- The current known global intrinsic value at RPX.V’s Wawa Gold Project is 700,000 oz of Gold grading > 5 g/t (~230,00 oz Indicated & 471,000 oz Inferred) already identified on the property in two deposit zones with over 95% of the contained ounces located between surface and 350 m depth, open at depth and on strike. Note: It is not uncommon in Canada and around the world for gold deposits to typically extend to vertical depths exceeding 2 km.

- The property hosts several former mines with a combined historic production of 120,000 oz gold. The underground developments of the historic Jubilee and Surluga mines provide access to the zones of the current Surluga resource.

- The Company has numerous gold-bearing structures identified on the property, several exploration targets at the Wawa Gold Project combined could contain up to 3.0 million oz gold.

- Entering 2020, look for management of V.RPX to make moves that will greatly improve shareholder value.

Red Pine Exploration Inc. (TSX-V: RPX) (US listing: RDEXF) (Frankfurt: VG31) is the subject of a

Market Equities Research Group Market Bulletin. Shares of Red Pine Exploration Inc. present an ideal way for investors to gain exposure to precious metals in a safe/stable mining-friendly jurisdiction, as the Company continues to build intrinsic gold value at its flagship 5,500 hectare Wawa Gold Project in the McMurray Township, 2 km southeast of the Town of Wawa, Ontario, Canada. Seasoned precious metal experts agree, when the price of gold takes off the shares of mining companies with intrinsic gold value are apt rise at multiples, several times that of the underlying commodity.

2019 saw Red Pine update the Mineral Resource estimate on its Surluga Deposit. The new underground resource represents a significant increase in grade, quality and continuity of the gold zones at Surluga, and a shift from an open-pit development plan to a high-grade underground model; a 2.7 g/t cut-off within a 2 g/t envelope, now stands at 1,202,000 tonnes at

5.31 g/t for 205,000 oz gold in the Indicated category and 2,362,000 tonnes at

5.22 g/t for 396,000 oz gold in the Inferred category. The technical report, by Golder Associates Ltd., included both Mineral Resource estimates identified, to date, on the Wawa Gold Project – the updated Surluga Deposit noted above, and the previously reported NI 43-101 Minto Mine South Deposit (105,000 tonnes at

7.5 g/t gold in the Indicated category for 25,000 oz of gold and 354,000 tonnes at

6.6 g/t gold in the Inferred category for 75,000 oz of gold).

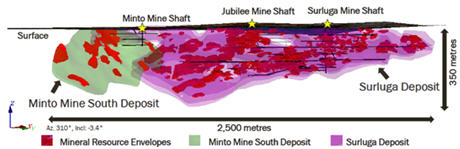

Figure 1 (above) Minto Mine South and Surluga Deposits

Figure 1 (above) Minto Mine South and Surluga Deposits. Over 95% of the contained ounces at both deposits are located between surface and 350 metres depth. Both deposits remain open at depth. The underground developments of the historic Jubilee and Surluga mines provide access to the zones of the Surluga resource.

Most recent exploration related news from Red Pine Exploration Inc.:

November 21, 2019 -

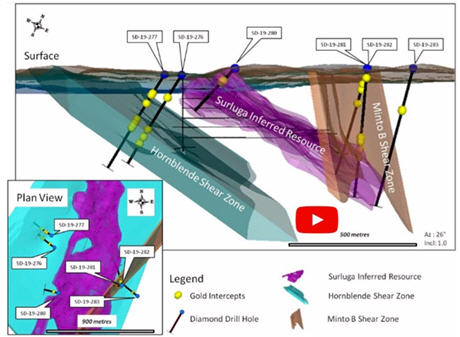

Red Pine Intersects Unexpected Gold Zones at the Wawa Gold Project - Highlights Include 2 g/t over 11.28m including 6.13 g/t over 3.15m ; Quentin Yarie, Red Pine's CEO, offered the following synopsis in the release

"Our 2019 exploration results continue to successfully extend the Wawa Gold Project resource with gold intercepts in the Surluga Deposit, the Hornblende Shear Zone, and the Minto B Shear Zone. The new gold zones in the hanging wall and footwall of the Surluga Deposit indicate that new discoveries are still possible, and continue to be uncovered, near and beyond the footprint of the current resource. Also, results to date show that the resource can not only be expanded at depth, but also laterally. We now have evidence of the continuity of gold mineralization over a strike length of 1 kilometre in the Hornblende Shear Zone and 800 metres in the Minto B Shear Zone with both zones remaining open along strike and at depth."

Figure 2 (above) 3D rendition of new gold zones intercepts

Figure 2 (above) 3D rendition of new gold zones intercepts; click to view

https://youtu.be/7d2n7s7b_uI [running time 35 seconds].

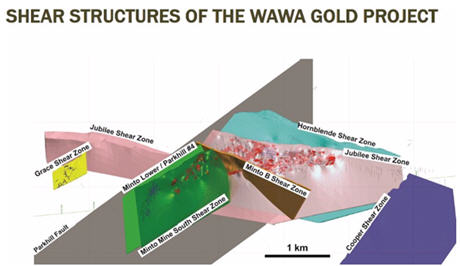

Figure 3 (above) Shear Structures of the Wawa Gold Project

Figure 3 (above) Shear Structures of the Wawa Gold Project

The current ownership of the Wawa Gold Project is 60% Red Pine Exploration, 40% Citabar LP., Red Pine is the operating manager of the Project. Should a near-term consolidation of ownership in Red Pine’s favor occur, as rumored on some message boards, this would prove additionally favorable for shareholders.

The 2020 exploration season should see Red Pine Exploration Inc. advance the Wawa Gold Project toward becoming a valuable marketable asset. Red Pine should be able to demonstrate its ability to readily extend the gold zones at depth. It is typical of mines in the area to line up a few years of initial quality mineralized material but remain operational for many decades, adding as they go, several km down over the decades.

The Company should also further demonstrate the large bigger-picture / districtwide new discovery potential.

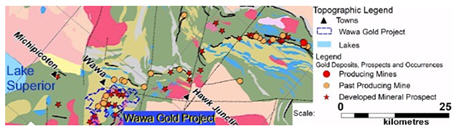

Figure 4 (above)

Figure 4 (above) map showing location of Wawa Gold Project along regional mineralized trend. The best place to find a new mine is next to a past producing one, the target-rich property is 5,500 hectares and highly prospective for new discovery.

Figure 5 (above) – Wawa Gold Project map.

Figure 5 (above) – Wawa Gold Project map. The Darwin-Grace structure is a high-grade structure located 3 km south of the southernmost extension of the Surluga Resource, and just one example of many exciting big-picture targets. The historic Drawin-Grace Mine milled over 41,300 tonnes at an average grade of 17.63 g/t Au (ended production in 1938). Highlighted 2019 channel sampling results include: 16.49g/t Au over 0.6 m, 7.56 g/t Au over 1.05 m, and3.75 g/t Au over 1.0 m.

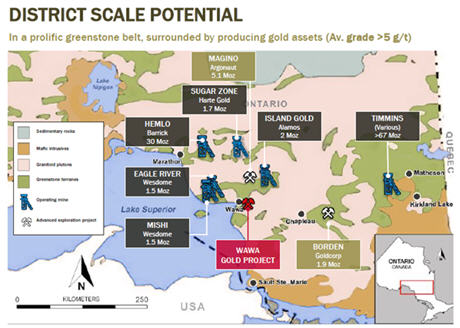

Figure 6 (above) District scale potential

Figure 6 (above) District scale potential.

Wawa Gold Project gold camp comparisons of other near-surface deposits that remain open along strike and at depth:

Magino owned by Argonaut Gold, current depth is ~400 m, total gold resource is ~2.137 Moz.

Island Gold owned by Alamos Gold, current depth is ~1,500 m, total gold resource is ~1.007 Moz.

Eagle River owned by Wesdome Gold Mines, current depth is ~1,600 m, total gold resource is ~0.416 Moz.

Now consider…

Surluga/Minto South owned by Red Pine Exploration, current depth of <350 m, total gold resource of ~700 Koz. The comparisons above are more advanced with multiple variables (difficult to compare apples with oranges between them), however comparatively RPX.V appears on sale and clearly presents opportunity at its current trading price.

Look for the market to put a bid under shares of Red Pine Exploration Inc. (TSX-V: RPX) entering 2020. The Company is building a significant gold asset and is poised for upside share price revaluation to better reflect the growing intrinsic value.

The following URLs have been identified for further DD on Red Pine Exploration Inc.:

Company website:

https://redpineexp.com

SEDAR:

click here

##

Fredrick William, BA Ec.

Fredrick is a freelance information services professional and consultant to several financial publications, he monitors and invests in the resource, technology, consumer staples, healthcare, financial, energy, utilities, and biotechnology/pharmaceutical sectors.

***

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. The author has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. The author makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of the author only and are subject to change without notice. The author assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, the author assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.