BIGGEST WITHDRAWALS ON RECORD

There is a lot of relevant information in the text below from a Wall Street Journal article dated

December 8, 2019:

“Investors have pulled $135.5 billion from U.S. stock-focused mutual funds and exchange-traded funds so far this year, the biggest withdrawals on record, according to data provider Refinitiv Lipper, which tracked the data going back to 1992.”

DOES 2019 LOOK ANYTHING LIKE THE MAJOR PEAK IN 2000?

Given we know extreme sentiment can be a powerful contrary indicator, we would expect exuberant investors to rush into stock-based investments near a major stock market peak, which is exactly what happened in the year 2000. From a Federal Reserve Bulletin dated December 2000:

“Mutual fund investors returned vigorously to equity funds, increasing the pace of net new cash flows into those funds to a record level over the first eight months of 2000.”

Keep in mind, the S&P 500 peaked in March 2000 and investors were still adding to stock-based funds at a record pace through the end of August 2000, which looks nothing like what we have seen in 2019.

HOW DOES 2019 COMPARE TO OTHER PERIODS?

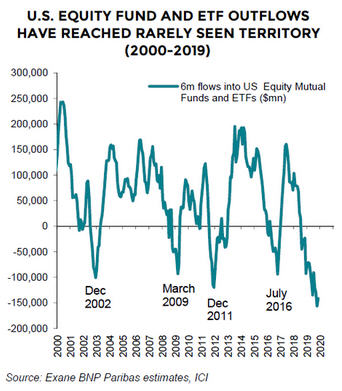

As shown on

December 2, when investors made a mad dash for the equity fund exits, it occurred near major stock market lows in 2002, 2009, 2011, and 2016.

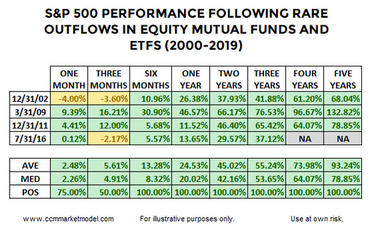

We just experienced heavy equity fund outflows in 2019, similar to the periods shown in the graph above. How did the S&P 500 perform walking forward from December 2002, March 2009, December 2011, and July 2016? The answer is in a manner that looks nothing like a major stock market top.

TEN NEW STOCK MARKET SIGNALS

This week’s stock market video covers ten “this just happened in 2019” signals. The video also takes a look at the blow-off top cases cited in a recent

CNBC article.

DAY BY DAY

The market still has trade-related hurdles to contend with between now and December 15, reminding us to walk forward with a flexible, unbiased, and open mind. The fund flows data above simply helps us with historical perspective on what has taken place in 2019. From The Wall Street Journal:

“There’s not a lot of faith in this market,” said Scott Wren, a senior global equity strategist at Wells Fargo Investment Institute. “There’s no chasing going on. Usually before you hit the top in a cycle, there’s a lot of chasing and fund flows are higher.”