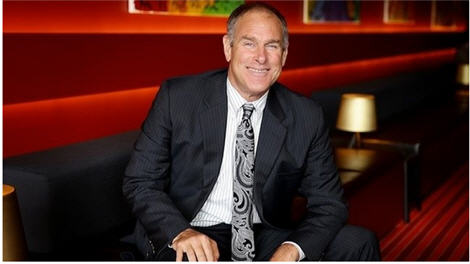

The Critical Investor sits down with Rick Rule, CEO of Sprott U.S. Holdings, for a wide-ranging discussion of his more than four-decade-long involvement in the resource sector.

Several months ago I thought of something different. Wouldn't it be nice to interview the real movers and shakers in the mining industry? I decided to start with Rick Rule who is present at almost every conference I go to myself, and easily approachable. Mines & Money London 2019 was to be the stage for this interview, and quickly arranged as well. A quick bio: Rick Rule began his career in the securities business in 1974 and has been principally involved in natural resource security investments ever since. He is a leading resource investor specializing in mining, energy, water utilities, forest products and agriculture, and has originated and participated in hundreds of debt and equity transactions with private, pre-public and public companies.

Mr. Rule is also the founder of Global Resource Investments, president and CEO of Sprott U.S. Holdings, Inc. and a member of the Sprott Inc. Board of Directors. He has financed many success stories and projects of other titans like Ross Beaty, Robert Friedland, Frank Giustra, and Adolf and Lukas Lundin.

Without further ado, here is the first part of the interview, conducted in London. As it turned out, several more sessions by phone were necessary to provide Rick with enough time to thoroughly answer all questions, and this provided enough material for another three parts, which will be published in the near future. Enjoy:

The Critical Investor: Welcome, thank you for doing this interview at Mines & Money London. Let's focus on gold for starters. Do you believe in gold fundamentals? In my view there is no single fundamental that has delivered consisting outcomes, not even negative real interest rates. Therefore I prefer to call it a sentiment driver. What is your preference?

Rick Rule: Thanks for having me, my pleasure. My belief is that there are a range of fundamentals that have continued to drive gold. I continue to believe (perhaps it's an America-centric point of view), that the most important determinant is faith or lack of faith in the ongoing purchasing power of various fiat currencies, but the most important of which on a global basis to the gold price, is the US dollar. The US dollar is the world's reserve currency, and more importantly, the US dollar as expressed by the US 10-year Treasury is the world's benchmark security.

My suspicion is that in the last 18 months, while gold has done well against all currencies in the world, the fact that it's more than held its own against the US dollar suggests that investors around the world, including in the United States, believe that the current interest rate offered up by the US 10-year Treasury is insufficient to compensate investors for the depreciation of the purchasing power of the US dollar, the US CPI estimates notwithstanding. That doesn't suggest that geopolitical events or fear of equity markets or other fundamentals aren't drivers. It also doesn't take into account that by many estimates gold was in a bear market for six or seven years, and that there are investors who in fact are playing gold simply as a consequence of a rebound that has nothing to do with fundamentals like US interest rates or geopolitics.

TCI: Why do you see those factors as real drivers, fundamental drivers?

RR: Well, gold is unique really. I think gold is unique in the sense that it's a medium of exchange. It's simultaneously a store of value. It isn't a promise to pay, but rather payment itself. It is true that some of gold's value isn't purely utilitarian despite the fact that it is used in religious iconography and jewelry and things like that. But if you think of it, as a medium of exchange, it's not a credit instrument, but rather a payment in and of itself. I think that that's an important differentiator between gold, and say the euro or for that matter a cryptocurrency. I'm not one of those who suggests to you that as a consequence of any set of circumstances, that gold will as an example, replace the US dollar and suggesting that this will happen. This is a consequence of a convergence of factors, but particularly lack of faith in fiat currencies.

TCI: You are talking about the value of all these assets as some kind of reliable store of value. What's the reliability of it? I was more or less focusing on the fundamental value of the fundamentals basically, which is different.

RR: Well, one could suggest that the implied value of gold is religious in the sense that its primary utilization through history hasn't been related to its utility for anything other than being a savings instrument or a medium of exchange. What's interesting about it is that it has been a store of value and a medium of exchange in many cultures simultaneously over a very long period of time. So when people criticize it as being a pet rock, in some senses that's true, but that pet is a pet that many people have been fond of from varying cultures over a very long period of time.

The religion, if you call gold a religion, is not a religion that was imposed from the top down, like the religion associated with fiat occurrences, but rather a religion that's sprung up in Mesoamerica, in Europe, in Africa and Asia 3,000 years ago or 4,000 years ago or 6,000 years ago by some estimates. And has been shared really as a sort of a common part of human heritage, and while I don't understand necessarily why that's true, I do observe that it's true.

TCI: Really what I am questioning is more assumed one on one relationships between, for example, a stronger dollar and the lower gold price as a fundamental, I'm more talking about those kinds of fundamentals.

RR: I'm having a difficult time understanding the term fundamental with regards to that. I suspect that people are concerned about the efficacy of the US dollar as a store of value, given as an example the balance sheet behind that credit, the US government, or the income statement behind that credit, which was of course a deficit. In terms of the fundamental, I suspect that people are concerned as we discussed earlier, the fundamentals behind the US 10-year Treasury. Franz Pick called many forms of government debt "certificates of guaranteed confiscation."

If you have a piece of paper which yields you 1.9% in a currency where the depreciation of your purchasing power exceeds 1.8%, you are in trouble, particularly if you're simultaneously concerned with the credit. I can talk more easily probably about the fundamentals around the US 10-year Treasury than I can about the fundamentals about gold, because the fundamentals around gold, the true fundamentals, the fundamentals that would be determined by the rent you could enjoy from it or its utility other than immediate exchange are, I suspect, largely faith-based.

TCI: I guess so, or fear-based, so my point actually was with this first question, that there aren't maybe real fundamentals for gold as compared to, for example, stocks?

RR: Absolutely. Absolutely. It's just, it's very difficult to monetize efficiently the values as mediums of exchange.

TCI: Are you still interested in blockchain, and still backing Tradewinds and its gold-backed token? Or do you see blockchain, as many attempts seem to fail to deliver economic viability, as something that has to prove itself over the longer term, and maybe much more below the radar compared to the disruptive shock wave it was hailed for last year?

RR: Am I interested in blockchain as an academic subject from a curiosity point of view? I'm extremely interested in blockchain. I need to begin by saying, with regards to Bitcoin, it's an instrument that I don't understand particularly well. I'm too old to understand some of the technology behind it. I know Bitcoin's utility as a medium of exchange is being challenged by its very volatility. The fact that it went from $10 to $10,000 or whatever it did, makes it very difficult to use it as a medium of exchange because somebody who spends it for say, a cup of coffee, doesn't know what they pay for that cup of coffee, neither does the merchant. Secondly, one of the attractions initially of the various cryptocurrencies was their anonymity, it would seem now that some parts of the crypto community looking for broader acceptance of cryptos has asked for more government regulation, which would seem to obviate the benefit of anonymity.

If you obviate utility associated with anonymity and there's a medium of exchange, one wonders what you're left with, other than an instrument which offers up volatility to traders.

For me, the blockchain and distributed ledger are very, very different. The idea that you can fractionalize assets and remove the friction and transaction at the same time that you can validate ownership and take trust or lack of trust out of the equation, I think that's extremely valuable as a circumstance.

TCI: For example the fractionality of Bitcoin.

RR: Yes, also the fractionality is useful. And I'm not talking about Bitcoin now. I'm talking about the ability that blockchain technology has to securitize virtually any asset or, frankly, any idea in the world, reduce if you will the unit, and so the unit cost, while at the same time, addressing title.

TCI: Shouldn't the unit cost be zero?

RR: The benefit that I see is that rather needing to transact in ounces of gold, physically, one can transact in fractions of a gram, virtually. One of the problems with gold as a medium of exchange for normal transaction has been the very, very high unit value. And the fact that it's very difficult to make change with physical gold, and the distributed ledger technology takes that problem away. Gold can be stored at a trusted counterparty, in our case, the Royal Canadian Mint. A delivery receipt can be distributed and fractionalized on the blockchain so rather than transacting in ounces of gold, one could transact in hundreds of a gram. At the same time, evidence through the distributed ledger of ownership could be proven to the extent that upon surrendering the crypto instrument ( the coin), one could receive in exchange physical gold. Now again, you have a medium of exchange that simultaneously is a store of value.

At Sprott, given that one of our primary businesses is gold, what we thought is that the distributed ledger would change the nature over time of gold ownership, gold storage and gold as a medium of exchange by taking many of the frictions, many of the transaction costs, out of owning gold. The consequence of that and probably the consequence of the older people at Sprott, myself as an example, not having enough technical knowledge to know which technology or packaging technologies would win, we've chosen to invest in five different gold oriented distributed technologies, including, of course, the Tradewind technology. Tradewind is beginning to prove its efficaciousness in the sense that many of the largest gold mining companies in the world are shareholders and are now transacting on Tradewind, depositing their gold in the Royal Canadian Mint, securitizing that gold through blockchain technology and selling ownership in that gold through the distributed ledger while the gold is still held at the Royal Canadian Mint.

For ourselves, in addition to wanting to be part of making the ownership of gold cheaper and more reliable, we are also interested in gold being used on a global basis, as an efficient medium of exchange. We see the ability to have a gold-backed credit card, the ability to have gold holdings evidenced on the distributed ledger as secure enough asset classes that lenders could lend against them, as two examples. So there are other initiatives. Onegold would be an example, Glint would be another example where from our point of view, the whole value chain with regards to gold, both as a store of value and a medium of exchange, is being addressed. Our suspicion is that larger units of gold on the distributed ledger will themselves be fractionalized and turned ultimately into coin. And my suspicion is that those digital coins will be effectuated by debit cards and in fact by credit cards where the interest that you pay on your credit card, as an example, if you do pay interest, could be paid in gold, could be paid in dollars, could be paid in euro. We think that the technology for that exists today, and we think that the regulatory climate is increasingly coming to the point where this will be a reality.

TCI: That should cover the question on blockchain. Let's switch to a more general topic again. Why is it that experiencing heavy losses is such a learning, enlightening experience? We are all smart, know the basics of money/risk management, have seen so many failures, but we still seem to behave irrationally and risky until the big one hits us. Why is this?

RR: That we are all smart is an allegation, unfortunately. On topic: I wish I knew to begin with. I think recency bias is part of it. I think we regard ourselves as rational creatures and I think that we believe that we take stimulus from many sources, and we dispassionately look for facts and then we believe that we process these rationally and come to conclusions. Often this is not what we do. We search for information that supports our existing paradigms and prejudices. In other words, we have a confirmation bias. The second thing is that the stimulus which we've received most recently is the stimulus which acts most importantly on our expectation for the future.

If your investment experience in the recent past has been unpleasant, if you've been "spanked," your expectation, in the recent past, is that in the immediate future, is that you'll be spanked again. And you'll become extremely cautious, which is why in bear markets, when assets are very cheap, investors are reticent to buy them. Their experience in the immediate past tells them no matter how cheap things are, they're due for another unpleasant experience like the ones that they've most recently suffered.

In "bull markets" where you've made money even on your mistakes, your experience in the immediate past is good, so your expectations of the future will be good. You think that the asset class that you're involved in is good despite the fact that it's overpriced in historic terms. And you also think that as a consequence of your recent success, that you are good at that activity.

So I think that confirmation bias and recency bias are the primary drivers of what you described. This is an important question to me because I've watched myself in four prior market cycles. In the first time I got it completely wrong. I learned from that. But the fact that I got it partially wrong in the three cycles that followed, having experienced such an ugly lesson in my first cycle makes me question my decision-making process, often.

TCI: How long would it take for you to say that you fully grasp the importance of that first time being wrong?

RR: Intellectually, I grasp it very well.

TCI: And actually putting it into practice?

RR: Well, as an example in 2010 in my sector, there wasn't much to buy and the consequences there not being much to buy, I decided that probably what I held was fairly fully priced and I should sell. And I did. I sold 35 or 40% of my portfolio. Now why didn't I sell 100% of my portfolio? The reason for that I think is that I believed that I was a better analyst than my competitors, which was true. I believed myself to be prudent. I believe that the teams that I had selected had better management belief was true and better assets, which was true too. But the truth is when the sector goes over a waterfall, the good, the bad, and the ugly all fall. And I suspect if I'm lucky enough to live through another major cycle, I will make some mistakes again.

TCI: The same type?

RR: Yes, yes, I'm embarrassed to say that, but I suspect it's true. In very good markets, investors must discipline themselves to sell at precisely the time when you think that the sector is attractive, when the price action in the sector has justified the narrative that caused you to believe the sector. Because the price action fulfills that narrative prophecy, you believe in the prophecy even more, despite the fact that the prophecy is now fully priced, you also come to believe as a consequence of your success that you have finally mastered the sector. And when those two things happen, you're getting set up to fail.

TCI: So why do you then hold on to sort of fully priced assets that are priced to NAV almost perfectly? What do you hope for instead of selling?

RR: I suspect that it's a recency bias and confirmation bias. I think it's the same circumstances that I described earlier and I suspect that they work on me, maybe not to the same degree that they work on other people, but I would be remiss in saying that I hadn't made those mistakes, so I won't make those mistakes in the future. Certainly when Warren Buffett describes his own successes and his own failures, Mr. Buffet said that his worst risks are located to the left of his right ear and to the right of his left ear. If there are mistakes which he's made on a repeated basis, and will likely make again in my suspicion is that if Mr. Buffett succumbs to this weakness, the idea that Rule could avoid them won't occur.

TCI: But that's still intriguing with so much experience, knowledge and everything.

RR: No, I think of myself as a wholly rational being. One consequence of my own rationality is that there's a different type of mistake I make. I'm a linear thinker and if you're a linear thinker and you come to believe that if A is true and B is true and C is true and D is true, and those truths mean that a specific thing must happen, you forget the time circumstance. My problem, and I've done this many times, a hundred times at least, I confuse two words in English: inevitable, which I get right, with imminent, which I get wrong. And if you're four years early, if you discount the outcome at 10% per annum, you are not early, on a net present value basis, you are wrong.

TCI: You mean you start calculating your time you get the thesis on your desk?

RR: No, I count from the time my check has cashed! By way of example, let's replay my favorite personal learning experience, the uranium bull market, in the early part of the last decade. I knew the uranium price had to go up. Uranium was and is an essential part of baseload electrical supply worldwide. Uranium was priced well less than the cost of production. If the price did not recover, the material would be unavailable, and the lights would go out!

I also knew that the very few remaining uranium companies would do very well when the uranium price recovered. My problem was that I began "placing bets" in 1998, and the move I expected, in uranium, and in uranium stocks, did not occur until 2002. Now, in truth, the magnitude of the gain was so substantial that the time value of money discount became less substantial, but the wait certainly tried my clients' patience and faith.

TCI: So you're are talking about really long-term investments.

RR: Most of the time, in my experience, mostly when I've made real money, large money, it tends to be long term. It has come from being right and then allowing myself to be right as a human. You prefer the answer to unanswered questions and the reward to occur in the short term. And as a human you come to believe that your preferences matter. Life has taught me that my preferences, especially with regards to time, are irrelevant.

So we're talking about time expectations. As humans we would prefer a short-term validation of our thesis. We would prefer to answer unanswered questions in the short term and we would prefer our rewards to be immediate. And we think for some strange reasons that our preferences matter. I think if you adjust your preferences to the propositions that are offered up to you, you become a better investor or a speculator.

Again, referring back to some of what I do, which is exploration speculation. In exploration speculation, what you're doing is contributing capital to answering an unanswered question. Very much like in venture capital in technology, the process involves understanding as best you can (never perfectly) the probability of success and anticipating to some degree what the value of success might look like, how much time will be required to answer the unanswered question and what the budget associated with causing that to occur would be.

Most speculators in exploration who I compete against have trauma holding stock over a long weekend and would like their preference expressed over a quarter. I have learned that the time it takes to answer an important unanswered question in exploration is about 18 months.

So if my own expectation isn't aligned with the task at hand, my expectation is unreasonable and my expectation therefore should be that I fail. Similarly, if you are looking at a commodity cycle, commodity cycles commonly take five to seven years to unfold. If your expectation is speculating in a commodity cycle and you don't have a five-year time frame, you should be in some other instrument, you should be in a bond. People's expectation and the reality that confronts them are very different. Reality won't change. So your expectations must.

TCI: So you're basically describing two different strategies here, the exploration strategy with an 18 month time frame, and the commodity cycle thesis.

RR: Yes, just for illustrative purposes.

TCI: It maybe also needs the commodity cycle play to have much higher returns because of this time value issue.

RR: Well, maybe higher returns, or higher certainty. Maybe you believe that the certain kinds of probabilities associated with commodity cycles is high enough that you can accept lower rates of return than in exploration, as an example.

In exploration, the expectation in any individual investment decision is that you're going to fail, but the exceptions are so lucrative that they can amortize the failures.

I have a different expectation, as an example, when I speculate on uranium or on petroleum where it's priced too cheaply. I'm almost certain that I'm going to be right. I don't know the time, but, in terms of commodity cycle, the question that I asked myself begins with when. In exploration, the question I asked myself begins with if, and if is a riskier question. So I demand a higher return for asking myself a riskier question in both circumstances. To some degree the time frame required to answer the question may be beyond my ability to estimate, so I have to do my best. I have to be very tolerant in both circumstances of the fact that I'm not going to get it absolutely right, that I have to get it more right than wrong and that I have to get there before my competitors do.

TCI: For sure, hopefully at the bottom.

RR: Or close to the bottom. Remember, the famous Bernard Baruch saying the only guy who ever bought at the bottom and sold it at the top was a liar, it didn't happen. You have to cut a fat slug out of the middle because you're never going to get perfectly correct.

TCI: I noticed you are fond of Pareto's law, especially taking the 80/20 principle further to 64/4, 51.2/0.8 and potentially even further down the line. As I recall it, this principle is based on the distribution of Italian land owners, not so much on economic relations between labor and output. Did you find the same relationship in mining, and do you consider this fair or just plain coincidence, eligible for a certain time frame during your career?

RR: I'm not so concerned; I don't expect a fair outcome when I invest. People rebel against Pareto's law as elitist, which it is. Performance dispersals are by their nature elitist and it gets worse. The performance dispersal curve is a bell shaped curve, of course, and on one side of the curve is the positive utility, which suggests that 20% of the population base generates 80% of the utility in any given function. The other access, of course, is negative utility and there's a different population base there. 20% of that population generates 80% of the disutility or you and I would say aggravation. And so from an investor's point of view, where what you're investing in is more human performance than the performance of the business necessarily or an asset, you'd have to be very careful to select the good 20 and avoid like the plague the bad 20.

They're equally numerous, of course. And as you suggest, if the population engaged in the activity that you're studying is large enough, the performance dispersal curve will conformably align for at least two more standard deviations, meaning the 20% of the 20 generate 80% of the 80, and further it happens for at least one more standard deviation, meaning that less than 1% of the population generated more than 80% of the utility. If I looked back over my career in speculation and I had worked much less hard, took more vacations, read more books, was nicer to my wife and employed the knowledge that I had gained by the time I was 30 as to who were the superstars and who are the jerks, I would have twice as much money. Well, maybe more, maybe more.

In speculative circumstances where people are growing businesses, where the calculation that you are involved in is risk adjusted net present value, meaning the value that can be created with human effort, the human is the one who contributes the effort, and aligning yourself with superior human beings, and teams of superior human beings, is most of the activity.

You also need to make sure that this competent performer is engaged in the same type of activity where they demonstrated their competence. Imagine a promoter who was a demonstrated success, operating a gold mine, in archean terrain, in French speaking Quebec. Imagine that the task at hand exploring for (rather than operating) a copper deposit (rather than gold) in tertiary volcanics, in Spanish speaking Peru. The existing skill sets are irrelevant to the task at hand.

TCI: There's also the average retail investor, which is my audience of course and is not as well informed as you, has different budgets, has different networks. So that's more or less what you're trying to convey here, related to anything remotely close to stock picking on your behalf?

RR: Yes, over time I would say that the lessons which I teach in natural resource investing are valuable. I spent 45 years learning lessons, I can help people at least avoid scar tissue; it's valuable. I've also become as a consequence of running financial services businesses for 35 years reasonably competent at investing in banks, insurance companies, financial intermediaries and things like that. You wouldn't want to take the reputation that I enjoy in areas that I understand and use that as a predictor of success in areas where I don't have the advantage either of experience or reputation.

In resources, if I don't know somebody, I know somebody who knows them. And if somebody beyond one contact for me, I know that they have no proven track record whatsoever. So in addition to having know how, I have know who; if you took me away from that and put me in Silicon Valley in technology, I would have neither the reputation, the Rolodex, nor the experience to understand whether or not what I was being told was plausible or implausible. And one would be ill-advised to follow my advice in technology, even though I understand the process of speculating on uncertain outcomes.

TCI: Notwithstanding this, in general, you can always point out certain metrics or aspects of good projects, good companies, good expertise.

RR: Sure, sure.

TCI: This leads us to the next question. To expand a bit further on Pareto in mining, how do you sift through these different levels of C-suite mining execs, and can you indicate criteria for 80/20, 64/4, 51.2/0.8 and further?

RR: We answered that a bit the last time. "There's different horses for different courses." There are people who have specific skills in a certain aspect of geology. There are other people who have specific skills involved in mine building. There are the odd people like Robert Friedland whose skill set is understanding other people's skill sets and assembling teams, like somebody might assemble an orchestra. But it's important in the context of Pareto's law that you discriminate amongst people and look for the skill sets that are appropriate to the task at hand. I've been very fortunate in my life to be associated with extraordinarily successful exploration entrepreneurs, the first of whom was Adolph Lundin, who was serially successful, enjoying success in the mining business in various ways, in the oil and gas business over time.

Adolph had certain skill sets, one of which was frontier exploration. Adolf was willing to go to places like Sudan and Indonesia and Congo and Argentina long before it was popular. Adolph understood that you made money by applying old technology in new places or new technology in old places, but you didn't make money applying old technology in old places because that assumed that you were smarter than everybody that came before you, which was a very, very poor assumption. Ross Beaty I think succeeded because he is a superb businessman, which many technologists aren't, but he's also a wonderful consumer of technologists. In other words, he understands enough about geology and engineering to know what he doesn't know.

TCI: Where do you see him differentiating between other mining titans?

RR: Well, as an example, if Ross was going to build a mine in Peru, he would hire for that job somebody who had built three prior mines in Peru; he wouldn't go to a headhunter or recruiting firm and say, find me an engineer with mine construction experience in Peru. Generally, I mean too many times in the mining business, somebody has enjoyed success in Michigan and we send them to Brazil, realize that somebody has to be first, somebody has to gain the experience, but they don't have to gain that experience on my payroll. Ross has a unique experience, a unique ability to hire people who are appropriate to the task at hand, not merely because of their great CV, but because of their practical experience, to the task at hand. Ross also told me to have a look at their failures, and ask them about their failures and ask them how they made the failure.....

TCI: And how they handled it.

RR: Yes, and how they handle the failure, how they would avoid at this time and that type of thing. You know, it's applied, he doesn't just read the headline on the resumé in terms of what these people have done, what he's trying to determine and he's uniquely good at this, is understanding how he will need to lead that person, how he will have to analyze the information that they give him relative to that person's biases and experience. I would say that that's one of the skill sets of Ross Beaty. Ross Beaty will go into terrains and geology that he is less experienced with than I would prefer, but what I've learned in doing business with him for 40 years is he's unusually self honest. He will admit to himself what he doesn't know, and he will hire people who are suited to that task and he will listen to them and try to get to know them well enough, that he understands their bias and can value what they say based on his inclination as to their prejudices.

TCI: Can he do that on all different terrains like geology or engineering or metallurgy?

RR: The evidence over 40 years would suggest yes.

TCI: How does he do this, how does he have the knowledge and experience to ask the right questions to those people?

RR: Well, for one thing, I think he started off having his own business when he was 23 and he's now 68. He made some mistakes earlier in his career. I was around for some of them, but through force of will and intelligence, he worked his way through them. He doesn't see any particular need, thank God, in repeating those mistakes.

TCI: He was a lawyer by training.

RR: Well, his first degree was in geology. And his second degree was in law, having done that, he got a masters in geology. So he is rather over educated. He didn't let that formal training get in the way of his real education, of course. So he has an edge. He's a surprisingly good geologist. In truth, I don't want to make this whole interview about Ross Beaty. When people look at Ross, they see a lawyer and they see a businessman, and they see a phenomenal storyteller. If you sit in a technical meeting with Ross Beaty where three or four geologists who are taking them through cross-sections as an example, he's a damn good geologist and the geologists who work for him know that, and he has been very good about sharing the wealth associated with the successes. And so damn good geologists want to work for him and they still stick with him and grow with him.

TCI: And what about this engineering angle that he also seems to excel on?

RR: Ross is not an engineer. Ross is an extremely impatient person and the consequence of that is that Ross is probably even more demanding of his engineers because Ross again knows what he doesn't know. Ross might be willing to take a bet on a geologist because Ross believes, probably correctly, that he can second guess or understand the input he is getting, but Ross is extremely demanding with regards to engineers of mine operators because he recognizes intuitively that that's an area that he needs even more help in. He's extraordinarily self honest. Many people who have been as successful with him and are leaders to the degree that he is, come to believe that their sweat doesn't stink, you know, and Ross is much better than that.

TCI: I see, I'm just wondering how he would select the best engineers for his projects.

RR: He might not select the best, but he's a long way off the worst. He would remember that the quest for absolute perfection is a form of procrastination. You have to get somewhere as cheaply and as quickly as possible. And the outcome has to be within an appropriate range of probabilities. Ross, because he is so confident and so driven, I think tells himself preemptive truths, in other words, Ross believes that something's going to happen. He might say that a X, Y or Z deposit will be producing 150,000 ounces a year by Y that is often Y+2 in terms of months or something like that. But the truth is that he gets you closer to the truth quicker with more certainty than 99 of his competitors. And the fact that somebody gets me there closer, quicker, but with more certainty is good enough for me.

TCI: For sure. It would be your best bet.

RR: Yes, as far as people go. Okay, I hope, I hope we answered the question, I guess we cloaked the question at Ross Beaty.

TCI: Well, although the roundtrip with Ross Beaty was very interesting in itself, the answers were not so much about different selection rounds (20% of 20%, etc.) in your case, maybe you have a little bit to add here, do you select teams on that basis?

RR: As for myself, yes, I try to get to the 20% of 20%. I've become a fairly good interviewer, and I'm a determined student and I have a large team. So our process probably involves taking presentations from 30 companies before we invest in one. I really like, if I'm meeting someone for the first time, to know more than they think I do both about their background in their project, and I like asking somebody a question that I know the answer to. Listening to their answer, if somebody deliberately misdirects me, it doesn't have to be a lie, it can just be deliberate misrepresentation, or misdirection. What I know then is that I can't trust the information that I get from that person and the consequences, irrespective of how much I like that person or how much I like their project, I probably will never trust what they tell me enough to have enough information to be a competitive capital provider to them.

TCI: Very interesting. Are these type of trap questions the first round in your selection process, or saved for later on? Or does everything start with trust?

RR: Definitely the first round. My job, because I have to talk to so many people, is to throw away projects as fast as I possibly can. You do start with trust as the basis and reputations and not merely industry reputation. The reputation that matters to me is reputation established with somebody I know and love and trust myself. Well, as an example, I met Bob Quartermain because Ross Beaty called me and said, I know this young geologist who works for Teck and you need to know him, he needs you and you don't know it yet, but you need him and you should meet him. That counts for a lot with me.

Subsequently, I've met other people and I've heard that they were associates or had been done business with Bob Quartermain and I'll call up Bob and say, "Bob, I'm interested in meeting such and such and so and so, what can you tell me about this person?" If I get information from people I know and trust and love, then I have some sense of what they value and how their values differ from my own, this allows me to take the leap to begin to assign people in categories.

At 66 years of age, with a good memory, I already know what to expect from many people in the industry. That it does have going for me, I have a really good memory. So I got to know, as an example, Nolan Watson, a young man when he was CFO at Silver Wheaton, so long before he formed Sandstorm. I got to know him as an employee toiling in the bowels of a highly successful company that I knew well, and working for a guy named Randy Smallwood, who I knew very well and trusted completely. So when Nolan spun out of there and I asked Randy, what can you tell me about Nolan, despite the fact that Nolan left and was going to become a competitor of Randy, so Randy had every reason to badmouth him. Randy said, he's a young superstar. This guy is going places. His first effort may not be a success, but he will be a success.

TCI: Talking about mining executives, you mention specifically Robert Quartermain in the same category as certified titans like Friedland, Beaty and Lundin. Do you think this is entirely justified considering the way Silver Standard suffered through Pirquitas, and Pretium suffers through Brucejack? Both had or have issues with overly positive resource statements before going into production.

RR: Yes. The caveat is that Bob is a geologist and a promoter. Our first adventure together was Silver Standard, beginning at $0.72 and peaking at $45. Did Bob make mistakes at Pirquitas? Yes. Has any successful financier not? But the company SSR is today is really a consequence of Bob Quartermain's vision and execution. Then, he spun Brucejack out of SSR, and formed Pretium. This time, realizing that he was not a mine builder, he built a team, which built the mine. In between, Bob has mentioned about one stock to me every five years, all of which have done well.

TCI: I believe both mines have issues that were reserve/resource connected?

RR: I would argue that the problem with Pirquitas was much less a problem of resource continuity or resource grade, much more a consequence of design and execution flaw in mine building. At Pretium, the jury is out on how great the mine will be, but a profitable mine, it is.

About putting Quartermain in the same line-up as Friedland: comparing Robert Friedland with any mortal that I've ever met in the mining business isn't fair. Robert Friedland is the best communicator that I'd ever met. He is the smartest guy that I've ever met in mining. I've met other people that were as smart as him in other fields. He is the best person I've ever met at hiring and motivating. That's an unusually diverse skill set.

One of the best geologists I've ever met in my life was a guy named Doug Kirwin and Kirwin is just, he's a super geologist, superb human being. On his time off he studies mines around the world and maps pit walls and things like that. I mean, you would never see this guy in Disneyland if there was a mine within three hours of driving at Disneyland. He's just a freak, a wonderful human being. And at one point in time when I was less happy with Robert than I am today, I was talking to Kirwin about Robert and I said, you know, how can you stand working for this guy? From Robert's point of view, the whole world revolves in a tight concentric orbit around himself. He'll call you at three o'clock in the morning assuming that you want to talk to him because he wants to talk to you.

And Doug Kirwin said to me: "This is interesting and it's all true. But the truth is for 20 years in my career, people said that I had good ideas. And Robert drilled them. And when I made a technical mistake in Kalimantan, when I had a good idea, Robert funded it and Robert lost $6 million. Robert called me up and said, take the weekend off to grieve and then let's get back to work. That's a mistake that I would make again, based on the information that we had available to us. You did nothing wrong. You had a great idea, you had a great thesis, you tested the thesis correctly and the thesis turned out to be wrong, which is the expectation in mining. I realize you can't come to work today, but I expect you back to work and I expect you to forget this."

Now think about that. Think about how empowering it is to you. If your boss who just spent $6 million on your say-so says to you, I would do it again. I believe in you. You must not let this failure cause you not to believe in you.

TCI: you have to keep thinking out of the box in order to be very successful.

RR: Yes, and there is another great example, it illustrates the same lesson, and this is Jim Bob Moffett who built Freeport McMoRan. When I used to analyze Freeport, in various forms of exploration efficiency in the Gulf of Mexico, we used many efficiency measures, and Freeport would be in the top three, in each of them. Freeport's combined score crushed all of its competitors.

When I asked Mr. Moffett how they did this, I remember him saying to me: "In exploration, there are superstars, and we must hire and motivate superstars. So if I have a young superstar geologist working for me who was too cautious, I go over and sit down and I say to this young geologist, you know, I have more faith in you than you have in you. You are being too cautious. You're too smart to be generating the ideas that you're generating. I didn't hire you to drill 2 billion cubic foot corner shots. I hired you to make the 200 billion discovery. And you don't do that by not drilling dry holes. I don't want you to make a habit of drilling dry holes and I don't want you to drill any dumb dry holes, but I want you not to be afraid to drill a smart dry hole while you are working for me."

It was the same theme Robert Friedland said in effect.

TCI: It sounds so simple, but why are only very few C-suite people doing it like Friedland you think?

RR: Most executives lie to themselves. I think most executives are looking to make some money in the market as opposed to build hugely spectacular companies. Many mining industry executives, particularly in the juniors, their goal is to get a Lamborghini or pay their house off through a lifestyle company. And that is not what drives a Bob Quartermain or a Ross Beaty or a Robert Friedland or an Adolf Lundin. That's not what drives them at all. What drives them at all is the thrill of the chase, building a business. These guys invariably, when they've had a success and they have sold their business, they go through a period of mourning. They put $300 billion or $400 million in their jeans and for a little while they're sad about it because their baby is now somebody else's peeve. And they're afraid that somebody will spoil their child.

For Ross Beaty, well, for all these guys, it's not about a Lamborghini. It's not about a condo at Whistler, it's not about any of that. It's about building a business. It's also about being self honest, understanding that although you'd like it to happen in 90 days, it's going to take 10 years. Although you'd like to never drill a dry hole, the price of success is repeated failure. It's difficult for most people to communicate that to other people because they don't want to believe it themselves. Most guys that you talk to at a conference like this want to get a 25 cent stock to 75 cents and they want to raise enough money that their salary is secure for 18 months. Those are lofty goals, of course, but it doesn't do anything for me as an investment. And so I'm not interested in that, except that you are happy for them that they have job. Aligning yourself with people where those topics are not of interest, where they want to discover a billion barrel field and build multibillion dollar companies and put in place teams that are identical, at least in every different discipline better than they are themselves, that's what they want.

TCI: So you're talking about standards, so you have very high standards, high expectations in regard to 95% of all the other executives.

RR: 99% I would say. I got a call once from the receptionist at Silver Standard thanking me for my help in Silver Standard. It turned out that Bob Quartermain had distributed options all the way down to the receptionist and the receptionist's options had allowed her to put down a downpayment on a condominium. She had never thought as a single mother that she would be an owner, so this was life-changing. So Quartermain or none of these guys hog all the benefits. They build teams. They're genuinely proud that their investors may invariably share the wealth. When one of these superstars as an employee leave like Randy Smallwood did with Watson, they missed them, they're proud of them, they want to help them.

TCI: It is well known that you are a big fan of Amir Adnani and Nolan Watson. There is no doubt in my mind these CEOs are pretty smart and ambitious, but I have some remarks. Watson broke into the scene with Sandstorm by cutting corners, sometimes too much, resulting in lots of failed projects, in an attempt to break into the royalty game in a high risk way. What do you think of this, and does it resemble younger year failures for a giant in the making? Adnani seems to be the king of leveraged plays, which as a waiting game strategy doesn't seem to do justice to his capabilities as a smart mining entrepreneur. Almost everybody can buy uneconomic deposits and hold them, waiting for higher metal prices, no special skills required for exploration/development strategies. I don't believe the latest jump in gold caused a corresponding jump in GOLD.TO. What makes him so good you think?

RR: You have asked lots of questions there. The mistakes that Nolan made early on were a consequence of believing too much in his financial and modeling skills and ignoring technical inputs, engineering and geological inputs when ironically they interfered with the models, in other words, garbage in, garbage out, and Nolan probably wasted $100 million of investors' money with improper technical inputs. It was pretty clear when I would talk to him that he was completely models driven. And when I would talk to him about the inputs in the model, he simply wouldn't answer the questions, which led me to believe as it turned out afterwards correctly, that he didn't care. He was so models driven that he thought that financial model was more important than the assumptions that went into the model. He had worked prior to that for a guy that was pretty good technically and he never had to model anything that wasn't true.

What separated Nolan was, after he came to understand the nature of his mistakes, first of all, he was deeply remorseful. He, as he should have done, owned and personalized the mistakes and felt terrible for costing lots of people their money and was in fact grateful, literally grateful that I had sold my stock.

After that he set about building the technical team, people like Keith Laskowski, and never minded hiring them, listening to them when somebody like Laskowski would say, this is all pretty, but it's bullshit. Nolan would rip it up and start again, which is to say he learned from his failures. Beyond that, he began to reimagine the way the royalty and the streaming business works, by understanding how to be correctly early by providing office space and seed capital and raising seed capital for entrepreneurs who had sold their business. What it means is that when somebody needs money, he's a known entity and people like I who compete with him might not be known entities. It gives him the durable competitive advantage. He learns from his mistakes, and he built on his successes, which is all I think that anyone can ask for.

Amir's skill set is different. Amir has many skill sets. First of all, he's an astonishingly competent marketer. Amir has the ability to understand how to use mentors, alternative media, money, to build retail investor clubs that are in effect cults, which lowers his costs of capital. In addition to being a good marketer, he's an amazing salesman. He's easy to like one on one. When he broke into the uranium business and I heard he was buying the Rainier assets, I said, oh, no. An Iranian producing uranium in South Texas, he's in real trouble. Now, the truth is that because he's so good one-on-one, those South Texas ranchers love him. He has this wonderful personality.

He set out to build a uranium company. His uranium price assumptions were wrong, shut down production, did something very hard to do. All these guys want to be centerfolds in Mining Magazine. Amir looked at the facts and said, I was wrong. He went into survival mode at the same time that he had built a large enough cult, 45,000 retail investors and a few big institutional backers, including Wilton, which is Li Ka-Shing.

So Amir lowered his cost of capital to the point where he was competing with other people that had higher cost of capital in a business where cost of capital is a durable competitive advantage. Right now UEC is his focus. The time will come when Amir needs to focus on GoldMining Inc. What Amir did is he copied what was, in effect, the old Rick Rule Sprott playbook from 1990, buying assets that were deeply out of favor, spending no money on them. We built and sold a couple companies in that fashion.

Buying 20 million ounces is way easier than finding them, even if at current prices those ounces are uneconomic. Often, once you own an asset, the right thing to do is nothing. If you own an asset that requires higher commodity prices, don't waste capital trying to beneficiate those ounces. Communicate the optionality offered up by those ounces, build a constituency around optionality, and use that constituencies' share purchases to lower your cost of capital

TCI: Do you think large producers will have an interest in these ounces at higher prices, say $1800–2000/oz?

RR: A large producer perhaps not, depending on where the gold price goes. What it will allow Amir Adnani to do is what Ross Beaty did with Lumina Copper, buy the assets that are available to you in prices you are able to pay, you use the critical mass in the commodity story to build a constituency, you lower your cost of capital. You buy better projects, you sell your not so good projects and you understand that the process is going to take 10 years while your competition wants to get their Lamborghini in nine months. There is a certainty that if gold really truly returns to favor the perception of these marginal ounces changes. It is a certainty that the consequences of Amir Adnani having 45,000 people who believe in Amir Adnani and the fact that he has 20 million ounces if gold returns then these ounces will be rerated.

We have a rude phrase at Sprott to describe amalgamators, people who assemble assets over time on a commodity theme. We called them turd collectors. They buy two or three marginal assets to establish critical mass. They describe their strategy to people inclined to their thesis. As their constituency lowers their cost of capital, they buy better properties, and beneficiate their existing properties, gradually selling their more marginal assets, to focus on the best.

TCI: So it's actually a kind of a stepping stone strategy to complete the leverage on the deposits that he has at the moment.

RR: Completely. There is a value, maybe there's not an empirical value, but there's a narrative value in what they're trying to accomplish in the context of leverage to the gold price. Could gold go back to $1100 from here? Absolutely. Could it go to $2000? Much easier than you think. I remember myself in the year 2000 having to write a letter to my clients who were by and large gold bugs saying that there was a case for gold in 2000, I didn't say the case for gold, I had to make the point that there was a case for gold and the aftermath of that was gold went from $250 to $1,900 over 10 years.

GoldMining Inc. doesn't make anyone any money if the price of gold stalls at $1600. If the price of gold goes from $1400 to $2000, GoldMining Inc. makes people much more money than they anticipate. The consequence of being seven years in a bear market means that the dreamers hope that they might double. History teaches that being right is an if question, not a when question. The denominator if the if question becomes a when question is much greater than people realize.

TCI: Shouldn't he have bought better quality assets to play the leverage game with more strength?

RR: With the cost of capital he had at that point in time, it didn't make sense. He optimized the capital that he had available to him at the price he had available by buying large assets that made no sense at $1,200 gold but would make sense at a higher price. There is always an optionality constituency in the market. Accessing that optionality constituency gives you access to the cost of capital that you can afford in building a portfolio of out of the money assets and then as you're disciplined, optimizing those assets or optimizing the narrative to buy better assets.

TCI: Ok, I will follow Amir Adnani and his GoldMining Inc. more closely from now on, as I have good experiences with stepping stone strategies. You discussed your biggest winner Paladin many times as an example. What caused you exactly to think you were right and the markets were wrong? Where did your thesis differ from mainstream analysts? Why did you hold on when it dropped so low, far below your 50% intermediate average loss on positions? Do you have money management rules in place for drops during an investment?

RR: Many, many questions here. The difference, in my opinion, between myself and other analysts, when I made the investment in 1999, there were almost no analysts left in the market who could spell uranium. So I was all by myself. Maybe my personality is perverse, but I enjoy being by myself. I was searching for a uranium opportunity and I like passionate, knowledgeable people. Well, I met John Borshoff. He had been worldwide head of exploration for a company that was basically a branch of the government of Germany, so he'd spent a billion dollars over the 20 years prior to him coming to my attention. What really mattered to me was that he took his severance pay rather than cash in the database that had built up as a consequence of 20 years in terms of exploration. And when I talked to him and said, how do you find good uranium deposits, your market cap is only A$1.8M. And he said, I won't. The government of West Germany already found them. I have the data and I will merely stake the deposits that I found years ago with other people's money. That was a very good answer. So with A$1.8M market cap, I got this experienced exploration partner.

So I had this thesis I liked. I had a guy with a durable competitive advantage who knew he had a durable competitive advantage in a A$1.8M market cap. I had a $1B database and a very disciplined guy. So that's how I made the decision. How I differed with other analysts, well they couldn't even spell uranium at that point in time.

After identifying the opportunity, and leading an investment round, I found out how early I was. We did the financing at AU$0.10, mercifully, with a warrant. The stock went from 0.10, to 0.12... so far, so good. Then back to 0.10, and down to 0.08, Not so good. Then 0.07, 0.05, 0.03, 0.02......all the way to 0.01.

If you have a 1 cent price against the 10 cent cost, there's no such thing as a hold. You have a buy or you have a sell, but not a hold. So I had to re-examine my premise and I pretended, although you really can't, what I sold the stock, that I re-examined all of it. And I came back thinking nothing has changed except though that my faith has been shaken by the price action. What I'm doing is I'm allowing my judgment to be shaped by people who know less than I. So mercifully from me I worked up the courage to buy some stock and then of course the uranium thesis turned out to be true.

TCI: Fascinating. What was your average cost if you want to disclose?

RR: Well, I must say in all honesty, that the first financing I did was a $2 million financing at 10 cents, probably $200,000 of which was mine. They were great, great clients who believed in me. But clients who I knew and talked to every day, had Jim Blanchard or Doug Casey for example lost $100,000, had I lost $200,000. I don't mean to sound arrogant, but it wouldn't have changed my decision as to what to have for breakfast. So the downside relative to our networks or our portfolios were insignificant. The ego damage from 10 cents to a penny is in fact fairly substantial.

When I revisited the premise and found out I was right, not wrong, that was useful because then I was able to tell clients that were somewhat less well-heeled that this is a risk that they should take.

And when I told them in the context of me being in for the dime and then having the chance to be in for two and a half cents, it turned out that was a fairly persuasive pitch. And almost immediately after that, this stock began to work because uranium began to work and Borshoff had been able to stake as opposed to buy two deposits that were rapidly becoming economic and they were both large, not small, and he was able to acquire them practically for free at the same time that he was able to acquire other deposits that were distal to his focus and sell them to other speculators for cash.

He was able to go on the road and tell the story by saying, I told you so, which is an extremely powerful sales pitch and the stock was 10 cents and then the stock was 60 cents and then the stock was a dollar and then the stock was $2. I mean, the ascent was as rapid as the descent. Now your audience would be mistaken if they believed that I bought my stock at a dime all of it, and I sold it at $10 all of it. I began selling fairly sparse some amounts of 60 cents. I have this belief that if the share price goes up faster than the fundamentals are going up, you owe it to yourself to sell in the stock, to get yourself in a cash position. I sold a lot of stock at a dollar, a lot, and when the stock was at $5, I somewhat resented the stock that I sold at the dollar.

But the truth is if you're able to sell 10% of your position as an example, and recoup all of your capital, it's a good thing in most circumstances. And the truth was by the time the stock hit $10, I had nominal amounts of stock left as one would expect from a professional speculator. The second thing that happened in the course of that stock, and I would say this as John Borshoff was president, John drank his own Koolaid, John never sold a share. And at some point in time, John came to believe that his equity was so valuable that he began to borrow. And when I saw the liabilities that John had taken to build these mines, exceed $1 billion in a commodity that was as volatile as uranium. And I came to understand that John was really an explorationist, but probably had the wrong skill set to build a mine. The sell decision became fairly easy for me, with a positive outcome. John, on the other hand, if you include the tax he paid on his options, made no money on Paladin.

John made no money, but he had a much larger position. The truth is that John, one of the reasons why John became such a persuasive salesman, he believed with every fiber of his soul. It turns out ultimately the what he was believing wasn't true. That's often the case, but he wasn't lying, but he was mistaken.

TCI: That's too bad. With regards to your position, what really made you sell between say 60c and $1?

RR: The stock went too far, too fast. And the opportunity of selling existed. One of the things you learn when you're financing, if you raise $2M for the full warrant for a company with a market cap of A$1.8M you're not an investor, you're the owner. And in a circumstance like that, you don't sell necessarily when you want to, but rather when you can.

TCI: And that kind of volume was probably very rare.

RR: Yes. And then at a dollar the volume went up.

TCI: Could you explain why you kept selling around a dollar, instead of, for example, waiting until momentum started to subside and the volume started to come down?

RR: What I decided was that remember at a dollar I had live 15 cent options. So if I sold a share at a dollar, I could buy six shares at 15 cents. So what I decided to do between sort of a dollar and a $1.50, was sell enough stock so that I could exercise all my warrants, put money in the company and put me in a risk-less position. I paid for all my stock. I paid for all my warrants and everything I had left over was paid for, which meant that I could afford to become extremely patient. Really, I had no risk and my clients had no risk. We call that the point of no concern to differentiate it from losing money, which is the point of no return. It's an extremely healthy and extremely comfortable position to be. I try and accomplish that in riskier ventures.

TCI: And then this wasn't the most risky you could imagine?

RR: Oh no, I've done many things. More foolish, but this was risky enough. And the opportunity to derisk it presented itself. The other thing that was happening is that my perception of uranium as a lonely contrarian trade began to change. There began to be lots of competition in the uranium space from people who had more money than me.

People whose outlook was suddenly more ambitious than mine. Many of my expectations were met. And I needed to begin to monetize. So in the sort of $2.50 to $3.50 range, from my point of view, Paladin on a risk adjusted net present value basis was at least fully valued. I didn't want to continue in a trade to determine just how stupid the rest of the market would become.

TCI: It is all very recognizable. What was the uranium price doing at that moment?

RR: Yeah, the uranium price went nuts. I remember when you or anyone was at $8 thinking, you know, the uranium price could, I'm not saying it will, but it could go to $35, well, it went to $138 instead.

TCI: I'm just trying to figure out how this works, this kind of investment, when a volatile commodity is still racing to a top. Or were you saying uranium is much too volatile, much of dangerous, we better sell now?

RR: My thesis in uranium was that the cost to produce it fully loaded was $30. At $40, it would incentivize new production, and so between eight and third year $35 I was okay. Above $40 my thesis had to change and as it went above $40, other people who were less involved in the thesis than I and more involved in momentum. Remember earlier in this interview, despite the fact that price action justifies narrative, irrespective of the fact that narrative has become overpriced. Price action justifies narrative. Having made that mistake myself earlier in my career, it was a mistake that I was determined not to repeat. And so when it appeared to me that the uranium price didn't have to go up, although of course it could continue to go up, and the fact that people who I think knew less about uranium were suddenly crowding into uranium and repeating my earlier thesis, but with higher numbers and less need for them to come true, was a strong indicator for me to exit.

TCI: A truly fascinating story, really material for a book or a movie. Thanks for taking so much of your time, and providing some more in-depth color on various topics, very interesting.

This concludes the first part of four of a large interview with Rick Rule, CEO of Sprott US Holdings, part of Sprott Inc., which is a US$12 billion global asset manager with over 200,000 clients.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website, https://www.criticalinvestor.eu in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Disclaimer:

The author is not a registered investment advisor, has no financial relationship with Sprott Global and doesn't have a position in any stocks mentioned. All facts are to be checked by the reader. For more information go to www.sprott.com and/or websites of other companies mentioned, and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Pretium Resources. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Pretium Resources, a company mentioned in this article.