Since gold’s spectacular run last summer, it has surged even higher to nearly $1,600/oz.

After waiting so patiently for gold to rise above its 2013 high, it might be tempting to take your minimal profit and run.

Or, following the slight dip and stagnation in late 2019, it’s easy to get nervous about entering the market in the first place.

But if historical precedent is any indication, there is a lot more money to be made.

Especially if you’re investing in gold the right way.

Your profitability in the gold market heading into 2020 requires having the answers to these three questions:

- Is this rally ever really going to take off?

- What’s the best way to get in on the action?

- When exactly will this cycle end?

Analysis will tell us company specific details.

Macro research will tell us the overall direction.

But one of the most important indicators is sentiment.

And there’s no better gauge of sentiment than a conference solely focused on resources – the 2020 Vancouver Resource Investment Conference – that’s happening this weekend.

This is a special conference for me personally. It’s where I met my wife.

In fact, this VRIC will be my 20th in a row. The first time I met Rick Rule at this conference, he was my age that I am today. And now, I am always on the lookout for the next superstar young gun.

I’ve been co-producing VRIC with Jay Martin and the young guns at Cambridge House for the last half decade. Time sure flies while you’re waiting for a bull market!

There have been lean years where Bitcoin and Cannabis were kings. But now that pendulum is shifting to precious metals… in a big way.

If conference attendance is any indication, the pre-registration tickets are through the roof and the attendance is at sellout capacity for one of the biggest conference venues in the entire city.

But that doesn’t mean it’s the peak…

The Real Gold Bull Market Is Yet to Launch

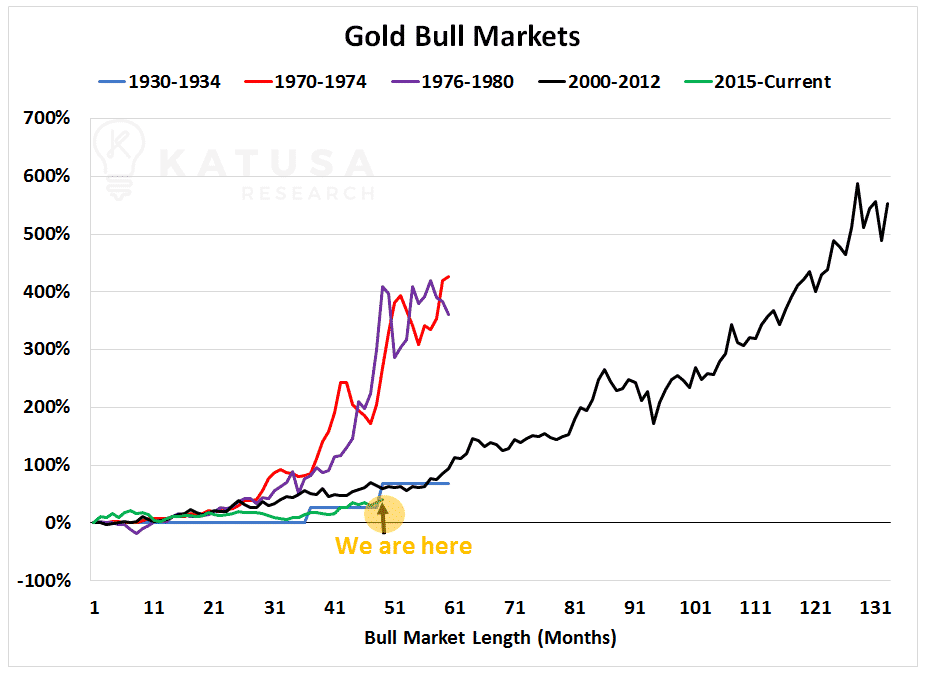

The gold market has always moved in cycles—from dramatic boom to overnight bust, and eventually back again.

So far in this “boom,” gold has barely risen 20% from its floor.

That’s not even close to the minimum required to qualify for a true “bull market” over the past century.

- The smallest gold run-up in the past 90 years was 45% from 1930-1933—more than twice the current gain.

The other rallies were far, far bigger: from 1972-1974, the rally yielded a 100% gain.

From 1978-1980, another 100% gain. Then from 2007-2010, a 67% increase in the price of gold.

The point is this: when gold is ready to rise, it takes off.

Every single one of the years in the date ranges above saw an increase of more than 20%. What some investors might see as slipping backwards may just be the cycle getting ready for its next natural advance.

- So if you’re a subscriber to my Boom-Bust-Echo theory, then you know the gold rally has barely just begun.

The biggest profits still lie ahead of us.

Savvy investors will patiently hold, before finally selling near the peak of the boom.

For example, many major gold producers right now, such as Kinross, Gold Fields, Alamos, and Eldorado are trading around $5-6.

(Gold Fields is up nearly 190% from its lows 14 months ago – and that’s a $5 billion company!)

These stocks could easily be sitting at doubles a year or two from now. And the juniors’ percentage returns will likely be an order of magnitude greater.

It might be hard to believe that gold stocks could see gains of 500% or more in the next couple years. It was equally hard to believe in 1933, 1972, 1978, and 2007… but it happened every time.

Why Gold Is a Bad Investment When “This” Happens

During a gold rally, you might be tempted to invest directly in gold bullion.

There are many reasons why that’s not the best way to invest, including the persistent strength of the U.S. dollar. Have some bullion exposure.

But another really big reason is the potential for extreme leverage with gold stocks.

Look at what happened to gold in the ‘70s…

It took off early, cooled off a bit in the mid-‘70s, then hit the afterburners headed into the latter part of the decade.

On December 31, 1978, gold was at $226 an ounce.

On January 21, 1980, it maxed out at $850 an ounce.

That would be like gold going to $5,641 by the time the next U.S. President is inaugurated. If it happened forty years ago, it can happen again.

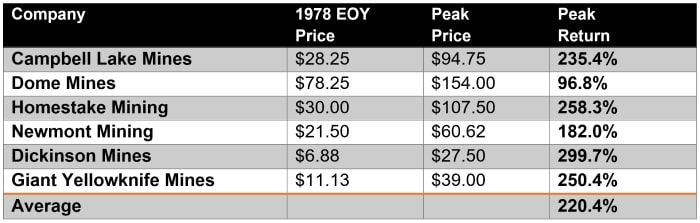

Now, digging up information on tiny gold producers from the early ‘80s is no easy task. Most of the information was not digitized then.

But here’s data we put together below on a few producers that the Katusa Research team found, along with the percentage returns at their peak:

Table 1. Gold Producer Returns, 1979-1980

That’s an average of a 220% gain.

Of course, it’s only the lucky investor that’s going to catch it right at the top.

But suppose you could capture 75% of those gains. That’s still a 165% return.

Buying into gold stocks instead of gold takes luck out of the equation. But we still haven’t mentioned where the real gains are to be had.

The ones that turn a modest portfolio into your whole retirement plan.

And how you can beat the GDX returns by over 200% or more.

Next week, I will reveal the kind of stocks that really move your net worth needle. And my team and I will see many of them front row center at the 2020 Vancouver Resource Investment Conference with over 350+ companies in attendance.

This year we have a world-class line up you don’t want to miss…

Peter Schiff, Lord Conrad Black, Ross Beaty, Raoul Pal, Grant Williams, Brent Johnson, Rick Rule, Frank Holmes and many, many more.

My team and I will have our boots on the ground on the conference floor and on the stage, interviewing companies and meeting with key management behind the scenes.

I’ve spent many years in this gauntlet and know exactly what to look for in a great opportunity and speculation.

I encourage all Katusa Research subscribers to attend if they’re in the area and to come say hello.

For more information on the event, click here.

To get complimentary tickets, go to the registration page right here and then enter code “katusa100”

Regards,

Marin