Chris Temple, editor and publisher of

The National Investor, explains why he recommends this small-cap as a Buy.

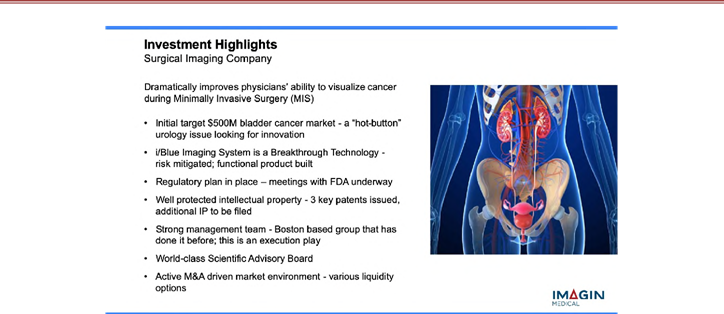

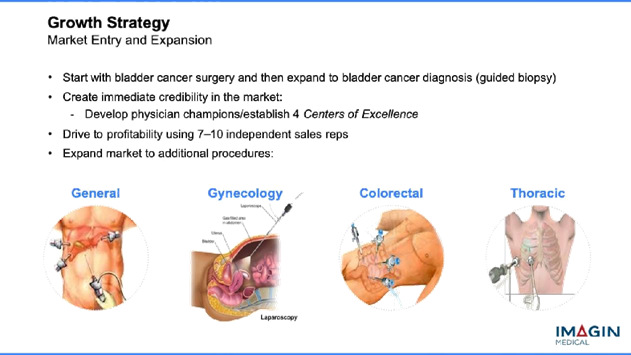

- Imagin Medical's disruptive technology is poised to deliver the most significant advancement in bladder cancer detection and removal in decades, making the detection and removal of cancer FAR more efficient and effective.

- Already, Imagin's i/Blue Imaging™ System is being embraced by urologists, most recently at the American Urological Association's annual meeting, held in May in Chicago. Imagin held private focus groups, where leading urologists assessed the initial functional product and provided overwhelmingly positive feedback that was used to finalize the i/Blue product user's needs.

- So compelling is Imagin's proprietary technology and potential benefits for both medical professionals and especially patients that leading urologists have even invested in Imagin Medical!

Whether in bull or bear markets, long-term success for individual investors has always primarily come from discovering and buying good companies when they are cheap.

Sometimes it's a household name or some other large company that for a time is "unloved" for whatever reason on Wall Street. Many a time, we have picked off such companies at a low level and done quite well.

The real fun, though, is when we can find a company that almost nobody knows about.

Advances in science and technology. . .more efficient means of transportation and communication. . .pending CURES for diseases rather than just better treatment. . .and so many more themes are continually sought after. When you find the right combination of management, support, market need and the rest in a young company, the rewards (and not just monetary) can be astounding!

As I teach in a FREE tutorial on stock picking/research (easily accessible on my website), sometimes great investment ideas are right under our noses one way or another as we go about our everyday lives. Who among us, for instance, does NOT remember the decades-long run of the late actor and comedian Jerry Lewis and his annual Labor Day telethons? For many years our hearts broke for "Jerry's kids" who were beset by one form or another of the scourge muscular dystrophy.

Years ago my "homework" brought me into contact with a tiny biotech start -up whose science on RNA-based therapeutics showed great promise. Sure enough, shares of Sarepta Therapeutics hit the big time back in 2012, when trials in adolescent patients who have Duchenne muscular dystrophy actually showed that Sarepta's drug was allowing some of them to produce dystrophin and GROW muscle tissue!

Such a breakthrough as this had never before been seen. Sarepta has now gone from the tiny, largely unknown company it was when I first ran across it to, now, a multi-billion dollar biotech leader. Our members who followed my recommendations on Sarepta have made GOBS of money. More so, we have the satisfaction of being part of a great STORY that is changing lives for the better!

Biotechnology and other medical and health-related breakthroughs, from an investment perspective, are not only exciting and potentially VERY rewarding. They are opportunities as well that have little if anything to do with the broader economy and stock market. So arguably more than in any other sector of the market, health care/biotechnology companies are driven chiefly by their success. . .or failure.

As this is written I have other "story stocks" in this sector among my recommendations: companies working on everything from Alzheimer's disease (a "return trip" in this one as well, after quadruple-digit gains here, too, a few years back!), to a potential reversal of type one diabetes.

And in the medical device/technology area, we have Imagin Medical.

Imagin—a company I have already recommended to my members at The National Investor—is working on one of the most disruptive new technologies for medical devices in many years.

Chiefly, its technology holds the promise of leading to the most efficient detection and removal of bladder cancer of anything the industry has seen in some 30 years. Managed by a team with past success already in bringing transformative new products to market, Imagin has already been embraced by key urologists and opinion leaders in that industry. Some of them have already become shareholders of Imagin Medical to boot!

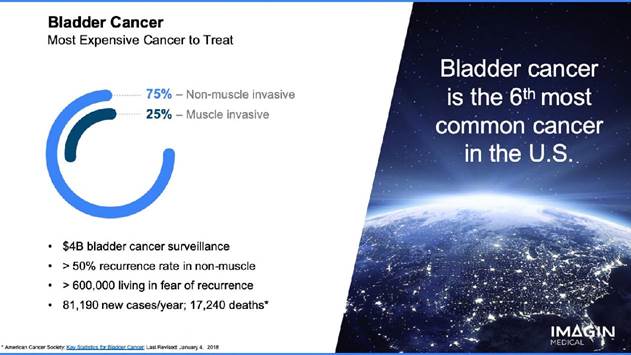

The need for a better, more efficient, modern standard of care is indisputable. Bladder cancer is the sixth-most prevalent cancer in America. One reason for its recurrence in too many patients is that the medical profession is, quite simply, using dated technology to detect bladder cancer in the first place. Imagin's i/Blue Imaging System has the potential to be a game-changer in this area!

As I write this, the company has just had its second key meeting with the U.S. Food and Drug Administration.

On the home page of its website, Imagin Medical bills itself as a medical device and—more—so technology company that is, ". . .focused on establishing a new standard of care in visualizing cancerduring minimally invasive surgery. . ."

As I have rolled up my sleeves and come to get to know Imagin better, the company—which intends to initially focus on bladder cancer—seems to have an imaging technology and platform that is at the same time revolutionary . . . yet quite simple and common-sense. The concept has already shown a better ability to detect cancer and allow urologists to be more certain that they have completely removed it in a procedure.

I'll quickly explain the current technology here, on the way to explaining how Imagin's i/Blue Imaging System—if commercially successful—would be such a benefit to both doctors and patients.

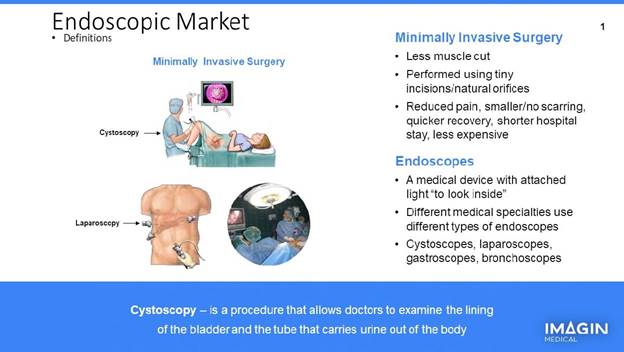

Surgical practices have advanced tremendously over the years with advances in technology and know-how. For many procedures, it was once common to open up a part of the body—say, an abdomen—and take care of what needed to be done. Among the things this meant was a longer hospital stay and a longer time to recover and heal following such an invasive procedure.

For almost everything, this has been replaced by minimally invasive surgery (MIS). Advances in optical technology especially have effectively allowed small cameras mounted on endoscopes to be inserted in pretty much any area of the body, whether to take out cancerous tissue, repair a hernia or what have you. Once the necessary procedure has been identified via the endoscope (which comes in many shapes and sizes, but all of which pretty much work on the same principles) the procedure—for our purposes, the identification and removal of bladder cancer—can also be accomplished more simply than in the past.

In light of this, I'm sure you won't be surprised to learn that globally, nearly $50 billion a year is spent on endoscopic procedures. This is not always to treat maladies or to eradicate cancerous tissue, but sometimes to confirm that further medical attention is not needed.

Where bladder cancer is concerned—the single most-expensive cancer in North America to treat—more than $4 billion per year is spent in the U.S. alone just on bladder cancer surveillance using the current generation's imaging technology.

It is in this area that Imagin is focusing its technology to make this surveillance—and what the patient has to endure—easier, more efficient and more successful.

When I first had the opportunity to visit at some length a while ago with Jim Hutchens—the C.E.O. of Imagin—I was surprised to learn how in one sense the current technology and products in the market can often fall far short in easily and accurately identifying some cancers and tumors. Indeed, Hutchens quipped that "It is shocking to me how dated it is," meaning the relatively primitive optics and lighting currently used to "see" bladder cancer and tumors.

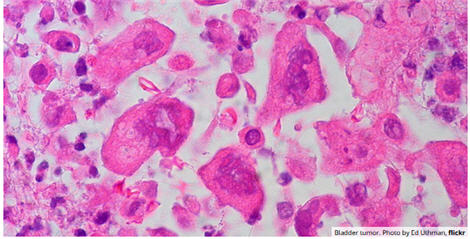

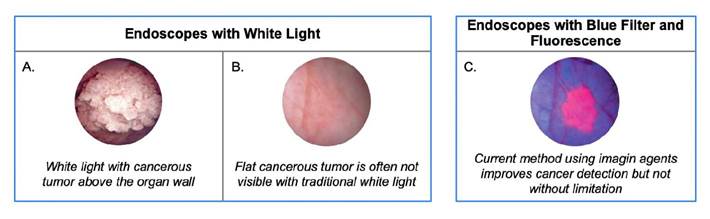

In typical white light cystoscopy, a fiber bundle or small camera is mounted at the end of an endoscope—or cystoscope in the case of bladder cancer—and enters the body. These scopes are delivered through the urethra and into the bladder to project clear images; essentially, any tumors that protrude above the wall onto a monitor that the surgeon then evaluates for possible removal.

The first challenge of using white light is that a surgeon cannot easily differentiate flat or tiny malignant and premalignant tumors from normal tissue or see the borders/margins of the tumor. Consequently, some cancer cells may remain behind undetected after a procedure. Using this dated technology even now is a contributor to the high recurrence rate of over 50% for bladder cancer.

The "remedy" to this point has been the use of a "blue" light in conjunction with fluorescing imaging agents. The agents are absorbed by the cancerous cells in the bladder. When exposed to blue light, they fluoresce, improving the surgeons' ability to detect flat cancers and visualize the margin for removal.

The challenge and shortcoming here, though, is that a urologist/surgeon has to switch back and forth between the white and blue images to figure out what is going on. The white light image shows the full landscape of the bladder but doesn't highlight the cancer. The blue light shows the cancer but doesn't show exactly where it is, so the surgeon loses orientation. In addition, the current technology gives the surgeons only one image at a time on the monitor, so they have to switch back and forth between the two and compare them from memory to remove the cancer.

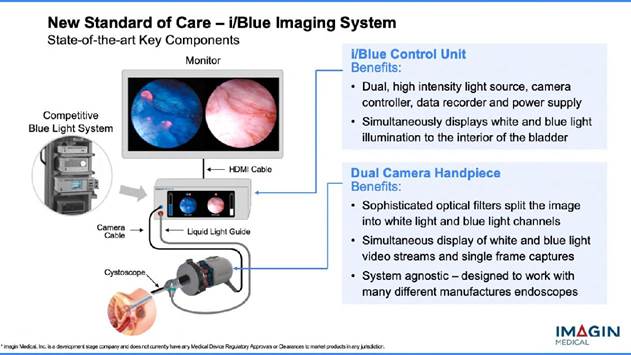

The i/Blue Imaging System addresses this problem because it shows both images on the monitor at the same time, side-by-side, and in real-time. So now, the surgeon won't have to switchback and forth and rely on memory to locate and remove the cancer. The procedure has the potential to make bladder cancer detection and removal more efficient and faster, as well as dramatically reduce bladder cancer recurrence rates.

Another ground-breaking aspect of Imagin's technology is the consolidation of instrumentation. The current blue light method needs a system tower that houses multiple units, including the light source, camera control unit and the video data recorder. The i/Blue Imaging System, on the other hand, using state-of-the -art technology, combines these three modules into one device , taking up a much smaller footprint. The current system is purchased as a "bundle" and, depending on accessories, can cost well over $100,000. The basic bundle includes the system's three units along with the company's proprietary hand-held "blue scope" with its built-in camera, the only scope that can be used with this system.

Imagin, however, plans to sell one System Control Unit and package it with a Dual Camera hand piece (see above). Special "blue scopes" are not needed because the i/Blue is "system agnostic," which means a medical professional can use practically any endoscope that he/she already has together with Imagin's superior imaging technology/platform. So not only does the addition of Imagin's breakthrough technology to existing endoscopes provide transformative NEW efficiency, but with a smaller “foot print” and at a lower cost for the industry! (NOTE: Imagin Medical already has three issued patents—with others pending—on this technology/I.P.–Intellectual Property.)

Stressing the relative simplicity of basically adding its own technology—the i/Blue Imaging System—to the current standards of care/usage in endoscopy, Hutchens reiterated, "We are not in the endoscope business. Our product consists of a dual camera hand piece that houses a micro camera with sophisticated sensors and filters that attaches to endoscopes already in the market and our proprietary consolidated imaging unit. This combination allows us to put both images on the monitor, in real time, simultaneously. This was well received in our focus groups." (Emphasis added.)

Indeed, a very upbeat Hutchens pointed out when he and I spoke recently how important the feedback was that the company received this past spring at the American Urology Association's Annual Meeting in Chicago. Imagin held private focus groups where leading urologists assessed the company's first initial functional product and provided feedback that was used to finalize the i/Blue product's user needs.

COLLABORATION WITH OPTEL; AND JAY EASTMAN

Again, Imagin is not trying here to totally "reinvent the wheel." It is simply adding cutting-edge imaging technology to make the "wheel" now used in cancer detection and removal more efficient than anything that has come around now for many decades. To that end, it's hard to overstate the importance of CEO Hutchens and his team joining forces with such an elite company as Optel.

Notably, Optel is headed up by Dr. Jay Eastman. You might recognize that name, especially if you—as I am—are from upstate New York and/or know the histories of the legendary companies that made that state their home, such as Eastman Kodak.

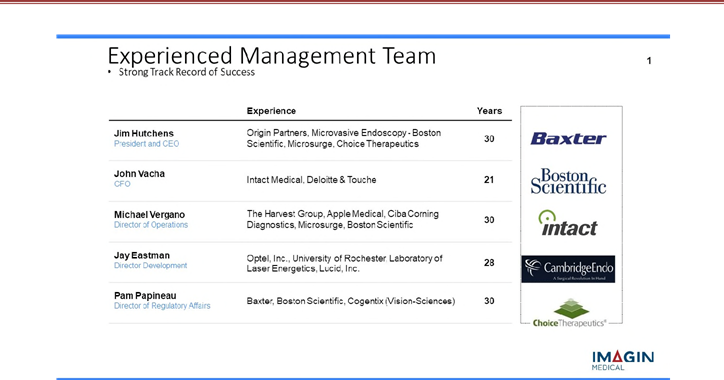

An industry leader, Dr. Eastman—who serves as Imagin's Director of Development—has a Ph.D. in optical design. Those talents are helping move along the i/Blue Imaging System to ultimately bring this disruptive technology to the endoscopy market. You can learn more about Jay in a video interview and here, for some biographical information.

Imagin seems well positioned to use its protected Intellectual Property (specifically where i/Blue is concerned, in its process for simultaneous/parallel acquisition of images and combining them into one monitor) to first exploit the "low-hanging fruit" of the bladder cancer area. Notably, the company obtained much of this technology and patents from California's prestigious Lawrence Livermore Lab. Indeed, a confident Hutchens recently mentioned to me, "This market is really ready for innovation. . .they know they're behind."

OVERALL MANAGEMENT TEAM WITH A PROVEN TRACK RECORD

What's especially nice to know here—apart from the company's progress to date in moving toward development and commercialization—is that this is "not the first rodeo" for Imagin's management. Looking at the success of Hutchens and others in the medical equipment space overtime—and that added heavyweight name/stature of Dr. Eastman in the optical space—makes Imagin a compelling story of a potential breakthrough technology being shepherded forward by experienced hands.

President and CEO Hutchens' own background with the likes of Boston Scientific (NYSE-BSX), particularly in the medical device arena, demonstrates that he knows the ropes in developing and bringing to market new and better technology and products. Among his other past accomplishments aside from serving as an executive at BSX, he founded two other medical device companies. Further, Hutchens (at left, as he spoke last Fall at our Chicagoland investment conference) has bolstered research staff now at Imagin to strengthen the process and development regimen for the i/Blue Imaging System ahead of its recent meeting with the FDA as well as in anticipation of making the hoped-for approval process stronger.

John Vacha, Imagin's chief financial officer, does not just add financial and administrative acumen. John has 20 years of experience in the healthcare field as well. Among other accomplishments, he holds two patents in electrosurgical administration and has as well brought a medical device company from start-up phase to acquisition, in that latter instance, serving for seven years as president, CEO and board member of Intact Medical Corporation before it was acquired by Medtronic, plc (NYSE-MDT) in 2017.

Among other key people, Imagin has brought on board Pam Papineau as sirector of regulatory affairs. Ms. Papineau has over 30 years of experience in quality and regulatory affairs with Baxter, Boston Scientific and Cogentix (Vision-Sciences) and has served as a consultant on a wide variety of devices that includes endoscopy, imaging, GI/GU, orthopedic and cardiovascular. She has successfully prepared dozens of FDA premarket submissions and European Union (EU) technical files.

A key medical advisor to Imagin is Dr. Ashish Kamat. He has been named by Expertscape as the world's the top-rated expert in urinary bladder neoplasms. Dr. Kamat has extensive experience with cystoscopic procedures, has been a principal investigator for multiple oncology and urology clinical studies for both drugs and devices, and has been involved in blue light cystoscopy studies since 2007. Dr. Kamat is an Endowed Professor of Urologic Oncology and Cancer Research at the University of Texas MD Anderson Cancer Center (MDACC); Associate Cancer Center Director, RFHNH in Mumbai; and President of International Bladder Cancer Group (IBCG) and International Bladder Cancer Network (IBCN).

I encourage you to visit here for an even more complete background on all of the company's management and advisers.

DEVELOPMENT PROGRESS; WHAT COMES NEXT

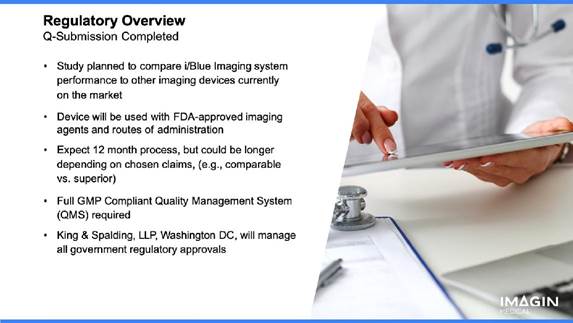

Like all medical device companies, Imagin's fate will be determined by ultimate FDA approvals of the i/Blue Imaging System, its eventual design tweaks and then manufacturing of that system. This is why Hutchens early on knew he had to assemble such a top-flight team, one with direct, hands-on medical device experience in moving products from concept through development to commercialization, including managing the FDA process.

On September 26 Imagin announced that it had met with the FDA for its second so-called "Q-Sub" meeting. "We are pleased with the feedback we received from the FDA during our second meeting to discuss i/Blue's regulatory path," said Hutchens. "We will continue to collaborate with the Agency as we move closer to our submission package."

The company had already announced progress back in July—bolstered, in part, by feedback from that May meeting/focus groups—that its i/Blue product has entered the verification stage of the medical device design control process.

Along the way, a University of Rochester Medical Center 10-subject investigator-sponsored research study had led to some key redesign work of i/Blue. Imagin, in conjunction with Optel, furthered the refinement of the product, essentially from a "clunky box" to the streamlined unit that received such a positive reception back in May at that American Urological Association conference.

Said Dr. Eastman along the way, "The lessons learned from the URMC Research Study has provided valuable technical data, clinical insight and physician feedback that has significantly influenced the design of the i/Blue System. All of this information increased our confidence that the miniaturization, imaging quality and cost reduction goals for the i/Blue System are important to surgeons performing bladder cancer procedures."

These design improvements will ultimately allow a surgeon/urologist to be more efficient in their work, and that—of course—is the whole point. And there's something else: that is, Imagin hopes a successful development and commercialization of a superior and cost-effective system will bring the i/Blue Imaging System into practitioners' offices as well. Greater efficiencies and a better standard of care still could be effected by urologists having such a state-of-the-art and quick system on hand outside the operating room, whether for initial examinations or post-procedure follow-ups.

Now, Imagin is moving forward to finish final design and manufacture of the initial i/Blue functional products, along with the necessary documentation to support them, over the coming few months (hopefully, in fact, prior to the end of 2019.) If all goes well and there are not any unforeseen delays, the company believes it can have a final product ready for commercialization and approval by late 2020. Thereafter, sales and revenue could commence very soon.

A COMPELLING INVESTMENT THESIS AND "RISK-REWARD" DYNAMICS

For any start-up/research-oriented company, a LOT has to go right. More companies over time fail than those which succeed for one or more reasons: everything from inept management and a lack of money to see things through, to the lack of legitimate expertise in its area, to misreading the need for its product/technology and more.

In the case of any such company—and realizing the general inherent risks of investing in such small companies—I always advocate we approach them and make investing decisions simply as Benjamin Franklin would have done. Franklin famously advocated that in any important decision, one simply write opposing pros and cons on a piece of paper opposite one another—weight them as necessary, as to importance—and make a decision based on the preponderance of either positive or negative factors.

In my view, making a decision in this way as to investing in Imagin Medical's shares is no contest, as the pros as I see them significantly outweigh the cons. Management knows what it is doing, in part due to its past experience. It has world-leading, cutting edge technical know-how, especially in the persons of Dr. Eastman and Dr. Kamat.

Most important, what Imagin is working toward is final FDA approval and commercialization, not in and of itself insurmountable. Keep in mind that the i/Blue Imaging System is simply adding its superior optical technology and far greater efficiency/utility to blue-light endoscope techniques that the F.D.A. has already approved.

Still, by their nature, companies involved in most any kind of research and development such as this are deemed to be speculative. Until Imagin has an approved product(s) for commercialization and the game plan/means to begin selling it to the industry, the company has no revenue, let alone a profit. Thus—as much as this is a compelling story—even an Imagin Medical is not a company that you put your grocery money into!

That said, there certainly does appear to be a great potential reward here to go with the usual risk. As of this writing, Imagin has a market cap of a tiny C$7 million, or about US$ 5.4 million. Compare that against—first—the US$4 billion market on bladder cancer scoping alone; not to mention that—if successful here—Imagin may well be poised to proceed to disrupt other segments of the endoscopy market.

There are two main risks as I see them:

1. The FDA – There is no guarantee that the company's expected time frame will be realized. It may end up being a bit longer before commercialization is achieved. But the seeming risk would be one more to do with delay to satisfy the agency, not anything fundamental that calls into question Imagin's technology.

2. Funding – Still topped up for now following its most recent cash injection late last year (including the exercise of prior warrants, largely by management and "insiders"), it's likely that by the middle of 2020 Imagin will need to go back to market to raise money. With shares on their back foot due to both some investors becoming impatient and the typical tax-loss selling that hits this time of year, any such financing to come could be dilutive of existing shareholders.

With its team, technology, progress and the rest, though, I think it's much more a question of that than any worry over Imagin being able to raise money at all. And in any case, some dilution to come or not, Imagin's market cap and share structure even afterwards will STILL be dwarfed by the potential upside, market penetration, etc.

In making a decision on my part to recommend Imagin Medical—and on your part to invest in it—it's VERY nice to know that we are joining as shareholders medical professionals including Dr. Stan Swierzewski, chief of surgery and director of urology at Holyoke Medical Center in Massachusetts, and Dr. Roger Buckley, division head of urology at North York General Hospital in Toronto.

To say the least, when the potential customers for Imagin's iBlue System are so excited about what it will do for them and their patients that they want to invest in the company personally, it's a vote of confidence the likes of which you don't always see!

Said Dr. Swierzewski PUBLICLY about his own investment decision (investing in a private placement in Imagin in April, 2018),

"As a practicing urologist, I invested in Imagin because I have a duty and responsibility to advance any improvements in treatment and technology that will benefit my patients and save lives. Current technology is cumbersome and time consuming. . .making it less effective as a screening or follow-up tool. Bladder cancer patients are basically monitored for life with in-office cystoscopies which are not effective in differentiating between inflammation and cancer. To be safe, we perform surgery on many patients which often turns out to be negative. Imagin's i/Blue technology, given its potential speed and sensitivity, will help us assess the patient's condition more quickly and accurately and avoid unnecessary surgery. It will also make necessary surgery more successful, ultimately saving lives and reducing medical expenses. I'm confident that using the i/Blue system will become the (new) standard of care. . .I cannot wait to use this technology in treating my bladder cancer patients."

This is all why Imagin Medical is rated as a speculative "BUY" in The National Investor!

I will, of course, have ongoing updates on the company as warranted, whether in my twice-monthly newsletter or, as appropriate, any of my between-issues shorter alerts. For more information, you can visit me at The National Investor.

And, of course, you should do your own due diligence on Imagin Medical directly, starting at the company's website.

A Reminder. . .

HOW TO PURCHASE SHARES OF IMAGIN MEDICAL IF YOU ARE A U.S. INVESTOR USING A U.S.-BASED BROKERAGE ACCOUNT

For those of you who are not already used to buying shares of companies such as Imagin Medical that are listed primarily in Canada, I want to give you a quick and easy "tutorial." It's MUCH easier than you think, if you have never done so, to buy such companies in any U.S. brokerage account. Indeed, as I have explained in one of my investor tutorials, it's just as easy and inexpensive to buy shares in an Imagin Medical as it is to buy Apple!

Many larger Canadian and other foreign companies have primary listings on more than one major exchange. For those listed on the New York Stock Exchange or the Nasdaq as well as Toronto, you need only buy/sell using the U.S. market. Generally, there would be no reason to check prices and such on the Toronto Exchange first.

More often than not, smaller companies—for both cost and logistical reasons—do not LIST their shares on a major U.S. exchange. But they are still easily TRADABLE in the U.S. via the NASDAQ's OTC Market. All you need to know is the company's symbol; unlike most U.S.-listed companies, it will always be a five-letter symbol ending with an "F."

In Imagin Medical's case, its ticker symbol in the U.S. is IMEXF , while on the Canadian Securities Exchange (CSE) it is IME. (NOTE: The CSE in Canada is the functional equivalent of the U.S. OTC market.)

The main consideration in buying shares of Canadian stocks via the U.S. OTC market is that SOMETIMES—if you look at the OTC quote FIRST—you are not getting as fresh and accurate a price as you would if you went to the Canadian Exchange. This is because with most, the majority of their activity is on the Canadian market where it is listed; sometimes hours can go by between trades on the OTC, if the company you're looking to buy isn't actively traded at the time. Thus, you simply need to insure, via a simple process, that you are neither overpaying for a stock when you buy it, nor getting less than you should when you sell. That is easy to accomplish.

The most reliable and current quotes for shares of companies such as Imagin are to be

found first on the Canadian Exchange where they are primarily LISTED. Prices and volume activity are updated all through the trading day on the Toronto Exchange, TSX.V and the CSE (again, the equivalent of the U.S. OTC market), just as they are on the NYSE or NASDAQ, and are generally fresh/instantaneous.

I will use the following example to show the simple process that will normally take you LESS THAN TWO MINUTES to enter a trade to buy Imagin's stock via the OTC market in the U.S., in a typical U.S.-domiciled brokerage account:

1. First check the Canadian quote for the company, via its ticker symbol on the CSE, IME. You'll find this at the Exchange's website. Plug in "IME." We'll say for purposes of this lesson that the current asked price for IME's shares is C$0.06, or 6 cents per share in Canadian currency.

2. Next determine what that price is in U.S. currency. If you don't follow exchange rates on a daily basis, you can get a fresh picture by going to Kitco's website, at www.kitco.com (or your own favorite one that lists currency differentials; there are many.) Near the bottom of Kitco's front page, you will find a table of various currency exchange rates. At this writing the Canadian dollar, rounded off, is worth 76.9 cents in U.S. currency.

3. Do the math as to what IME's U.S. asked (selling) price on the OTC market should be:

C 6 cents per share X .769 = US 4.61 cents per share.

4. Finally, enter a LIMIT ORDER to buy the number of shares of Imagin you want in your U.S. brokerage account at or very near that price. Personally, I would first start with US 3.9 cents per share; as of this writing, Imagin has a respectable amount of activity/liquidity on the OTC market for a company its size. If the order doesn't fill right away, bump it up by a tenth of a cent once or twice until it does (these days, most online brokers will allow you to use tenths of a cent in pricing.)You would use the company's 5-letter symbol, which is IMEXF.

It's that simple! And, of course, you would do much the same thing when it was time to sell some of your holdings. But in the case of a sale, you would focus on the bid price listed on the CSE's site for the company in question.

Don't forget that those of you so inclined can follow my thoughts, focus and all daily.

* On Twitter, at https://twitter.com/NatInvestor

* On Facebook at https://www.facebook.com/TheNationalInvestor

* Via my (usually) daily podcasts/commentaries at https://www.kereport.com/

* On my You Tube channel, at https://www.youtube.com/channel/UCdGx9NPLTogMj4_4Ye_HLLA

Chris Temple is editor and publisher of The National Investor. He has had a more than three-decade career in various areas of the financial services industry. Temple is a sought-after guest on radio stations all across America, as well as a sought-after speaker for organizations. His commentaries and some of his recommendations have appeared in Barron's, Forbes, the Dick Davis Digest, Investors' Digest, PrudentBear.com, Kitco.com, the Korelin Economics Report and other media.