MBH Corporation PLC (

FRA: M8H) is a company with an exceptionally fundamental concept to facilitate access to a diverse portfolio of high-motivated, high-growth, small to medium-sized enterprises (SMEs). Designed to maximize its shared value.

MBH’s primary focus is the acquisition of 100% holdings in profitable, well-managed companies within multiple industry sectors. The current three core business sectors of MBH include education, construction services & engineering services.

We’ll evaluate MBH Corporation PLC (

FRA: M8H) in this report is to determine whether it could have potential as an investment idea. Specifically, we’ll consider its annual revenue growth, current market value and future forecasts since that will give us an insight into how efficiently the business can generate profits from the capital it requires.

1. Steady Growth

The annual growth rate of MBH group holdings' revenue has been expanding steadily for the past four years. The company top line growth of 7% and EBITDA growth of 6% for this group compared to the same period last year.

REVENUE for the half-year ended 30 June 2019 totaled £21.25m which comprises revenue from companies acquired in 2018 of £15.9m and newly acquired companies in 2019 of £6.05m. The growth in organic revenue from companies acquired in 2018 was 7%.

The current assets increase by 213% or £20.91m from £9.99m as at 31 December 2018 to £31.24m as at 30 June 2019 is primarily due to an increase in cash of £3.11m and trade debtors and other receivables of £17.4m.

The Group’s shareholders’ equity increased by 6% or £1.66m from £28.34m as of 31 December 2018 to £30.01m as of 30 June 2019 is mainly due to the issuance of shares from the conversion of notes and share-based payments, and profit for the period.

Source: MBH Corporation.

Source: MBH Corporation.

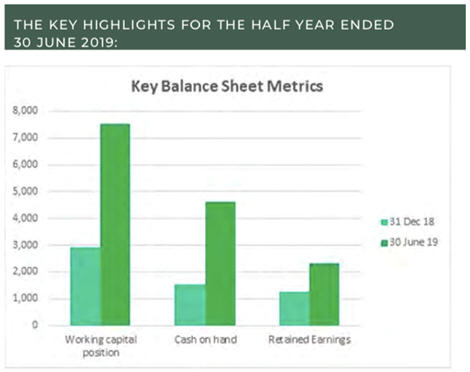

- Working capital position increased to £7.5m (increase of 158% from 31 December 2018);

- Cash on hand increased to £4.63m (increase of 204% from 31 December 2018); and

- Retained earnings increased to £2.34m (increase of 88% from 31 December 2018).

Overall, the cash and cash equivalents of the Group increased in 1H FY2019, ending the period with cash and cash equivalents of £4.38m.

2. The Future of MBH

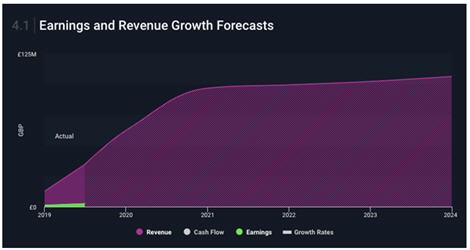

M8H is an attractive stock for growth-seeking investors, with an expected earnings growth of 24% in the upcoming year. M8H's revenue (17% per year) is forecast to grow faster than the German market (4.9% per year).

Source: DB:M8H Earnings and Revenue Growth Forecasts.

Source: DB:M8H Earnings and Revenue Growth Forecasts.

This increase in bottom-line is influenced by equally impressive top-line expansion over the same period, which is a permanent driver of high-quality earnings, as opposed to net cost-cutting activities.

M8H is currently trading below its actual value, meaning the market is reducing the company's expected cash flow. This misconception gives investors an opportunity to buy into the stock at a cheaper price than the price they received, should the analyst consensus forecast be correct. In addition, M8H's share price is trading below the group average, relative to the rest of its peers with similar levels of earnings. This promotes the proposition that the price of the M8H is currently discounted.

3. MBH growing its market shares outside of UK

“It’s always easy to forget the age of something, particularly when you have been heavily invested for a long period of time,” says Allan Presland, a non-executive chairman of MBH Corporation PLC.

MBH Corporation PLC only reached its listing on the Frankfurt Borse a little on 7 months before the date of this statement, and yet its growth is significant.

Three main companies of this group, Parenta, Cape and Acacia have continued to thrive within their new listed environment. It has added four more companies du Boulay and Guildprime within the Construction Services Vertical, International School of Beauty to our Education Vertical, who are all based in the UK, and APEV to our newly formed Engineering Vertical, based in south-east Asia. As a result, the company’s total revenue has increased from £ 37m per annum at the end of 2018 to £97m per annum, and an additional £6m has been added to EBITDA.

The group now has assets in Education, Construction Services and Engineering, and our geographical spread extends from the UK to New Zealand, Singapore, and Papua New Guinea.

However, this is just the beginning. The company’s ambition for additional acquisitions of EPS will continue this trend. For that, the MBH group welcoming new industries to expand their values to other regions or sectors.

Watch Out Company Future Development

MBH’s future expects is to driving organic growth, engaged new global investors, and using an acquisition strategy in order to build a diversified portfolio of excellent companies and talented entrepreneurs, giving investors unprecedented access to profitable businesses.

MBH is always open to welcoming new industries if attractive opportunities arise, and are willing to expand into other areas.

MBH is building a value-added SME portfolio of profitable businesses with excellent growth prospects, enabling business owners to grow and grow their businesses organically in a plc environment. This enables the principals of a publicly listed company to continuously develop and improve their products and services.