Two Analysts See Company as a Buy for 'Game-Changing' Potential in Bladder Cancer Detection and Surgery

The disruptive technology is 'poised to deliver significant advancement in bladder cancer detection.'

Imagin Medical Inc. (IME:CSE; IMEXF:OTCQB) is developing technology that can greatly improve the ability to visualize cancer during minimally invasive surgeries. Its i/Blue Imaging™ System is in development for use in bladder cancer, the sixth most common cancer in the United States. The company has just hit the significant milestone of completing design verification for the system.

The company and its technology have caught the attention of two industry observers.

Chris Temple, editor and publisher of The National Investor, writes that Imagin Medical's "disruptive technology is poised to deliver the most significant advancement in bladder cancer detection and removal in decades, making the detection and removal of cancer FAR more efficient and effective."

"Imagin's i/Blue Imaging System has the potential to be a game-changer." - Chris Temple

Concerning the value proposition, Temple writes, "There certainly does appear to be a great potential reward here to go with the usual risk. As of this writing, Imagin has a market cap of a tiny C$7 million, or about US$ 5.4 million. Compare that against—first—the US$4 billion market on bladder cancer scoping alone, not to mention that—if successful here—Imagin may well be poised to proceed to disrupt other segments of the endoscopy market."

Imagin's technology has the support of experts in the field. "Already, Imagin's i/Blue Imaging System is being embraced by urologists; most recently at the American Urological Association's annual meeting, held in May in Chicago. Imagin held private focus groups, where leading urologists assessed the initial functional product and provided overwhelmingly positive feedback that was used to finalize the i/Blue product user's needs," Temple writes.

"So compelling is Imagin's proprietary technology and potential benefits for both medical professionals and especially patients that leading urologists have even invested in Imagin Medical," he states.

Imagine Medical's "technology holds the promise of leading to the most efficient detection and removal of bladder cancer of anything the industry has seen in some 30 years. Managed by a team with past success already in bringing transformative new products to market, Imagin has already been embraced by key urologists and opinion leaders in that industry. Some of them have already become shareholders of Imagin Medical to boot!" writes Temple.

"The need for a better, more efficient, modern standard of care is indisputable. Bladder cancer is the sixth-most prevalent cancer in America. One reason for its recurrence in too many patients is that the medical profession is, quite simply, using dated technology to detect bladder cancer in the first place. Imagin's i/Blue Imaging System has the potential to be a game-changer in this area," Temple concludes.

Read Chris Temple's article here in its entirety.

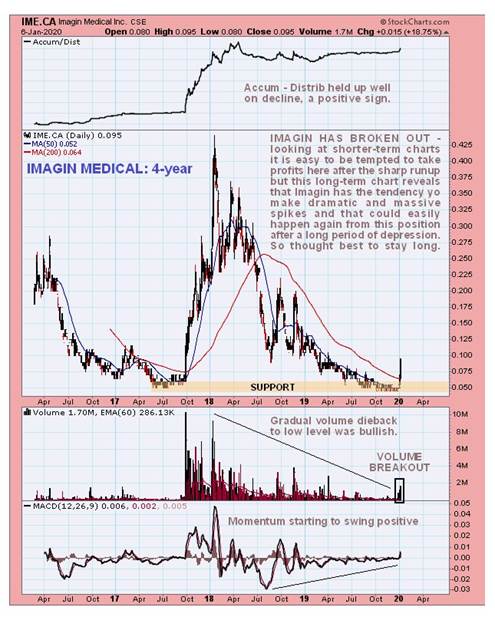

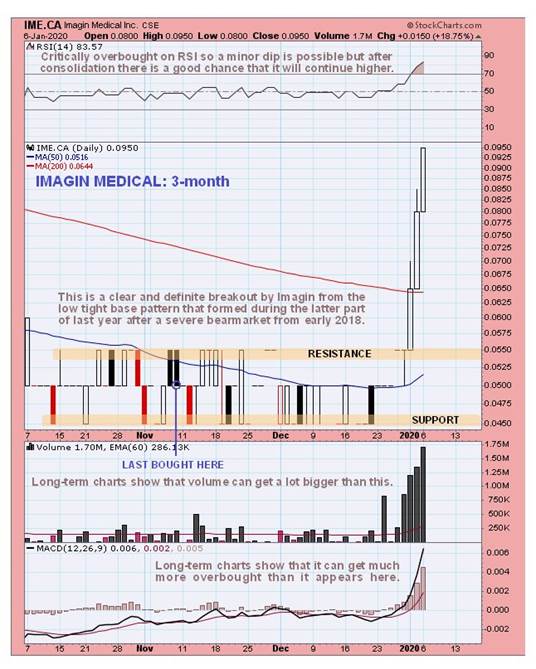

Technical analyst Clive Maund also follows Imagin Medical closely. Writing in CliveMaund.com on January 7, Maund stated, "We were accumulating Imagin Medical stock last fall, most recently in November, and the good news is that it has just staged a dramatic breakout, almost doubling in the last three trading days, or just since the start of the year.

"We can see this dramatic breakout to advantage on the latest 3-month chart, with it soaring above its 200-day moving average on expanding volume to become quite heavily overbought on a short-term basis, which makes it tempting to take profits or at least scale back positions, but should we?"

The longer-term charts come in most useful with respect to making such a decision. The 4-year chart shows that when this stock decides to go up, it goes up big, as it did most notably in late 2017 and early 2018. The spike moves can continue for a long time until it becomes massively overbought, and given that this company has a great invention, as we have already observed, it might be foolishly premature to sell this here as it could go much higher. So we stay long and it is a buy on any dips that might occur.