SIGN OF GROWING CONFIDENCE

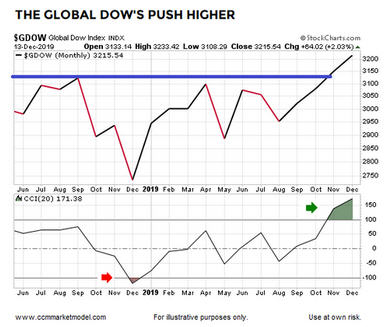

At the end of November, monthly CCI completed a momentum round trip by closing above 100 after closing below -100 in late 2018. CCI helps us track market momentum. The turn that just took place over the last year is typically associated with a significant shift from pessimism to optimism as it relates to investor perceptions of future economic and market outcomes.

HISTORY SAYS THIS SIGNAL INCREASES LONG-TERM BULLISH ODDS

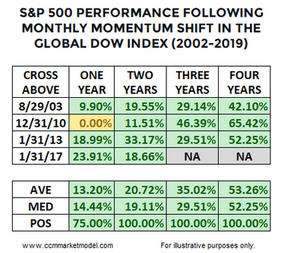

If we look at the same Global Dow chart on a much longer timeframe, we get a better understanding of the possible significance of the recent signal. The blue arrows below indicate similar turns in monthly CCI have occurred near major lows in the Global Dow. The bottom portion of the chart shows long-term S&P 500 performance was favorable following past “highly pessimistic to optimistic” moves in monthly CCI.

EVIDENCE OF INSTITUTIONAL SUPPORT FOR STOCKS

Large institutions tend to move markets. If large institutions thought the long-term outlook for stocks and the global economy was highly negative, it is unlikely the chart of the Global Dow would see a bullish turn in monthly momentum similar to what just took place over the past year. Keeping in mind this signal helps us with long-term odds, the table below shows very favorable historical outcomes for the S&P 500 looking out one to four years.

HISTORY SAYS THE S&P 500 COULD BE HEADED TO 3600

This week’s stock market video explores realistic expectations for both upside potential and volatility looking out 1-2 years.

SIGNS OF GLOBAL ECONOMIC STABILITY

The trade war has raised concerns about slowing manufacturing activity around the globe. Recent economic data from China seems to align with the story being told by the monthly chart of the Global Dow. From

The Wall Street Journal:

“There have been positive signs from other regions. In China, the private Caixin manufacturing purchasing managers index notched its fourth straight month of growth in November, bolstering the case that factory activity in the world’s second-largest economy has stabilized after a decline.”