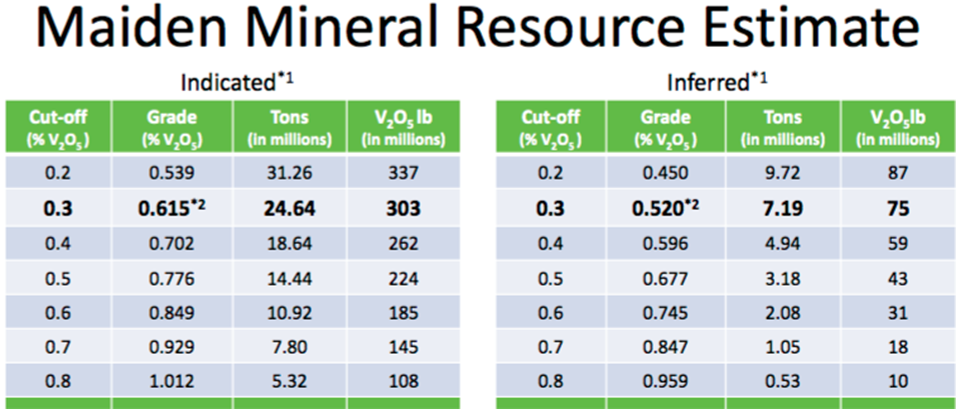

Most new projects on the drawing board simply don't work at today's prices. However, First Vanadium's large, high-grade, near-surface, primary vanadium project in Nevada could potentially be viable at a price below US$10/lb. [NI 43-101 resource: 303 million pounds Indicated @ 0.615% V2O5] / [75 million pounds Inferred @ 0.52% V2O5] [Corporate Presentation]

Readers may recall that First Vanadium's property is in the Carlin Gold Trend. CEO Paul Cowley knew he had one or more gold targets at depth, but two years ago, he had a straightforward, low-cost shot at delineating an attractive vanadium resource, so that's the path the team took.

Paul tells me he underestimated the strength of the gold prospect, only coming to understand the bigger picture with a decisive stamp of approval from legendary geologist Dave Mathewson. Mathewson has joined First Vanadium's stellar Technical Advisory Board.

With a fully funded PEA to be delivered in Q1 2020, management has more time to prudently pursue the gold opportunity. With that in mind, the team is looking for a strategic / financial partner to move the gold target forward.

Although the following interview of CEO Cowley is focused more on the newly announced gold prospect, he and his talented team remain excited by their vanadium resource and newly identified gold target, both on the same property. Please continue reading to learn more.

Peter Epstein: Please update readers on the status of First Vanadium's flagship Carlin primary vanadium project in north-central Nevada (USA).

Paul Cowley: We have had a busy 2019 with the Carlin Vanadium resource since it was announced in February. It has been, and will continue to be, our primary focus. We added to our land position, extended mineralization and achieved crucial metallurgical advancements, enabling us to move forward to the next stage.

Our large, high-grade, primary vanadium resource is being advanced via a Preliminary Economic Assessment (PEA), conducted by Wood Canada Ltd., a highly reputable international engineering firm. Completion of the PEA is expected in the next three or four months.

Peter Epstein: Vanadium pentoxide prices have fallen further than most believed they would. The expectation heading into 2020 was around US$10-$12 per pound, but the price is now at US$6.2/lb. Any comments on the price?

Paul Cowley: The further leg down to this price happened only recently, I think we are at or near a bottom. The average Chinese price of V2O5 in 2019 is much higher, closer to US$11/lb. Over the past six months it has averaged about US$8/lb.

We anticipate prices will strengthen with stronger demand in rebar for construction and infrastructure in China and globally. Increased adoption of Vanadium Redox Flow Batteries in massive solar/wind projects, and in power grids will also be key drivers.

Near-term growth will be driven by steel production in developing countries, and especially developments in China with its higher strength standards in rebar for safer, stronger, longer-lasting structures.

Peter Epstein: First Vanadium recently announced a new gold target, on the company's existing property, identified by rock star geologist and mine finder Dave Mathewson. Please tell us about this latest development.

Paul Cowley: Yes, we are excited about how this is unfolding. We engaged Mr. Mathewson as a geological consultant because of his huge success in finding gold deposits in the Carlin Trend for Newmont Goldcorp (formerly a Newmont Mining regional exploration manager) and Gold Standard Ventures (co-founder and VP Exploration). We just recently appointed him to our Technical Advisory Board.

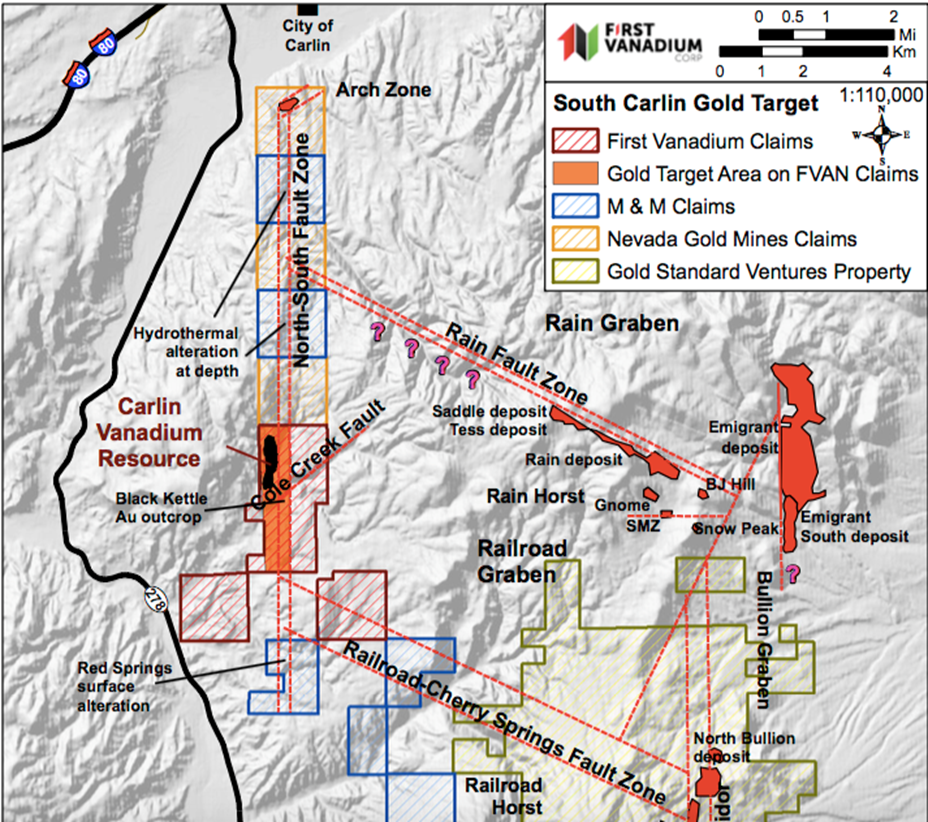

As a reminder to your readers, our vanadium property lies in the world famous and highly prolific Carlin Gold Trend, which has produced over 90 million ounces of gold. This trend is without question one of the best places on the planet to find gold. Dave has interpreted a Carlin-style, high-grade gold target at depth on our property.

Mathewson has tremendous local and Nevada statewide deposit knowledge and a big picture prospective in the Carlin Gold Trend. He's a Nevada-based exploration geologist with 50 years' experience, including 35 years conducting and managing gold exploration in Nevada. He and his exploration teams have discovered more than five million ounces of gold within eight miles of our property.

From our property data and Dave's extensive knowledge of the deposits in the vicinity, he identified, in his words, "a very real and significant gold target" supported by all the things he looks for in discovering these types of deposits —the right set of structures, geology, alteration, mineralization, host rocks and geophysical signature.

The target covers an area of ½ mile by 2 miles. Our news release of November 12th describes the target well and has a good link to a map to visualize the target relative to surrounding gold deposits. As mentioned earlier, Dave was so intrigued with this target's potential, he joined our Technical Advisory Board.

Peter Epstein: Nevada is world famous for its gold endowment. However, it typically requires a lot of time, money and drilling to delineate a meaningful resource. As a junior, how might First Vanadium move both its vanadium and gold projects forward?

Paul Cowley: Our focus remains on the vanadium resource, but we think this gold target is very compelling. Make no mistake, we need to be smart in how to advance it. With that in mind, we're looking for a strong strategic partner.

An obvious strategy would be to approach the Barrick Newmont JV (Nevada Gold Mines) whose claims border ours and are on trend, or a junior explorer, with a good balance sheet, who might appreciate an opportunity to gain exposure in the Carlin Gold Trend

Peter Epstein: Do you or your team have much experience in gold exploration?

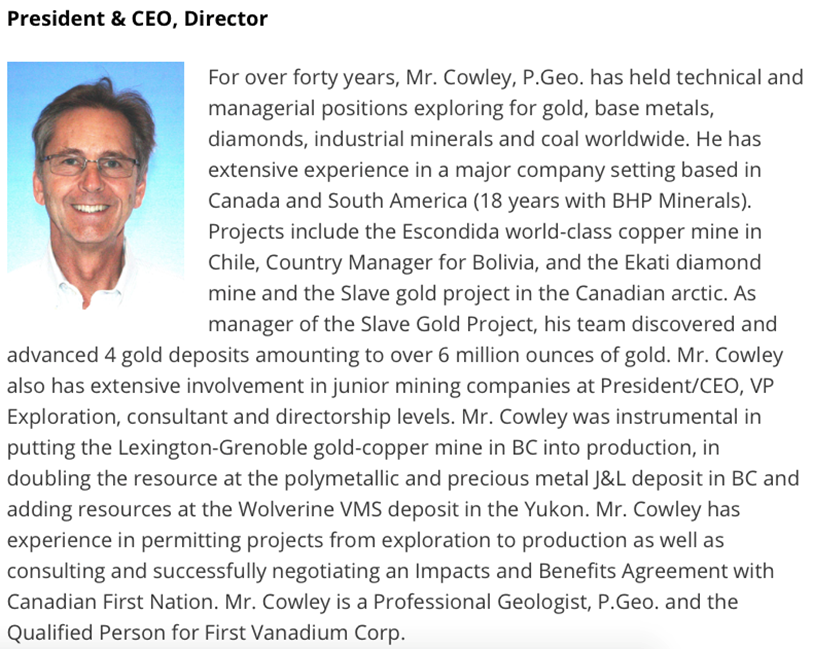

Paul Cowley: In addition to Dave Mathewson, I have 40 years' experience as an exploration geologist, principally in gold. As project manager on the Slave Gold Project for BHP, I led the team that discovered and advanced four gold deposits that amounted to over 6 million ounces of gold.

Peter Epstein: Since your gold and vanadium prospects are on the same property, could you potentially explore/develop BOTH concurrently?

Paul Cowley: There could be some synergies in both the exploration and development stages, such as in infrastructure. The two projects need not conflict with each other. The vanadium resource is envisioned to be open pit, while the gold target being at depth would be an underground scenario.

Peter Epstein: If the gold target is so exciting, why are you only now getting around to talking about it?

Paul Cowley: Good question. Look, one must be smart with your money, set priorities and decide where the money might have the biggest impact. The vanadium deposit was fairly advanced when we started. So, very inexpensively and quickly, we delivered a resource with an in-situ (in the ground) value in the billions of dollars.

Now that the vanadium resource is on a track for a PEA early next year, we have time to ponder the significance of the gold-bearing outcrops on our property as clues to something bigger. At the same time, we fortuitously connected with Mr. Mathewson, who was able to take the gold target a big step further. Now we're looking for a partner to share the exploration risk.

Peter Epstein: Thank you, Paul, for this timely update and a more detailed look at your gold target, conveniently situated at depth on your existing property. I look forward to First Vanadium's PEA on the Carlin vanadium project in just a few months.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Disclosures: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about First Vanadium Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of First Vanadium Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned no shares of First Vanadium Corp. and the Company was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this interview. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company, sector or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.